- Toncoin continued its downtrend despite the big uptrend.

- TON bulls will pause for a moment as the mid-August pattern repeats itself.

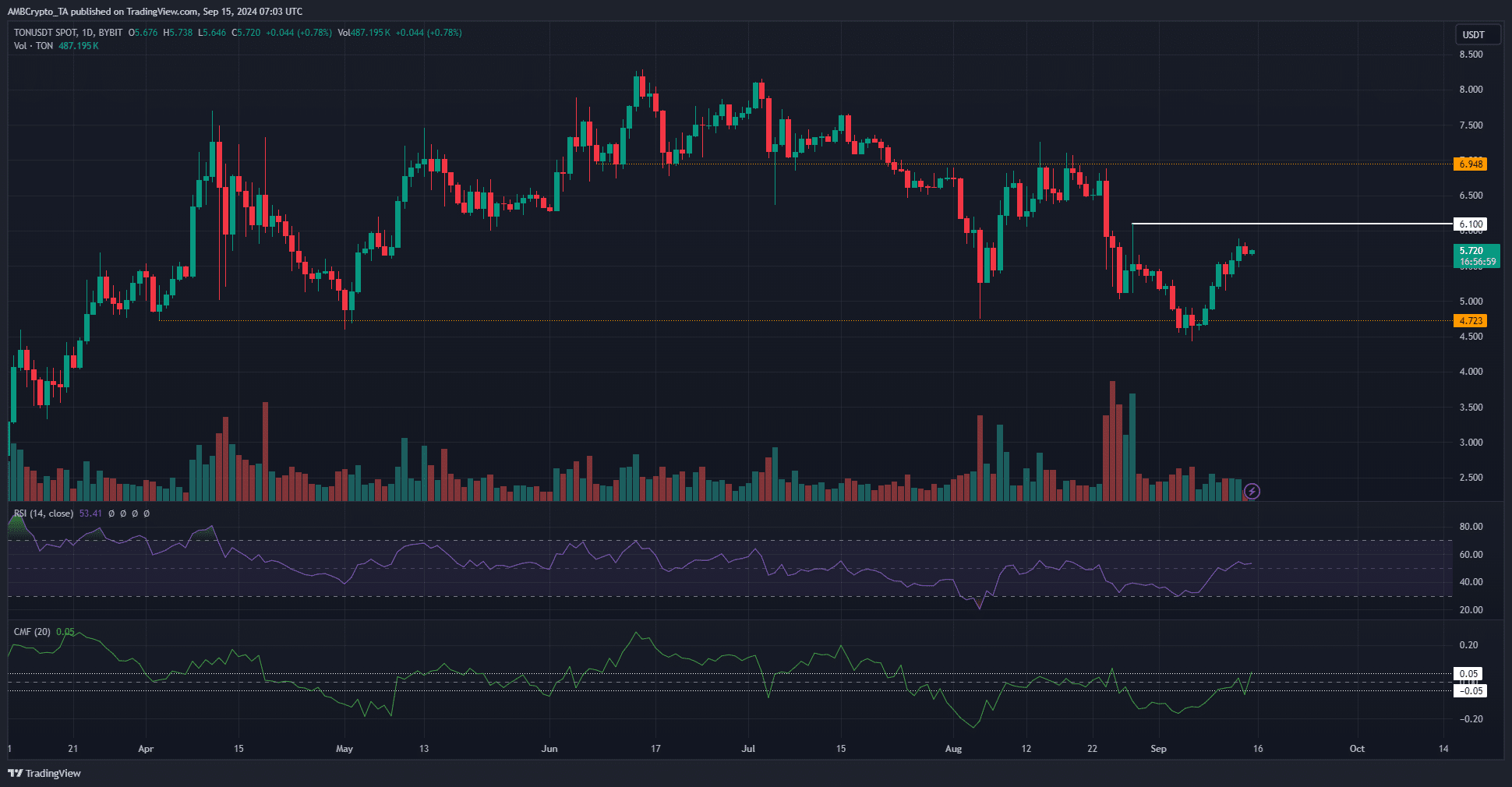

Toncoin (TON) rose 32.84% in a week from its low of $4.43 on Friday, September 6, reaching $5.885 the following week. Despite this strong rally, the market structure on the daily timeframe was bearish.

Heading into next week’s trading, Toncoin is one of the larger assets with high bullish expectations due to its performance in the previous week. Can buyers sustain the rally?

Is it a rally or a liquidity hunt before a sustained downtrend?

Source: TON/USDT on TradingView

Last week’s gain was significant, but the volume was not very high. In contrast, the decline from $6.8 on August 24 to $5.1 two days later had much higher volume.

The volumes over the past few days have been similar to mid-June levels, when TON was trading in the $7.1-$7.6 area, but without a strong trend. Therefore, a sustained uptrend would require higher volumes.

CMF was at +0.05, the limit of significant capital inflows. The daily RSI crossed the neutral 50 level, indicating bullish momentum. These factors gave the bulls hope that a market structure breakdown could occur soon.

Is this rebound a profit-taking opportunity?

Source: Santiment

In mid-August, the 30-day MVRV briefly turned upward. From a price movement perspective, TON was in a downtrend at the time. A few days later, on August 24, the price began to decline, and MVRV also fell.

Read Toncoin (TON) Price Prediction 2024-25

The recent rise in the past few days has brought MVRV back into positive territory, but TON’s downtrend is still ongoing. The downtrend could continue as it did last month.

On the other hand, the average coin age has been trending upward recently, which is a sign of accumulation and strength. Traders should be cautious until the $6.1 resistance level is broken.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.