- Altcoin season began with BTC testing $66,000, with values soaring during the recent bullish rally.

- However, an important factor is needed to trigger the start of altcoin season.

Bitcoin (BTC) A price correction is likely after failing to maintain the $66,000 level. AMBCrypto’s analyze This suggests that $61,000 could be the next support level and mark a major bottom.

Historically, altcoin The season follows the bottom of Bitcoin. If this pattern repeats, the current decline could trigger the next altcoin season.

The next cycle could trigger an altcoin season

Bitcoin’s current market share is 57.37%, a significant drop from its peak of 58.59% just 10 days ago. This decline in dominance could mean that confidence in altcoins is increasing.

Two days ago, BTC tested the $66,000 upper limit after a steady rise, and the rationale is clear for many stakeholders to benefit. Their exit may mark the next floor.

Additionally, this decline could spark renewed interest from holders, setting the stage for potential altcoin growth.

Source: BlockChainCenter.Net

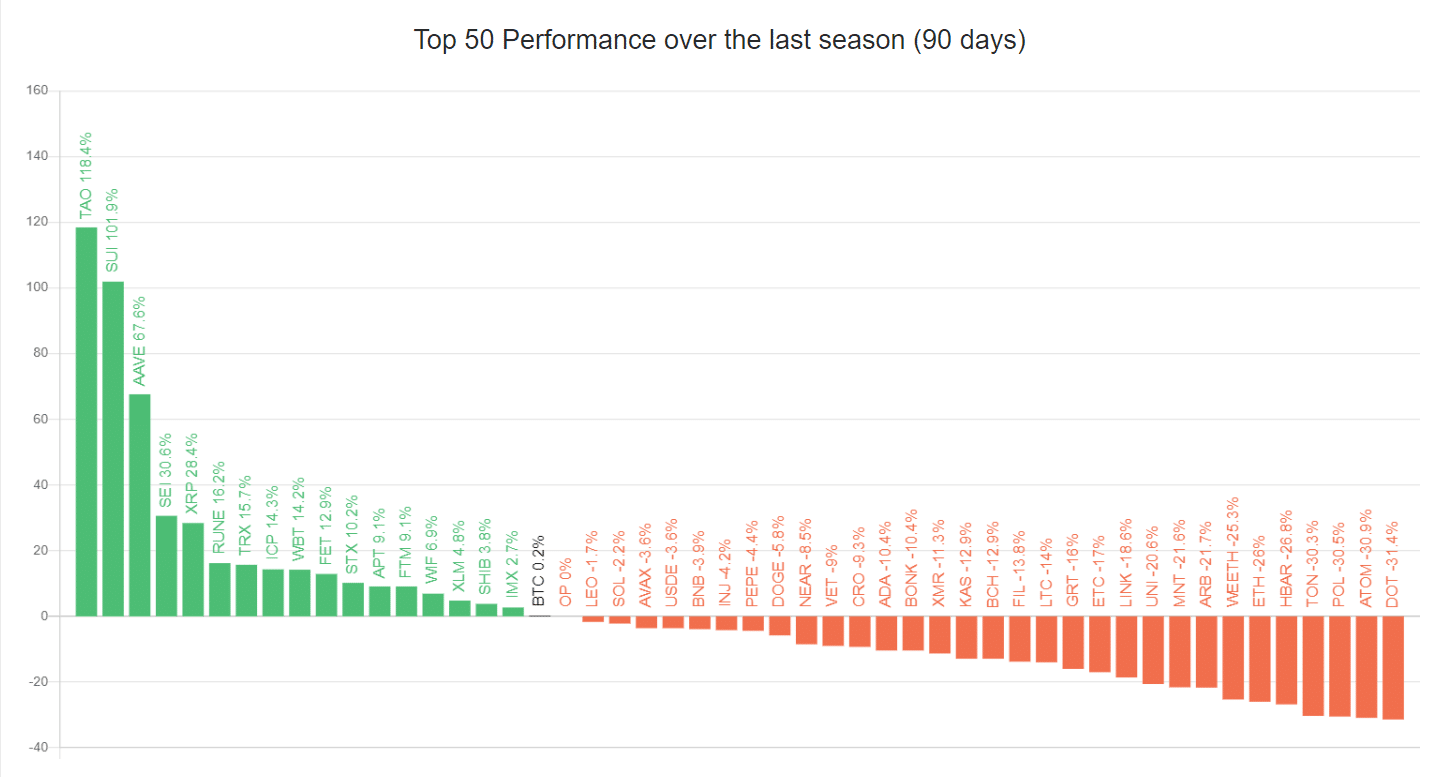

to presentOf the top 50 coins, 17 are ranked higher than Bitcoin, bringing altcoin dominance to 34%.

With many altcoins showing bullish momentum during the recent rally, another cycle may be needed to fuel the start of the next altcoin season.

