- Sui’s price increase, coupled with a 132.55% volume surge, suggests growing market confidence.

- Market sentiment is strengthening as social dominance increases and public interest increases.

SUI It has recently been receiving market attention due to price fluctuations and increased trading volume. Many traders and analysts are wondering whether this momentum could signal the start of a sustained upward trend.

Therefore, it is important to examine key market indicators to understand the full picture.

Price Action Signal Strength

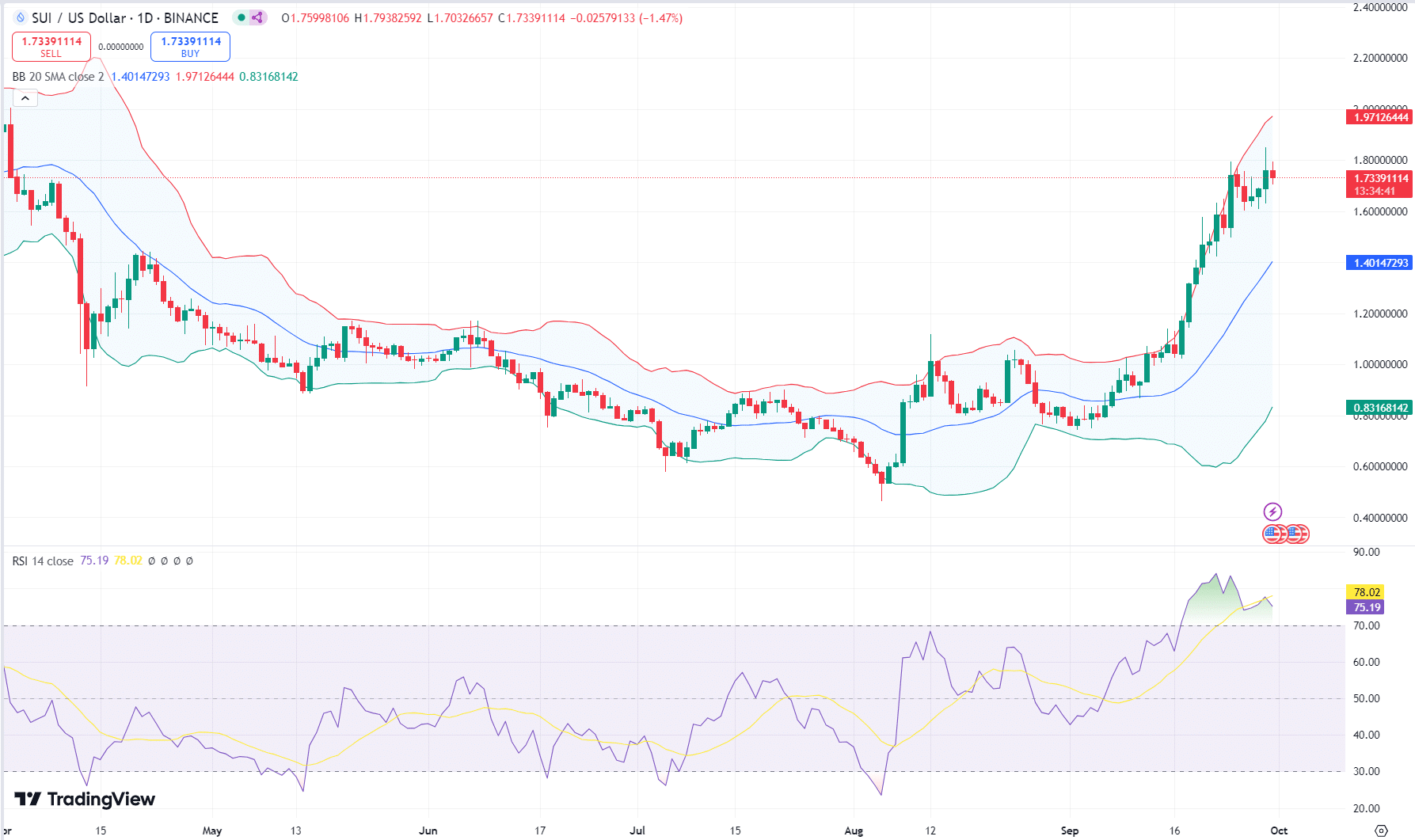

At press time, SUI was trading at $1.73, up 2.98% in the last 24 hours. This steady rise indicates growing confidence among investors.

Sui also continues to test important resistance levels, which highlights the bullish sentiment surrounding the token.

