- As of the time of writing, Helium’s record data revenue and increased token burn were driving the bullish momentum.

- Technical and on-chain indicators suggested room for further growth, but resistance appeared close at hand.

Helium (HNT)At press time, the price was $8.16, up 0.2% over the last 24 hours due to strong data revenue and increased token burn.

The increasing use of mobile and IoT services on the Helium Network has had a significant impact on token supply and price trends.

This analysis uses technical and on-chain data to determine whether the current uptrend is likely to continue.

What drives demand for HNT?

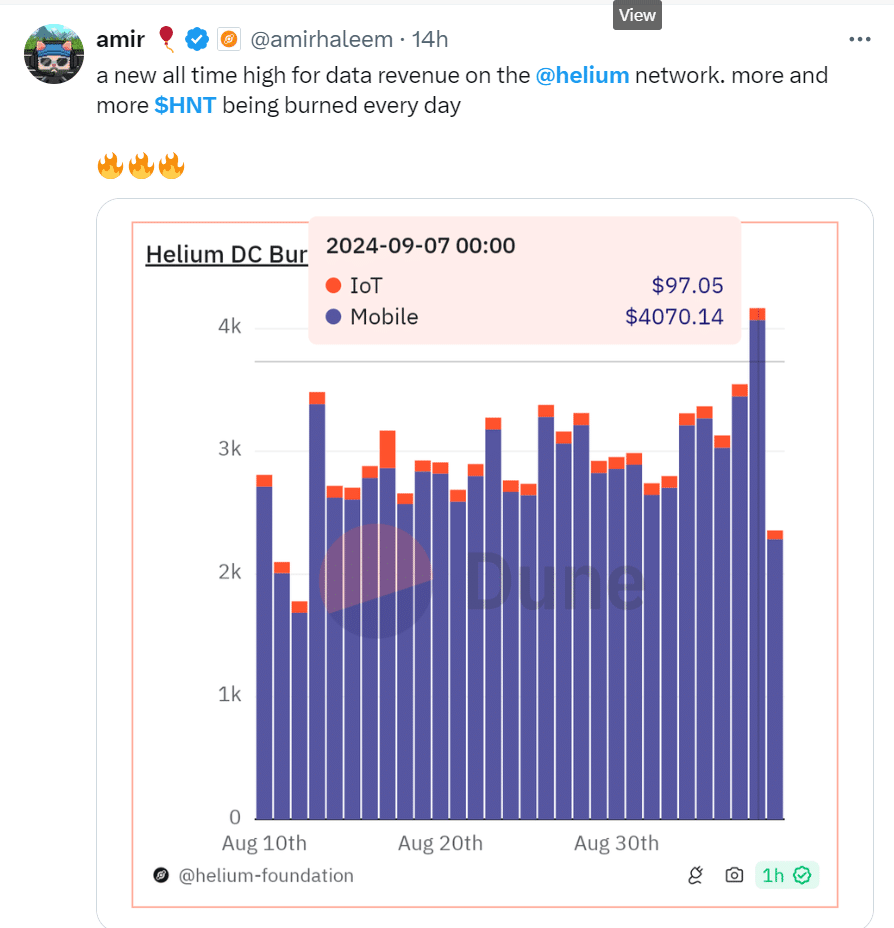

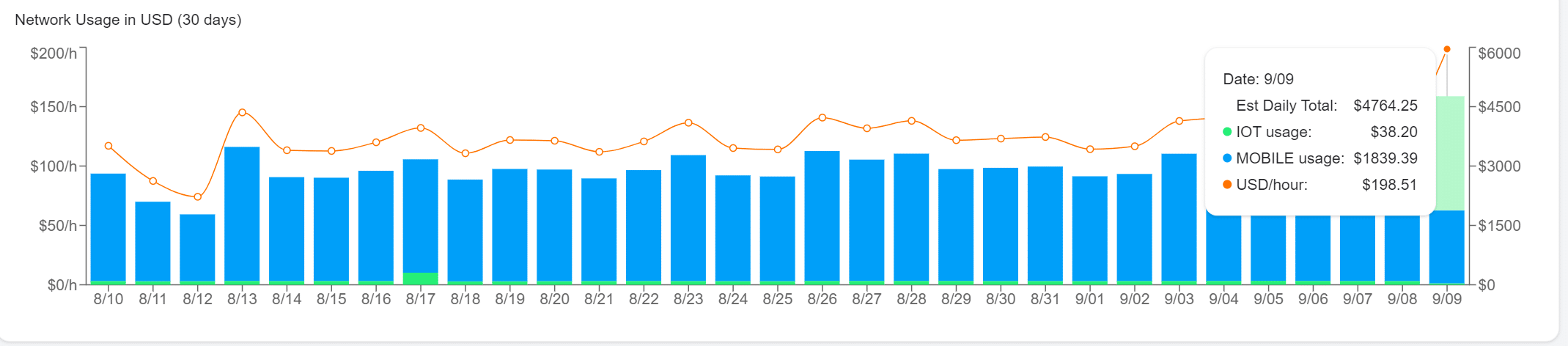

For example, on September 7, Helium recorded its highest daily data revenue, earning $4,070.14 from mobile and $97.05 from IoT services.

