- Flare crypto bulls attempted a breakout but were denied.

- Clues from the volume trend suggest a continued upward trend, with recovery still unlikely.

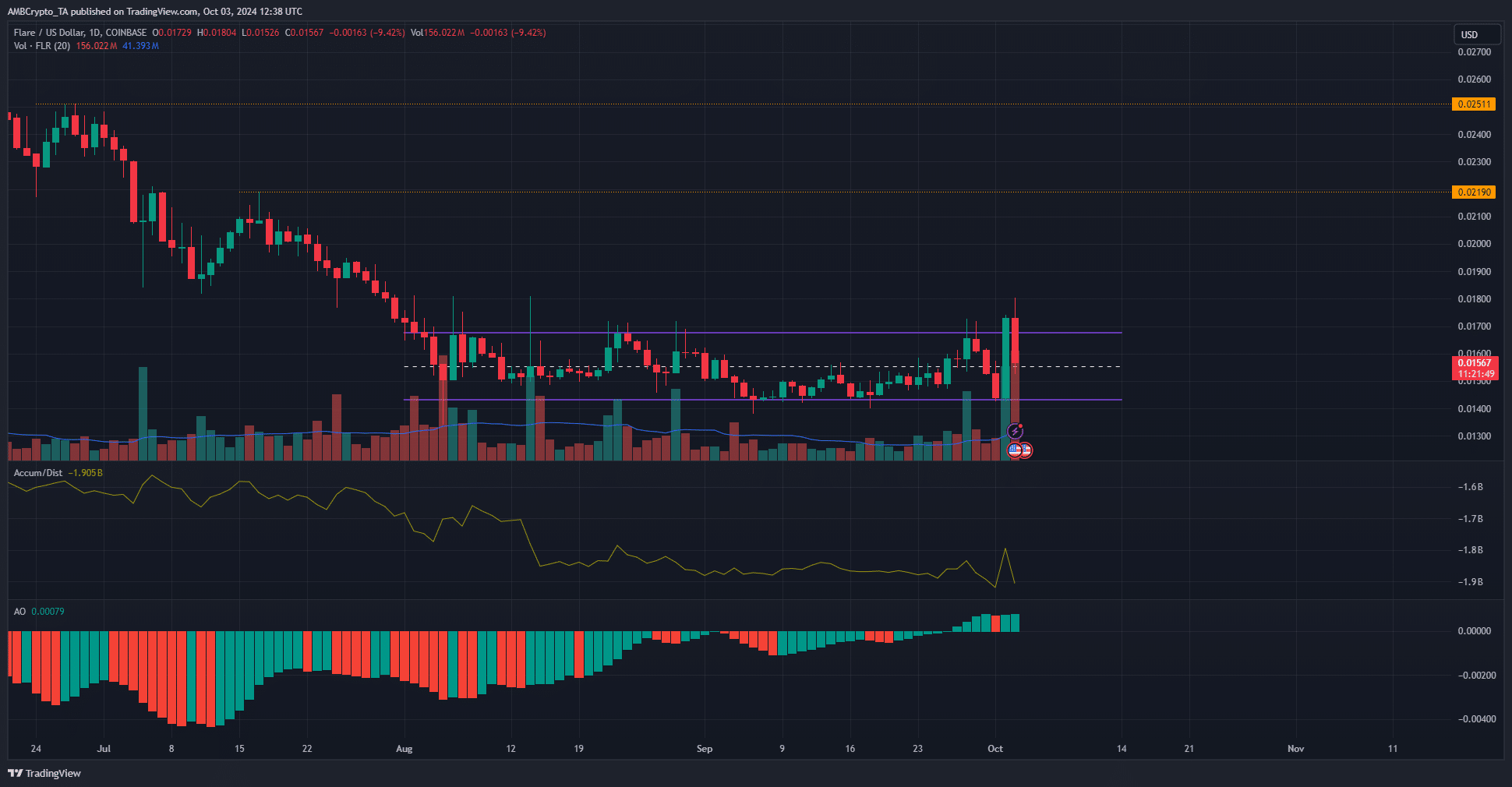

Flair (FLR) has been trading in a range since early August. The range extends from $0.0143 to $0.0167, with the midpoint at $0.0155. The token saw a significant surge in trading volume on October 2nd.

This surge was accompanied by sharp price increases. FLR surged from the lows of the day to achieve a breakout, but has since been forced to decline.

The out-of-range was flatly denied.

Source: FLR/USDT on TradingView

This price drop is a 12.42% decrease from the local high price of $0.018. We brought FLR back into the range formation and retested the mid-range level as support.

AMBCrypto examined the A/D indicator to see if the price trend is likely to resume its uptrend.

A/D has been slowly declining since mid-August. The previous day’s surge did not exceed the August high.

The cue for this volume indicator was bearish. Flare is likely not ready for a recovery towards March levels.

An attempted range breakout could be classified as a failure because the range high did not reverse to support.

The FLR bulls may have another go at achieving this, but traders and long-term holders should remain cautious until volume indicators show an upward trend.

