- Toncoin experienced an 80% surge in large transactions, with active addresses also increasing by 30%, reflecting strong market interest.

- Despite these positive trends, market volatility is increasing and there are cautionary signals as the long-short ratio declines.

Toncoin (TON) is gaining tremendous momentum in the crypto space. According to recent indicators, the number of large transactions has surged by 80% in the last 24 hours.

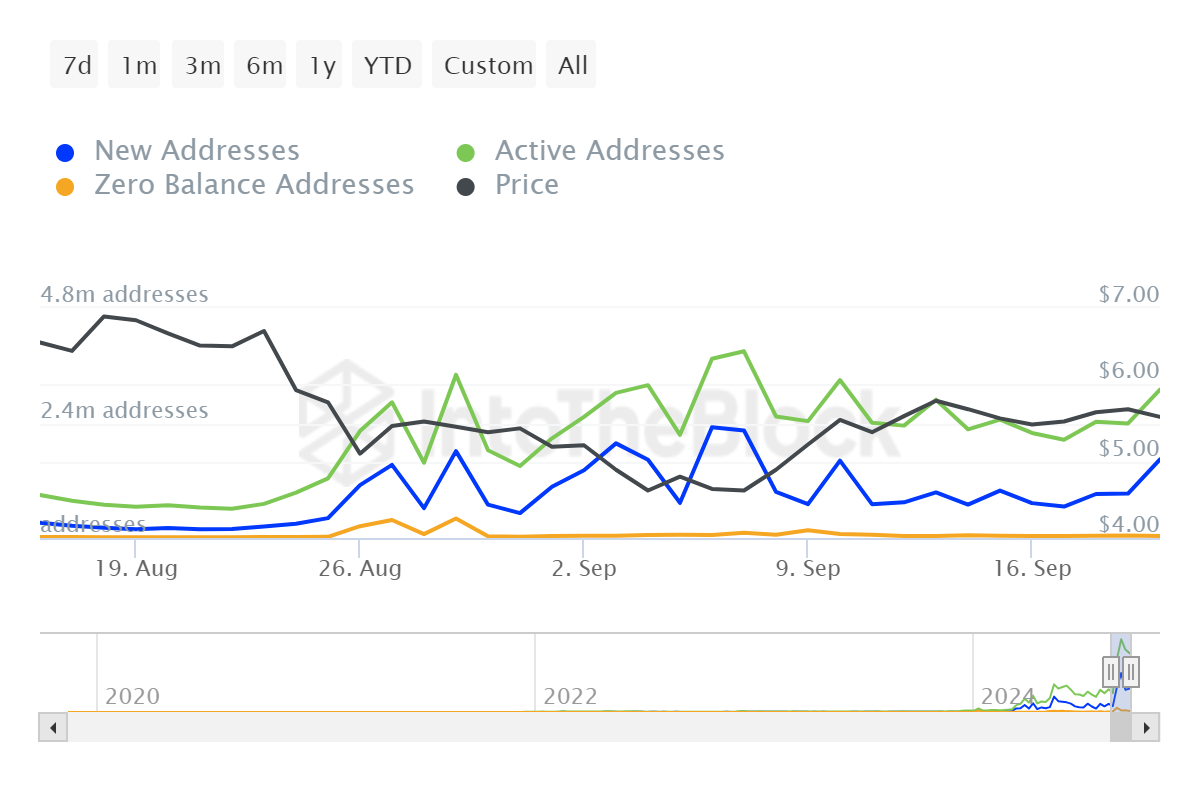

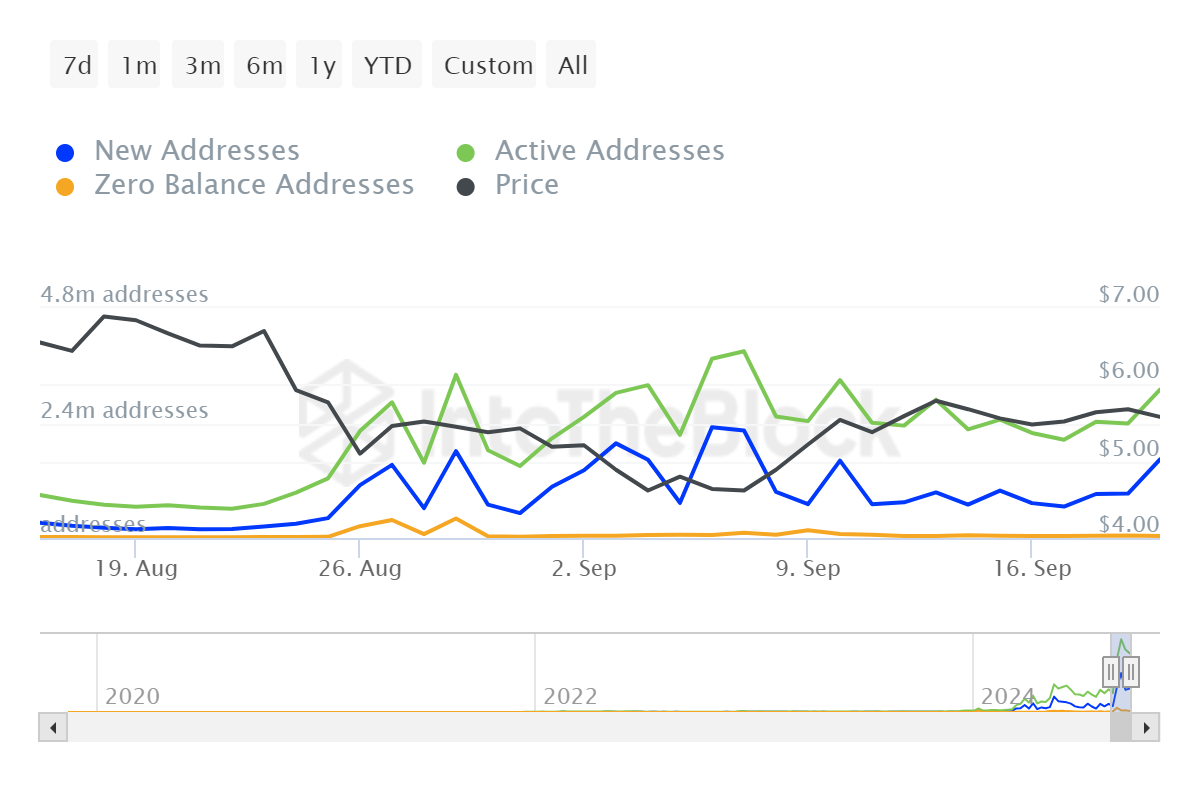

In addition to the aforementioned whale surge, trading activity is also starting to pick up, with active addresses up 30% at the time of writing.

A surge of celebration

A high increase of 80% in large transactions indicates strong interest in Toncoin. Often, as whales put more effort and pressure on the market, the confidence of small investors increases.

So this could indicate upward price pressure and possibly a surge in altcoins.