Therefore, keeping an eye on the upcoming Bitcoin cycle is important to know when these coins may begin to rally. To put it simply…

Bitcoin integration could be key

Market euphoria suggests a strong start to October for Bitcoin, but the daily price chart tells a different story.

A repeat of the mid-July rally, with BTC bulls breaking resistance at $66,000 and breaking $68,000, could see Bitcoin dominance restored, dampening the outlook for altcoin season.

However, a sharp decline in RSI indicates a loss of buying momentum. As Bitcoin enters a consolidation phase, major altcoins may gain attention.

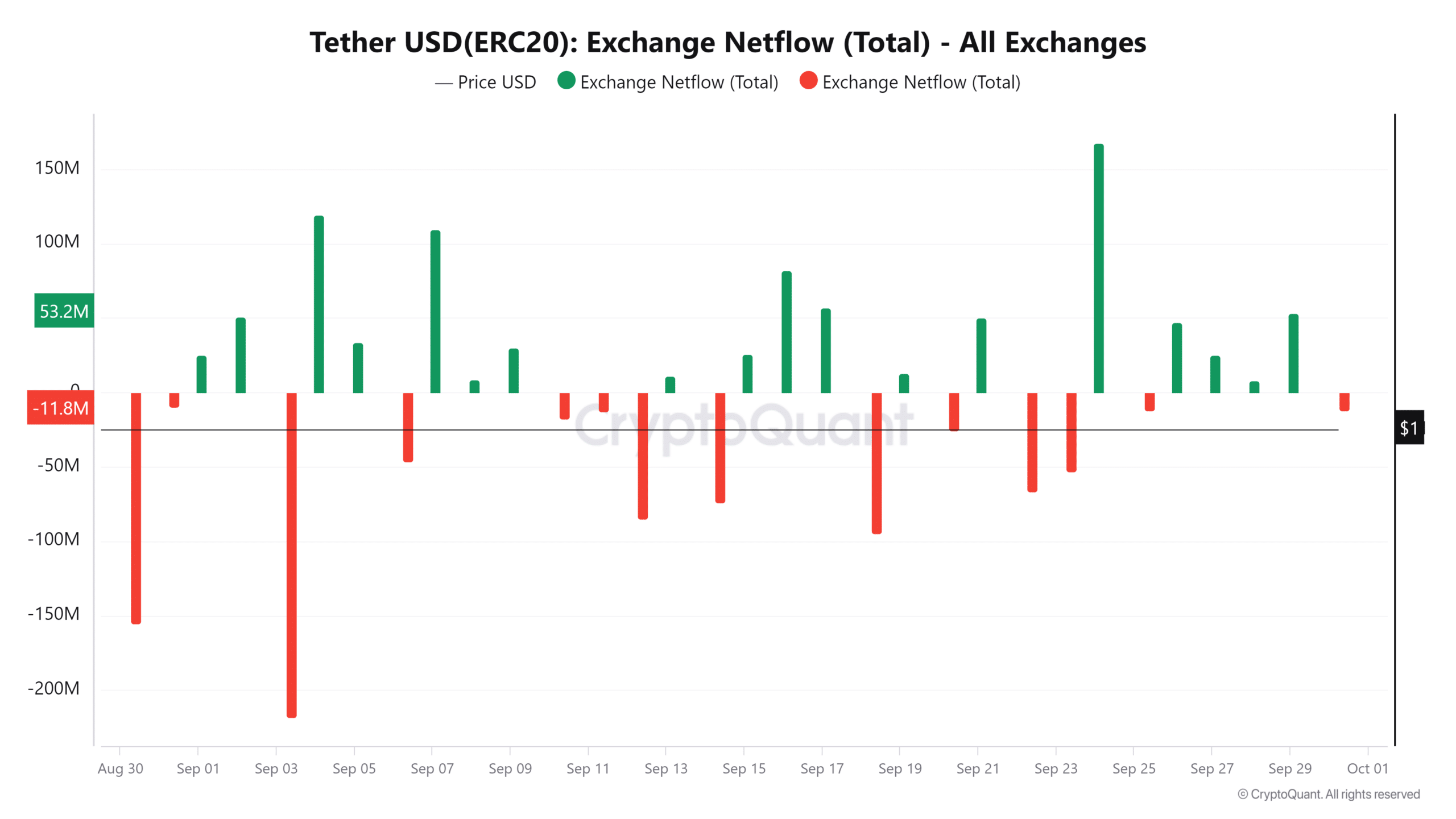

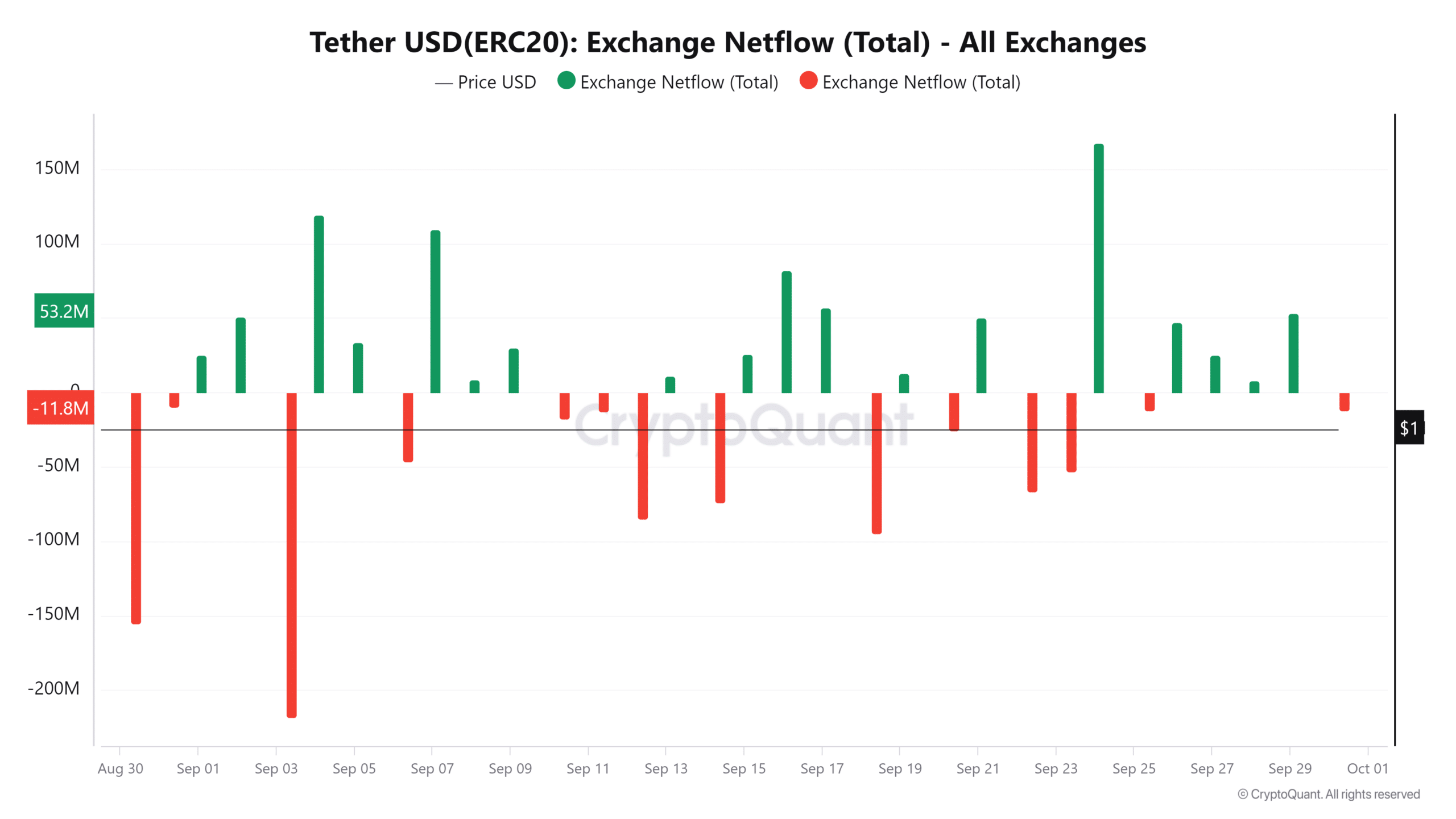

Additionally, increased USDT outflows suggest that more stablecoins are being withdrawn from exchanges.

Source: Glassnode

Historically, these withdrawals often coincide with Bitcoin losing key resistance areas, causing investors to turn to USDT as a safe bet.

Additionally, these investors see altcoins as more attractive assets while waiting for Bitcoin to decline.

As a result, liquidity flows into altcoins that are seen as cheaper alternatives, especially during periods of increased volatility.

That means that if BTC consolidates below around $64,000, investors could diversify their portfolios, potentially leading to a surge in altcoins.

The season may be coming

In addition to market sentiment, AMBCrypto has identified hidden patterns in historical trends.

Interestingly, when BTC dominance bottomed out six years ago, a reversal occurred 761 days later and altcoin season began.

Simply put, this pattern suggests that a similar timeline could soon signal the next altcoin season.

Source: X

In other words, if history repeats itself in a situation where Bitcoin dominance is currently declining, it could eventually lead to a revival of altcoin value.

Read Bitcoin (BTC) Price Prediction for 2024-25

As previously mentioned, current market conditions represent an optimal time for altcoins to surge due to declining Bitcoin dominance, increased USDT outflows, and historical patterns supporting this event.

Overall, it is important to keep an eye on these factors. If BTC falls into consolidation (likely), the next altcoin season could begin.