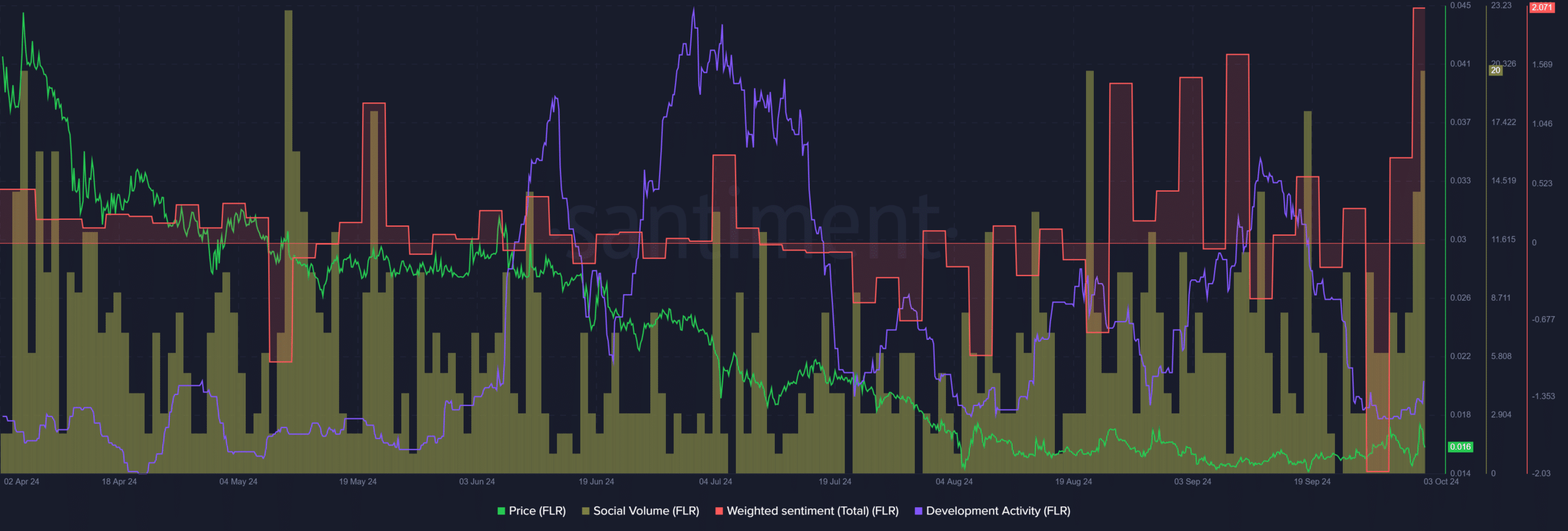

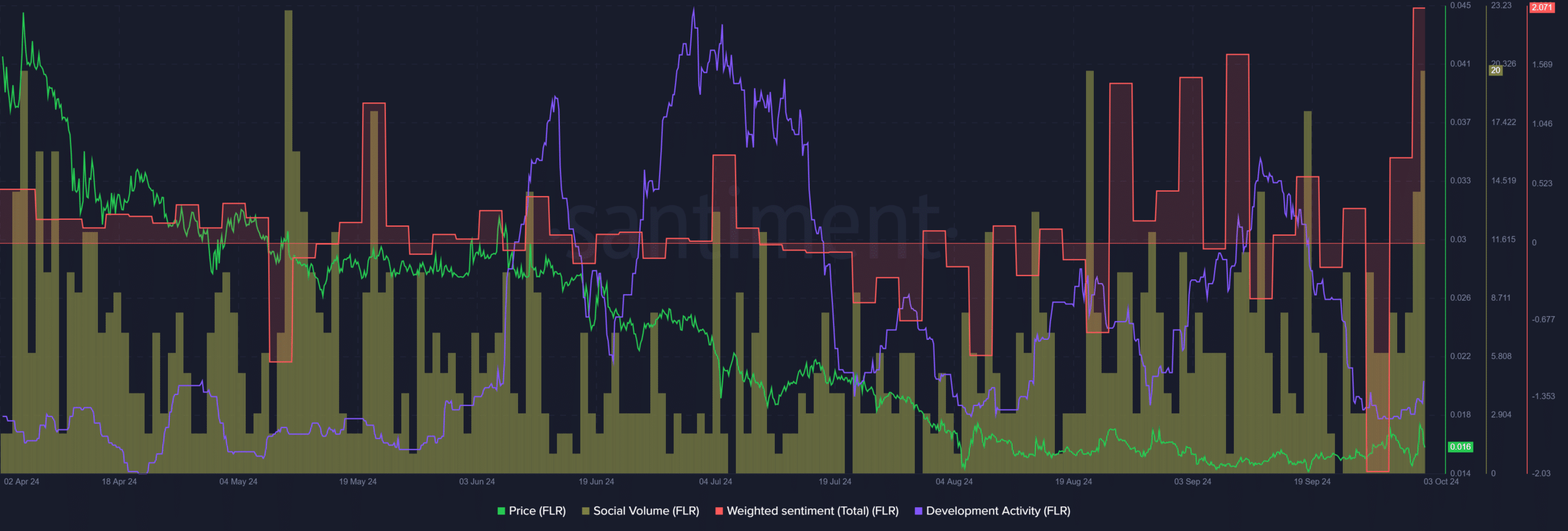

Social activity increases with price movements.

Source: Santiment

Weighted sentiment rose higher, reaching a high not seen since January. This reflected very positive social media engagement following the launch of the Flare range.

Realistic or not, the market cap of FLR in BTC terms is:

Social volume also grew noticeably.

Development activity has been falling in recent weeks and remains well below the highs it maintained in July and September. This may be a concern for long-term investors.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.