- BNB could rise 10% to $600 in the coming days.

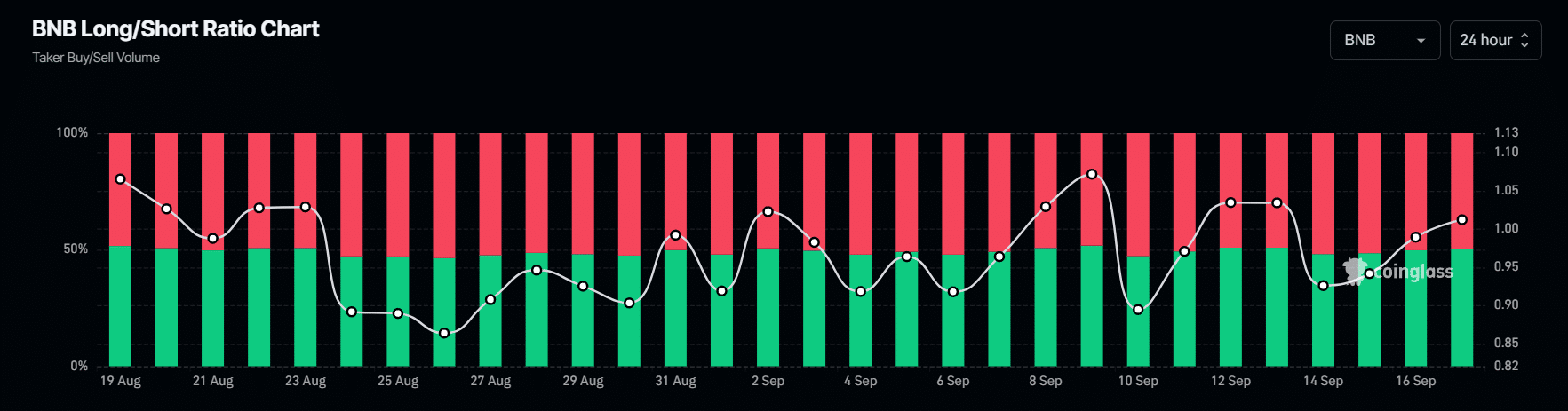

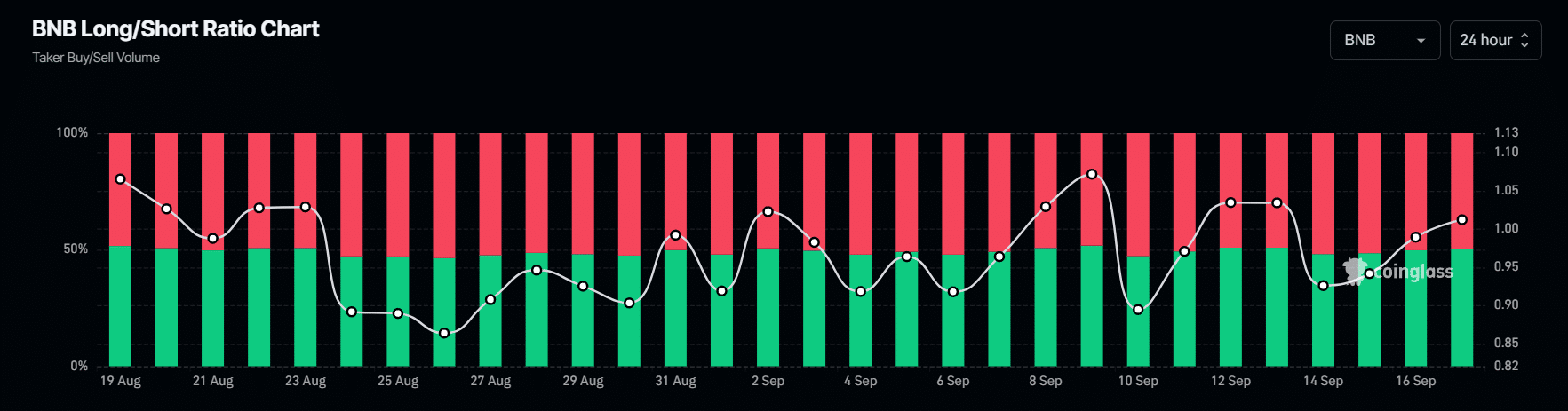

- The BNB long/short ratio currently stands at 1.031, indicating that traders are expecting a bullish market sentiment.

