- BTC.D fell 2.24% as investors predicted a new altcoin season.

- Over the past 90 days, 75% of altcoins have outperformed Bitcoin.

Over the past month, Bitcoin (BTC) dominance (BTC.D) has experienced consistent rejection at the $58 resistance level.

The constant failure to break out of this stubborn resistance level has fueled greater enthusiasm among altcoin holders.

Bitcoin dominance stood at 56.71 at press time after declining 0.03% over the past day. This is a sharp decline compared to 58% a week ago.

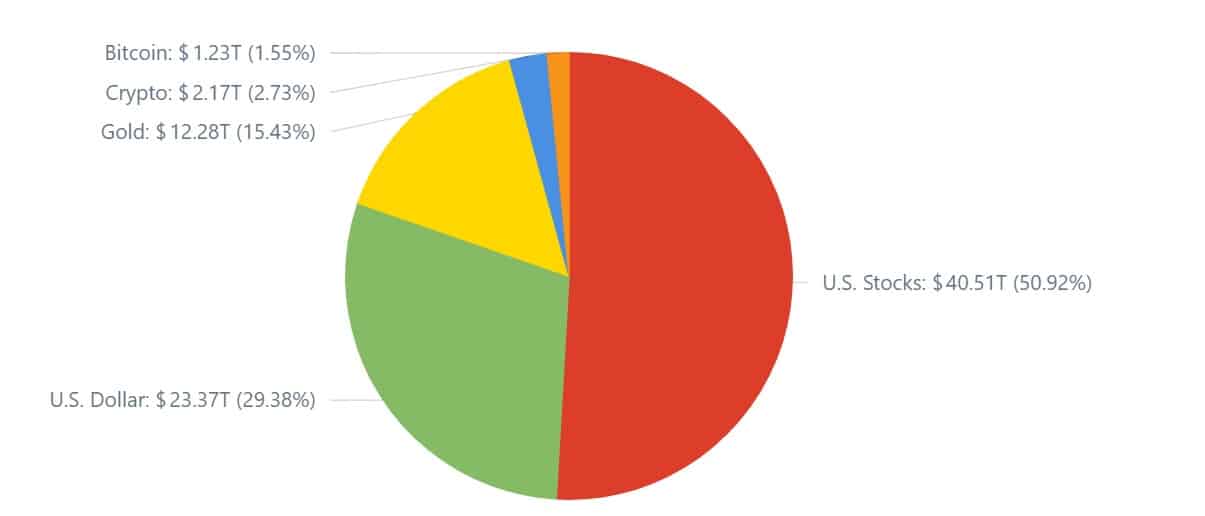

With this, the market capitalization reached $1.24 trillion, and the overall cryptocurrency market reached $2.18 trillion.

Source: Coincodes

Therefore, this decline leaves BTC accounting for 1.55% of global assets, which is significantly lower than the 2.75% of total cryptocurrency assets.

Historically, a drop in BTC.D is good news because altcoins tend to surge. Therefore, the current trend has analysts pondering the future trajectory of BTC and altcoins.

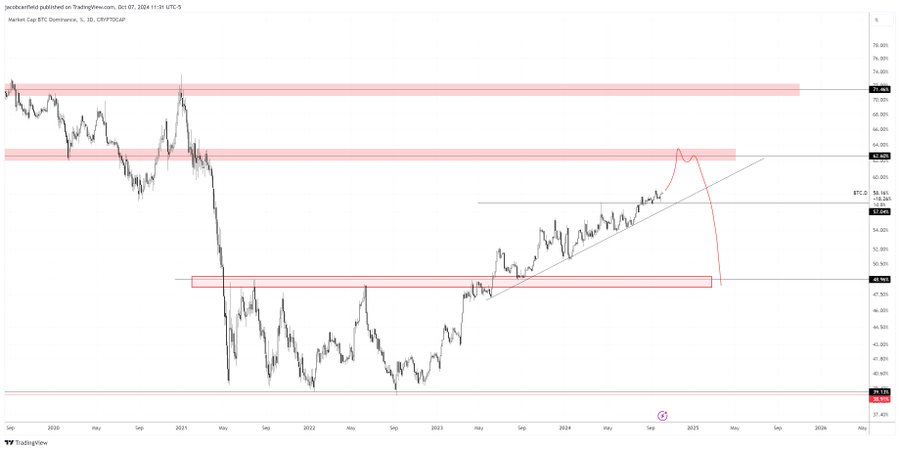

Johncy Crypto thus suggested a potential altcoin season, citing the formation of a rising wedge pattern.

