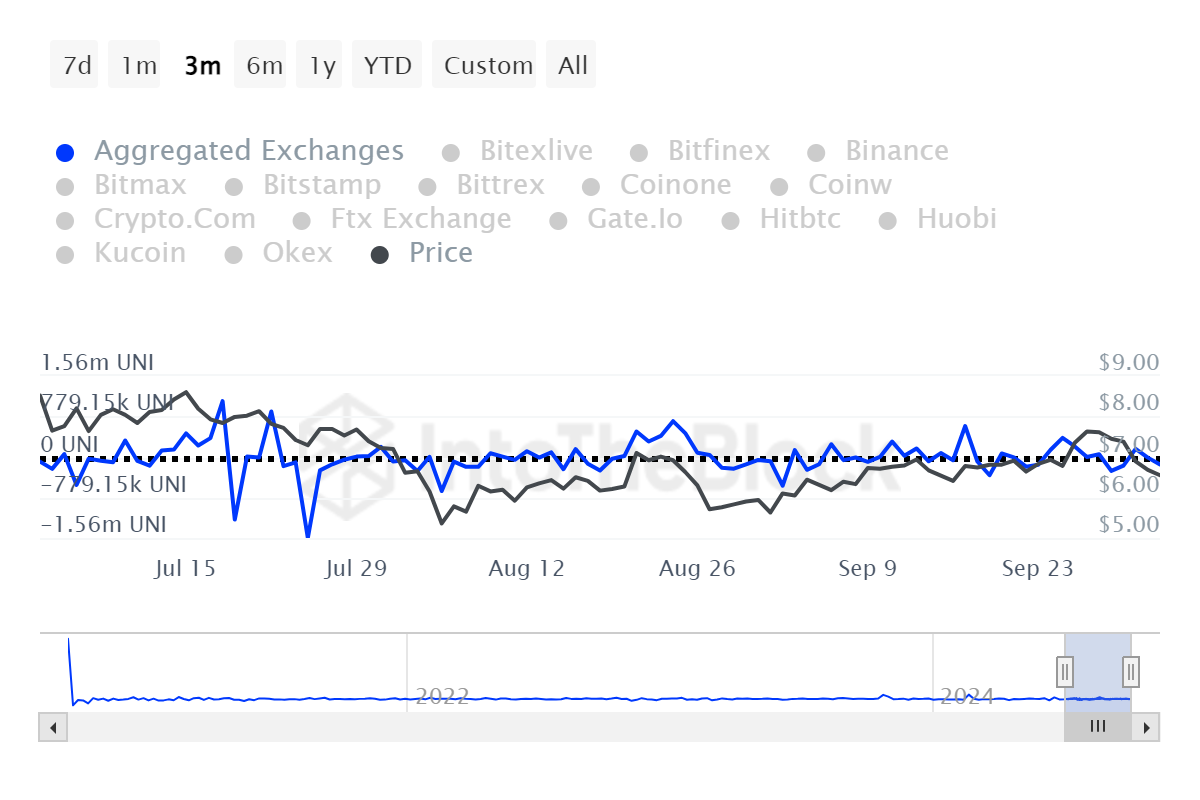

- Uniswap’s exchange net flows surged 1195%, indicating increased trading activity.

