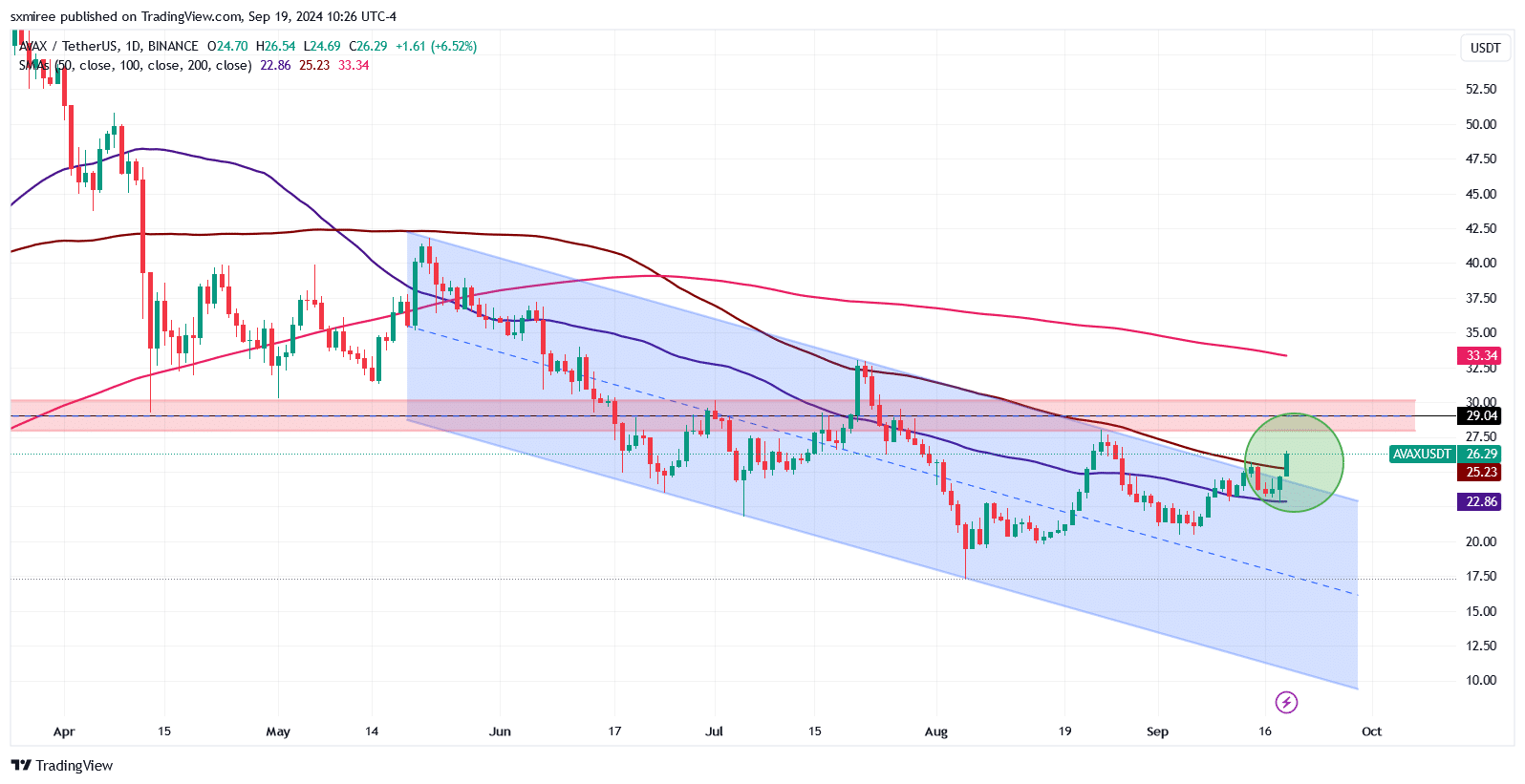

- The avalanche broke away from a downward parallel channel that had been in place for months.

- AVAX price is facing a significant test as it approaches the key resistance zone at $29.

Avalanche (AVAX) was a standout performer in the cryptocurrency markets during the week. AVAX’s price rose to a three-week high of $26.52 earlier today, extending the overnight rally from September 18.

At the time of writing, the altcoin was up 12% over the last 24 hours.

The rise in AVAX price coincides with the overall rebound in cryptocurrency markets, supported by favorable macroeconomic conditions.

The positive sentiment prevailed after the US Federal Reserve cut interest rates by 50 basis points to 4.75%-5% on September 18.

The recent adjustment of the benchmark federal funds rate signaled a shift in monetary policy to curb inflation and support economic growth.

The Fed’s decision is the first rate cut in four years and the third time policymakers have started a rate-cutting cycle with a 0.5 percentage point cut.

While largely expected, the result still created volatility in both stock and cryptocurrency markets. According to data from IntoTheBlock, 49% of token holders benefited from the rise in AVAX’s price.

Experts widely expect further cuts in the final quarter, but views are mixed on the impact of the Fed’s 50bp cut on risk assets.

Some analysts argue that the recent correction is only a short-term boost to the cryptocurrency market.

Avalanche’s DeFi Outlook

The recent surge in AVAX price is due to Avalanche continuing to gain attention in the decentralized finance space.

Avalanche’s total locked value in AVAX increased 11% from 28.1 million AVAX in Q1 to 30.8 million AVAX in Q2. According to data from DeFiLlama, Avalanche’s TVL is trending upward.

Source: DeFiLlama

TVL across all Avalanche protocols was 38.63 million AVAX as of September 18. The top 3 protocols by TVL accounted for the most TVL on Avalanche in Q3.

However, Benqi has surpassed Aave to become the largest protocol on the network.

TVL is widely regarded as a key indicator of adoption and activity within the DeFi ecosystem. Higher TVL generally reflects strong liquidity and user engagement, supporting a positive outlook for spot price movements.

AVAX approaches key resistance line

The daily chart of AVAX/USDT on TradingView shows that the pair is trending above its 100-day simple moving average (SMA) of $25.23 and its 50-day SMA of $22.82 at the time of writing.

With the price increase during the week, AVAX broke out of the descending channel that has been forming its price trajectory since late May 2024.

Source: TradingView

However, AVAX faces strong resistance between $27.92 and $30.14, a range that has been a significant obstacle for the past three months.

This range appears to be a hit-or-miss zone, as it has been subject to multiple resistance tests but has yet to be successfully broken.

Read Avalanche (AVAX) price prediction for 2024-2025

A successful challenge in this area could lead to further price appreciation to the north, with bulls eyeing $33 as the next target.

If the new sentiment fails to hold and break above this resistance level, it could drop below the 50-day SMA of $22.82 and possibly even the support area near $19.50, which was tested earlier this month.