- Polygon saw a sharp increase in open interest as speculators rushed to join the bullish trend.

- The failure to break the weekly structure suggests that bears may dominate here.

Polygon (MATIC) price surged last week, establishing a strong short-term uptrend. The local resistance at $0.43 was decisively broken, and the bulls were strong enough to lead a rally to the upper time frame resistance area at $0.58.

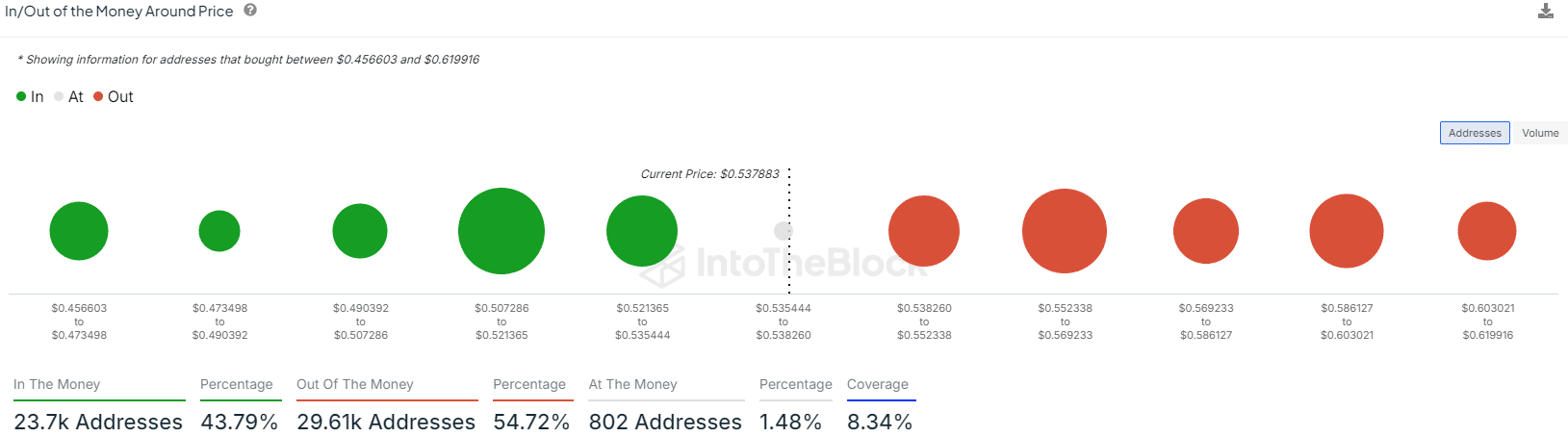

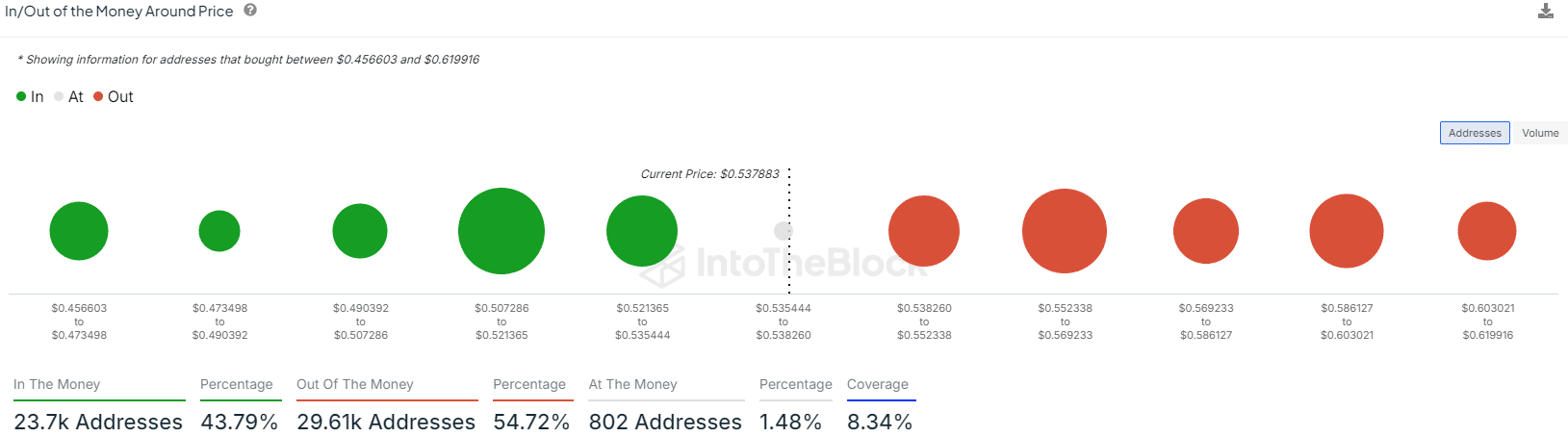

Source: IntoTheBlock

This price action was accompanied by a doubling of Open Interest, indicating high bullish sentiment. Since then, the price has fallen 7.5% after reaching a local high of $0.5819, with OI also falling.

Recent reports show that many MATIC investors are still reporting losses, and this is true for short-term investors as well.

Market participants may interfere with MATIC’s continued profitability.

Source: IntoTheBlock

According to local deposit/withdrawal data, 54.72% of addresses that bought MATIC between $0.456 and $0.62 suffered losses.

This means that if the price bounces, for example, to the $0.552 – $0.569 area, there will be a selling wave as underwater holders look to sell at breakeven.

Buying activity is likely to increase in the psychological $0.5 area to the south.

