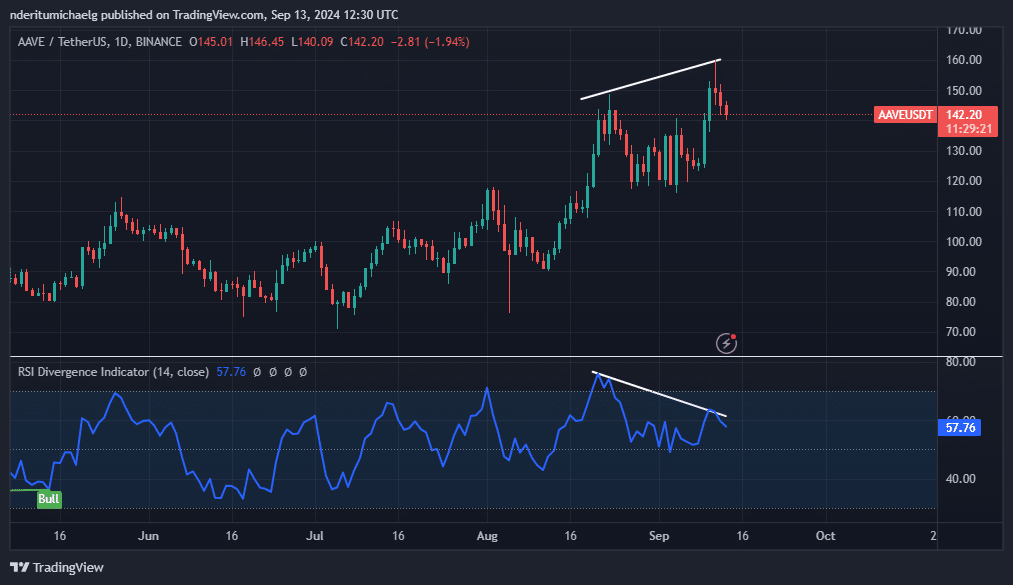

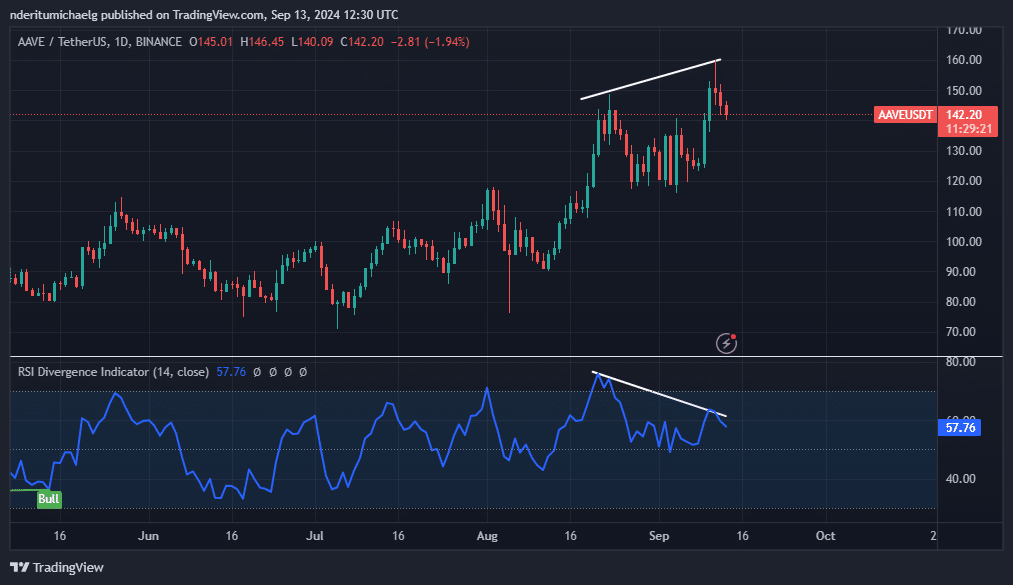

- AAVE has formed a bearish divergence pattern, which could signal a temporary slowdown in the impressive rally.

