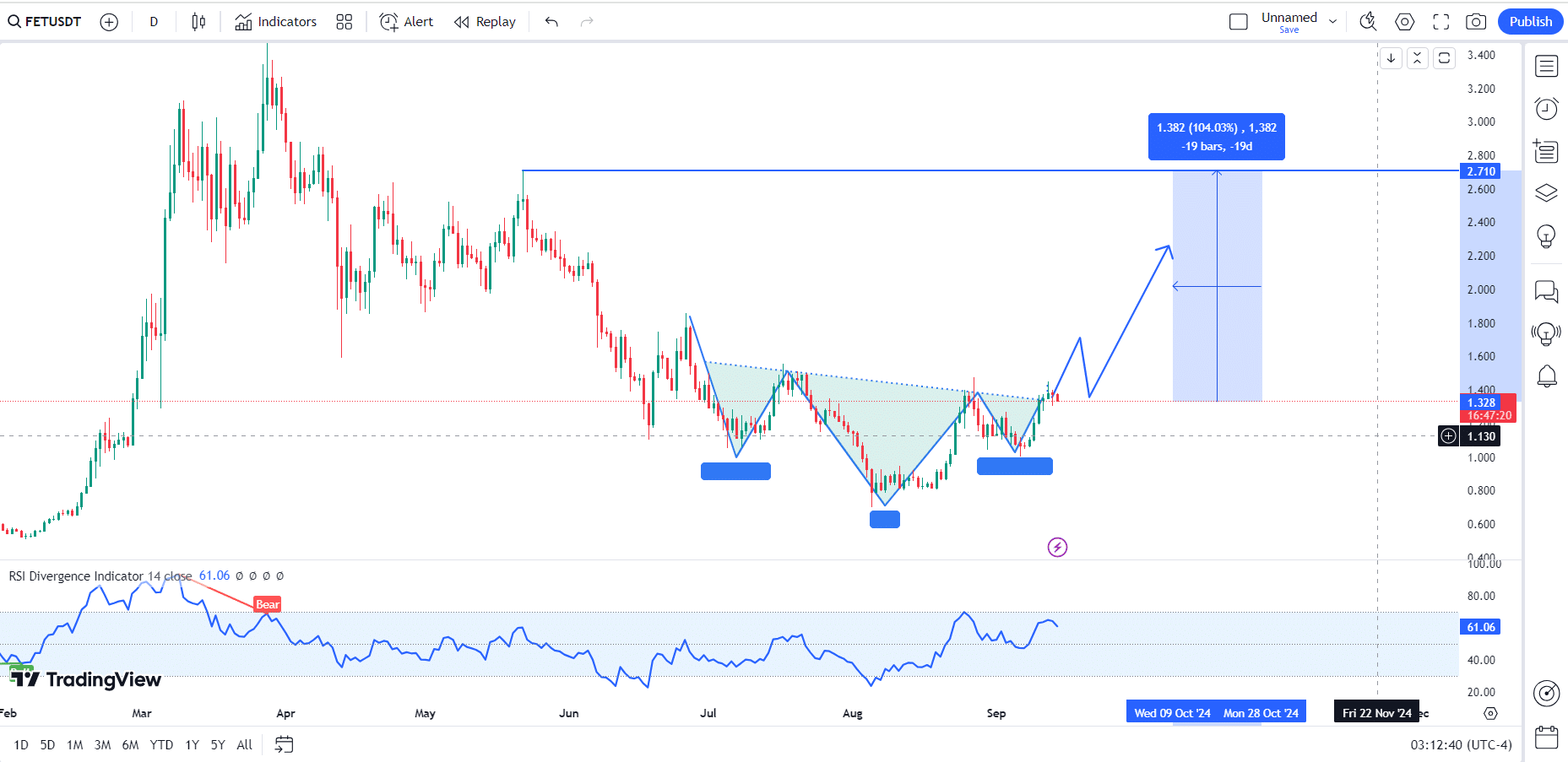

- Fetch.AI forms a head and shoulders pattern to signal a reversal.

- FET on-chain activity and social dominance increases.

According to CoinMarketCap, Artificial Superintelligence Alliance (FET) has seen impressive growth, rising more than 25% over the past seven days.

AI-related coins are getting a lot of attention, especially after Nvidia (NVDA) reported a better-than-expected earnings report.

Nvidia plays a significant role in influencing AI coins such as Fetch.AI, and the current price action suggests that ASI is poised to move higher as the cryptocurrency market is expected to recover in the last quarter of this year.

