The Cardano (ADA) price has recovered $0.38 for the first time since August 2, following an 18% gain over the past seven days..

What’s interesting is that this price increase coincides with a disclosure that may force ADA holders to sell some of their holdings.

Cardano Holders Prepare to “Sell News”

On Friday, August 23, Cardano founder Charles Hoskinson announced on X that the long-anticipated Chang hard fork had been postponed. According to Hoskinson, the development was necessary because some layer 1 centralized exchanges, including Binance, were not ready for the upgrade.

“Binance and a few others seem to need more time to get their house in order, so the rocket will wait on the launch pad. Another era will come when the weather improves. The next hard fork window is September 1st,” Hoskinson added.

According to the announcement, IntoTheBlock data shows that ADA holders appear to be ready to sell. BeInCrypto found this after examining the order books of the top 20 exchanges.

As shown below, market participants are ready to bid (buy) about 172 million coins. Meanwhile, on the other side of the gap, some participants are willing to sell more than 200 million coins. At the current price of the token, this is equivalent to almost $80 million. If the selling takes place, the price of ADA may drop for a while.

Read more: Who is Cardano founder Charles Hoskinson?

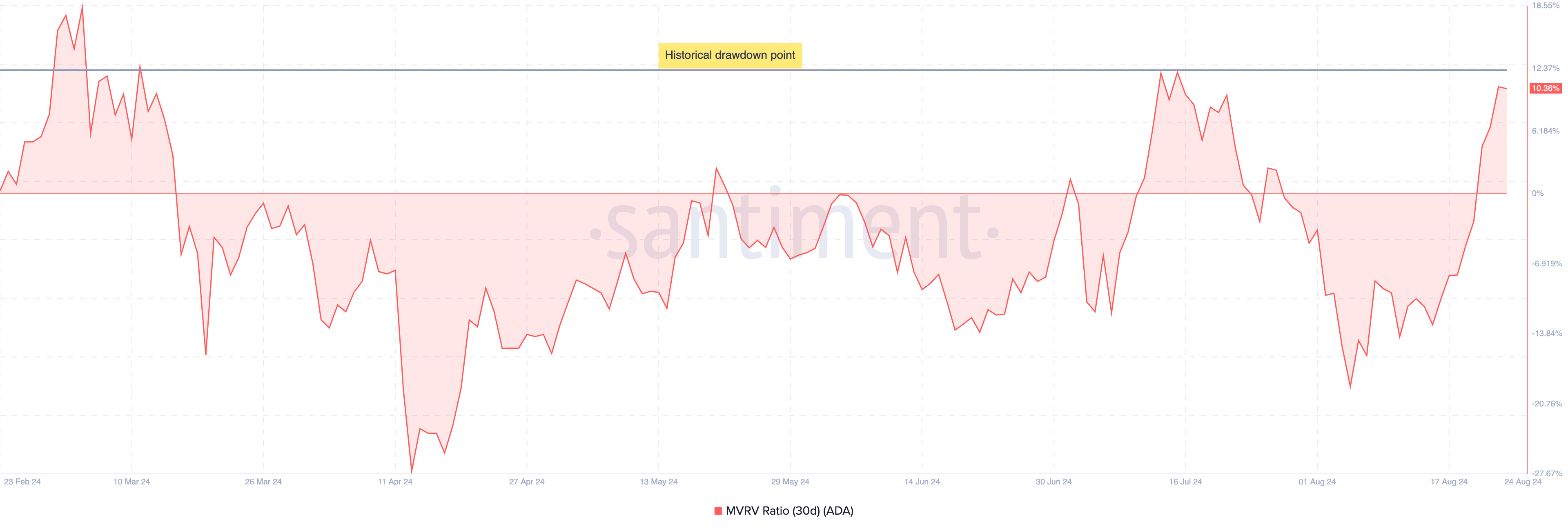

The recent price surge has also affected Cardano’s Market Value to Realized Value (MVRV) ratio, which is an indicator that provides insight into the profitability of holders, buying behavior, and the potential for a market peak or bottom. As of August 20, ADA’s 30-day MVRV ratio was 0.32%, indicating that the average holder is losing money.

However, this ratio has now risen to 10.36%, meaning that any holder would make a profit if they sold at the current price. This increase reflects a healthy market, but it puts the price of ADA at risk.

Historically, when the MVRV ratio reaches the 12.20% to 18.35% level, holders tend to take profits, leading to a price drop. If the value of ADA approaches $0.40, a retracement is likely to occur, wiping out some of the recent gains.

However, anonymous analyst XForceGlobal opined that ADA may be nearing its bottom.

“Cardano had an 18,000% gain in the last bull market, but it was also one of the strongest pullbacks during a bear market. The structure is very similar to when $SOL made a bottom for a 1-2 sequence. Wave 3 target would be around $3,” he said.

ADA Price Prediction: It Could Rise to $0.42

On the daily chart, ADA is showing strong bullish momentum, breaking above the important support level of $0.31 and the downtrend line. Also, at the time of writing, the price of $0.39 is trading above the 20 (blue) and 50 (yellow) exponential moving averages (EMA).

EMA helps to track the price trend of a cryptocurrency over time and predict potential moves. Generally, when the price is above the EMA, it indicates a bullish trend, while when the price is below the EMA, it indicates a bearish outlook.

Given this situation, ADA appears to be in a bullish phase. If this trend continues, the cryptocurrency could break the $0.40 psychological resistance level and target $0.42. However, market participants should be wary of the remaining death cross.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

A death cross occurs when the long EMA crosses the short EMA upwards, indicating a downtrend. Conversely, a golden cross occurs when the short EMA crosses the long EMA upwards.

As you can see, Cardano has not yet broken out of the dead cross, suggesting that bearish pressure may still be in play for the token. If the buying momentum fades and the bears regain control, the price of ADA could fall back to $0.37.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.