- On-chain data revealed dynamic changes in trading flow that foreshadow a bear market.

Aave (AAVE) has been one of the few cryptocurrencies that has managed to avoid the bear market situation over the past few weeks. However, what goes up must go down, and AAVE’s rally may be over, at least for now.

AAVE has been in a downtrend in the second half of this week. It has extended its downtrend over the past 24 hours. Second biggest loser It is one of the coins with the highest price in the last 24 hours.

It plunged more than 6% during the trading session.

The bearish results for AAVE were not surprising, as it has been showing major bearish signs recently. The cryptocurrency has hit higher highs this month compared to its August highs.

Meanwhile, the RSI formed a bearish divergence pattern, posting lower highs compared to its August high.

Source: TradingView

This divergence indicates that the bullish momentum is running out. Since then, there has been an 11.95% correction to the 147.20 reporting level.

Given the uptrend since the August lows, this could be the start of a significant correction.

Will the AAVE downtrend get worse?

AAVE is trading at an 85% premium to its August low despite the recent sell-off. If the downtrend continues, the next major support level to watch is just below $120.

That’s down 16% as of press time.

However, if market dynamics turn bullish, the bulls may gain momentum.

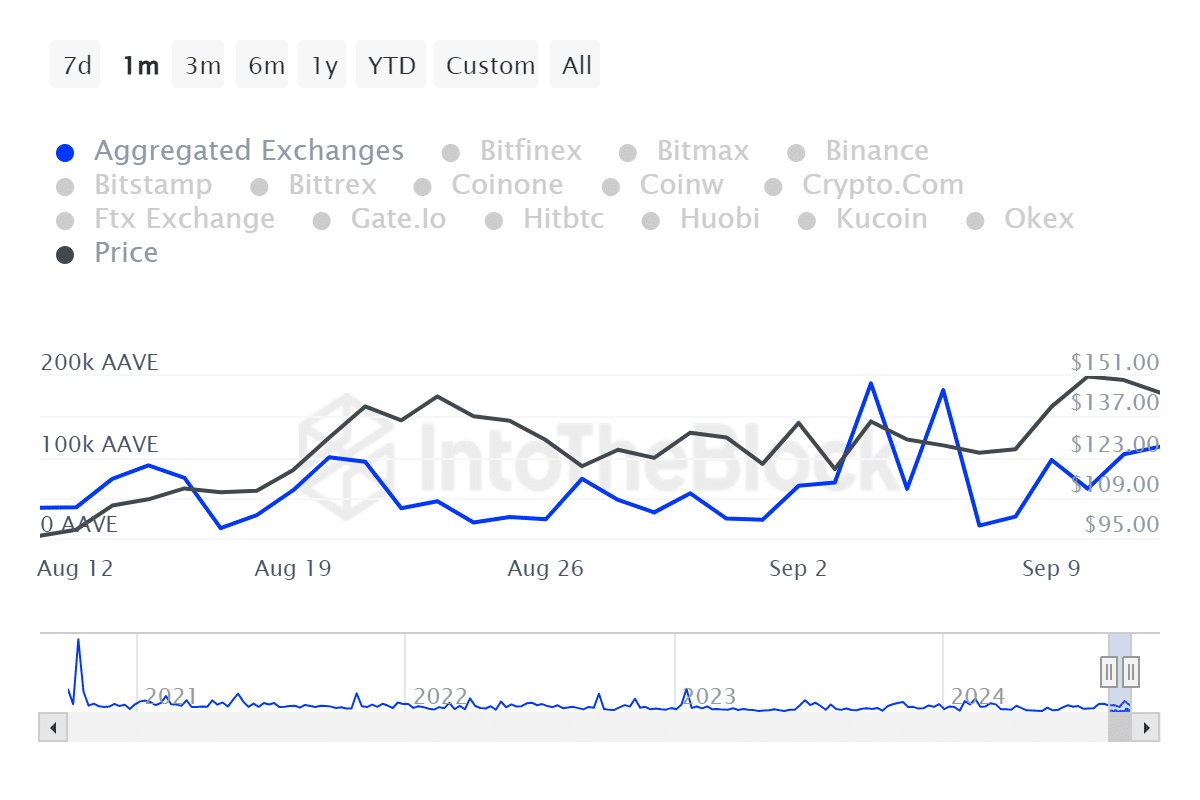

On-chain data shows a pivot in exchange inflows, confirming increasing selling pressure. Aggregated exchange inflows surged from 15,340 AAVE on September 7 to 112,780 AAVE on September 12.

Source: IntoTheBlock

Exchange outflows peaked on September 4th at 182,040 AAVE, and by October 12th, they had reached 85,200 AAVE.

This confirms a decline in demand that previously fueled the recent explosion in DeFi tokens.