Analysts predict that FET’s recent performance could be a sign of further upside, especially since an inverse head and shoulders pattern has formed, which usually signals a market reversal.

FET has been in a downtrend since April, but the current pattern suggests that the token may have found strong support levels.

Source: TradingView

If FET successfully breaks the neckline of this pattern and retests the breakout level, it could target gains of 104% or more by year-end or early next year.

Additionally, the Relative Strength Index (RSI) is above the neutral zone, suggesting that market sentiment is turning bullish.

These factors combined with a bullish pattern suggest that FET prices could see significant upside in the coming months.

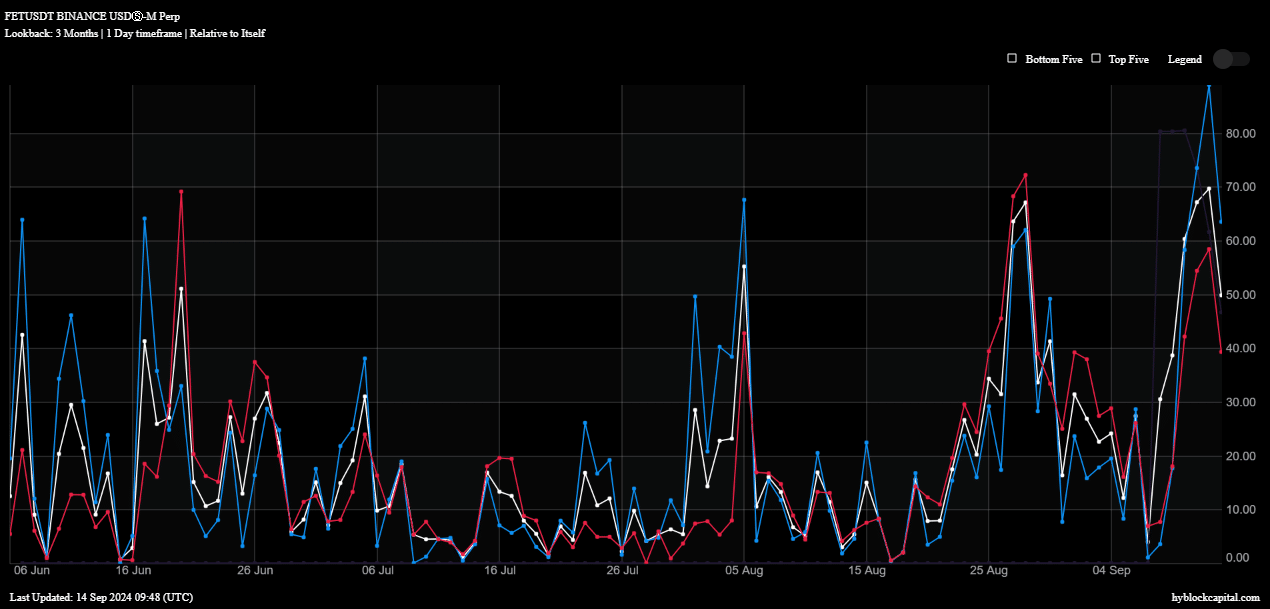

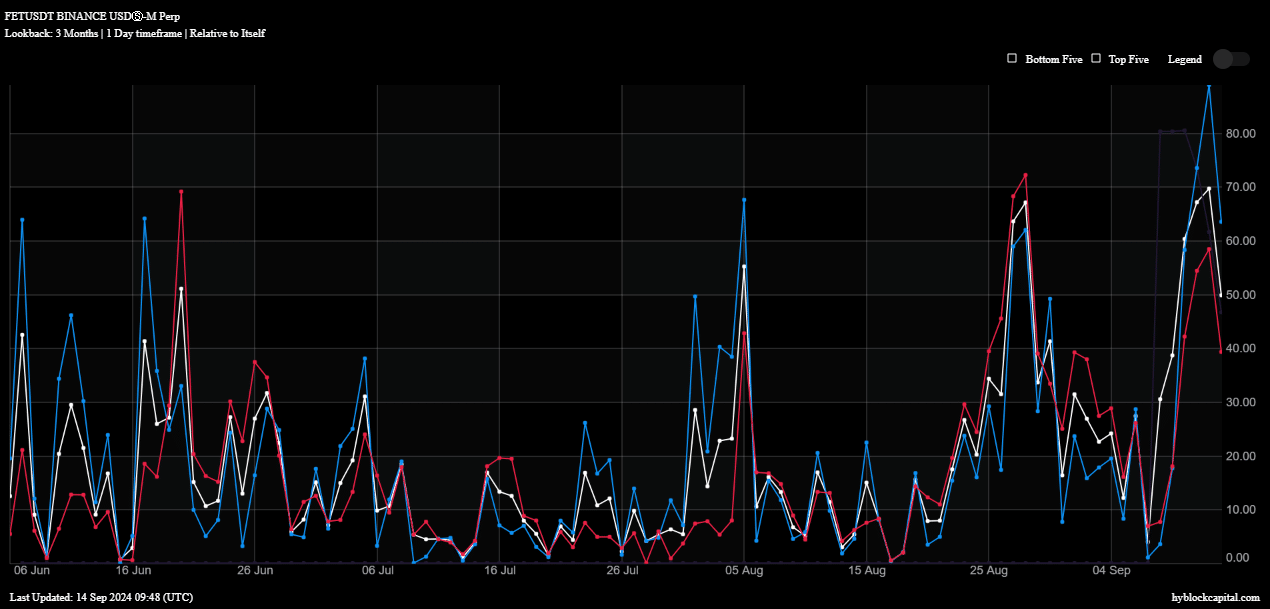

Liquidation, Funding Ratio and Volume

On-chain data provides more insight into FET’s price action. Liquidations, funding rates, and trading volume all show positive trends for FET, especially in September.

Currently these indicators are undergoing correction, but have been in an upward trend since early September, making it more likely that FET prices will move higher.

Liquidation rates are at 63%, global average funding rates are at 50%, and trading volumes are down slightly at 39%.

The 3-month lookback period shows that these indicators provide strong support for the bullish outlook. This consistent performance suggests that the ASI is poised for a sustained uptrend.

