- AVAX flips bull market support band as Q4 begins.

- Avalanche could surpass Bitcoin in the last quarter of the year.

Avalanche (AVAX) is a smart contract platform known for its ability to scale infinitely and finalize transactions in less than a second, providing a flexible ecosystem for developers.

Cryptocurrency markets have shown some bullish signals recently, but geopolitical tensions are expected to dampen these sentiments. Despite these challenges, the Avalanche flipped the bull market support zone.

AVAX is currently trading above its 20-week simple moving average (SMA) and 21-week exponential moving average (EMA), which is a positive sign for its long-term outlook.

Source: IntoTheCryptoverse

Many traders are questioning whether AVAX will be able to post significant gains and potentially outperform Bitcoin (BTC) in the final quarter of the year.

AVAX shows strength compared to BTC in its valuation.

If we examine AVAX/BTC valuation over the past two months, we can see that Avalanche has shown more strength than Bitcoin.

The current AVAX/BTC valuation is 0.000450, reflecting the steady growth of AVAX over the past two months. The charts are showing a steady upward trend, but AVAX has yet to hit a near-term high that would completely upset Bitcoin.

If Bitcoin leads the expected bullish quarter, the Avalanche may have trouble maintaining its lead. However, while AVAX has gained an early lead over BTC, it is still unclear whether this will be maintained.

Source: IntoTheCryptoverse

Last week, month, and quarter data showed that AVAX was up 2.81%, 1.79%, 20.23%, and 2.23% against Bitcoin, respectively, setting the stage for potential outperformance in the fourth quarter.

365-day ROI

Another key metric is the Avalanche’s 365-day return on investment (ROI), which currently stands at 3.067. This indicates that AVAX’s annual current returns are positive and beat its average for the year.

Many traders holding AVAX are making profits and due to the positive ROI, these traders are less likely to sell their holdings and choose to hold on to them for further profits.

This dynamic could contribute to continued price growth for AVAX, further supporting the case for a strong performance in the final quarter of the year.

