- Monero’s massive rally comes with renewed interest from investors.

- At the time of writing, the futures market was still bullish on the altcoin.

Cryptocurrency with a focus on privacy Monero (XMR) Despite the overall market sell-off, there was no unusual performance on the weekly chart.

According to CoinMarketCap data, XMR topped the weekly chart early in the Asian trading session on Thursday, with gains of around 10%.

Source: CoinMarketCap

The opposing and explosive price action on Monero’s price chart was seen before it attracted strong global attention in late August. Google Trends.

Global user interest in the search giant peaked at 69 from August 25 to 31, led by St. Helena and China. This was the highest level of interest since 2021.

Source: Google Trends

What’s interesting is that the increased interest in Telegram coincides with the arrest of Pavel Durov in France.

With Durov’s arrest generally perceived as an ‘attack on freedom of speech’, most users may be refocusing their attention on privacy-focused assets.

Monero (XMR) Price Movement

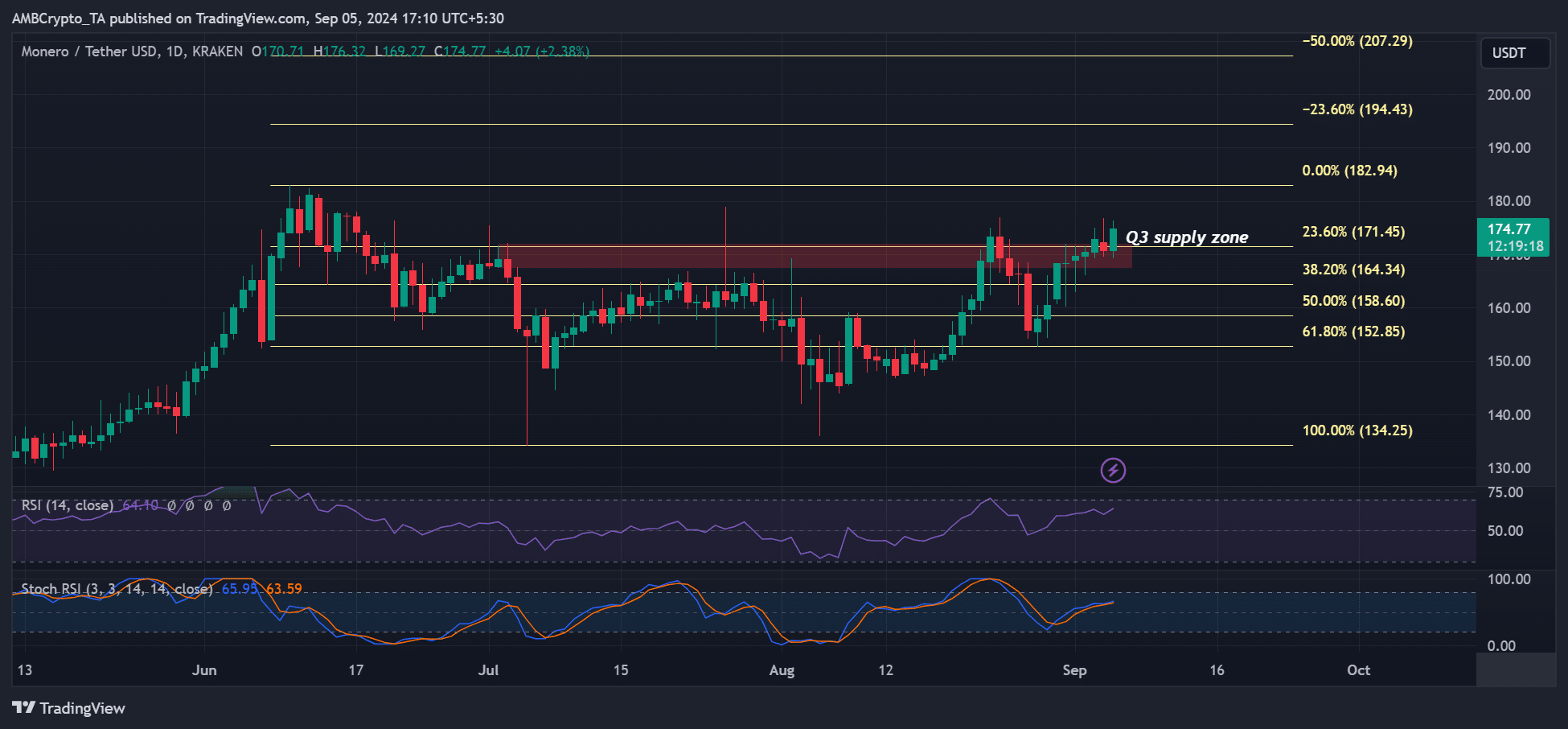

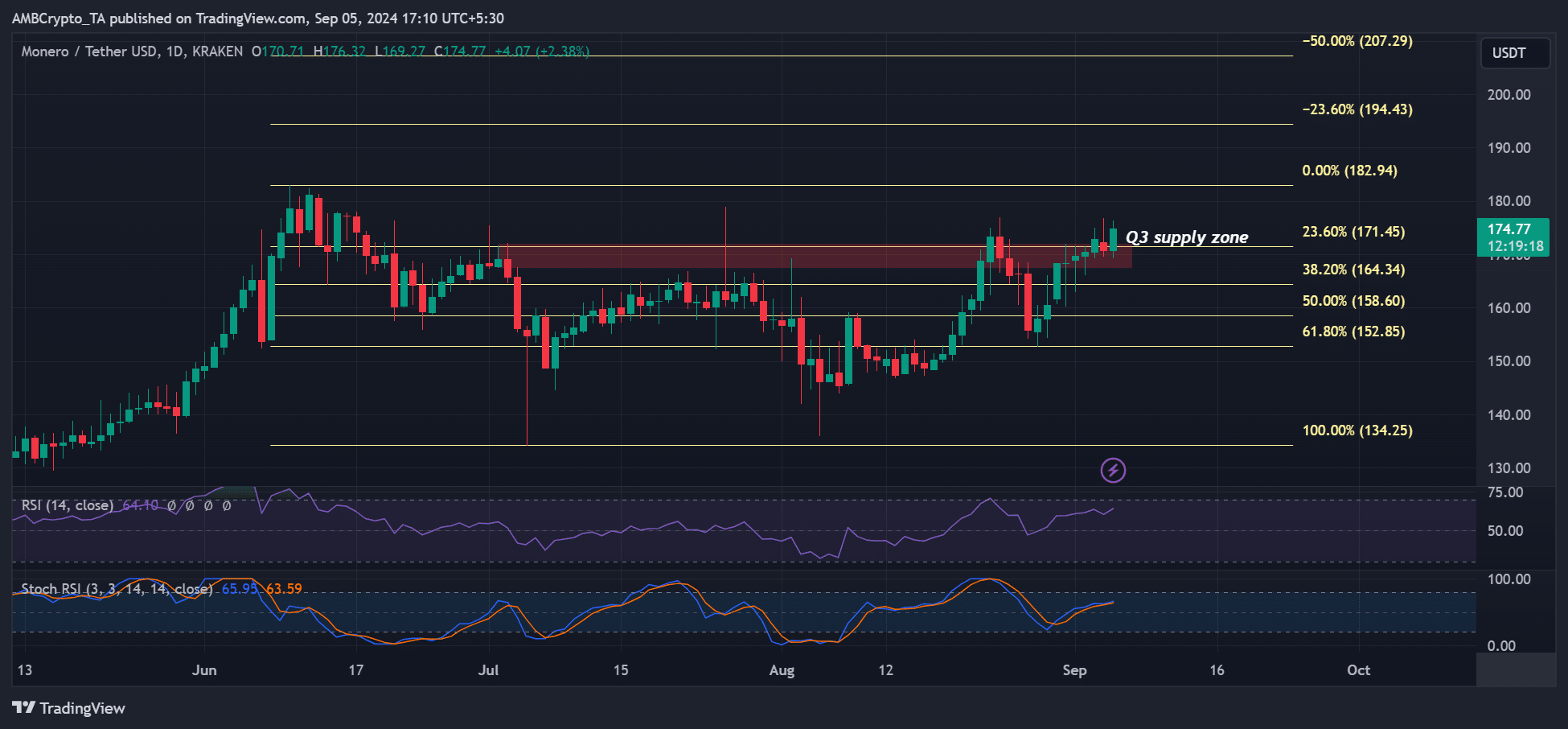

Source: XMR/USDT, TradingView

At the peak of interest in late August, XMR surged 12%, rising from $152 to $172. However, it has been consolidating around $170 over the past few days.

Evaluating the price action, the $170 level was the Q3 supply zone (highlighted in red) that signaled price rejection in July and August.

However, at the time of writing, XMR has remained above its supply for the past three days, but has not significantly extended the recovery that began in August.

Nonetheless, the Stochastic RSI (Relative Strength Index) and RSI suggested that a long-term rally was possible as the indicators had not yet reached overbought levels.

So in the short term, the next immediate target would be $182 or $194, especially if overall market sentiment improves.

