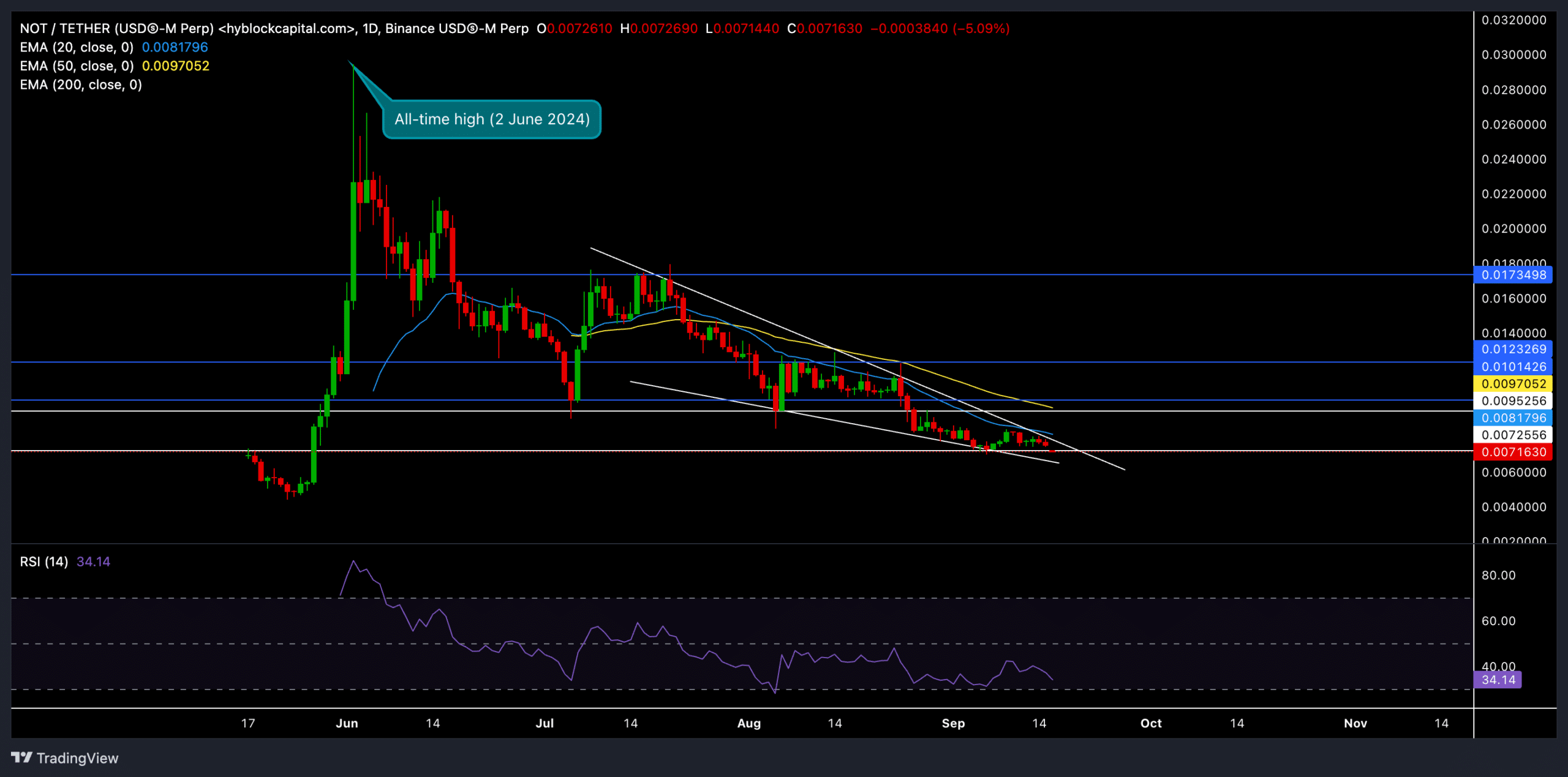

- Notcoin continued its downtrend, forming a falling wedge pattern on the daily chart.

- Binance derivatives data has given some hope for a short-term recovery.

Notcoin (NOT) experienced a prolonged downtrend after reaching an all-time high (ATH) of $0.032 on June 2. The token was under sustained selling pressure as bearish sentiment took hold across the market.

As a result, the price moved lower than the 20-day and 50-day EMA.

At the time of writing, NOT was trading at $0.00716 and was down about 8% in the last 24 hours. The $0.007 support level is essential for bulls to protect themselves from further declines.

Could this falling wedge pattern potentially trigger a reversal?

Source: TradingView, NOT/USDT

The current downtrend has taken Notcoin to a significant support area around $0.0072. This level coincides with the lower boundary of the falling wedge and is essential for the bulls to maintain momentum if they are targeting a short-term reversal.

Historically, the falling wedge pattern is considered a bullish reversal pattern, but buyers still need to react immediately.

A close above the 20-day EMA of $0.0081 in the coming session could set the stage for a potential recovery. In that case, the bulls could target the $0.0095 resistance level, after which they could retest the $0.01 mark.

On the other hand, a drop below the $0.0072 support level could lead to further declines to the $0.005 level before a meaningful reversal occurs.

The Relative Strength Index (RSI) is close to 34.5 at the time of writing, indicating overheated selling conditions. A reversal from this level could strengthen the bullish divergence, but a failure to bounce could confirm further downside moves.

Derivatives Data Disclosure THIS

Source: Coinglass

In terms of derivatives, Notcoin’s open interest (OI) has fallen by around 6.92% over the past day, indicating that market interest is somewhat weakening. The overall long/short ratio was 0.9102, which was biased towards short, reflecting bearish sentiment among traders. However, Binance’s long/short ratio showed a figure of 3.6992 (all accounts).

This shows that while short-term traders tend to take short positions, the overall market sentiment is not overwhelmingly bearish, leaving room for a recovery.

Notcoin continues to trade under downward pressure, but a falling wedge pattern is forming and overheated RSI levels could be an opportunity for a bullish reversal.

Read Notcoin (NOT) price prediction 2024-2025

A decisive move near the $0.0081 resistance level could encourage buyers to re-enter the market, pushing the price towards $0.0095.

However, failure to defend the $0.0072 support level could trigger further corrections, potentially sending the price down to the $0.005 range before any major recovery attempt takes place.