- ETH has attempted to recover, but evidence of low demand may cause the rally to cool down.

- Assess the impact of the surge in foreign exchange reserves and the state of foreign exchange flows.

Ethereum (ETH) has finally recovered a bit from last week’s massive selling pressure.

Although there was a slight recovery over the weekend, there are signs that recovery may not be easy this week.

After ending September on a weak note, ETH selling pressure finally eased on Thursday following the 15% retracement.

Some bullish momentum then continued over the weekend, recovering 7% from last week’s low.

ETH was trading at $2477 at press time. Price action was particularly respectful of the rising short-term trendline highlighted in yellow. The slight uptick so far suggests there has been some accumulation.

Source: TradingView

At first glance, the weekend rally may seem like a healthy one and with the potential for more upside ahead.

However, ETH’s money flow indicators have turned downward over the past 24 hours, suggesting a possible liquidity outflow from ETH.

Source: TradingView

MFI suggests the recent rally could be characterized by weak demand. This also means that ETH’s potential upside may be limited.

However, this may vary depending on changes in supply and demand dynamics during the week.

Will low excitement for ETH hinder its rise?

The above results are consistent with declining interest in the Ethereum cryptocurrency. For those seeking maximum short-term gains, this may be a sign that ETH may not be the best choice.

Moreover, on-chain data shows a sharp increase in ETH exchange reserves over the next few days. These results may be consistent with expectations of more selling pressure.

Source: CryptoQuant

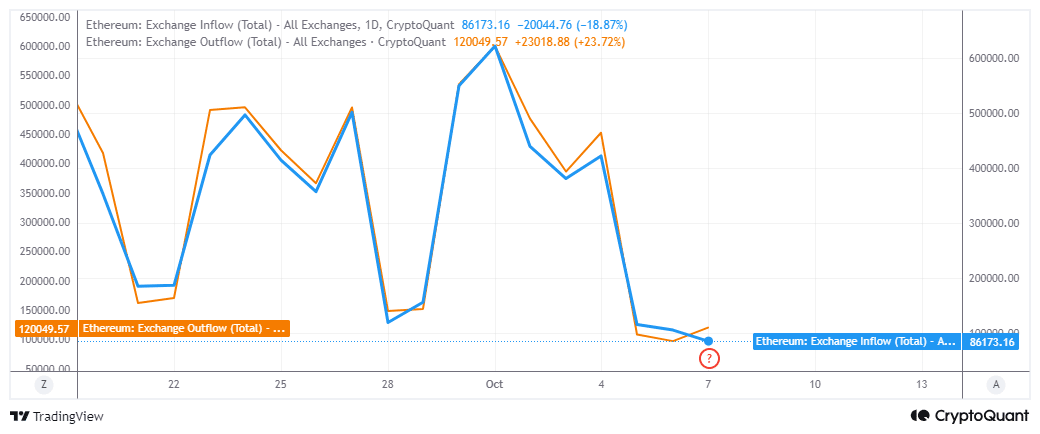

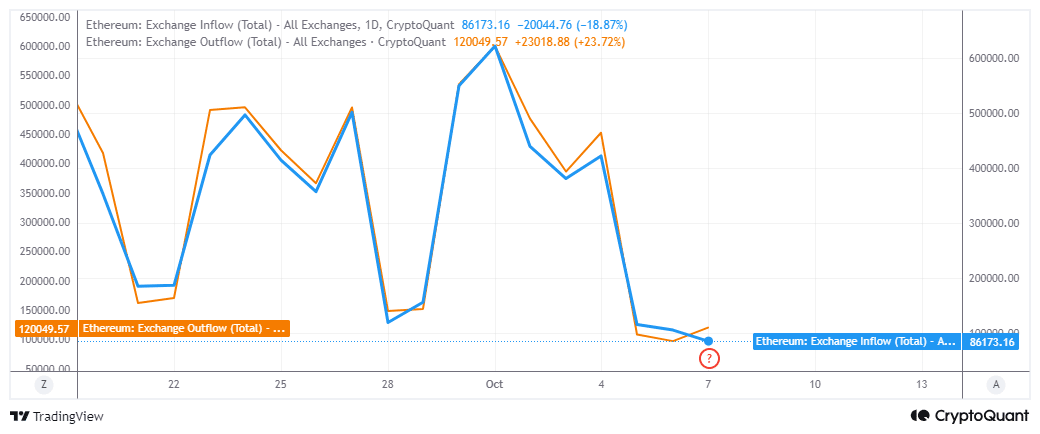

But what do exchange flows reveal about the current situation? According to CryptoQuant, ETH’s exchange flows diverted earlier this month, resulting in lower trading volumes.

For example, exchange inflows peaked at $621,000 ETH in early October, while exchange outflows were slightly lower at $599,778 ETH.

Fast forward to today and exchange inflows stand at 86,173 ETH. Exchange outflows were higher at just over 120,000 ETH.

This means there was a net demand of 33,827 ETH, equivalent to $83.5 million worth of demand.

Source: CryptoQuant

Read Ethereum (ETH) price prediction for 2024-2025

Based on the above data, we can conclude that there is some demand for ETH, but the quantities are relatively small.

This means that excitement around cryptocurrencies was low, potentially resulting in a muted outcome.