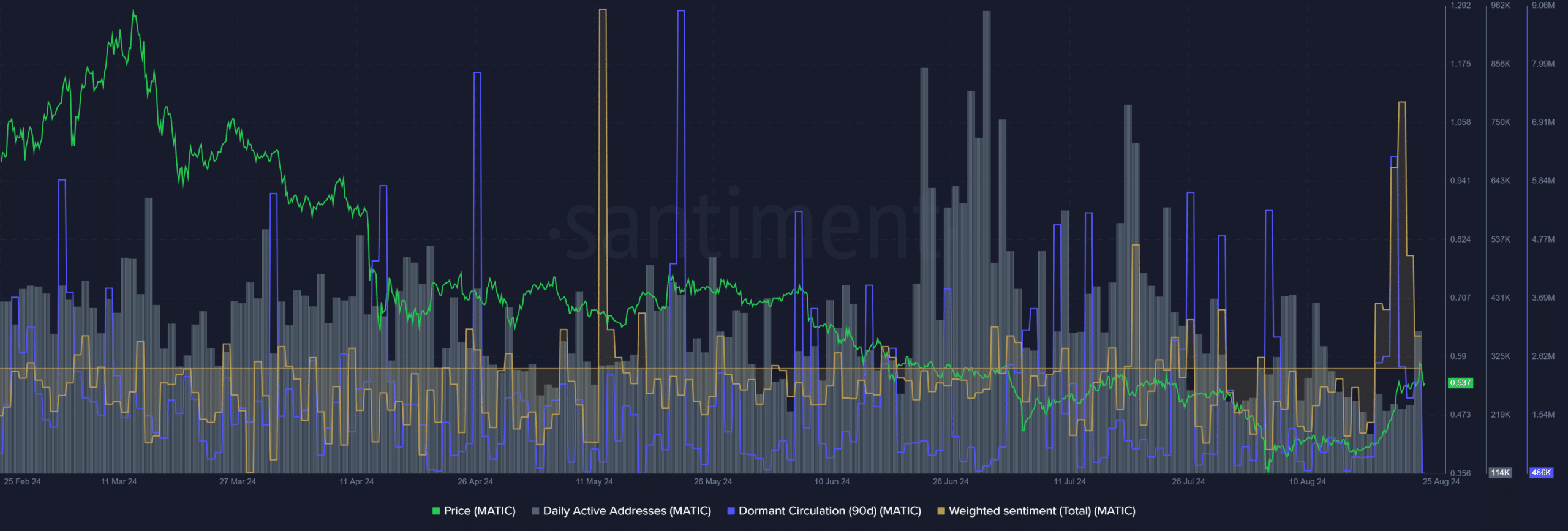

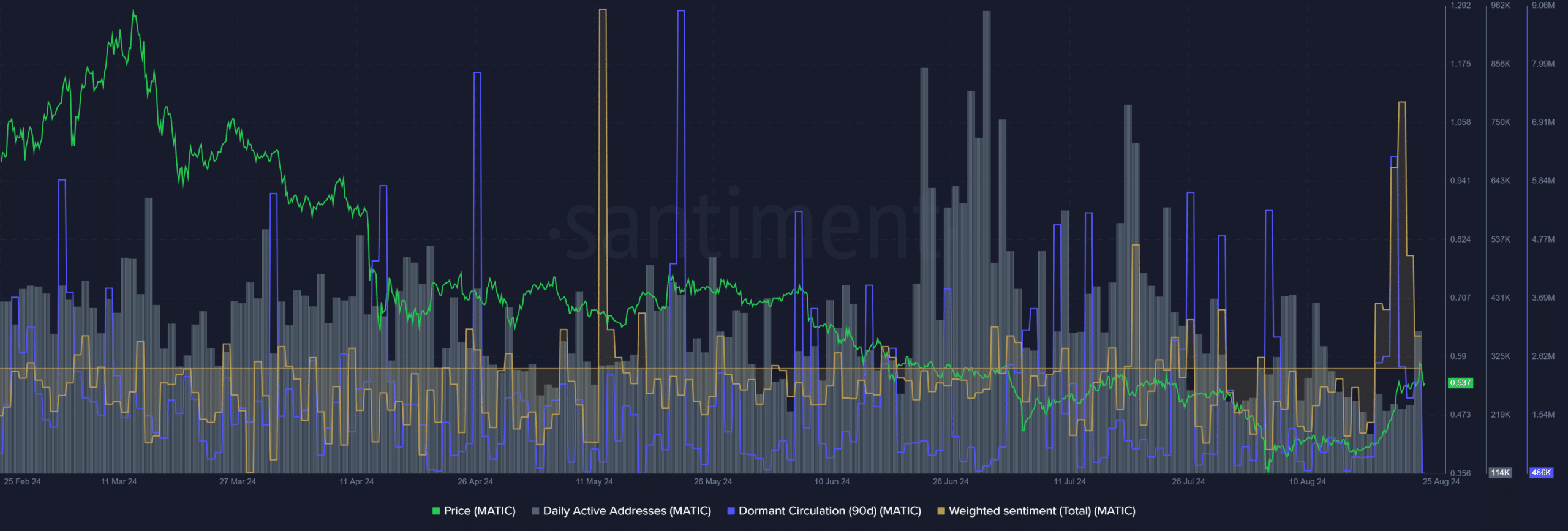

Source: Santiment

AMBCrypto found that the daily active addresses metric has been trending downward over the past month, indicating a decline in network adoption and token demand.

The price surge indicated that the weighted sentiment had reached its highest level since May, but another indicator served as a warning to buyers: the dormant cycle surged on Wednesday, August 21.

Typically, a surge in token movement of this magnitude indicates that a wave of selling activity is near, which could soon materialize and push the price lower.