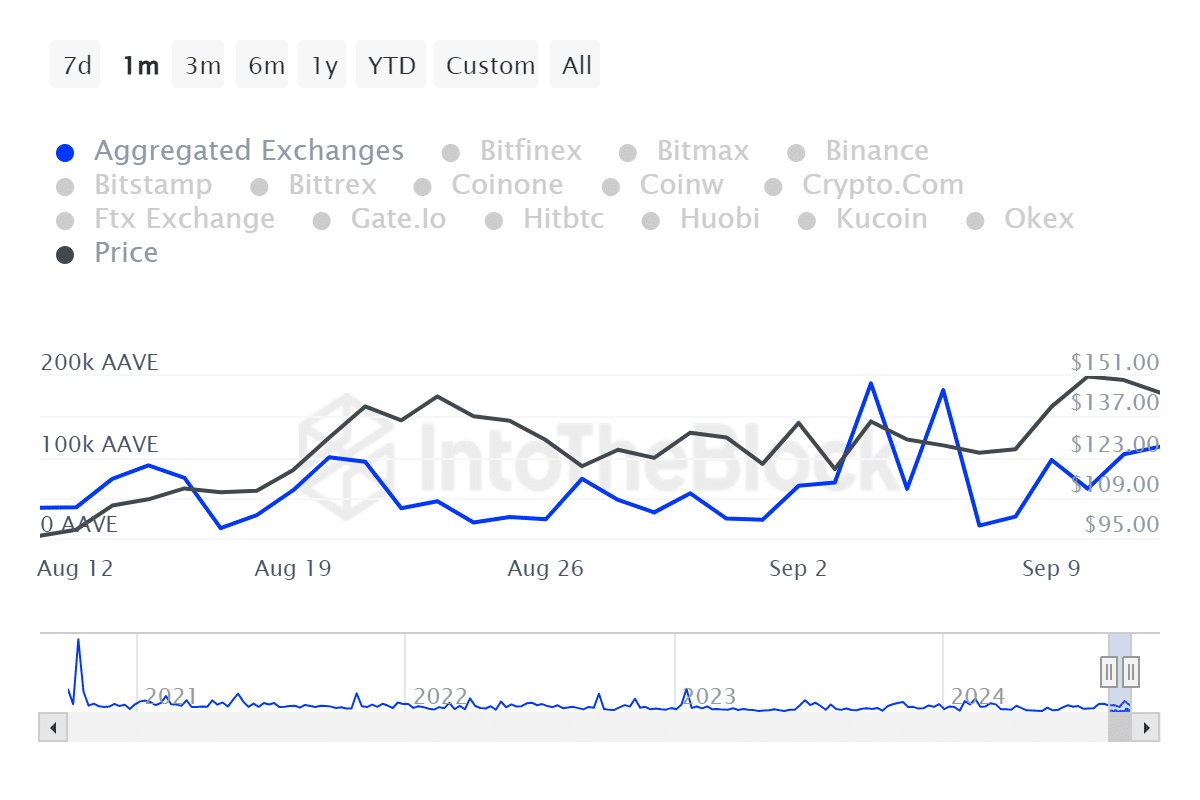

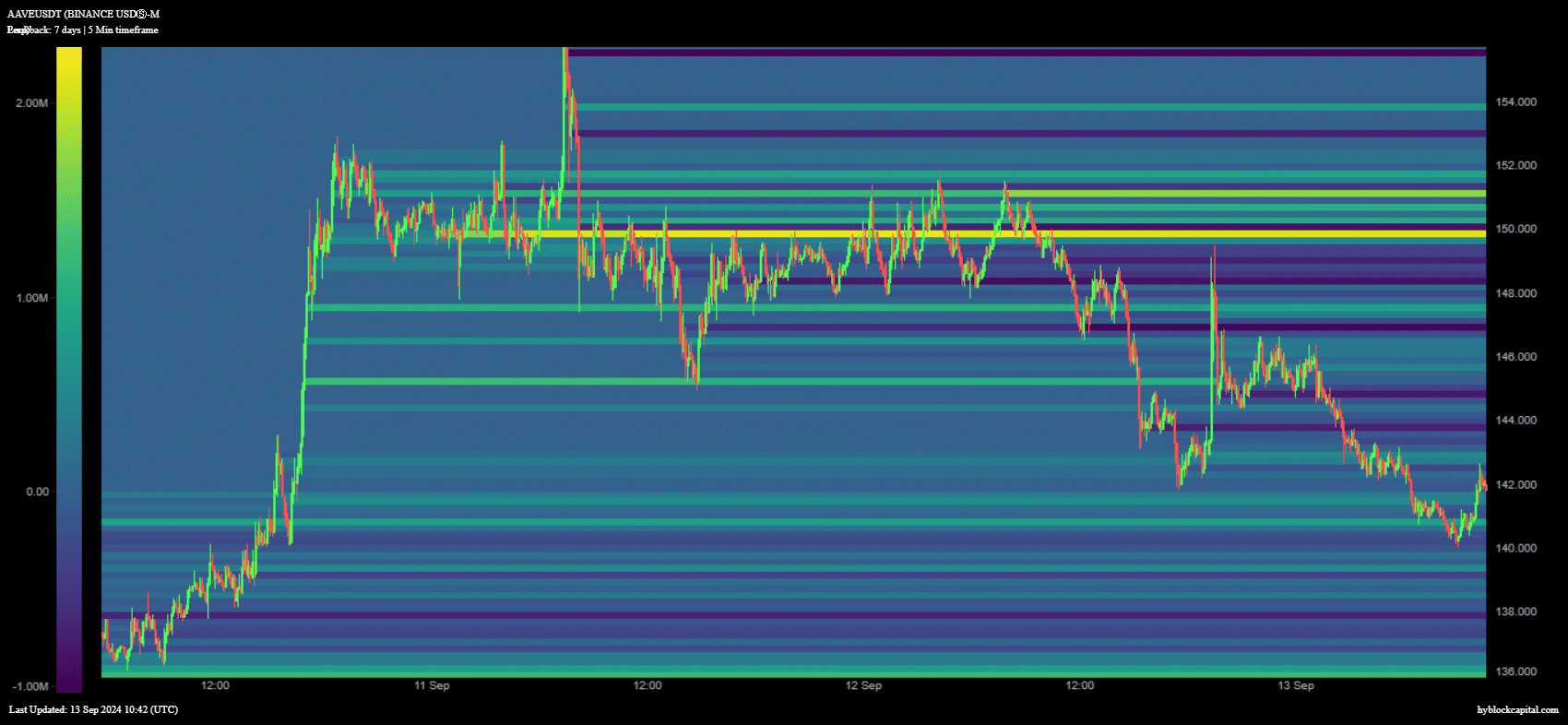

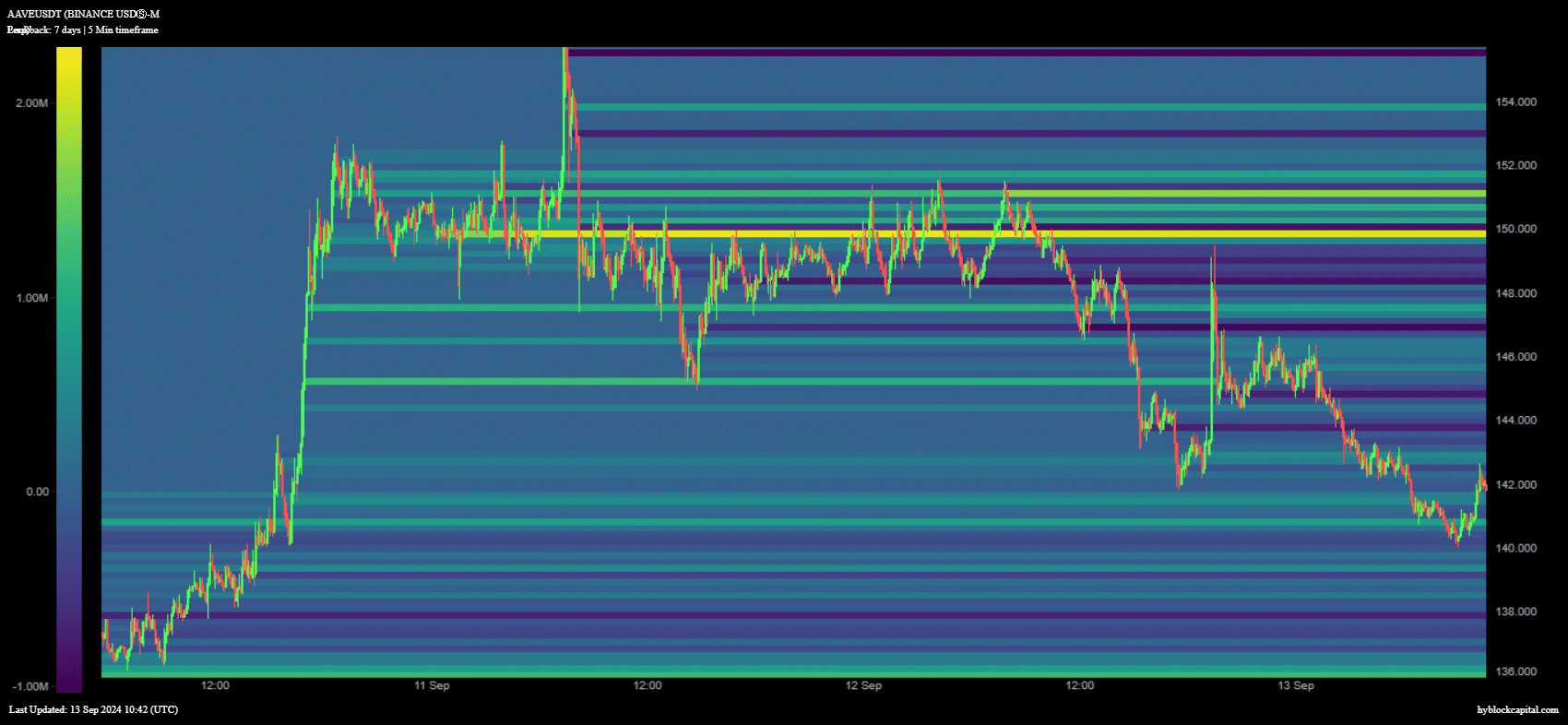

AMBCrypto also observed notable activity in the derivatives sector, with a surge in short positions around the $149 level.

Within that price range, 2.19 million short positions were recorded, which was met with significant resistance.

Source: IntoTheBlock

Read Aave (AAVE) Price Prediction 2024-2025

The heatmap also showed that the market had a net long position of 2.9 million at the $151 level on September 12.

This suggests that there may have been a significant number of liquidations following the price crash, which may have contributed to the selling pressure.