A widening Bollinger Band between $1.40 and $1.97 indicates increasing volatility. Additionally, RSI lies deep in overbought territory at 78.02, indicating strong buying pressure.

However, overbought conditions can sometimes signal a potential short-term downside, so traders must exercise caution.

Source: TradingView

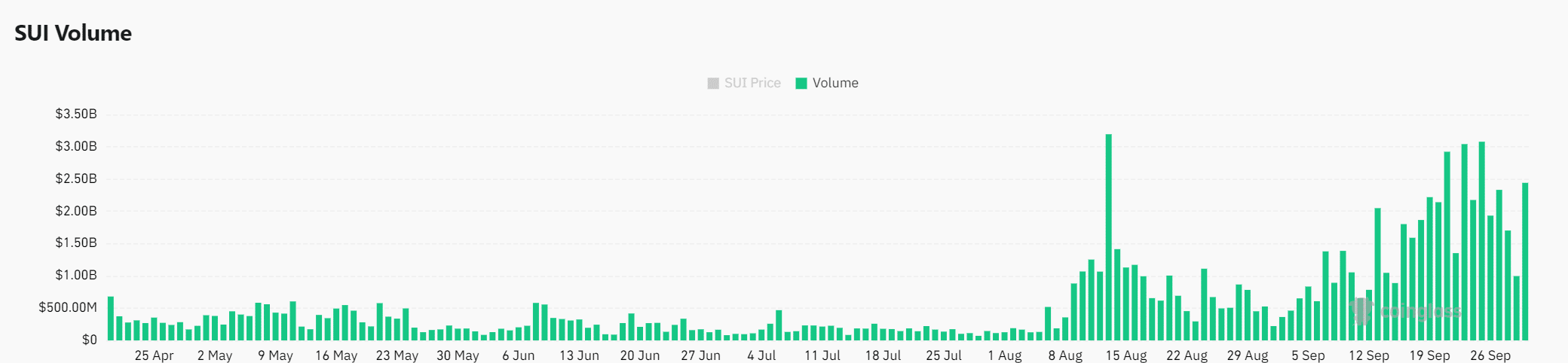

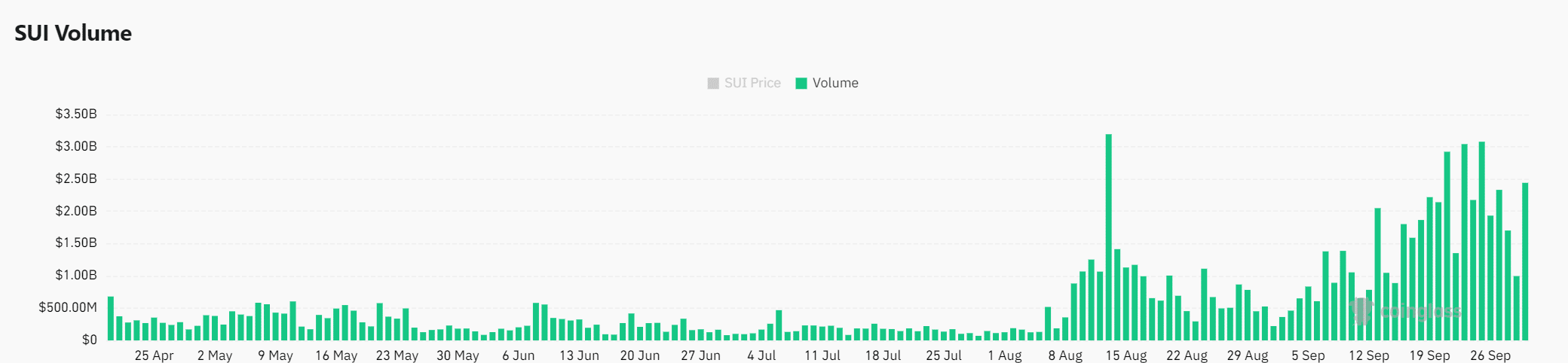

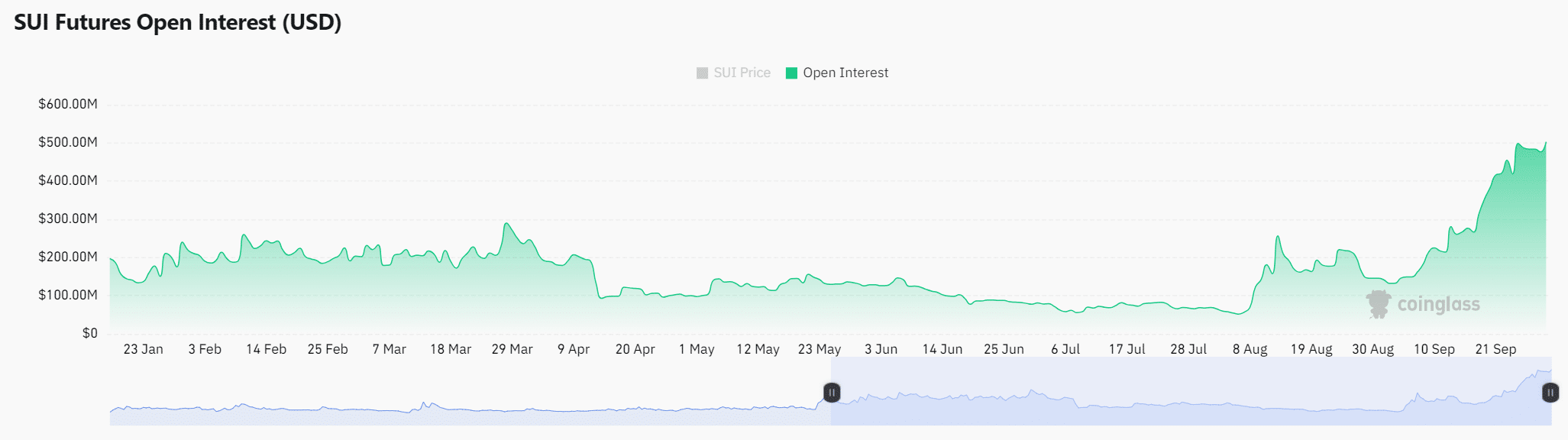

A surge in on-chain volume sparks interest

Moreover, the surge in SUI’s trading volume is an undeniable fact. With a massive increase of 132.55%, the current trading volume stands at $2.71 billion. This significant rise highlights the growing interest in the token in both spot and derivatives markets.

Historically, these volume surges have preceded sharp price movements, so these increases could push Sui’s price even higher in the future.

As a result, market participants should watch closely for further increases in trading volume. This is because it often reflects underlying strength.

