- Changpeng Zhao’s initial launch was expected to generate strength.

- The exchange token showed signs of a potential price retracement.

Binance Coin (BNB) has once again hit a 10-week high. The early release of former Binance CEO Changpeng Zhao was expected to spark bullishness in the market.

This sparked some bullish activity on social media, but not much on the price action charts. In the case of BNB, it fell 3.9% in the 6 hours following CZ’s “gm” tweet. Combined with long-term highs, this has raised several questions about the future trends of exchange tokens.

Possibility of going out of range

Source: BNB/USDT on TradingView

The old range for nearly three months ranged from $464 to $604, with the mid-range level at $535. This level has served as support and resistance in recent weeks. In mid-September, BNB rose 12.7%, retesting this level as support before reaching record highs.

The daily RSI remained in bullish territory above neutral 50 but formed a bearish divergence. RSI is making lower highs and prices are rising, making a retracement likely.

Moreover, OBV was unable to test the July highs. The same situation occurred in mid-August and BNB faced a strict rejection at the $600 level. A combination of technical indicators shows that rejection at the top of the range is the more likely scenario.

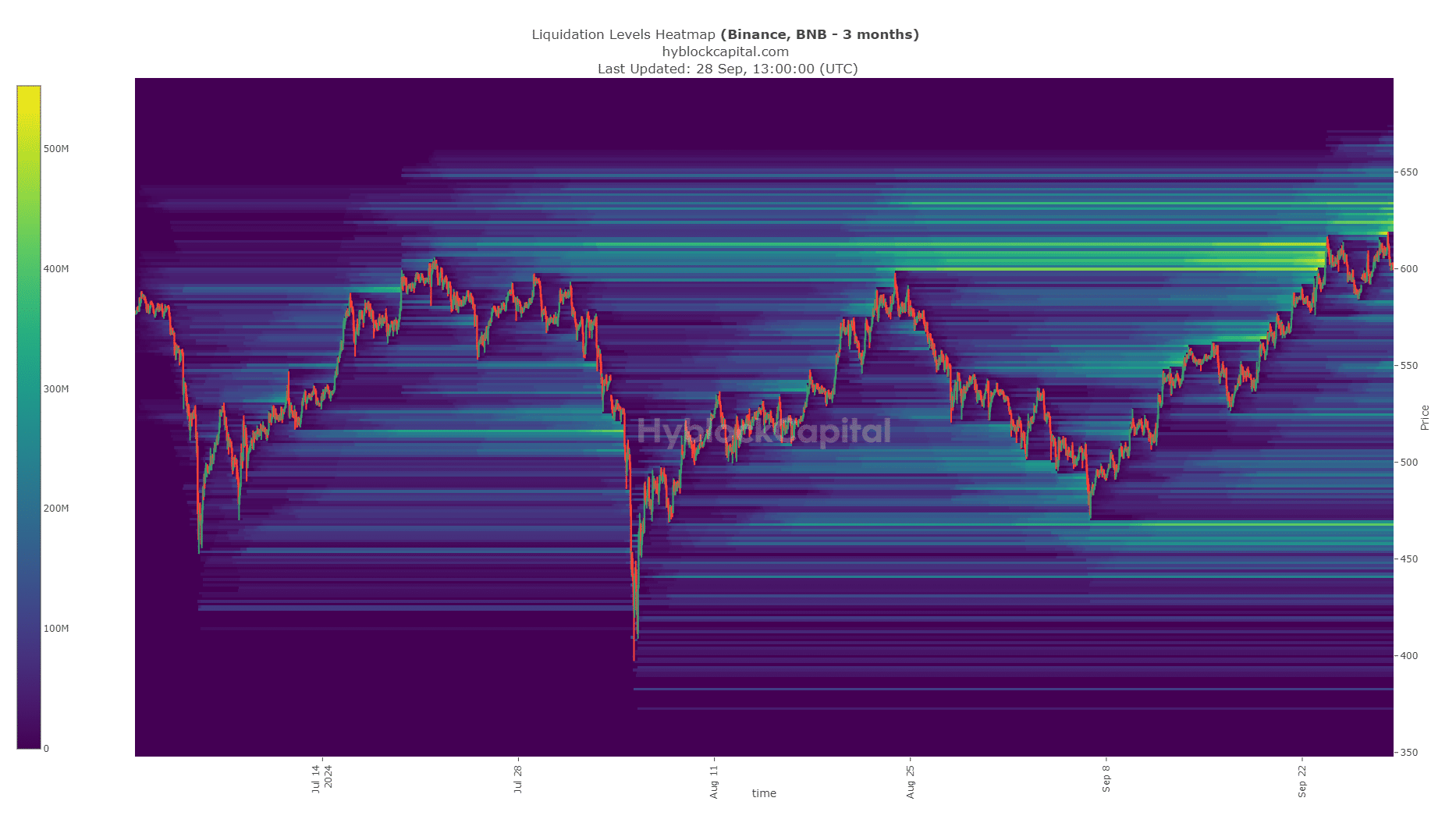

The liquidation level highlights the $635 area as a price target.

Source: Hiblock

Looking at the 3-month liquidation heatmap, it appears that the $621-$635 region is the magnetic zone for prices. Before that, the price gravitated towards the $600-$614 region before falling to $585.

Read Binance Coin (BNB) Price Prediction for 2024-25

In a similar fashion, a false breakout reaching $635 above the range high before a retracement was a distinct possibility. Traders should be prepared to take profits when BNB approaches these levels and wait for pullbacks and buying opportunities.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.