Source: IntoTheCryptoverse

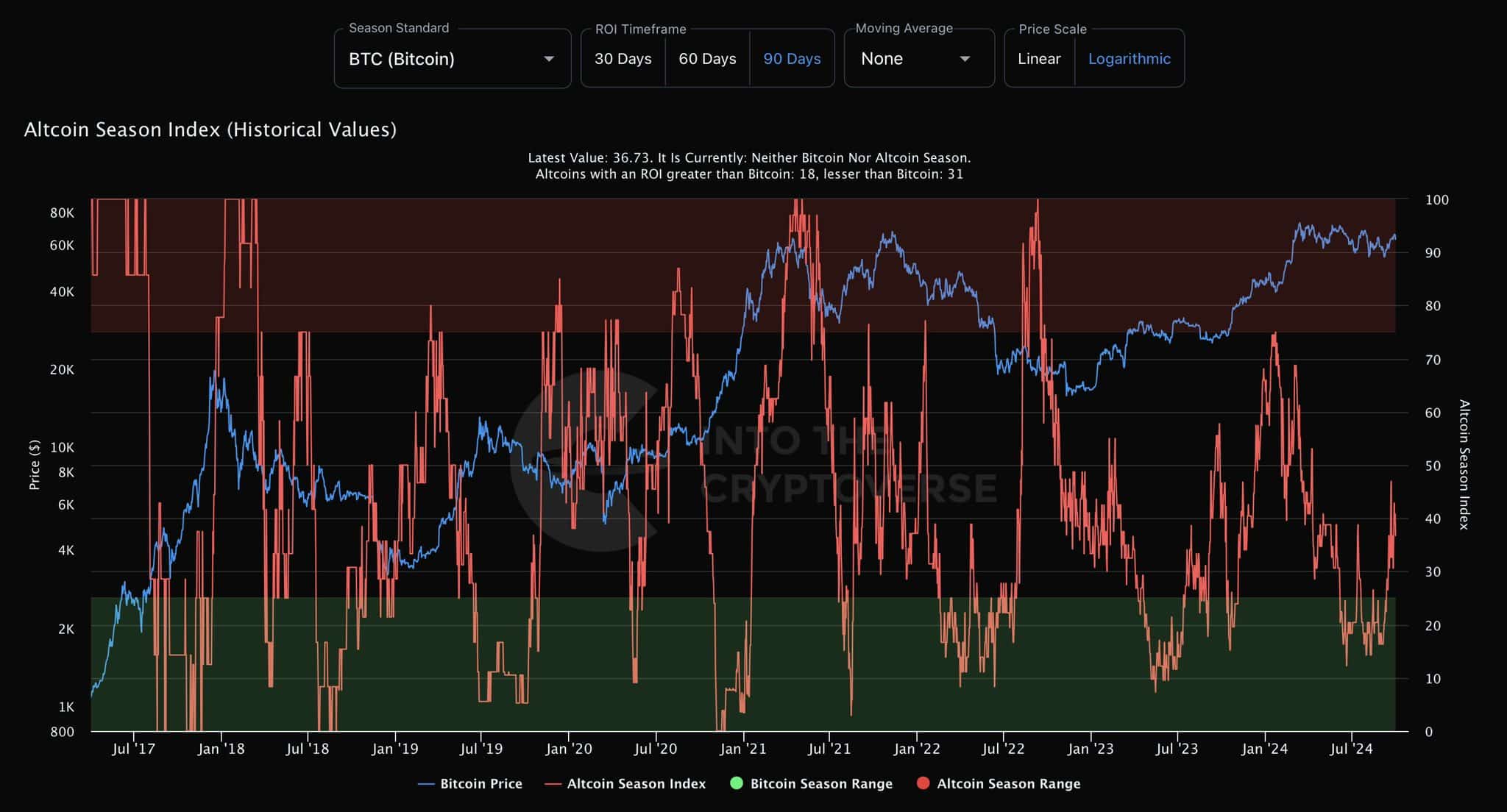

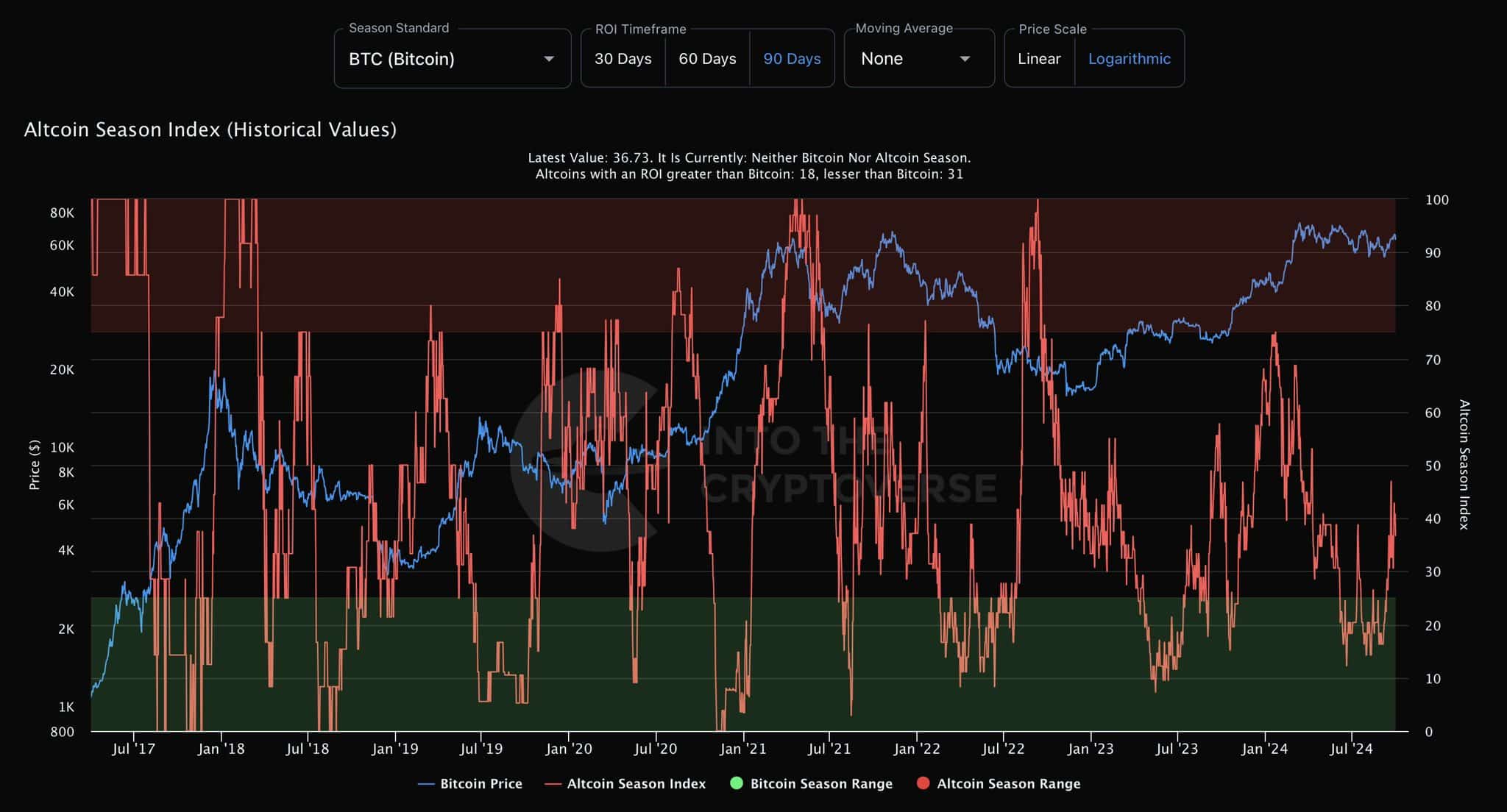

Altcoin Season Index

The Altcoin Season Index provides another perspective on Avalanche’s potential to outperform BTC. This index tracks how many of the top 50 altcoins have a higher 90-day ROI than Bitcoin.

The latest figure is 36.73, indicating that it is neither Bitcoin nor altcoin season. Currently, only 18 of the top 50 altcoins surpass BTC. This means that less than 75% of altcoins are ahead of Bitcoin.

Source: IntoTheCryptoverse

Read Avalanche (AVAX) price prediction for 2024-2025

The high level of BTC dominance suggests that both BTC and altcoins like AVAX are fighting for dominance in the fourth quarter. A change in BTC dominance could trigger a reversal, potentially favoring a price surge for AVAX.

While Avalanche is optimistic about the fourth quarter, BTC’s performance is uncertain and dependent on a number of market factors.