Source: Coinglass

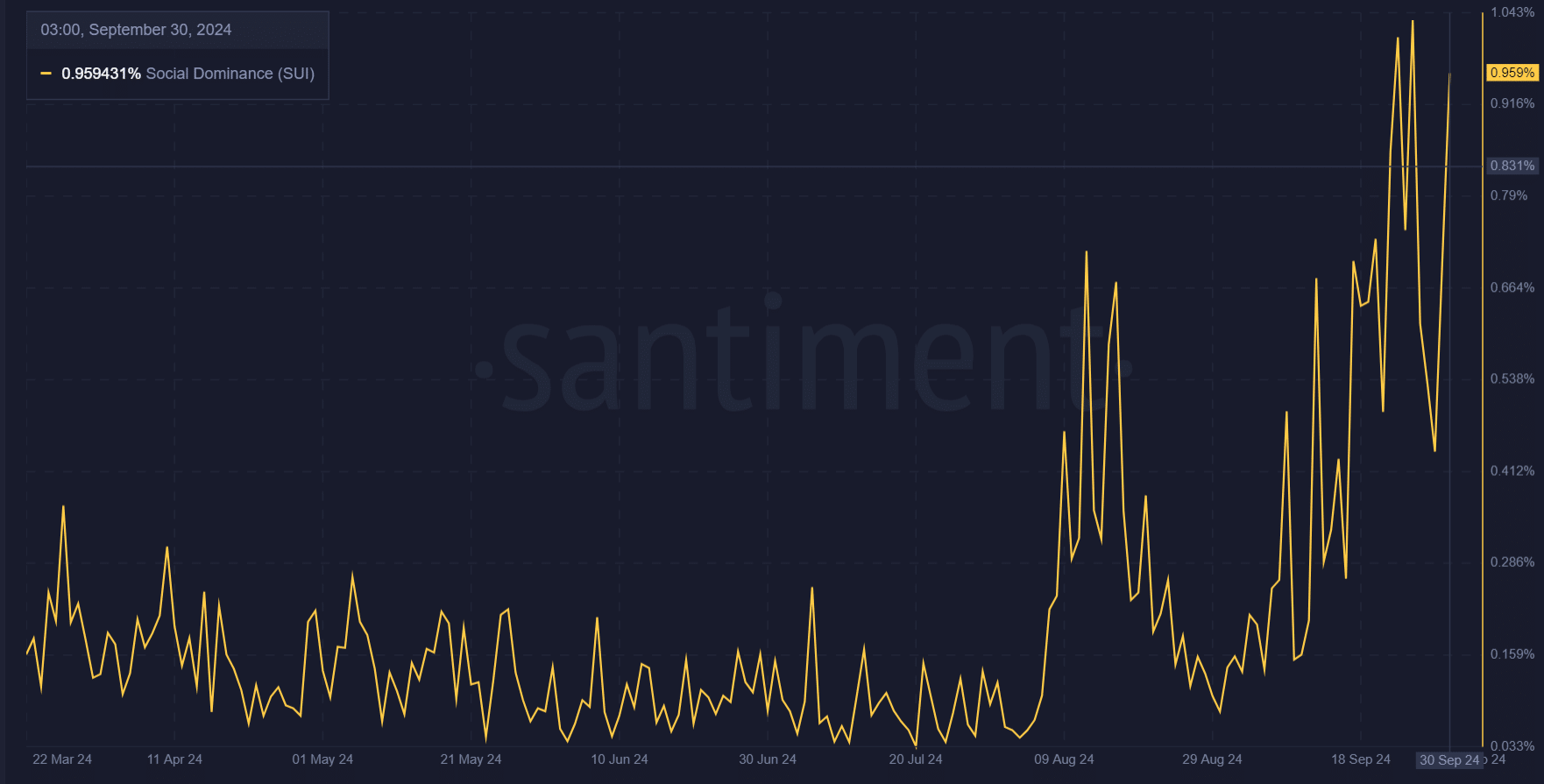

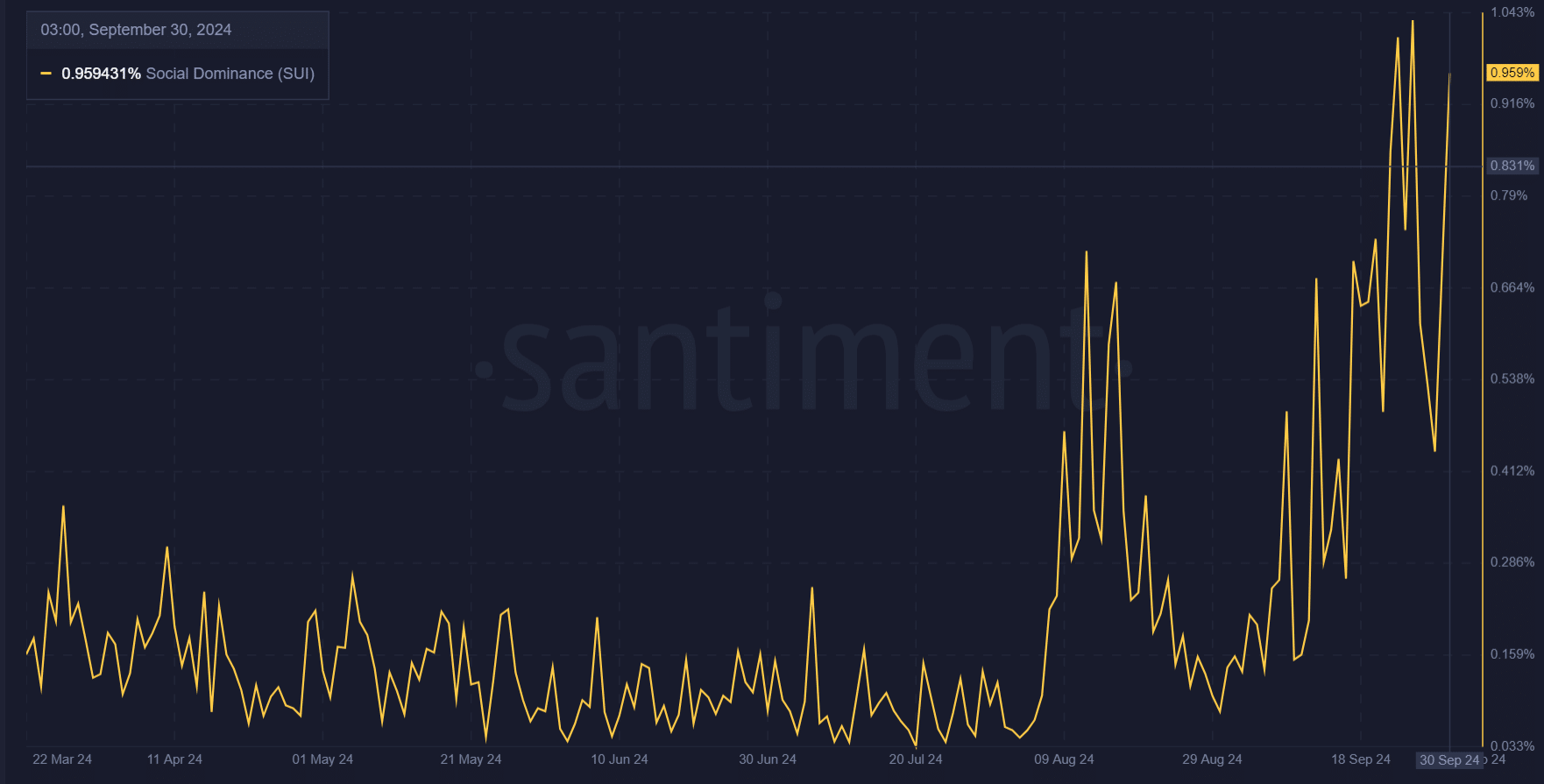

Increased social dominance of SUI

Additionally, SUI’s social dominance is gaining momentum, reaching 0.959 at 0.703% in 24 hours at press time. This rapid increase indicates that the token is becoming a hot topic in the cryptocurrency community.

Social media activity often serves as a harbinger of market trends, and as online discussion increases, SUI’s price may benefit from this heightened interest.

