- VELO could surge 81% on solid market sentiment and whale accumulation.

- Oversold RSI and narrowing Bollinger Bands suggest a possible price surge for VELO.

VEIL It has been gaining traction in the market recently, with some analysts suggesting that the token could see significant upward momentum.

analyze share Javon Marks, a cryptocurrency analyst at X (formerly Twitter), claims that VELO could rise 81% to $0.028876 thanks to the bullish market conditions.

But does the data support this optimistic outlook?

At the time of writing, VELO was trading at $0.01611, representing a daily gain of 8.94%, reflecting the growing interest and positive sentiment surrounding the token.

Additionally, the token maintained a healthy market cap of $119 million and recorded a strong trading volume of $21.69 million in the last 24 hours.

teaThese figures indicate strong market interest, but can this lead to sustainable growth?

Is whale accumulation fueling VELO growth?

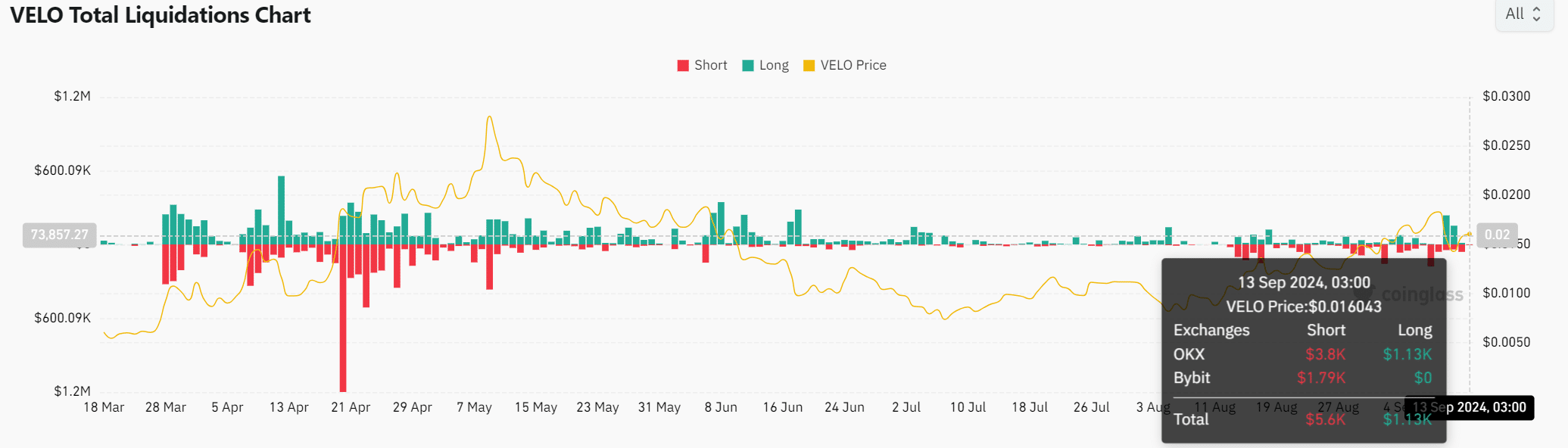

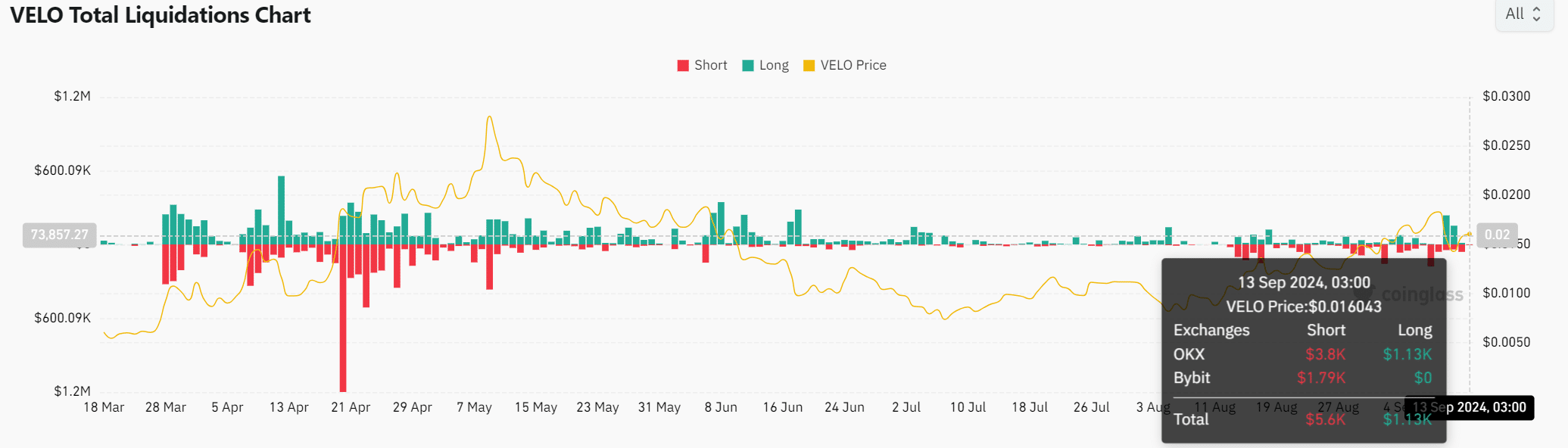

Whale activity has been a major driver of many bullish moves in the cryptocurrency markets. According to on-chain data, VELO has seen significant whale accumulation, which is evident in the total liquidation chart.

