- Despite the increase in revenue, the protocol’s network activity has declined.

- Token sale pressure is increasing, so a price adjustment is expected.

Since the beginning of the year, AAVE has shown promising performance in terms of capital appreciation. To be precise, the protocol’s revenue has skyrocketed.

In fact, the protocol’s token, AAVE, also recorded similar performance last year.

In-depth analysis of AAVE’s network activity

Milk Road, a well-known cryptocurrency analyst, recently shared the following: tweet An interesting development is revealed. According to this, AAVE has generated $500 million in sales since the beginning of this year.

Thanks to this, the revenue generated by AAVE is currently the highest among other top protocols. AAVE’s profits are followed by Venus Protocol and Compound.

However, despite the massive revenue growth, network activity has declined, according to AMBCrypto’s IntoTheBlock analysis. data. For example, AAVE’s daily active addresses are starting to decline slightly after a surge in September. A similar decline was seen on the transaction side, which could be attributed to a decline in active addresses.

Source: IntoTheBlock

Likewise, the protocol’s address birth-death ratio has also decreased. Here, this implies the rate at which new addresses are created compared to addresses with balances that have not been transacted in over a year.

What is the price action of the token?

After verifying the network activity of the protocol, AMBCrypto planned to evaluate the performance of the token in terms of price. We found that the token price rose by more than 100% in the last year. However, the past few months and weeks have been less volatile, which has prevented investors from making much of a profit.

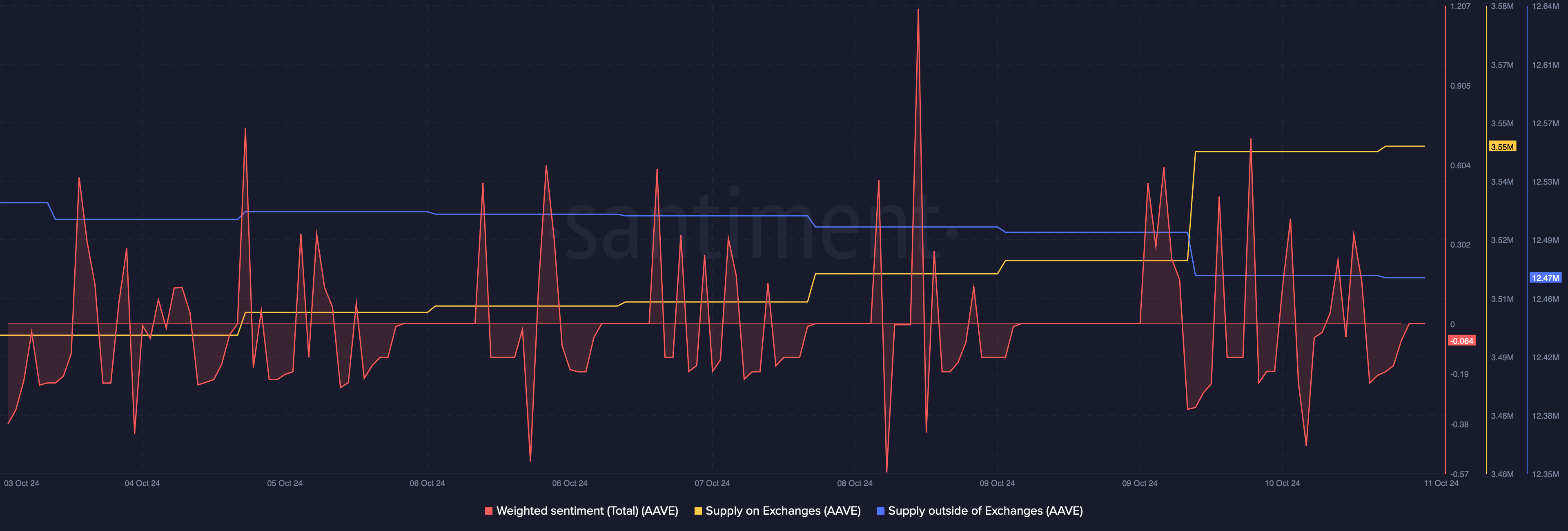

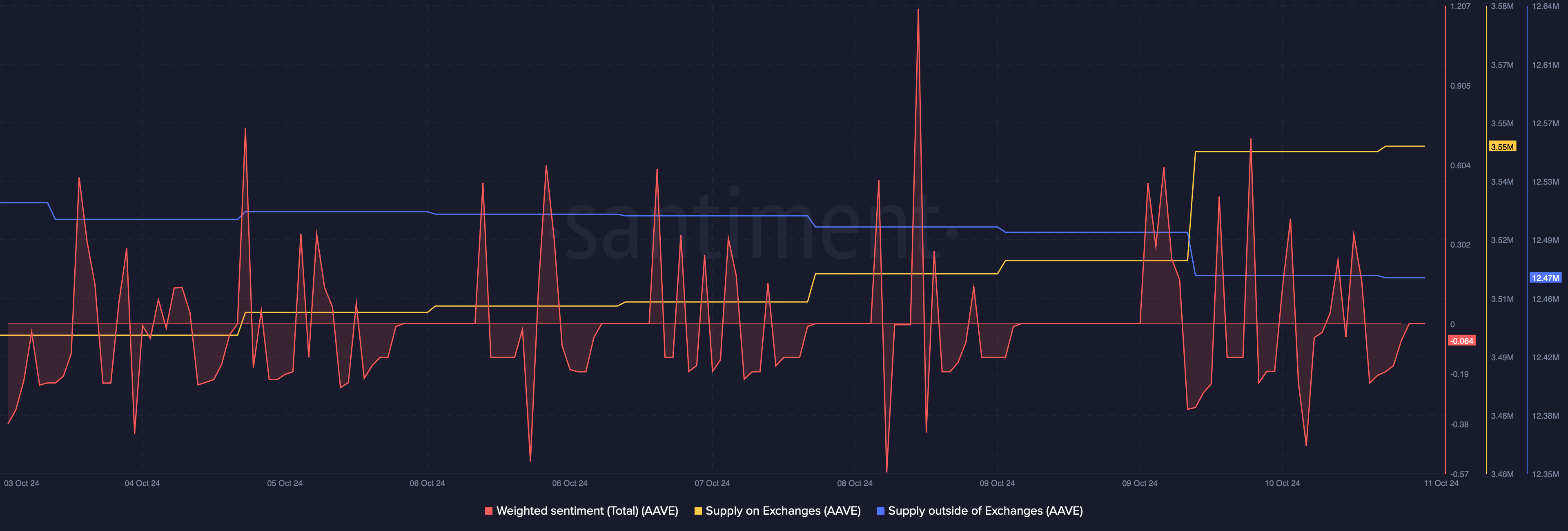

Therefore, we analyzed AAVE’s on-chain data to better understand whether things may change in the fourth quarter. Our analysis shows that the market sentiment surrounding the token has turned bearish, as evidenced by the decline in the weighted sentiment for AAVE.

The increase in selling pressure also proved the decline in positive sentiment.

According to data from Santiment, exchange supply of AAVE has increased dramatically. Meanwhile, supply outside of exchanges has decreased, indicating that investors are actively selling their tokens. Typically, price corrections occur as selling pressure increases.

Source: Santiment

read Aave (AAVE) Price Prediction 2024~2025

However, the good news is that a look at AAVE’s daily chart reveals that it has successfully tested important support near $135. This indicates a possible bullish trend reversal.

If that happens, the bulls could push the token back towards $170. However, if bears dominate going forward, it would not be surprising to see AAVE plummet to $118.

Source: TradingView