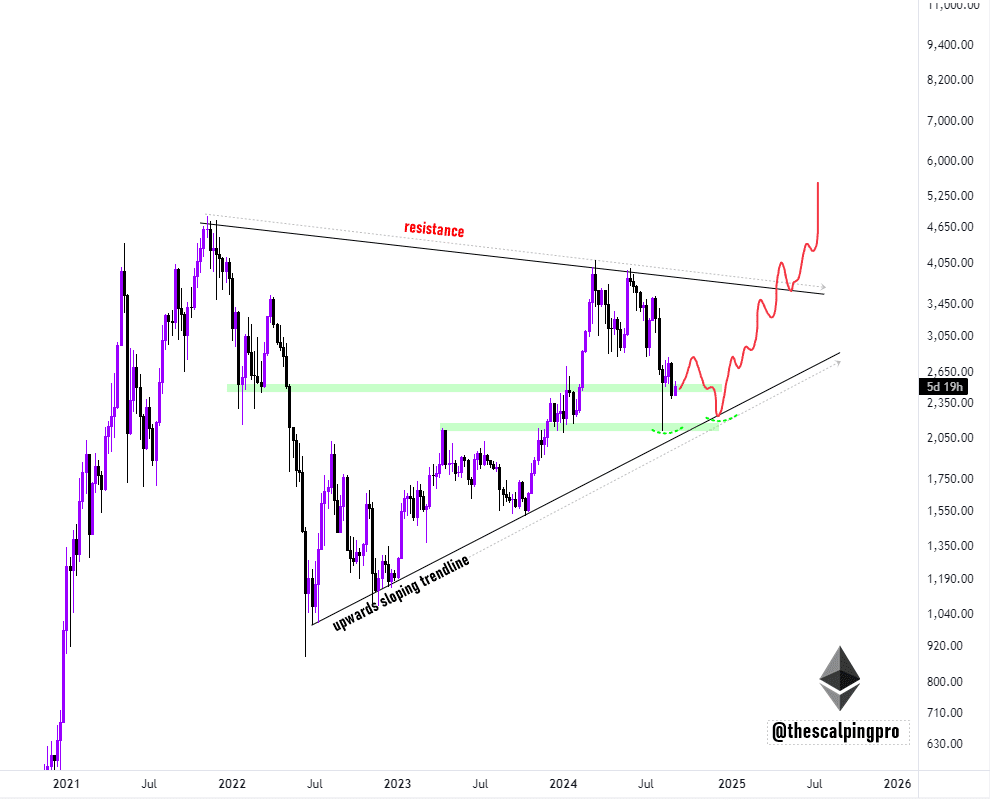

- At the time of writing, Ethereum was trading in a massive triangle formation, with analysts predicting a double bottom pattern.

- The increase in whale trading and active addresses suggests that the ETH price may rise.

Ethereum (ETH) has faced significant challenges in recent weeks, continuing its downward trajectory in both price and market sentiment. Following last month’s price crash, ETH has continued to experience a bearish market trend.

In the last 24 hours, the asset fell another 4.5%, reaching a trading price of $2,399, which is a further 2.3% drop in the overall market context.

Despite this continued downtrend, some analysts remain optimistic about Ethereum’s future price movements.

Recently, crypto analyst Mags from X (formerly Twitter) said: share His views on the potential for Ethereum to reverse its downtrend.

Is Ethereum recovering?

In his post, Mags noted:

“Ethereum is trading inside a massive triangle, and we may see a double bottom forming near the uptrend line support line, after which it heads up.”

According to this analysis, ETH is approaching a decisive moment, and a bullish reversal is likely soon.

In technical analysis, a double bottom formation is a bullish reversal pattern that suggests that the price of an asset is approaching a low and ready to move higher again.

This pattern is formed when the price drops to a support level twice and then rises slightly between the two lows.

If the Ethereum price follows this pattern as Max suggests, we could see a significant uptrend after the current downtrend.