Another reason why MATIC’s uptrend may be exhausted

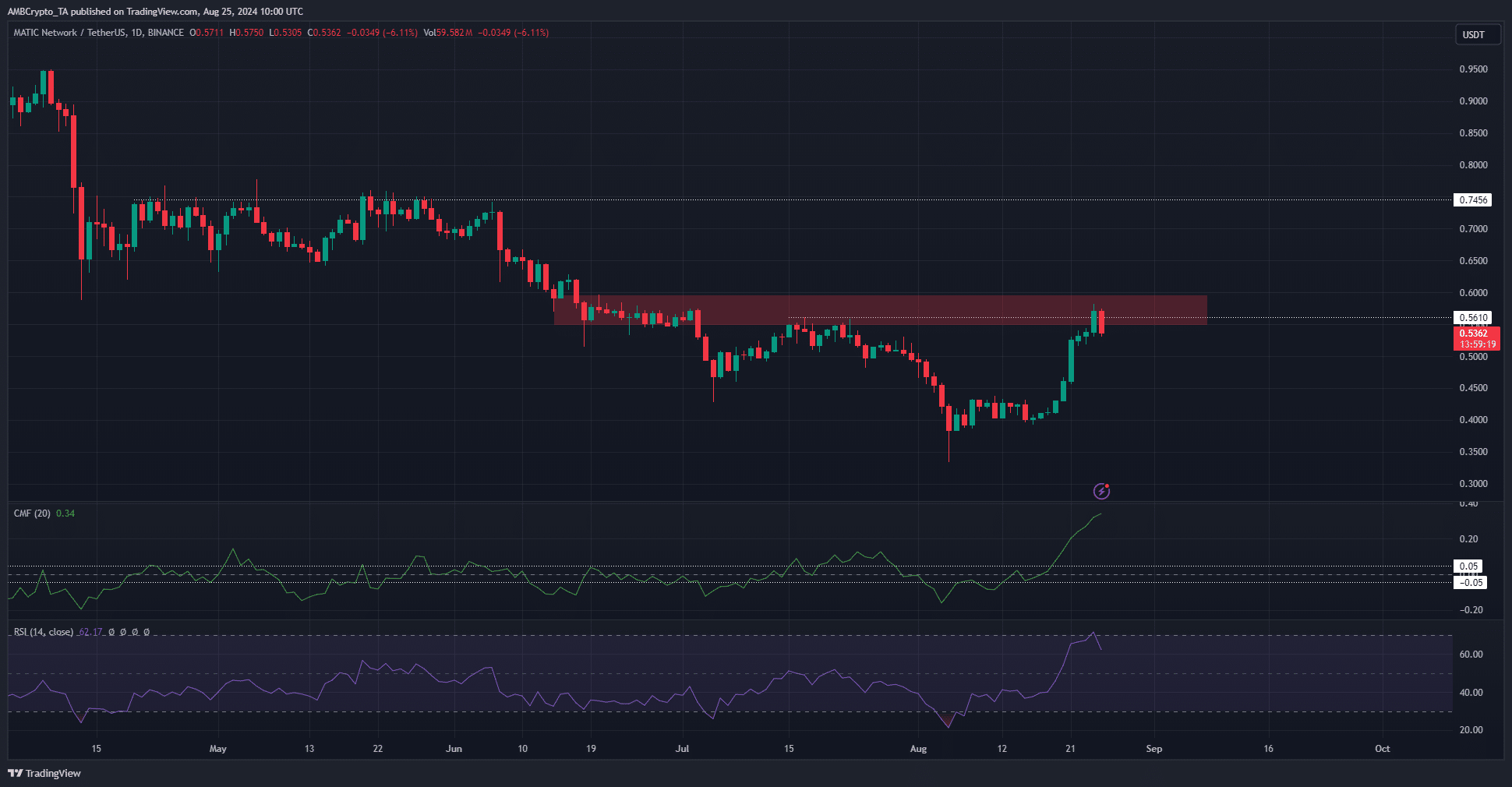

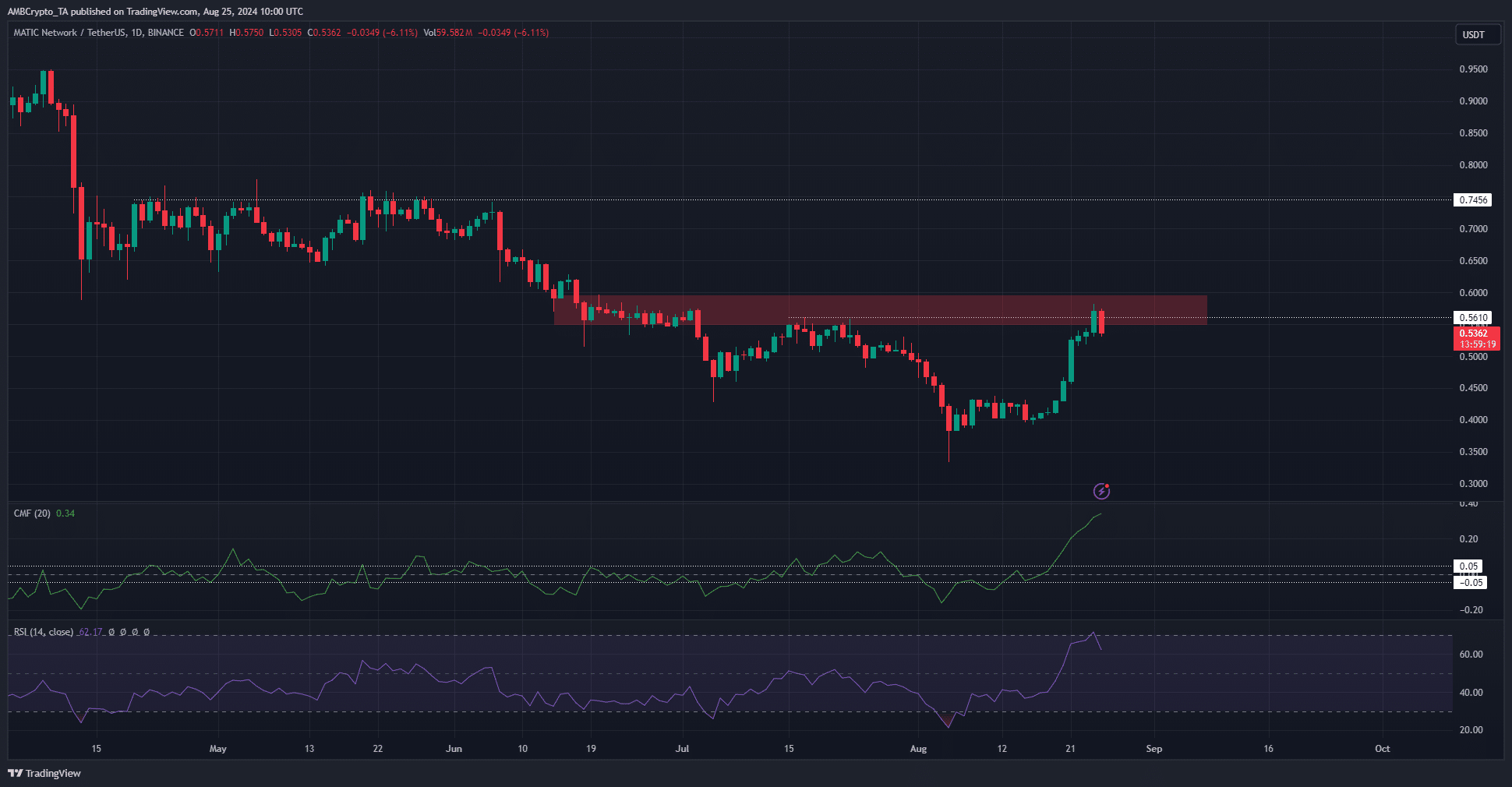

Source: MATIC/USDT on TradingView

The daily chart showed that the market structure was bullish after the recent move. The indicators were also in favor of buyers.

Realistic or not, MATIC’s market cap in BTC terms is as follows:

However, the $0.56-$0.58 zone has been the key weekly resistance level that MATIC has been resisting in the past few hours.

The market has revealed its strategy and the price is likely to consolidate between $0.56 and $0.58 during the distribution phase before moving south towards $0.5 or $0.45.