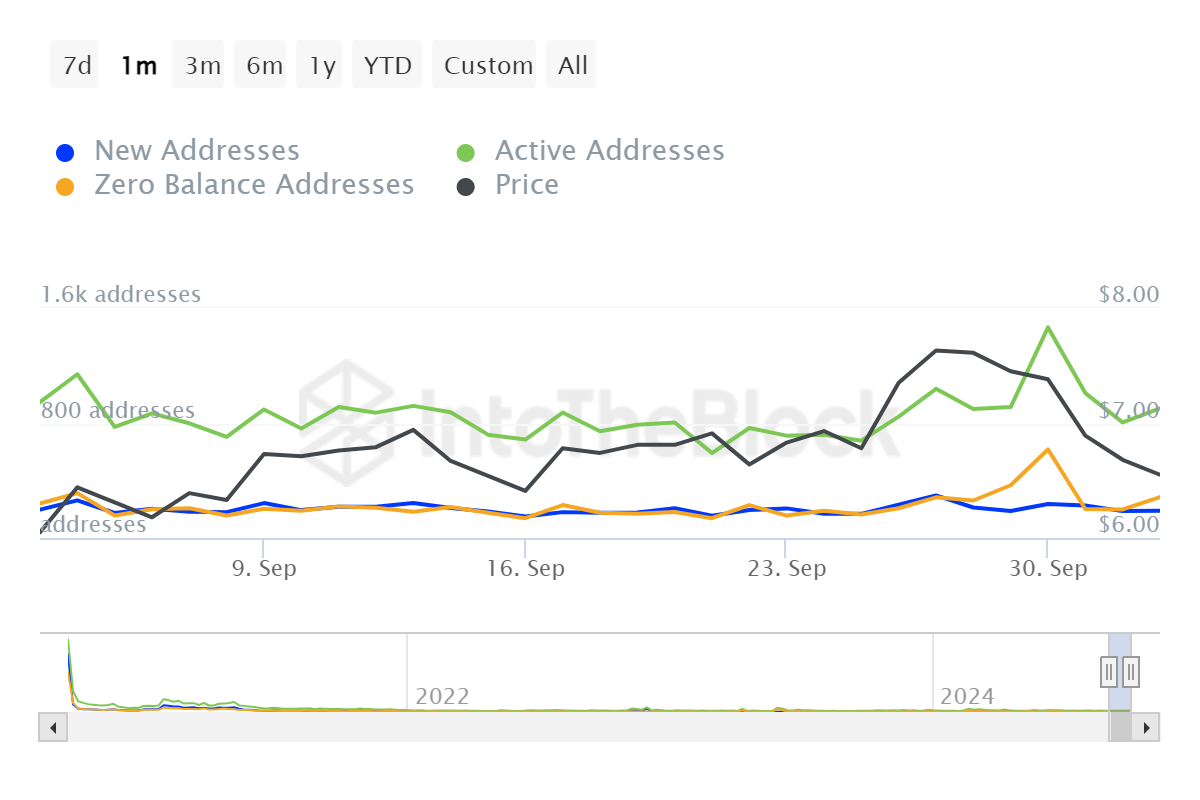

- Despite the surge in active addresses, large transactions plummeted by 63%, raising concerns.

Uniswap (UNI) has expanded 1195% in exchange netflow, indicating increasing activity on the platform. This has sparked debate as to whether it could signal a price rebound with active addresses recording an 11.9% rise.

However, large transactions fell by 63%, leaving questions about institutional interest.

What does Exchange netflow surge mean on Uniswap?

The recent surge in net flows on Uniswap means more funds are flowing into the market and rushing to take advantage of volatile price movements.

This generally means higher volume as retail traders become more active.

Large surges in activity often result in short-term volatility in asset prices. For Uniswap, this could mean more buying and selling pressure, setting the stage for a near-term UNI price rebound.

Source: IntoTheBlock

Are retail traders stepping up?

The 11.9% rise in active addresses means retail traders are participating. As more users interact with the platform, demand for Uniswap may also increase.

Here, it is worth noting that retail traders are often crucial in maintaining momentum when institutional interest is particularly weak.

Source: IntoTheBlock

Conversely, a 63% decline in large-scale trading represents a significant decline in whale activity. This trend suggests that major investors are watching market dynamics from the sidelines.

Without the big players, a longer-term retail-driven rebound could face some resistance.

Source: IntoTheBlock

Will Uniswap rebound?

The answer probably lies in how long retail traders can continue this activity and drive prices higher. If retail activity continues to increase, we may see a short-term price rebound.

However, UNI price may not be able to maintain this upward trend if large volume does not return.

Retail traders may be able to keep UNI afloat, but continued interest from institutional players will be key to a long-term recovery.