Source: Mags/X

Ethereum’s technical indicators support the possibility of a rebound, and at the time of writing, the asset is trading near key support levels.

If a double bottom pattern is realized, Ethereum could break out of its long-term downtrend and start a new uptrend.

However, this scenario remains speculative, and it is important to remain cautious as Ethereum approaches these key price levels.

Whale Trading and Active Address Rebound

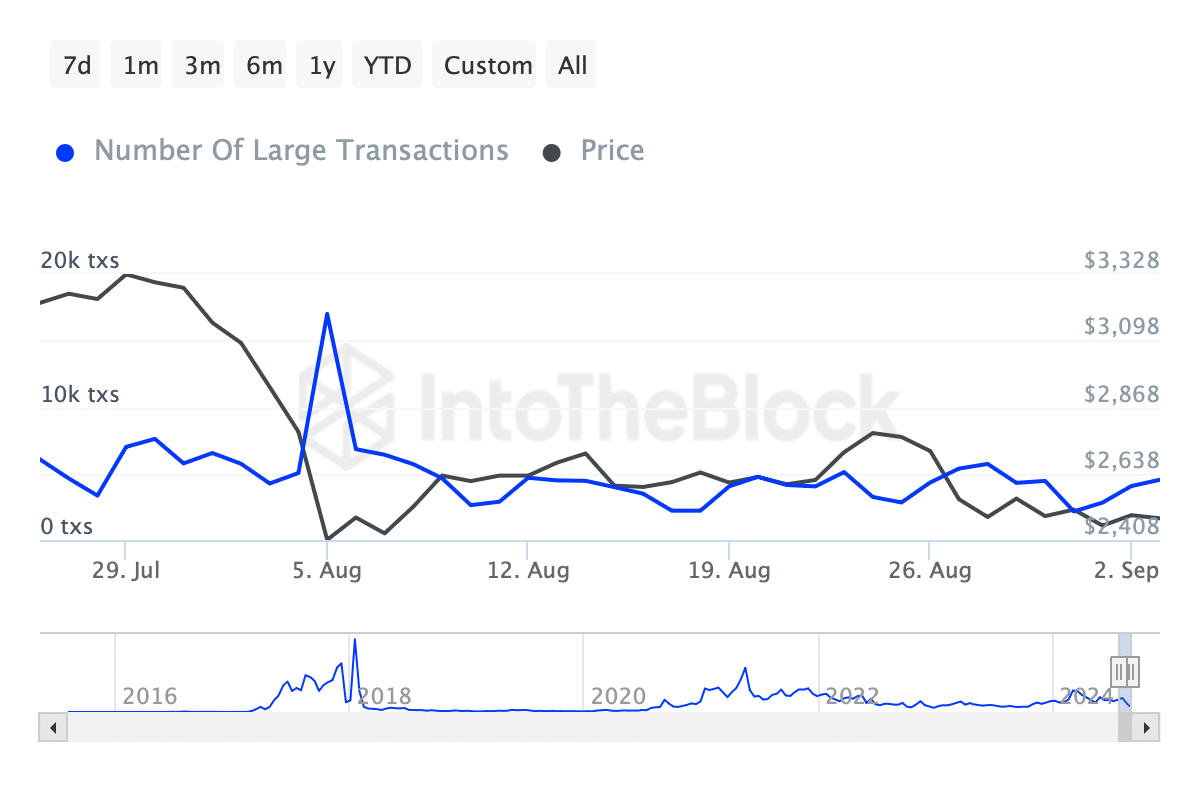

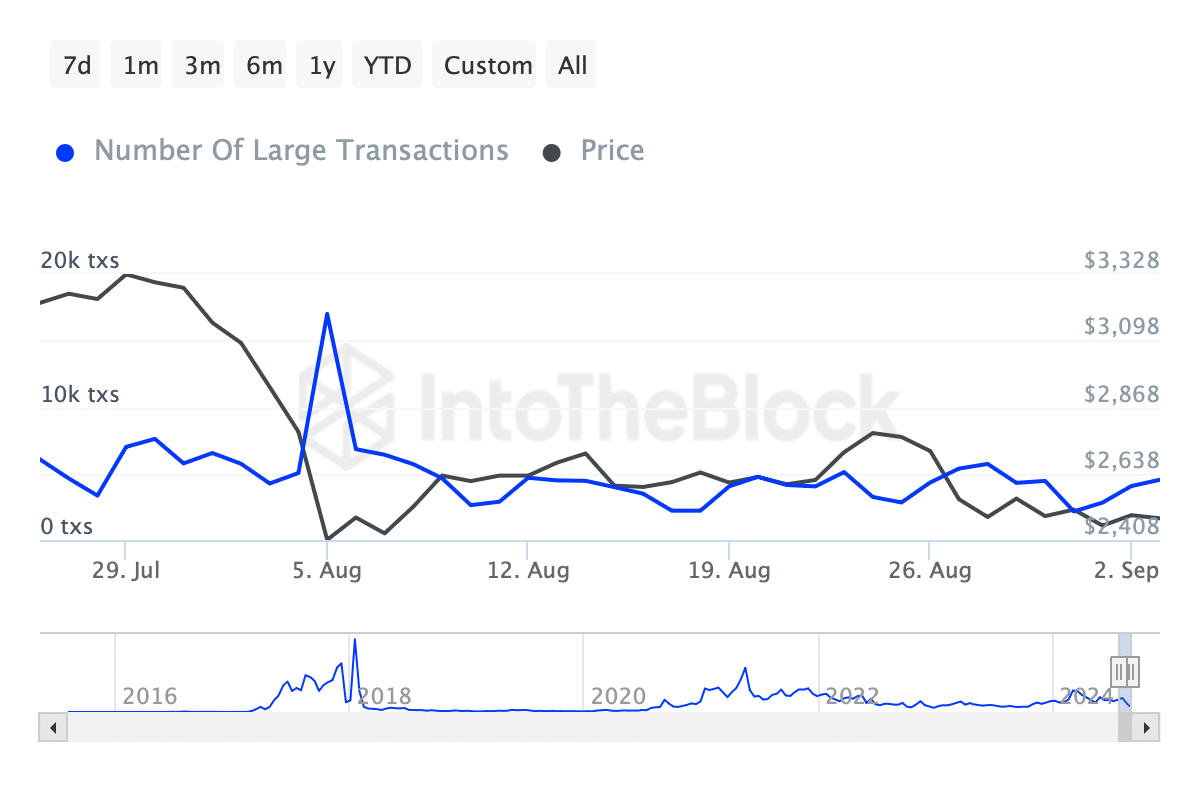

What’s interesting is that despite the Ethereum price decline, some of the asset’s fundamentals are starting to show positive signs.

for example, data According to IntoTheBlock, whale transactions worth over $100,000 in Ethereum are starting to recover after a major drop in early August.

On August 5, these transactions peaked at over 16,000, before plummeting to around 2,210 on August 10. Recent data has shown a recovery. Whale Trading At the time of writing, there were 4,530 people.

Source: IntoTheBlock

The rebound in whale activity suggests that large investors are bracing for a potential recovery in the Ethereum price.

An increase in whale trading is generally considered a positive indicator, as it signals increased interest from deep-pocketed investors, which can spark a broader market rally.