Source: Hyblock Capital

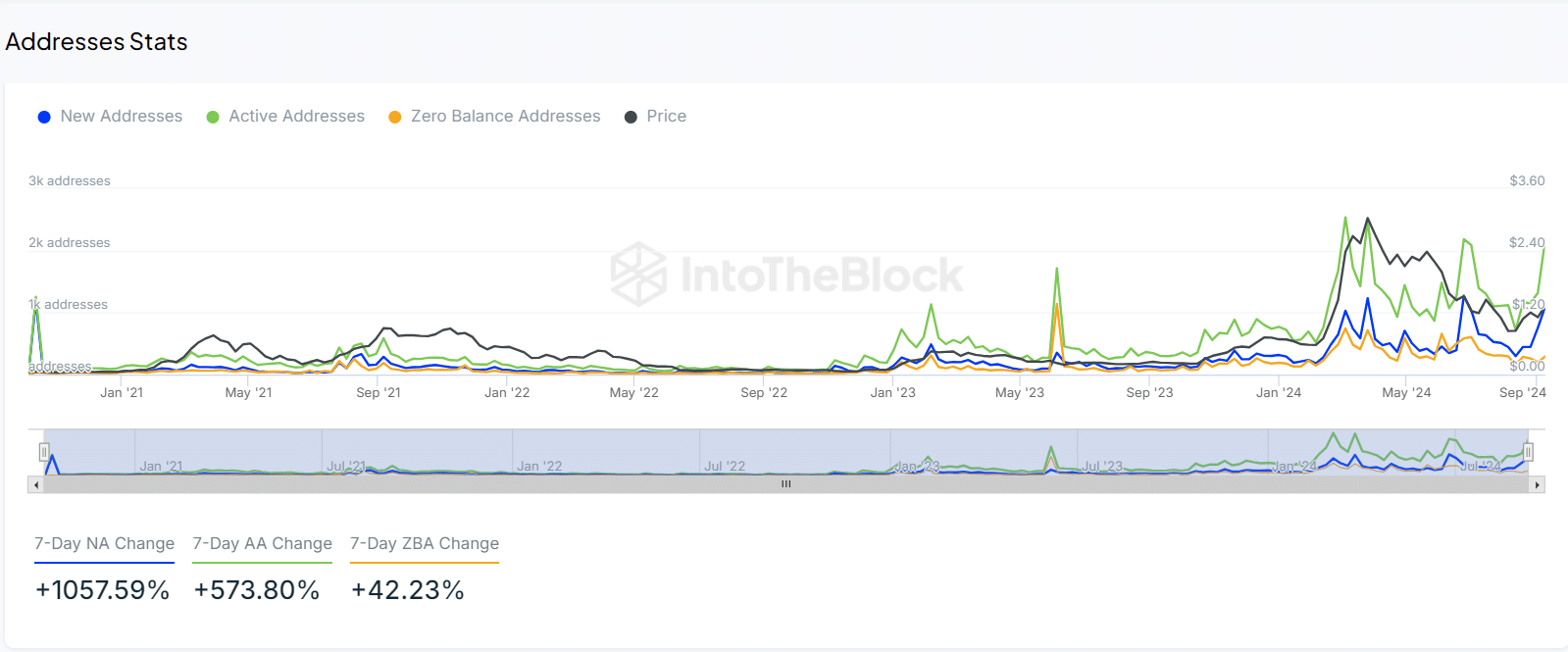

FET active address

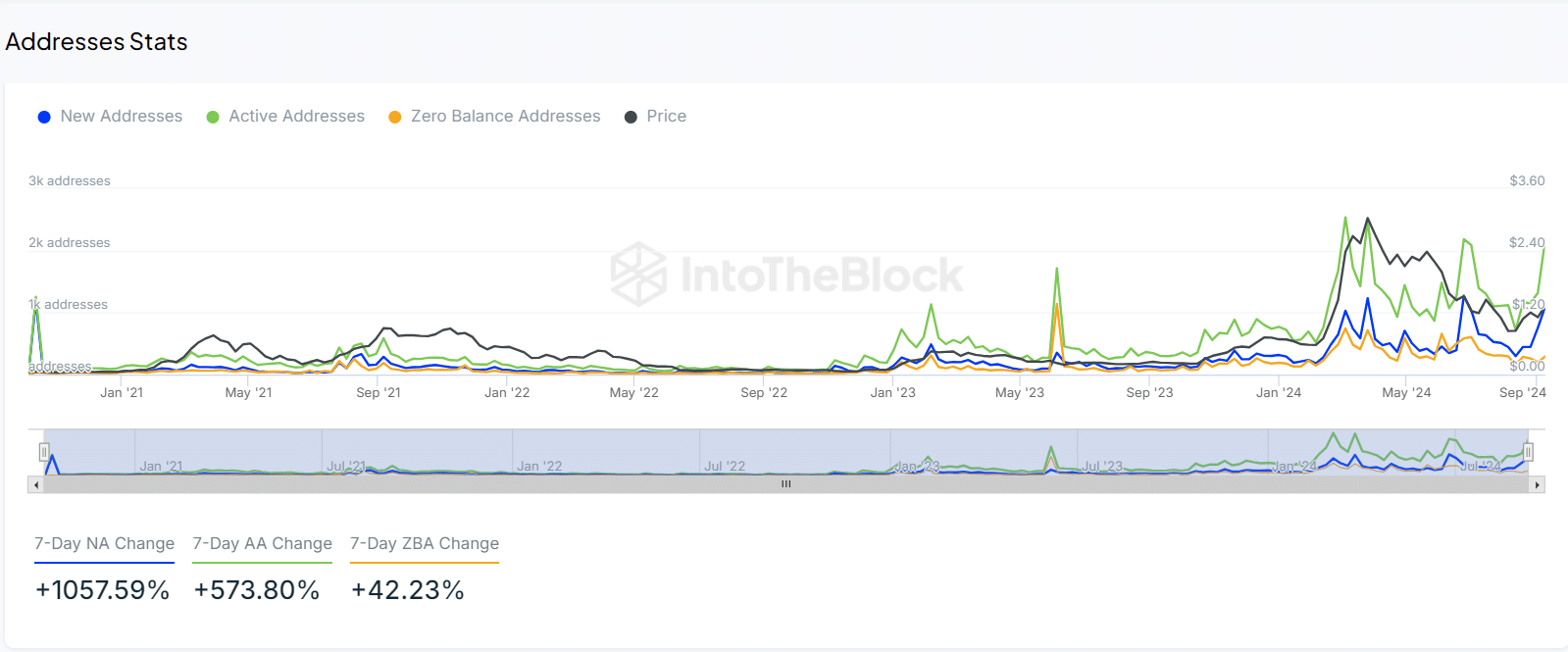

Looking at on-chain activity, the number of new addresses holding tokens has been steadily increasing since late August, while the number of addresses with zero balances has been decreasing, showing that more traders are accumulating tokens.

Additionally, the number of active addresses is approaching new highs, which is a bullish sign that interest in the token is growing.