On September 17, Binance Coin (BNB), the world’s fourth-largest cryptocurrency, successfully retested the $530 breakout level and is now poised for an upside momentum.

While major cryptocurrencies struggle to gain momentum, BNB experienced a price surge of over 3.5%, suggesting the possibility of an upcoming rally.

BNB Price Momentum

According to data from Tradingview, at the time of writing, BNB was trading near $545 and had experienced a price surge of over 3.5% in the last 24 hours.

During the same period, trading volumes fell by 9%, indicating that current market sentiment has led to lower participation from traders and investors.

BNB Technical Analysis and Key Levels

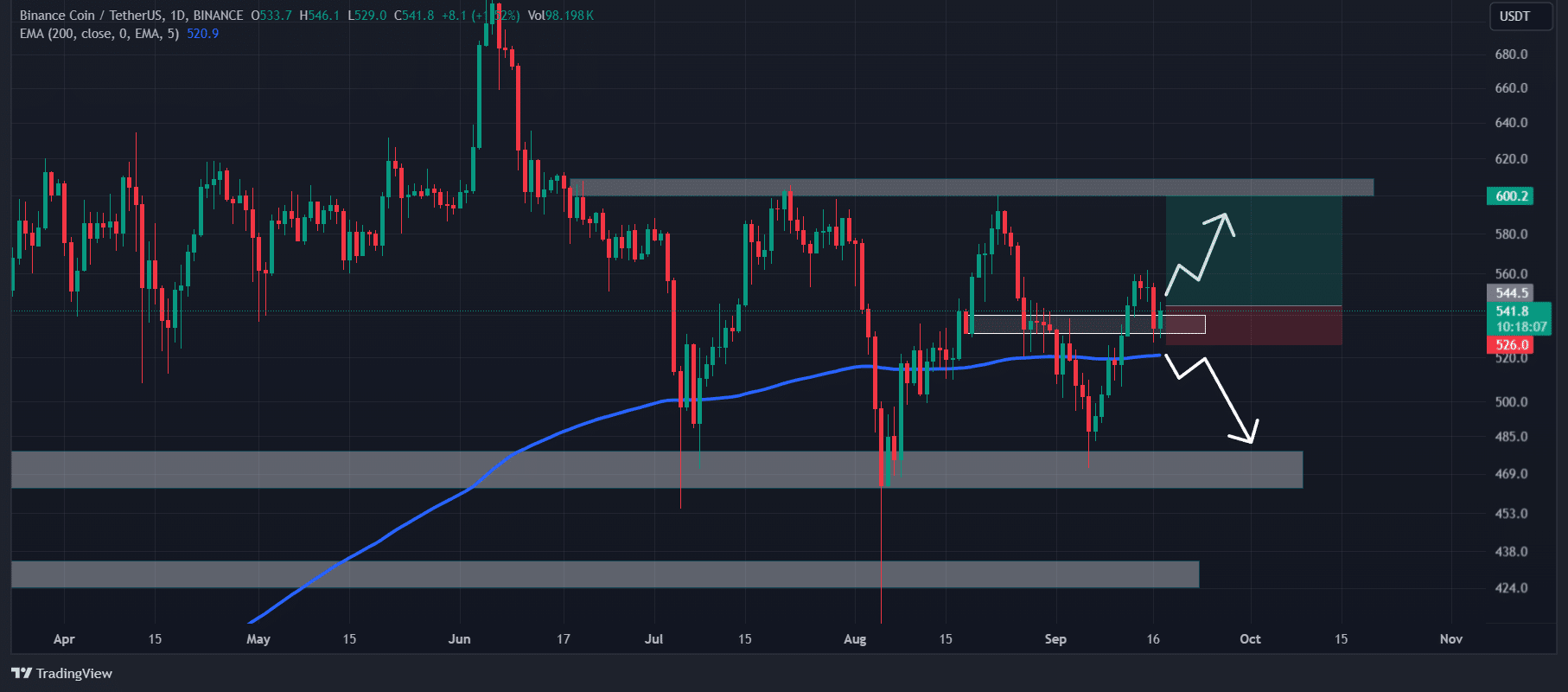

According to expert technical analysis, BNB is trading above the 200 Exponential Moving Average (EMA) on a daily basis, which looks bullish.

The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or a downtrend.

Source: TradingView

On September 12, BNB broke through a critical resistance level. The current momentum indicates that BNB has successfully retested that level.

Looking at past price trends, if this bullish trend continues, there is a high chance that BNB will rise by 10% to reach the $600 level in the coming days.

On the other hand, if BNB fails to maintain this bullish momentum and the price falls below the $527 level, it could fall by 8% to $475.

Trader’s Emotions and the Ideal Risk-Reward Ratio

Currently, traders can expect an ideal risk to reward ratio of 1:3. The perfect buy entry point is above $545, with a target of $600 and a stop loss of $525.

However, this trade will only be activated if BNB closes the daily candle above the $545 level.

Additionally, on-chain metrics further support this bullish outlook: the BNB long/short ratio on Coinglass currently stands at 1.031 (values above 1 indicate bullish market sentiment among traders).

