- Market structure showed hopeful signs, but the long-term trend was unfavorable for buyers.

- Short-term sentiment was bearish and spot buyers were also weak.

Ethereum Classic (ETC) broke above the $20 level on Friday, August 23. There were bullish expectations for the token, but sentiment across the market changed as Bitcoin (BTC) fell below $60,000.

Ethereum Classic could have bullish hopes if it can defend the nearby $18.3 and $17.68 support levels. In fact, volume indicators have shown a surge in buying pressure. But will that be enough?

Strong Structure, Bearish Trend

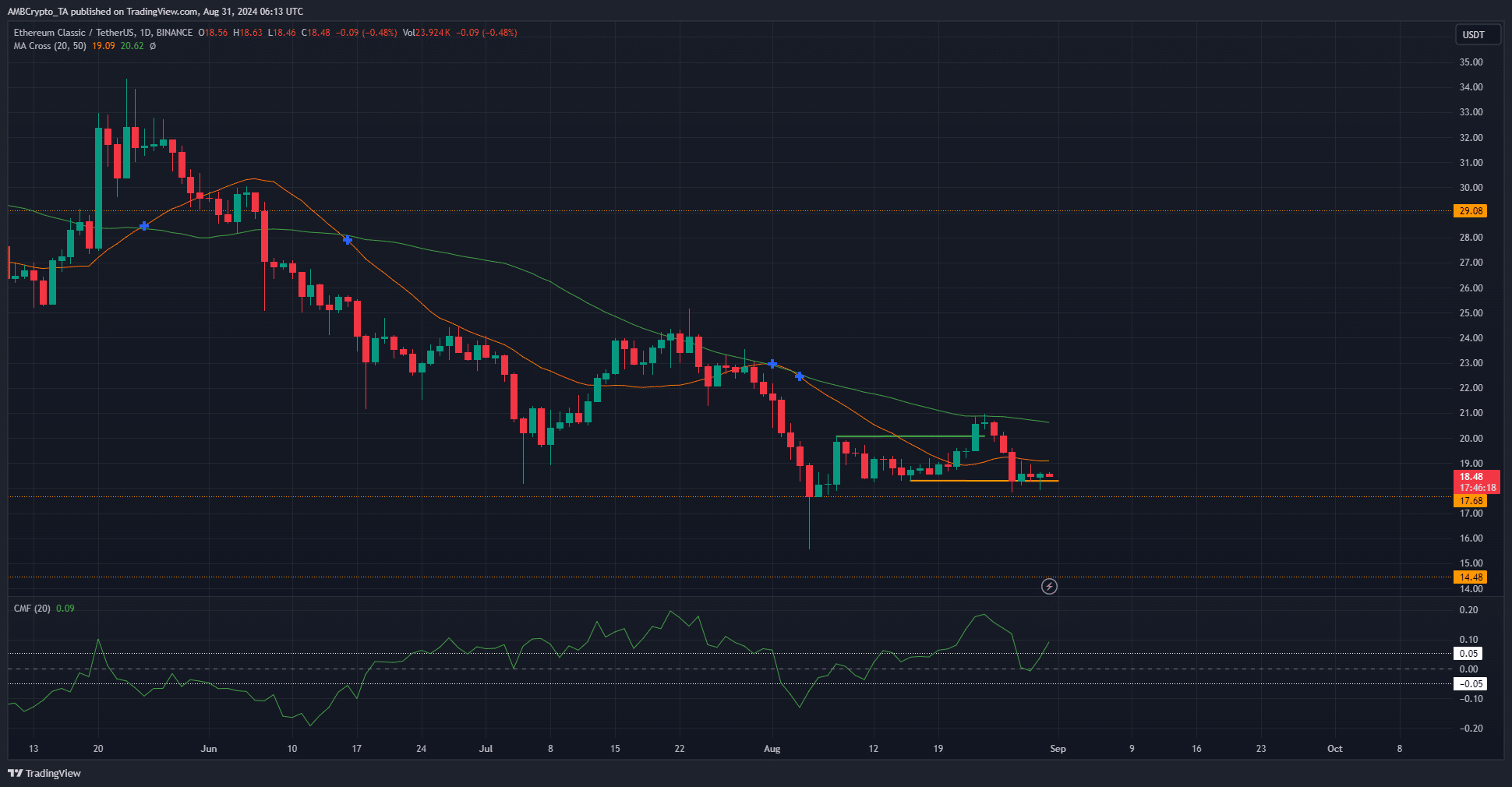

Source: ETC/USDT on TradingView

Ethereum Classic has been in a bullish market structure on the daily chart after breaking the recent low of $20.07. At the time of writing, the higher low of $18.3 has not yet been broken. However, the trend has been bearish since May.

