- Bitcoin ETF inflows are picking up again, led by Fidelity’s FBTC and BlackRock’s IBIT.

- The Ethereum ETF saw no new inflows on October 7, with trading volume decreasing.

Despite a slow start to October for the spot Bitcoin (BTC) ETF, the market is showing signs of improvement.

According to Farside Investors, the BTC ETF recorded notable inflows amounting to $235.2 million on October 7, marking the second consecutive day of positive capital movement.

Bitcoin ETF led by Fidelity

Leading the surge was Fidelity’s FBTC ETF, which recorded the highest inflows at $103.7 million.

Additionally, BlackRock’s IBIT, the largest spot Bitcoin ETF by asset, recorded solid inflows of $97.9 million, rebounding from zero activity on October 4.

As expected, Bitwise’s BITB won $13.1 million, Ark and 21Shares’ ARKB won $12.6 million, VanEck’s HODL won $5.4 million, and Invesco’s BTCO won $2.5 million.

However, Grayscale’s GBTC and six other ETFs recorded no new flows on October 7.

In other words, the total trading volume of the 12 ETFs was $1.22 billion, steadily increasing compared to $1.19 billion on October 4 and $1.13 billion on October 3.

Valqunas was already anticipating this.

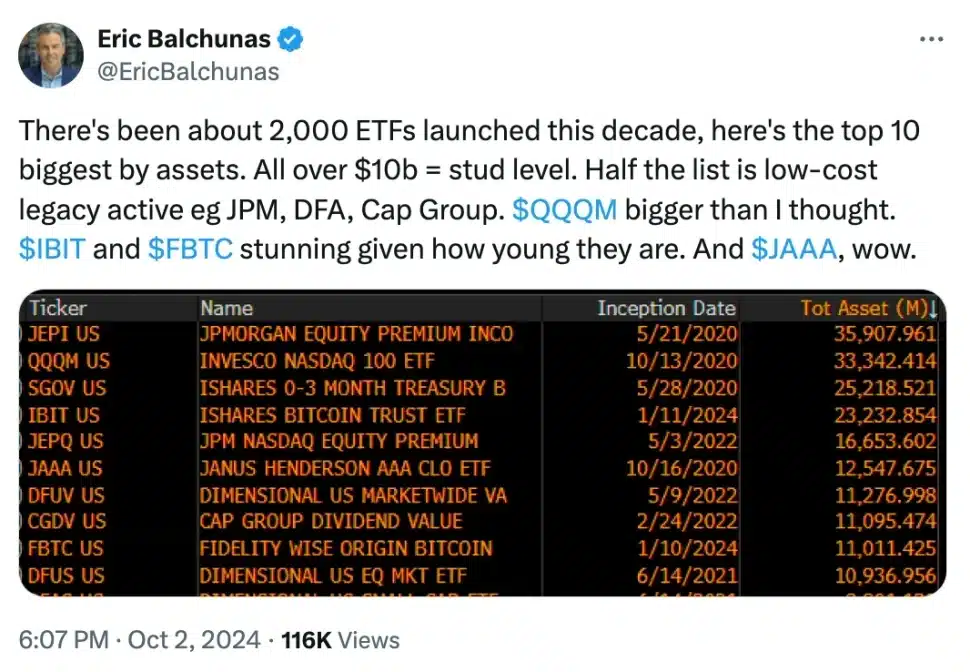

Bloomberg senior ETF analyst Eric Balchunas recently highlighted IBIT and FBTC as two standout BTC ETFs of the past decade.

He noted their impressive rise to “stud level” status, with each amassing more than $10 billion in assets under management (AUM).

Balkunas emphasized.

Source: Eric Balchunas/X

Bitcoin price shows weak momentum

BTC price has suffered a bit as Bitcoin ETFs unexpectedly gained investor attention.

The cryptocurrency is currently trading around $62,497 after falling 0.48% over the past 24 hours, falling short of its recent high of $66,000.

This development coincides with a significant legal decision as the U.S. Supreme Court recently declined to hear an appeal regarding the ownership of 69,370 bitcoins initially seized from the Silk Road dark web marketplace.

Ethereum ETF Analysis

Unlike the BTC ETF, the U.S. Spot Ethereum (ETH) ETF paused activity on October 7 after inflows of $7.39 million last recorded on October 4 and outflows of $3.2 million on October 3. It is done.

During this quiet period, trading volume for the nine ETH ETFs decreased, reaching $118.43 million from $148.01 million on October 4.

Meanwhile, on the price front, Ethereum fell 1.35% to trade at $2,436, reflecting the changing dynamics in the cryptocurrency space.