This resulted in more HNT being burned. This is how the Helium network works, burning HNT to generate Data Credits (DC).

Over the last 24 hours, 9.6 million DCs have been burned, indicating a decrease in the number of $HNT in circulation.

Another important achievement was captured by founder Amir Haleem. Posts from X (formerly Twitter)He noted that token burns are increasing daily as network adoption grows.

Source: X/Amir Haleem

This is consistent with the fact that as network utilization increases, the burn rate increases, resulting in deflationary characteristics for the HNT token.

Additionally, 7.68% of the total HNT supply is currently staked, limiting the market supply.

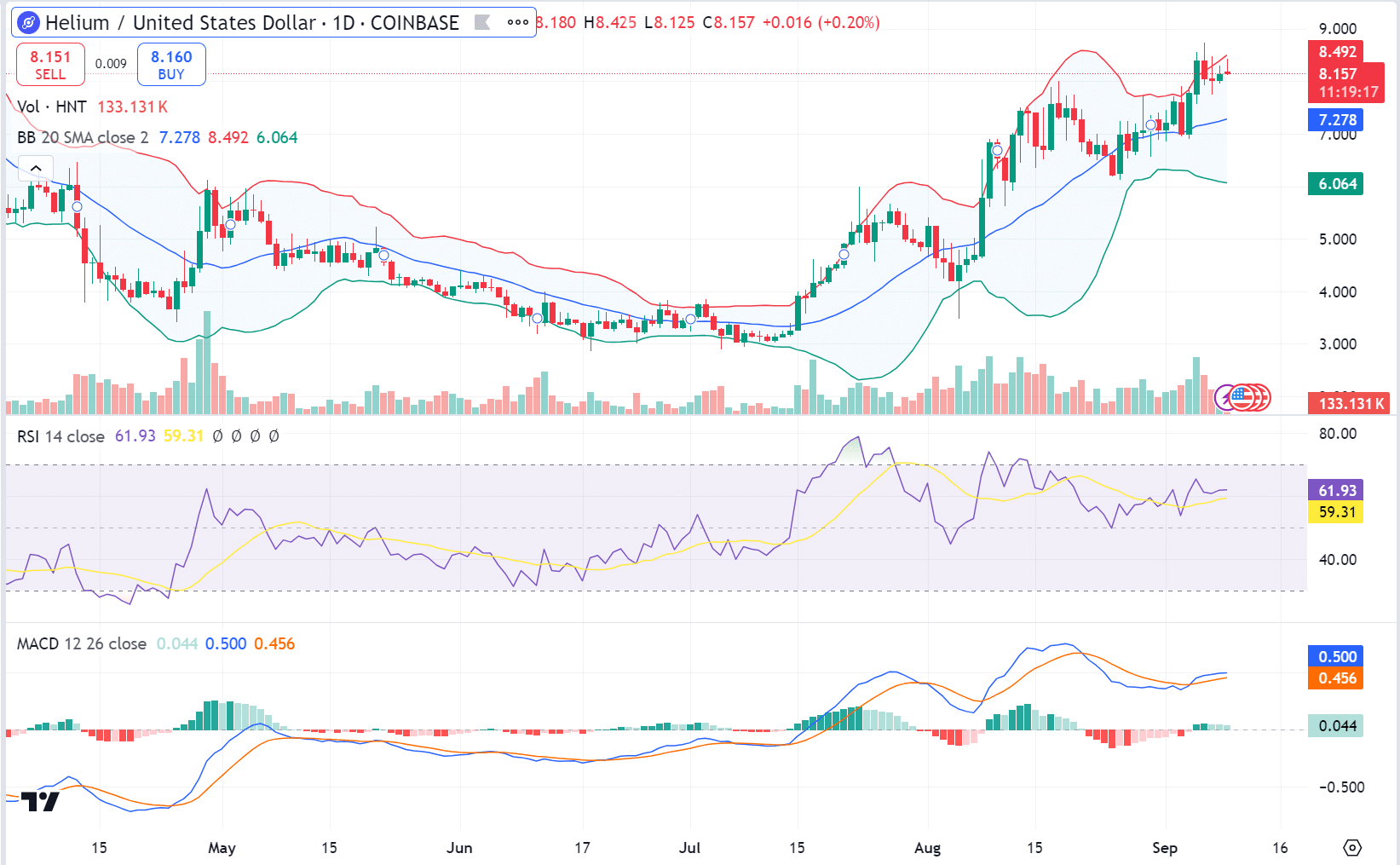

Technical indicators indicate short-term strength.