Source: IntoTheBlock

Source: IntoTheBlock

Toncoin active addresses are increasing

Also notable is the trading activity. The 30% increase in active addresses over the last 24 hours means that more people are active in the Toncoin market.

This increased inflow generally means greater liquidity: the more participants in the market, the more likely it is that trades will be smoother.

Source: IntoTheBlock

Source: IntoTheBlock

Read Toncoin (TON) Price Prediction 2024-25

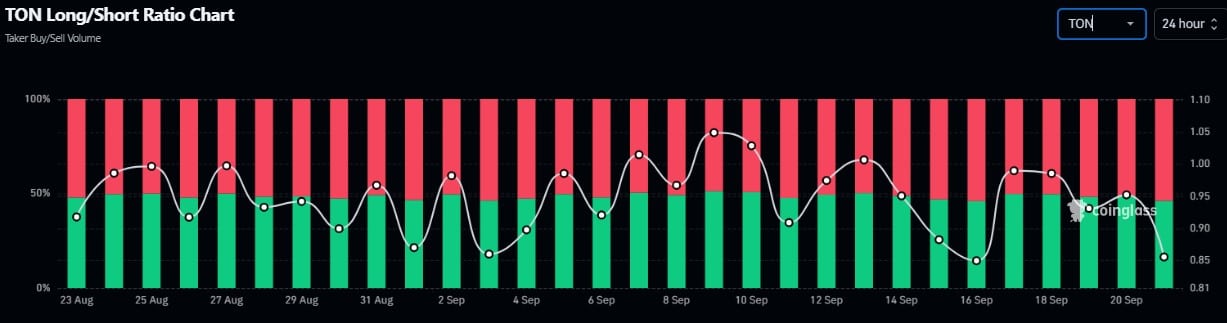

Long-short ratio decrease

However, not all indicators were positive. According to Coinglass data, the long-short ratio has deepened over the past 24 hours, indicating that fewer investors are taking long positions in anticipation of a Toncoin price increase.

Especially with the recent Fed rate cuts, this could signal a cautious approach, but it is also an indicator of repositioning for possible price corrections.

Source: Coinglass

Source: Coinglass