However, further weakness could see sellers push XMR down to the lower support levels of $158 or $152.

read Monero (XMR) Price Prediction 2024~2025

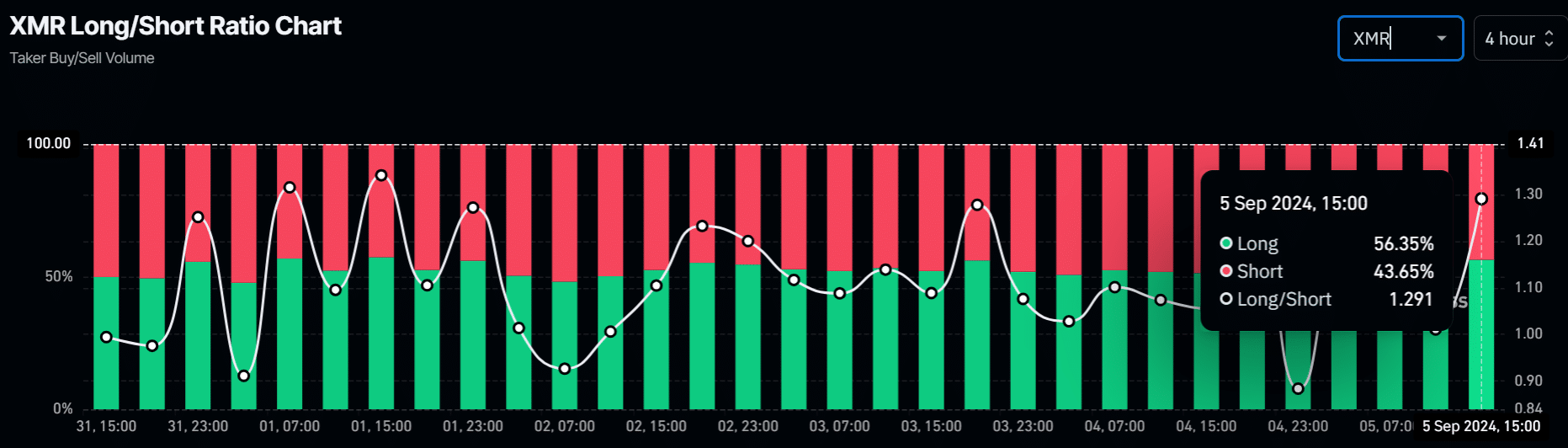

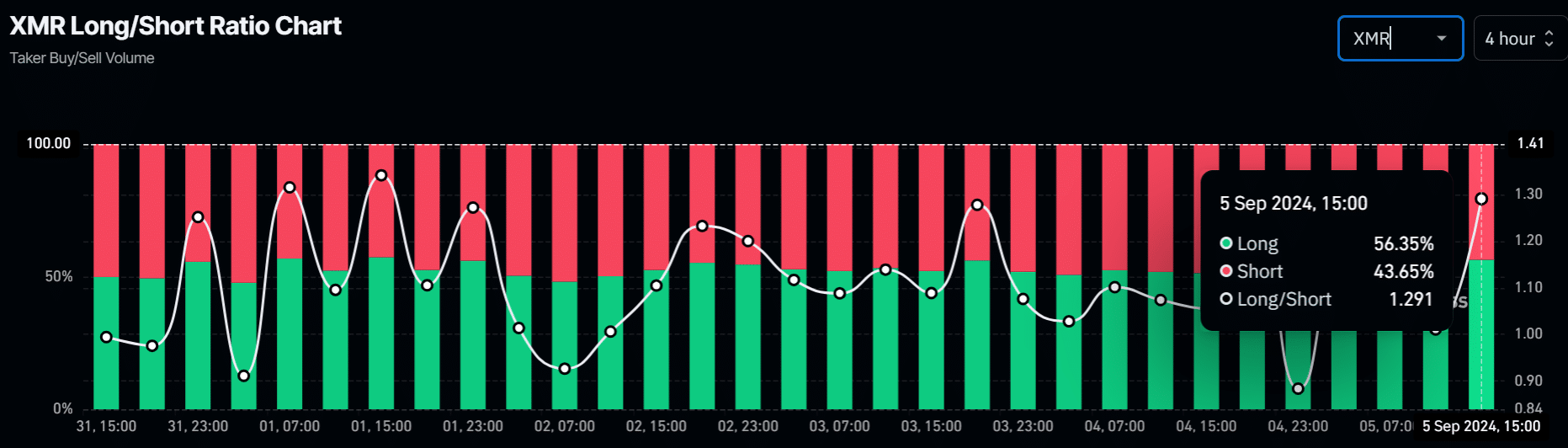

Meanwhile, the derivatives markets showed bullish confidence, with 56% of XMR speculators’ bets being long positions.

This suggests that futures traders are betting on a long-term recovery for altcoins.

Source: Coinglass