- Notcoin is currently gaining attention due to its healthy ranking in the Play-to-Earn category.

- The main trend pivot did not blink as the whales re-accumulated after previously pushing prices down.

Notcoin has become increasingly popular and rising in rankings recently. Actually, it was in 1979.Day At the time of press, it is the largest cryptocurrency by market capitalization. It ranks even higher in the Play-to-Earn category, which will be one of the fastest-growing cryptocurrency sectors in 2024.

Notcoin was 3.rd Ben GCrypto’s market cap of $897 million makes it into the top 10 Play-to-Earn coins list. However, it has the highest trading volume among all the coins on the same list. These achievements are a sign of Notcoin’s position, potential, and growing dominance in the sector.

Source: X

So the question is – can this performance help in the recovery of Notcoin’s native cryptocurrency? NOT has been in a generally bearish trend since June, with significant but short-lived strength in July. The main reason for this performance was mostly selling pressure from market whales.

How Notcoin Whales Affect NOT’s Price Action

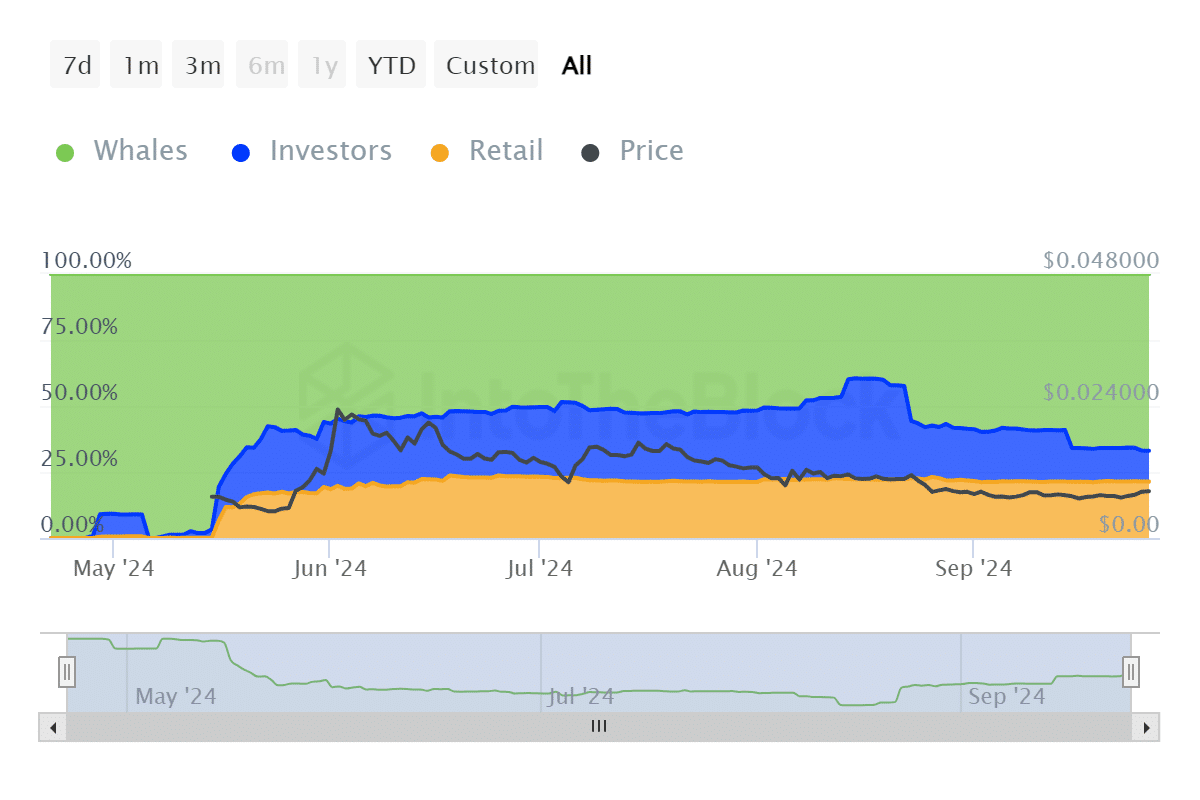

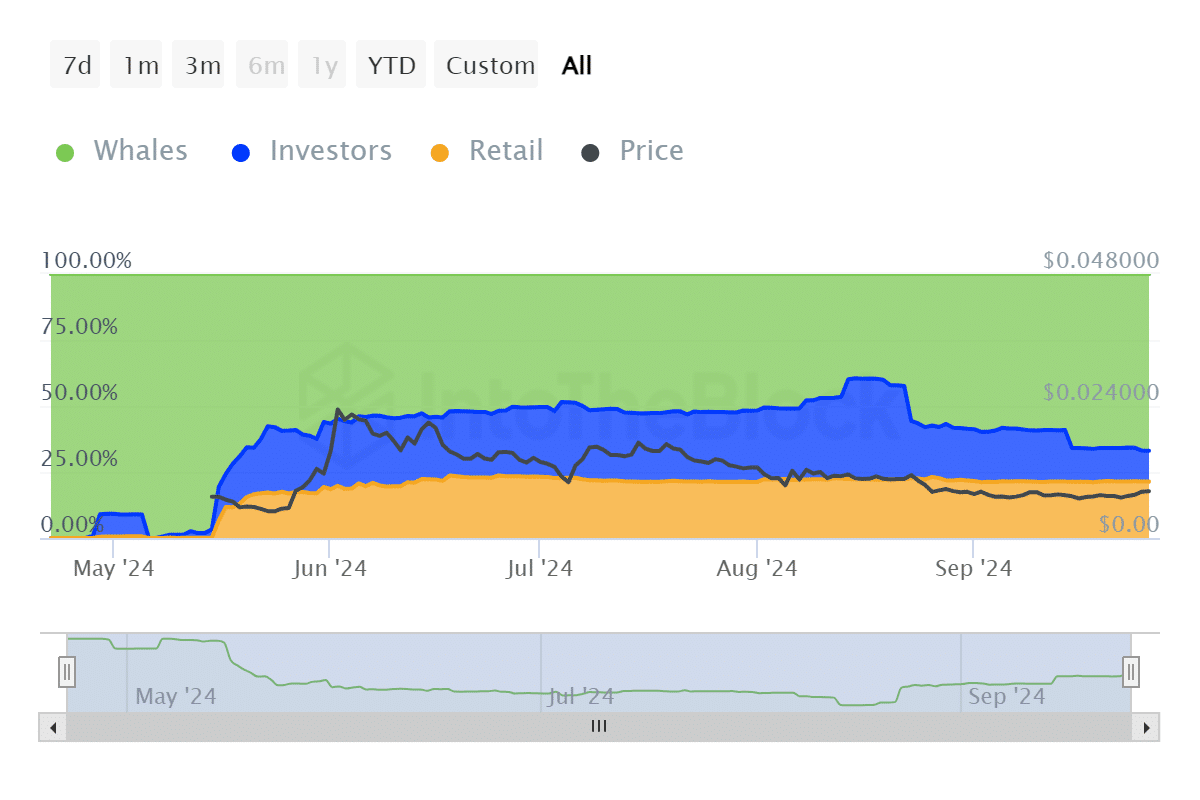

Historically concentrated data shows whale holdings hit a low of 54.17 billion coins (52.17% of supply) on June 14. However, as of August 17, whale holdings had fallen to another low of 40.54 billion coins (39.6% of supply). Simply put, whales have contributed significantly to the selling pressure.

Source: IntoTheBlock

Data also shows that whales have been accumulating NOT again since mid-August. At press time, their balance stood at 68.58 billion coins (66.91%) as of September 26. This accumulation appears to slow the decline of NOT.

Meanwhile, investors have noticed significant outflows, from over 22 billion coins in mid-June to just over 12 billion as of press time. Retail addresses fell by about 2 billion coins over the same period. This means that whales have had the greatest impact on altcoin prices.

Selling pressure on NOT appears to have stabilized within the $0.0071 price level this month. It has shown some bullish momentum this week, with the price up almost 40% in the last five days. In fact, the value of this altcoin was $0.0090 at the time of press.