As a result, more traders may be attracted to SUI as its visibility continues to increase.

Source: Santiment

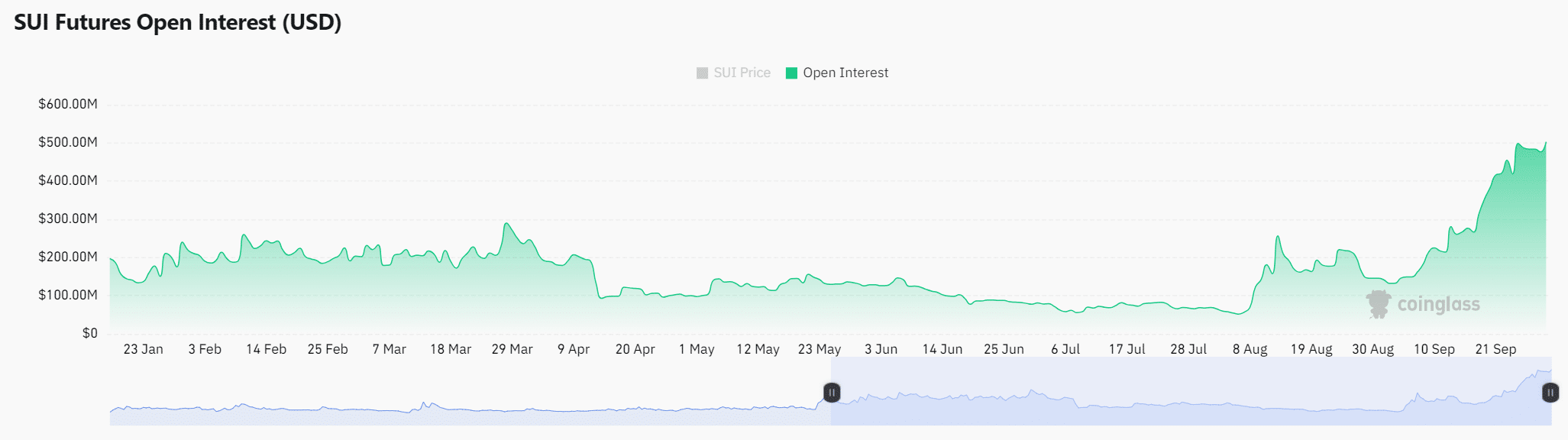

SUI Open Interest Supports Bullish Sentiment

SUI derivatives open interest also increased by 3.92%, reaching $473.24 million. This rise shows that traders are taking a fresh stance and suggests growing confidence in Sui’s future prospects.

Additionally, an increase in open interest, combined with an increase in trading volume and social dominance, indicates a stronger belief in a continued upward trend.

Source: Coinglass

Realistic or not, the SUI market cap in BTC terms is:

Considering the current market conditions, including rising prices, surging volumes, and increasing social dominance, SUI is expected to achieve continued growth.

Although a short-term decline may occur, the data overwhelmingly supports the possibility of a new upward trend. However, traders must remain vigilant as markets can change quickly.