Source: Coinglass

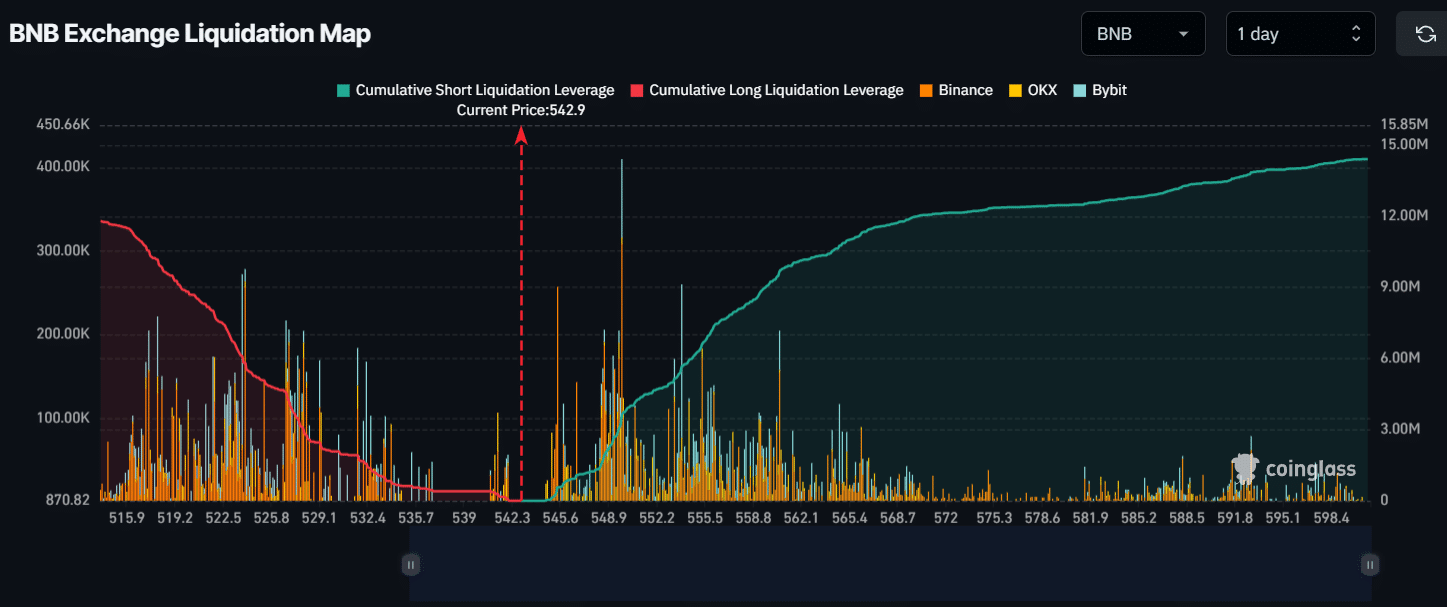

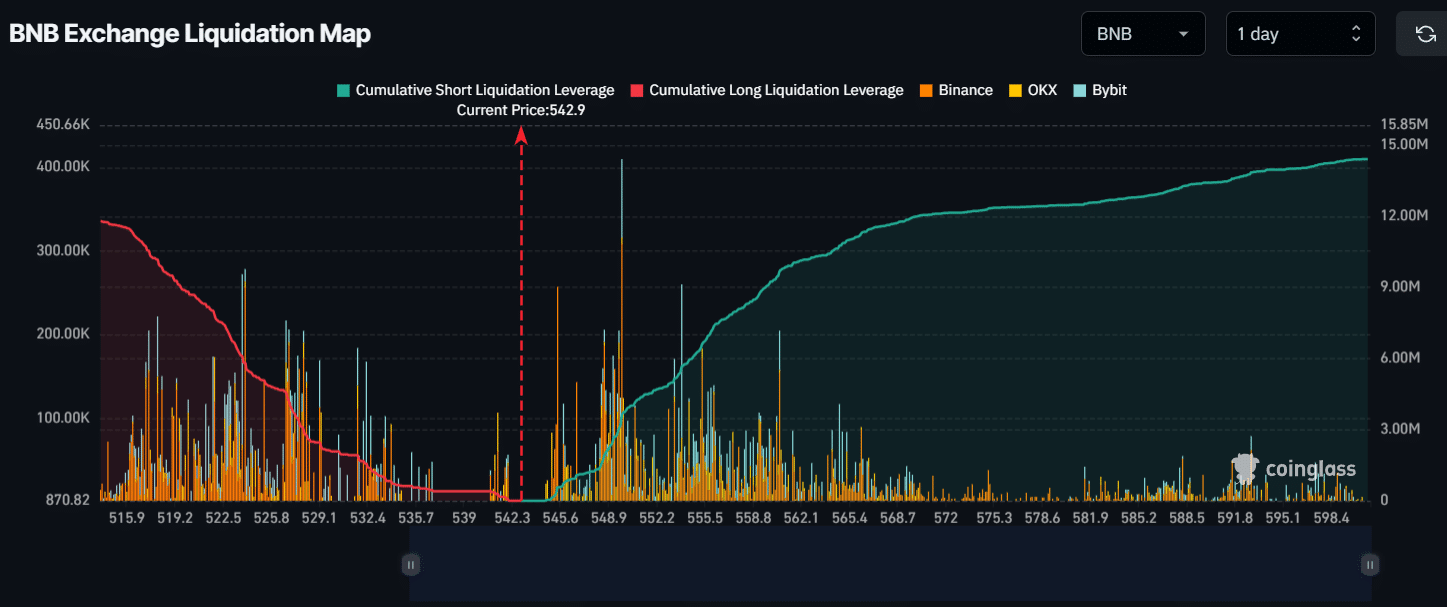

Major liquidation levels

According to Coinglass data, at the time of writing, the key liquidation levels are near $524 on the downside and $550 on the upside, as traders are overleveraged at these levels.

Read Binance Coin (BNB) Price Prediction 2024-2025

If market sentiment for BNB remains bullish and the price rises to $550, approximately $3 million worth of short positions will be liquidated.

Conversely, if sentiment changes and BNB falls to $524, long positions worth about $5.4 million will be liquidated.

Source: Coinglass