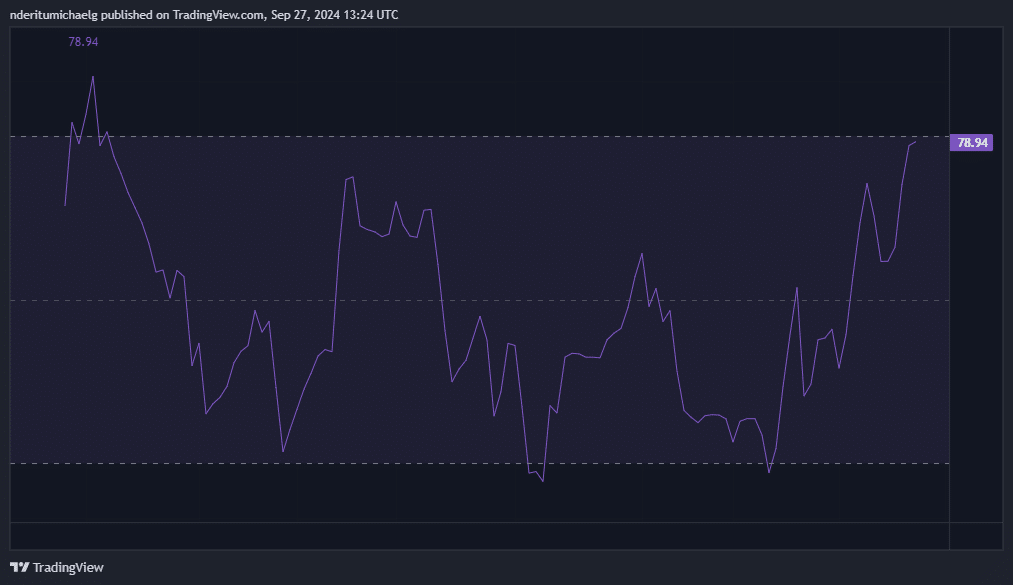

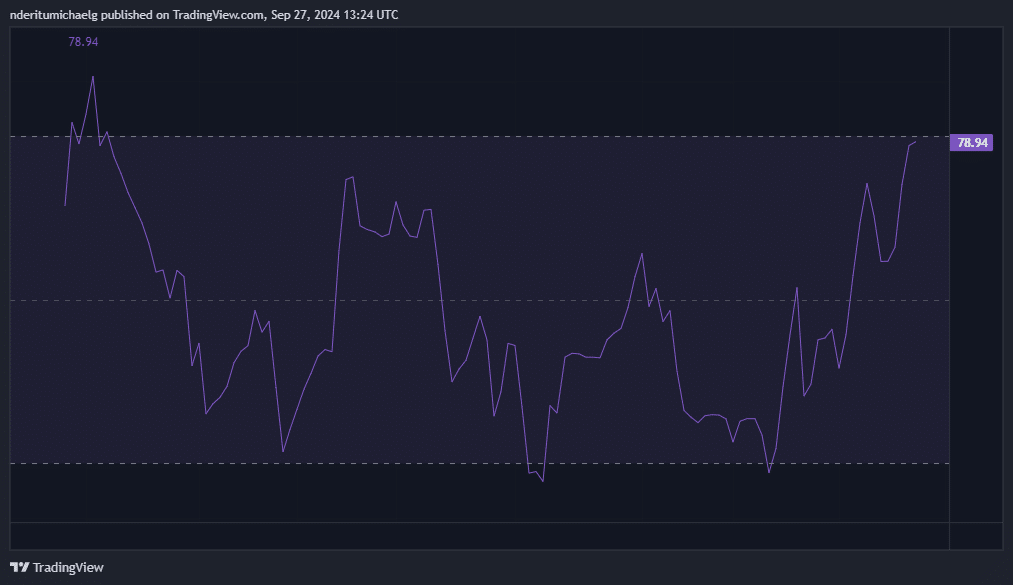

Source: TradingView

NOT’s recent uptrend reflects whale activity, which is very similar to a reaccumulation. The recovery in liquidity could allow Notcoin to make a further recovery in the coming weeks and months.

Finally, funds flow indicators have shown a strong liquidity revival so far this month.

Source: TradingView

At the time of this writing, NOT is trading at a 76% discount to its all-time high, which can be seen as attractive. A revival of liquidity, especially from whales, could reignite retail and investor demand. NOT’s next near-term price targets are $0.012 and $0.017.