Source: IntoTheBlock

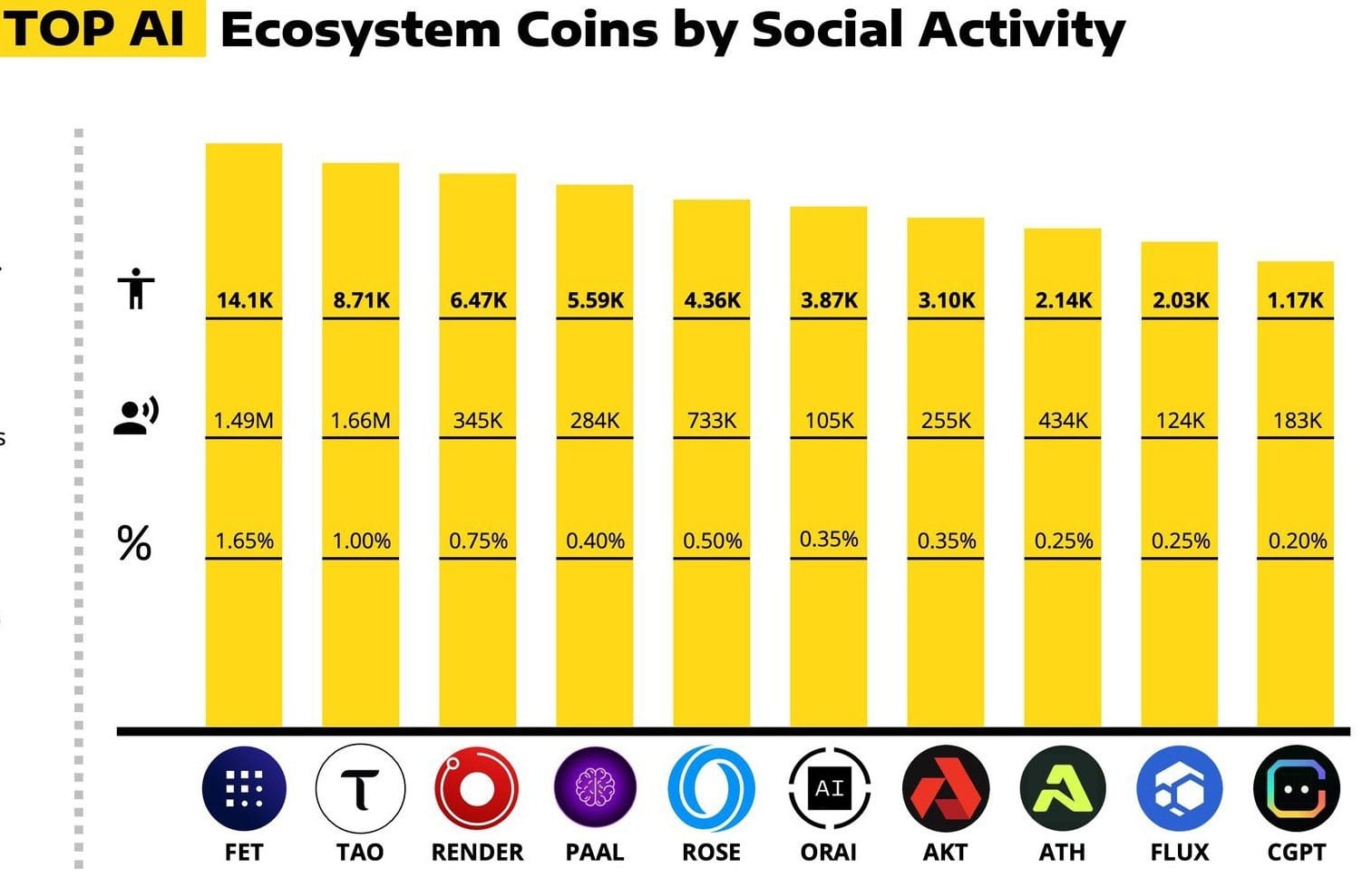

FET leads through social superiority

Social media activity is also favorable for FET, further brightening its outlook. FET is leading the AI ecosystem coins in terms of social dominance, 1.65% ahead of its competitor TAO.

The number of mentions on platforms like Twitter shows that interest in FET is growing, with over 1.5 million interactions and over 14,000 posts discussing the token.

Read the price predictions from the Federation of Artificial Superintelligence (FET) for 2024-2025

The increase in social engagement supports the increase in FET adoption, further strengthening optimism about AI-based cryptocurrencies.

Source: LunarCrush

Backed by strong technical patterns, favorable on-chain data, and growing social interest, FET is positioned to see greater price action, especially as market conditions improve in the year-end quarter.