AMBCrypto’s outlook on helium suggests a positive direction for the currency.

At the time of writing, the Relative Strength Index (RSI) was at 61.93, which suggests that $HNT is still below the overbought level of 70, and therefore has the potential to move higher.

The MACD indicator is showing a bullish crossover as the MACD line is 0.005 above the signal line, which suggests that the market is still in an uptrend.

However, the price is approaching the upper Bollinger Band at $8.492.

This suggests that there is short-term resistance, as most assets trading near the upper Bollinger Bands tend to experience increased volatility or consolidation.

If the price fails to break this level, it is likely to fall.

Source: TradingView

On-chain and emotional contrast

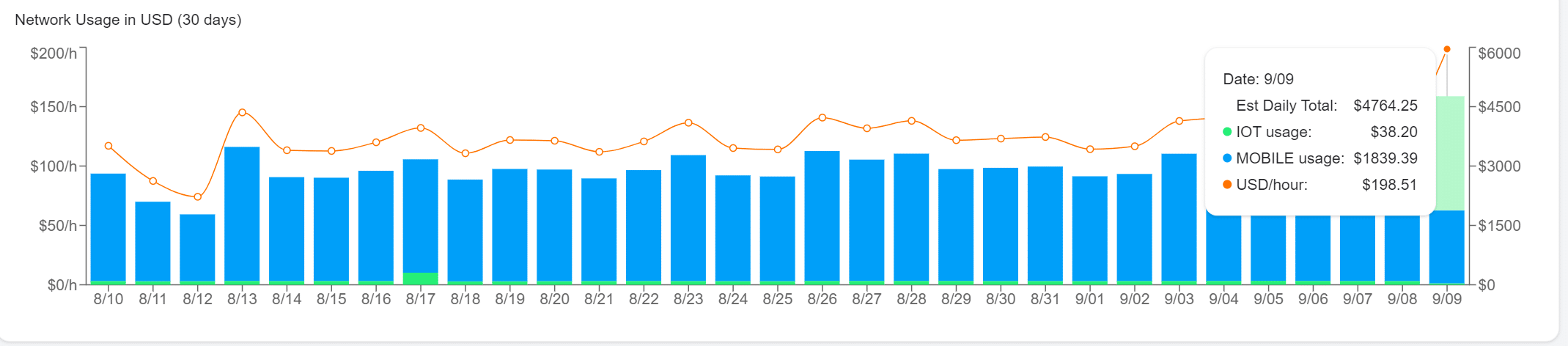

Blockchain data backs up these bullish claims about Helium: the network had 357,267 active hotspots at the time of writing, which is significant because it shows the growth of the physical infrastructure that is being provided for decentralized wireless services.

Additionally, as of September 9, Helium Mobile had 113,250 subscribers, which is the actual usage of the network.

The network generated a daily revenue of $4,764.25 on the day, which was primarily driven by mobile and IoT usage, which remains the cause of token burns and supply reductions.

Source: Helium Explorer

The overall market perception of Helium remains bullish at the time of writing, supported by steady growth in network usage and an increase in tokens being burned, which adds to the deflationary pressure on HNT.

However, investors should not overlook other market conditions, as even if the fundamentals of Helium are good, broader market conditions can impact the price of HNT as the network grows.

Sustainability of bullish momentum

From the above analysis, we can see that Helium’s fundamentals, namely, short-term data revenue growth, token burn, and network adoption, strongly support a bullish trend.

Making HNT a deflationary model means that as the network becomes more used, there will be less $HNT in circulation, thus driving up the price.

Fundamental analysis also supported the positive trend, while RSI and MACD also showed positive results in technical analysis.

However, traders should keep an eye on the Bollinger Band resistance level at $8,378 and changes in overall market sentiment.

Even if the current trend appears favorable, short-term fluctuations can occur if there are major difficulties or movements in the market.

Read Helium (HNT) Price Forecast 2024-2025

Driven by increasing data revenue and active network participants, the token burn rate is also on the rise, which is also driving up the $HNT price.

However, monitoring key resistance levels and market conditions is important to determine if this trend is sustainable or if there may be a short-term downside.