The balanced mix of short positions of $5.6K and long positions of $1.13K suggests that whales and large investors are confident in the upside potential of VELO.

Despite the recent reorganization, VELO’s price has not fallen significantly.

This stability often suggests that whales are accumulating tokens without causing price shocks, indicating confidence in future growth potential.

Source: Coinglass

Can technical indicators support a breakout?

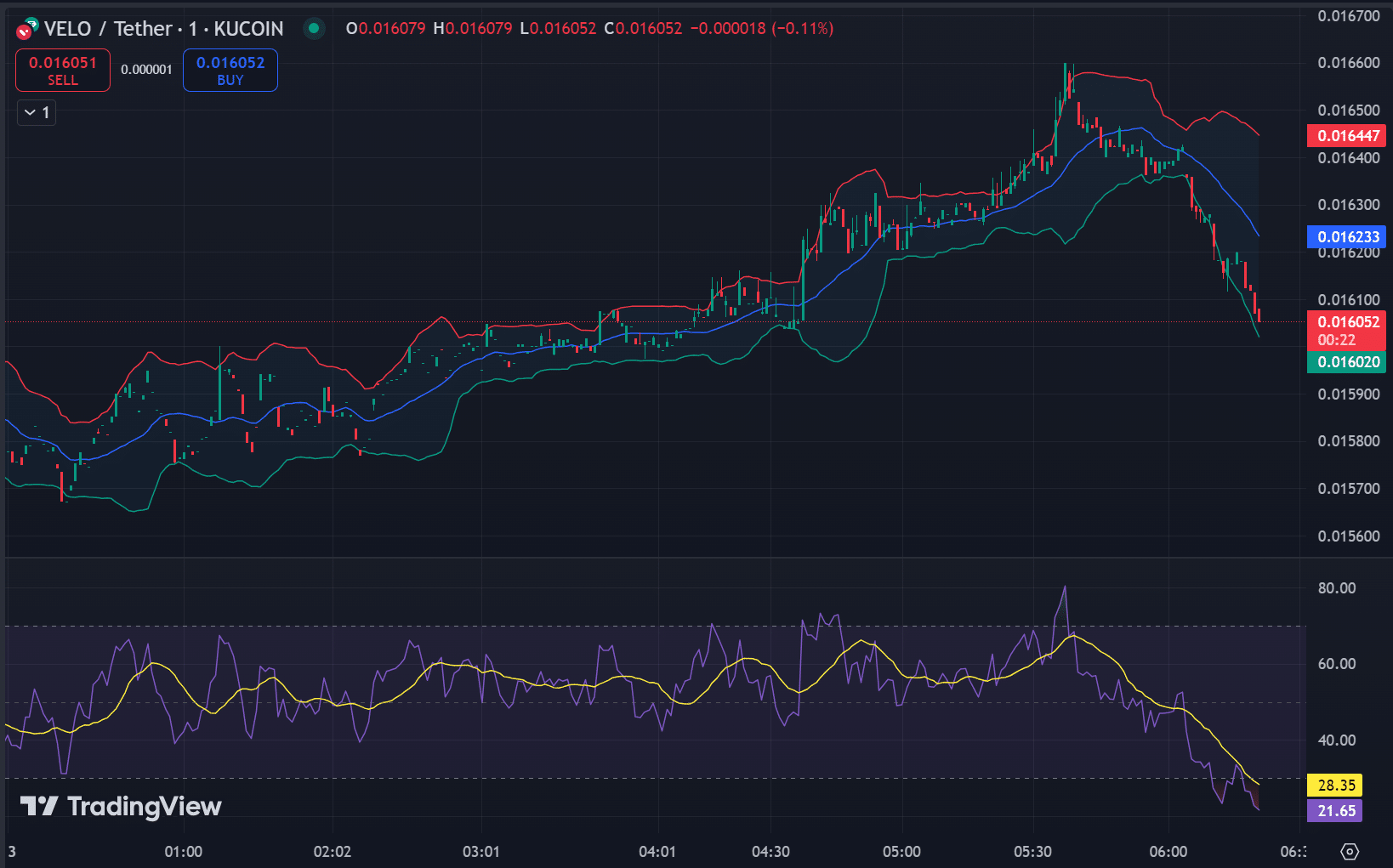

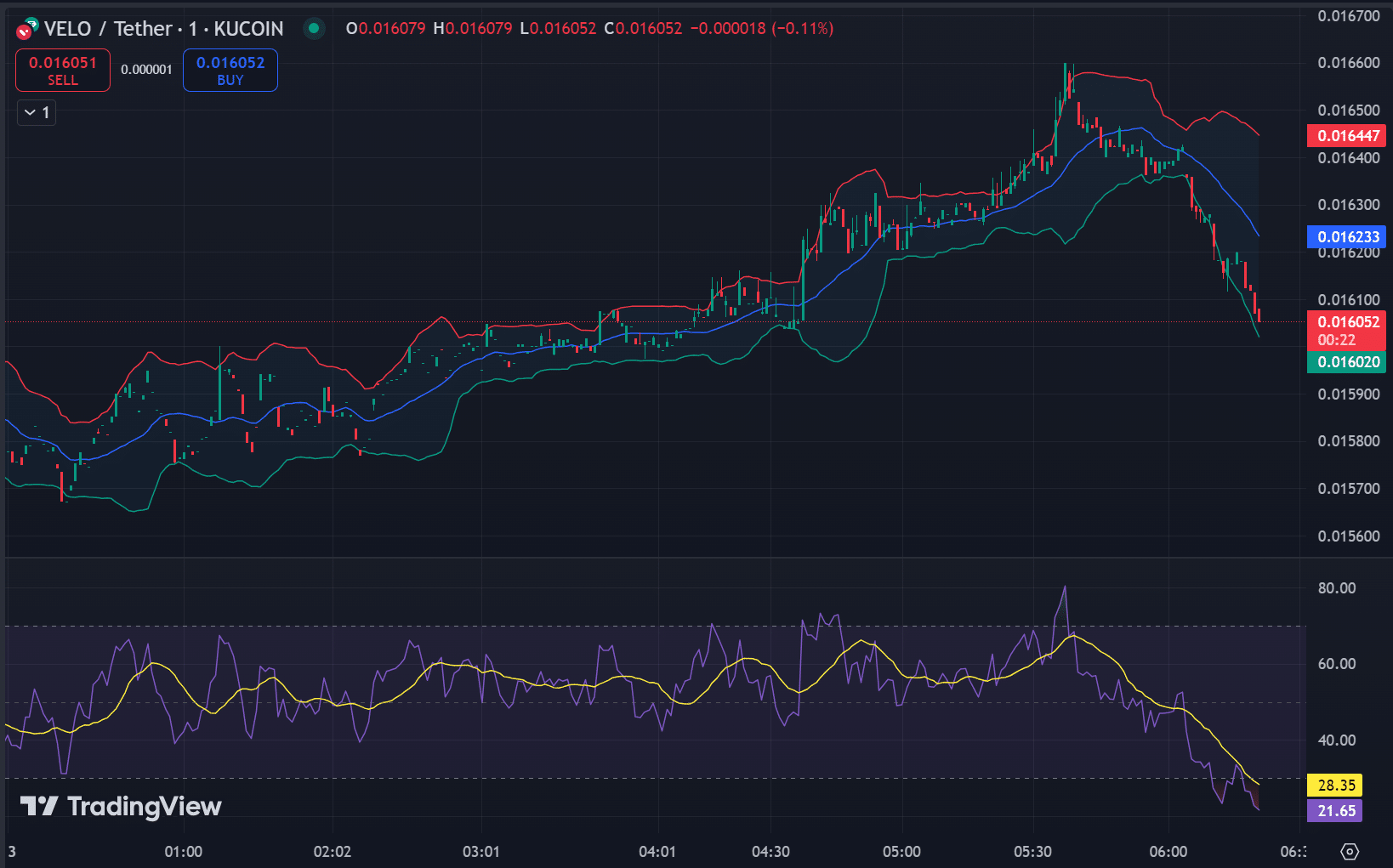

At the time of writing, the RSI (Relative Strength Index) was at 28.35, indicating that VELO is in the overheated sell zone. This generally suggests that selling pressure is weakening and a reversal is imminent as buyers begin to step in.

Likewise, according to Bollinger Bands, VELO was approaching the lower band at $0.01602 at the time of writing, while the upper band was at $0.01644. This tightening suggested low volatility, and an approach to the lower band often signals a potential price bounce.

Source: TradingView

These indicators suggest that VELO may soon experience a rebound, but a breakout of key resistance levels is essential for sustained upside momentum.

What do you think the outcome will be?

Analysts had expected an 81% increase, but a closer look at the actual technical situation suggests a more cautious outlook.

Read our Velo(VELO) price prediction for 2024-2025

For VELO to make such a big move, it first needs to break through the current resistance level of $0.016 and maintain momentum.

Market sentiment, whale accumulation and overheated selling support a short-term upside possibility, but traders should wait for a confirmed breakout before expecting an 81% rally.