Impact of BTC.D’s decline on altcoins

In his analysis, Johncy assumed that Bitcoin dominance is forming a rising wedge pattern on the weekly chart, which is a bearish signal.

Source: X

Therefore, a breakdown in this channel would confirm the bearish outlook for the cryptocurrency.

So, if BTC continues to trade sideways after last week’s decline, or shows strength during a decline in dominance, it could be a sign of altcoin season.

What this means is that if Bitcoin dominance continues to decline, altcoins may gain more market share, allowing altcoins to surpass BTC.

However, one of the best ways to determine an altcoin’s performance against BTC is to use the ETH/BTC ratio.

Source: CoinMarketCap

Accordingly, ETH/BTC is down 2.40% over the past 24 hours. But overall, ETH outperformed BTC. In fact, it has surged 6.28% against BTC over the past 30 days.

This means that the altcoin has improved its performance against BTC on the monthly chart as its dominance has dropped from 58% to 56%. 71.

Source: CoinMarketCap

Likewise, Memcoin saw a strong rebound on the weekly chart, with its market capitalization increasing from $43.7 billion to $50.9 billion.

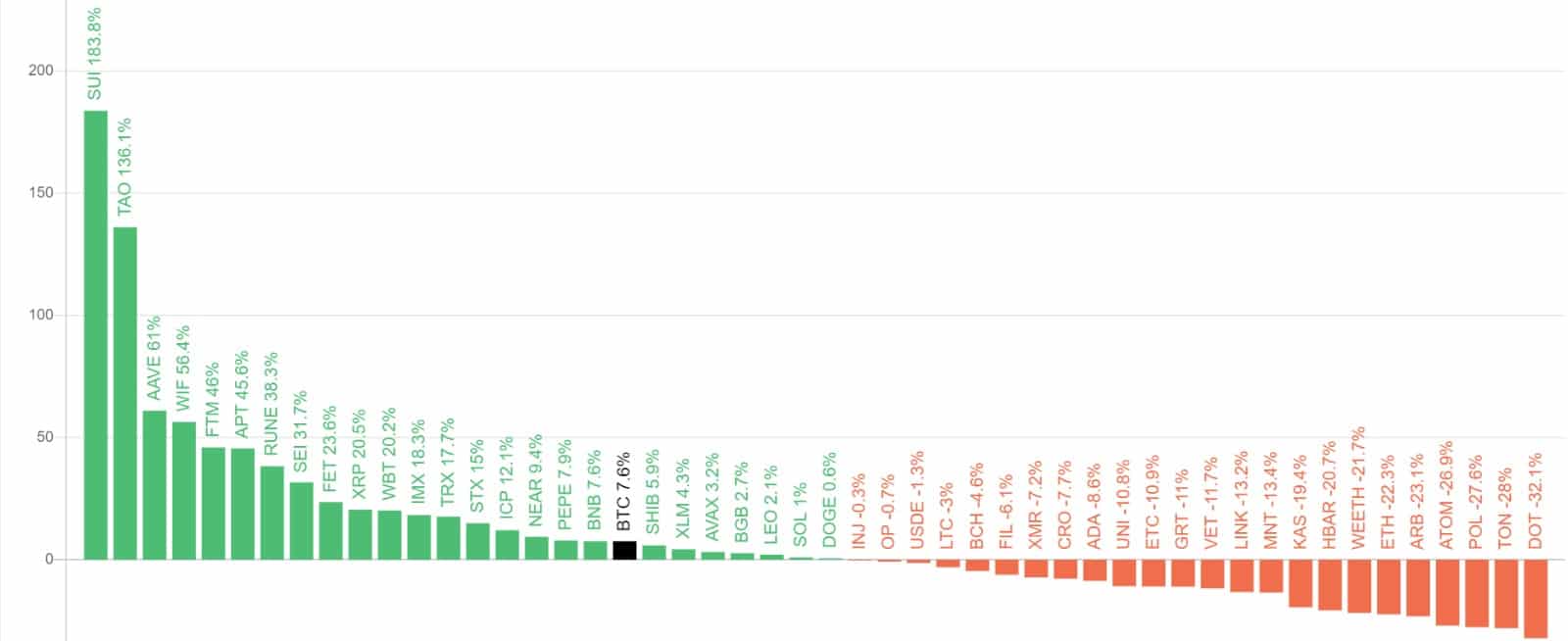

Source: Blockchain Center

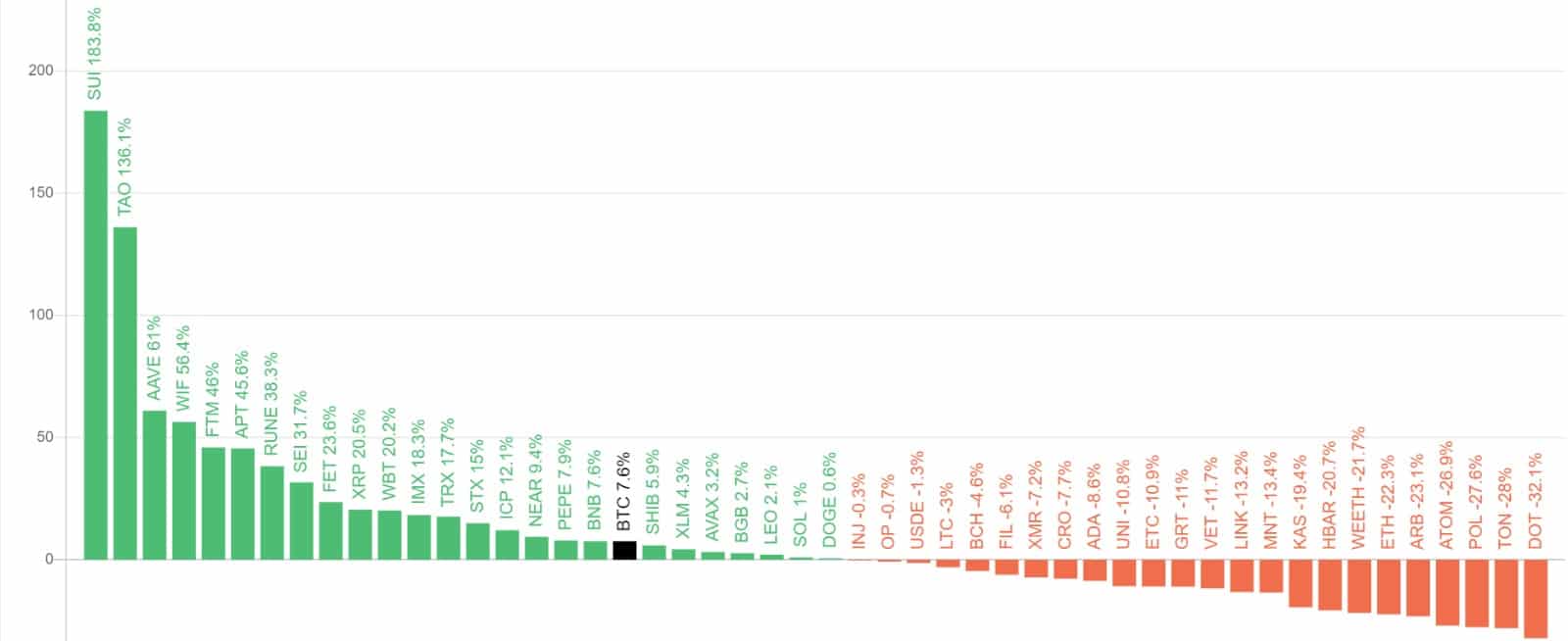

Additionally, various altcoins have outperformed Bitcoin over the past three months. In particular, Sui (SUI) leads with 183.5%, Bittensor (TAO) with 136.1%, Aave (AAVE) with 61%, and dogwifhat (WIF) with 56.4%.

