- Recent price action suggests that bulls are in control, but strong resistance at $162 could prevent an immediate rebound.

- Traders should keep a close eye on the $162 resistance level, as a break of this level could result in a strong recovery.

Solana (SOL) recently experienced a downtrend after witnessing a classic ascending channel breakdown and dropping below a key support level as bearish momentum took hold. The question is whether the bulls will be able to regain control or is further downside imminent.

Solana bulls re-enter the market.

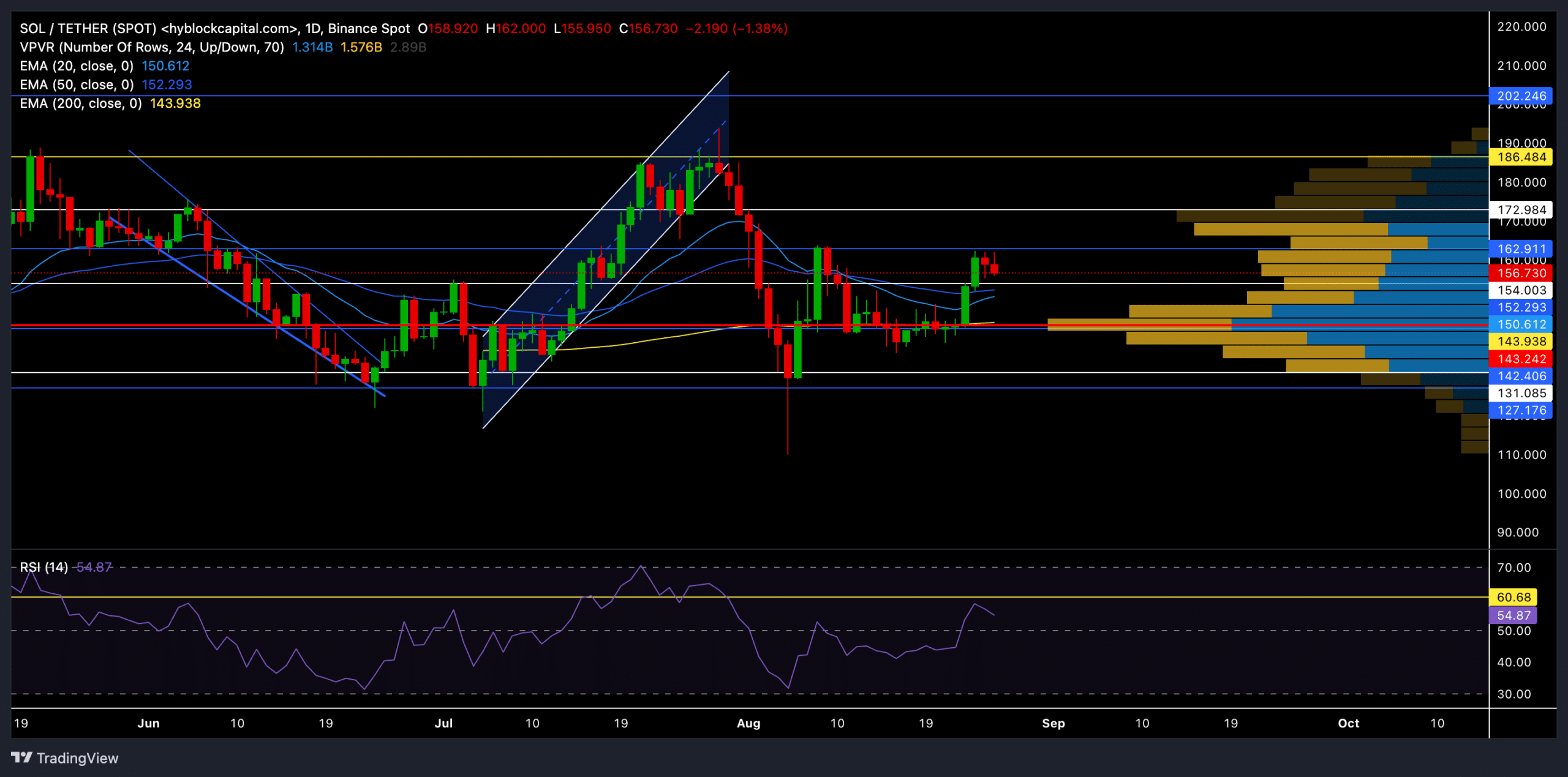

Source: TradingView, SOL/USDT

SOL came under downward pressure after failing to hold the crucial $172 level in early August. Currently trading at around $156.7, SOL is down around 1.26% over the last 24 hours.

After bouncing off the support level of $142.15 on August 6, SOL recorded a 20% gain in just three weeks. However, this bullish momentum was short-lived as the price hit resistance at $162, a level that the bulls have struggled to overcome this month.

Nonetheless, the price has reclaimed several key support levels and remains above the 20-day, 50-day and 200-day EMAs at the time of writing.

It is worth noting that there was some downward pressure as the altcoin reversed from the $162 resistance level, leaving the price in a zone where it could see more volatility.

The RSI was above the 50 mark at the time of writing, indicating a slight bullish edge. However, buyers should look for a possible close above the 60 RSI resistance level to gauge the possibility of a rally in the coming days.

Key levels to watch for

The immediate support level to watch is around the $150 mark (20-day EMA). If SOL can hold above this level, it may try to retest the $172 resistance zone in the coming days.

However, if the downtrend continues and SOL falls below $150, it could retest the $143 level, which is the control point (red) level of the VPVR indicator.

Over the past day, total volume increased by 13% to $6.73 billion, while open interest increased by 3.15% to $2.43 billion. This suggests that traders are still actively participating, but sentiment is tilted towards the bearish side.

Source: Coinglass

The long/short ratio for the last 24 hours was 0.9249, indicating a slightly bearish sentiment among traders.

Is your portfolio green? Check out the Solana Profit Calculator

However, on Binance, the SOL/USDT long/short ratio was bullish at 1.7917, showing that a significant number of traders are still bullish.

Buyers should also pay attention to Bitcoin sentiment and other macroeconomic factors that could impact SOL price movements in the coming weeks.