Read Ethereum (ETH) Price Prediction 2024-2025

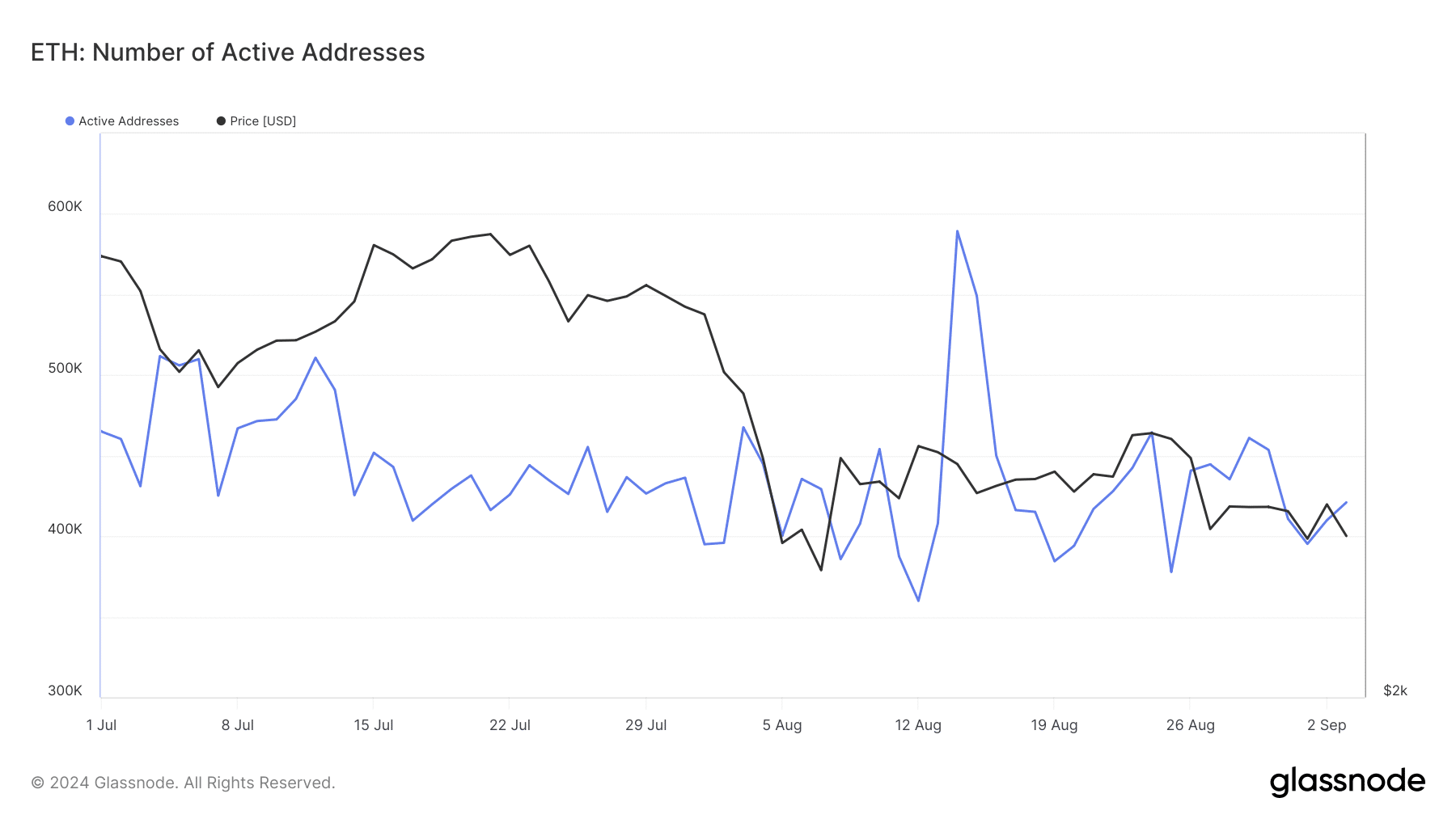

In addition to whale trading, data Glassnode highlighted that the number of active addresses on Ethereum has recovered. The number of active addresses peaked at 589,000 on August 14, but dropped below 400,000 last week.

Source: Glassnode

At the time of writing, this indicator has risen again to 420,000. A surge in active addresses usually reflects increased user activity on the network, which may also contribute to the price increase.