The moving averages also showed the same thing. It has not yet formed a bullish crossover indicating an uptrend. In addition, Ethereum Classic was rejected at the 50-day moving average a week ago.

CMF was at +0.09 indicating significant capital inflows, but the token was trading below its 20-period SMA. Bulls should be wary of another bearish move and may instead choose to wait for more definitive conditions.

Short-term outlook for ETC bullishness is not good

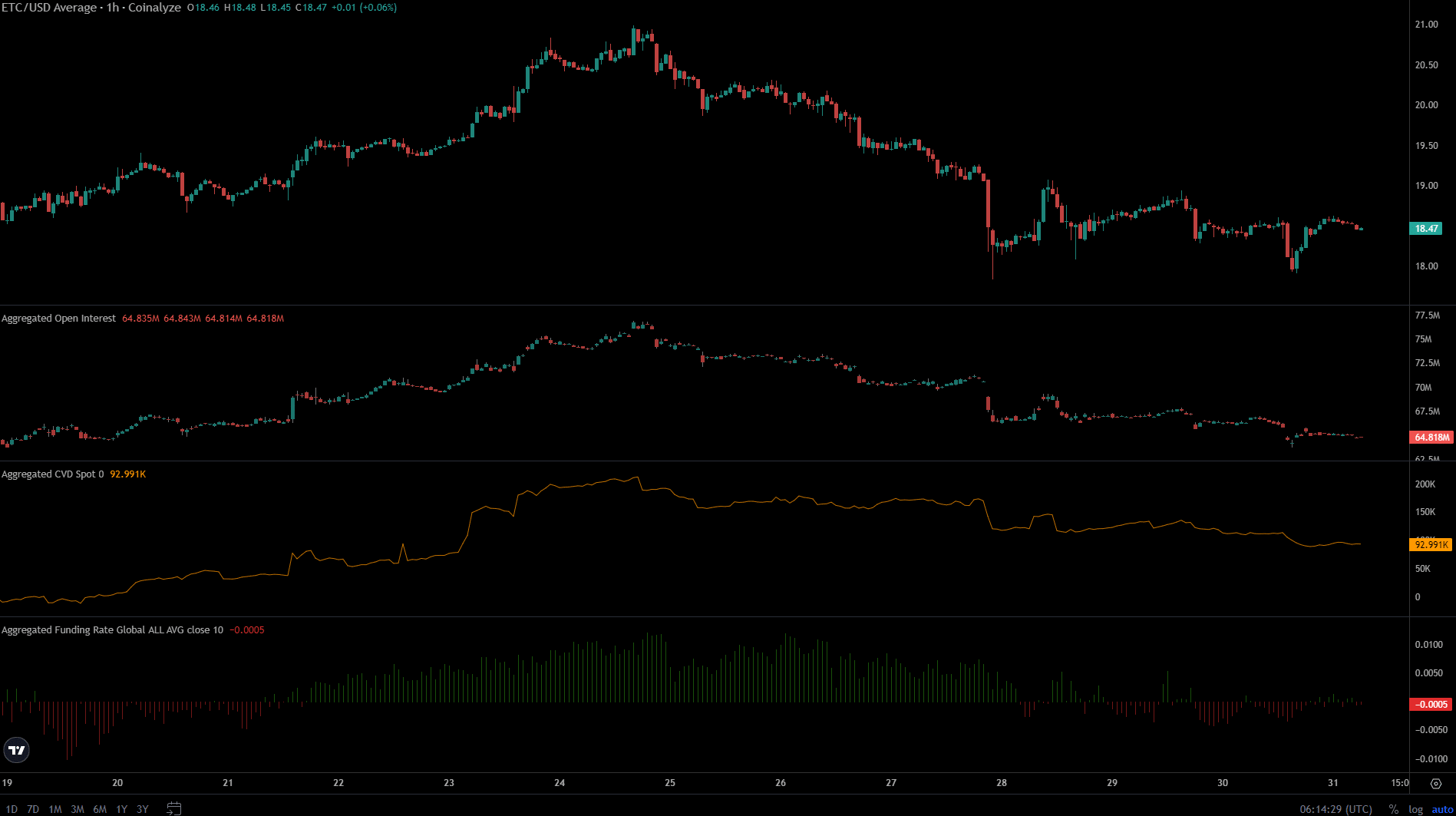

Source: Coinalyze

Over the past three days, Ethereum Classic has struggled to break above the $19 level and instead has moved closer to $18. This has led to a decline in Open Interest from $71m to $65m, indicating bearish sentiment.

Read our Ethereum Classic (ETC) price prediction 2024-25

During this period, the funding ratio showed a slight downward trend, which led to expectations of a downtrend in the futures market. Spot traders were also not interested in buying ETC, and spot CVD has been in a downward trend since then.

Overall, the trend for the next few days is likely to be sideways or down.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.