So, 75% of the top 50 coins performed better than Bitcoin over the last 90 days.

Source: Blockchain Center

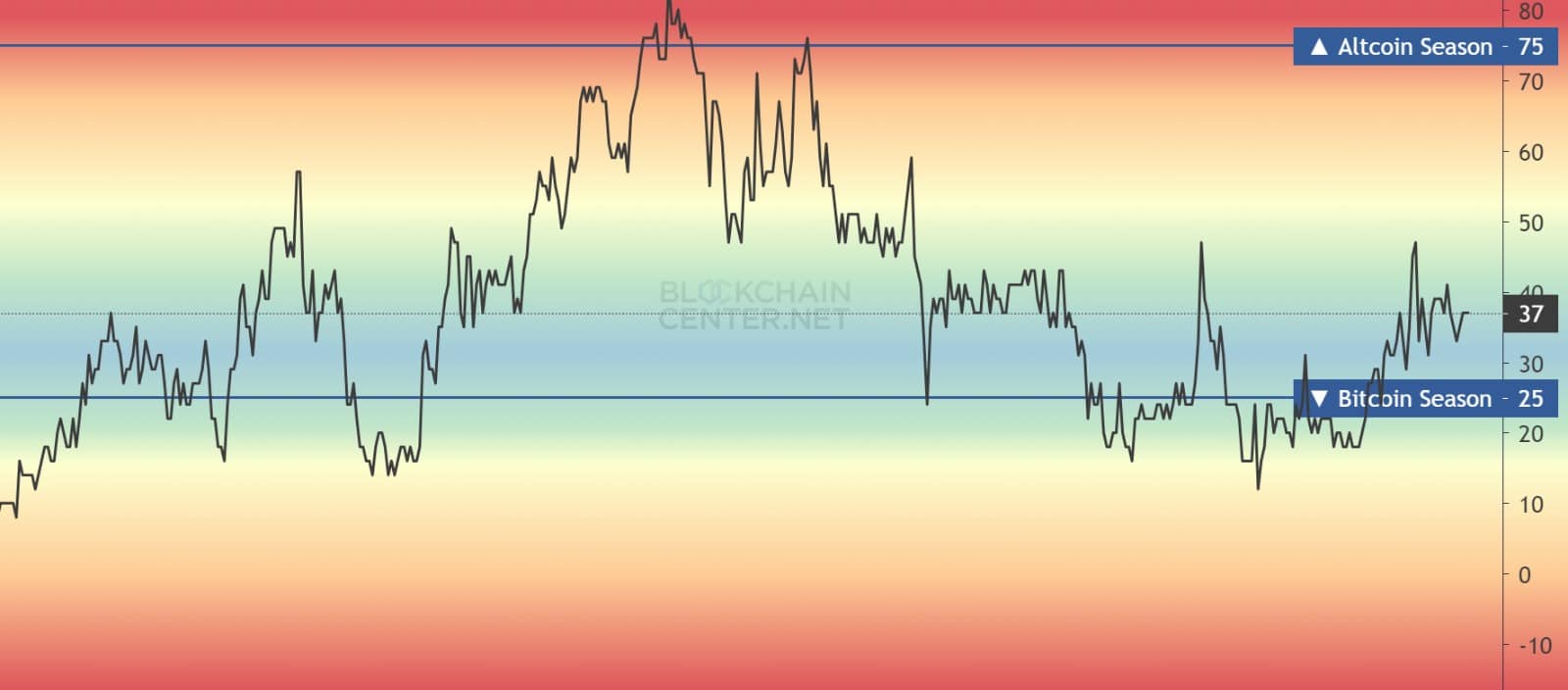

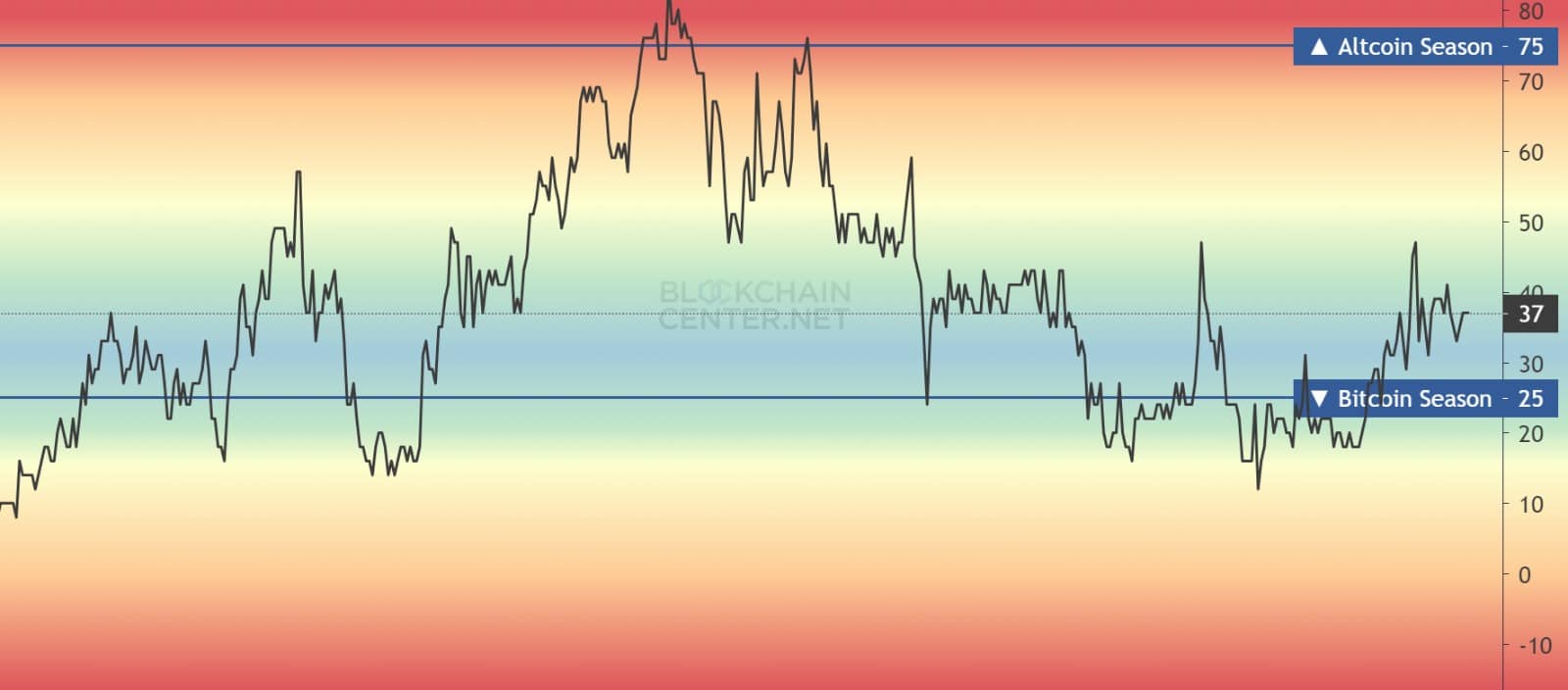

Finally, at press time, the altcoin seasonal index was at 37, up from 33 last week and down from a high of 47 15 days ago, while the BTC seasonal index was at 25.

Read Bitcoin (BTC) price prediction for 2024-2025

This scenario indicates increased demand for altcoins among investors compared to Bitcoin.

In short, altcoin season is slowly gaining momentum and the upside potential continues to increase.