- Rendering large transactions surged 527%, indicating increased whale activity.

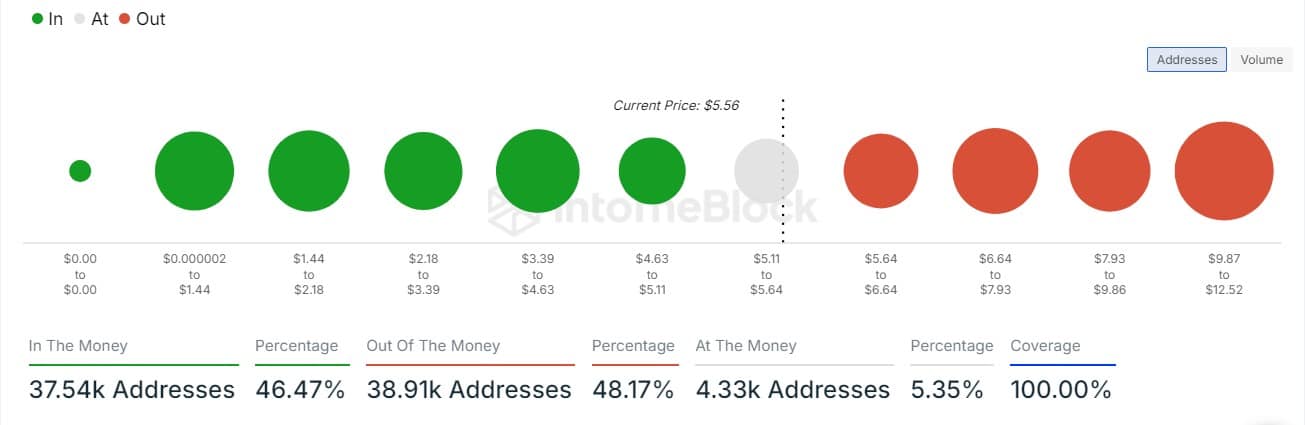

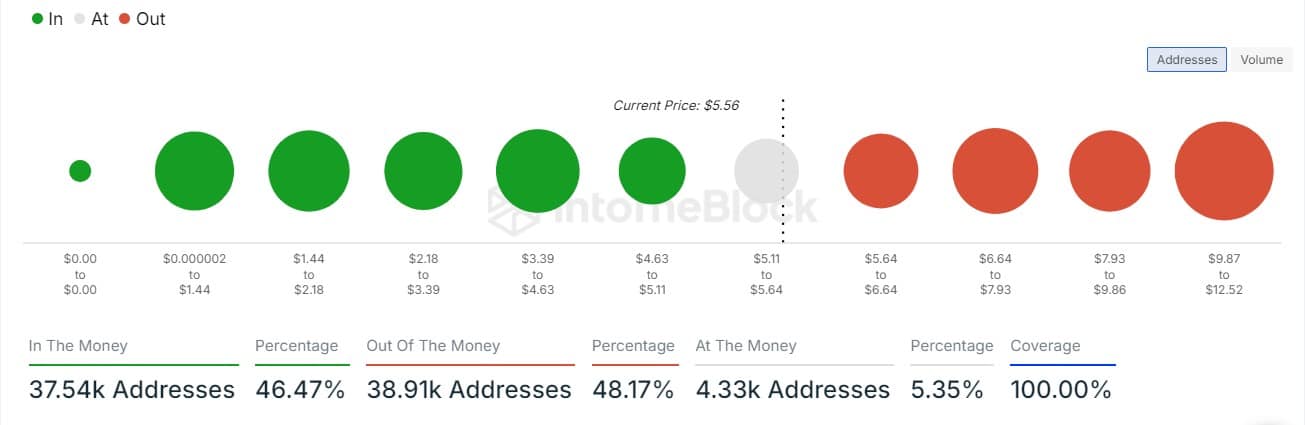

- Despite the bullish momentum, only 46% of RNDR holders are currently making a profit.

RENDER is receiving a lot of attention with a surge in large transactions over the past 24 hours.

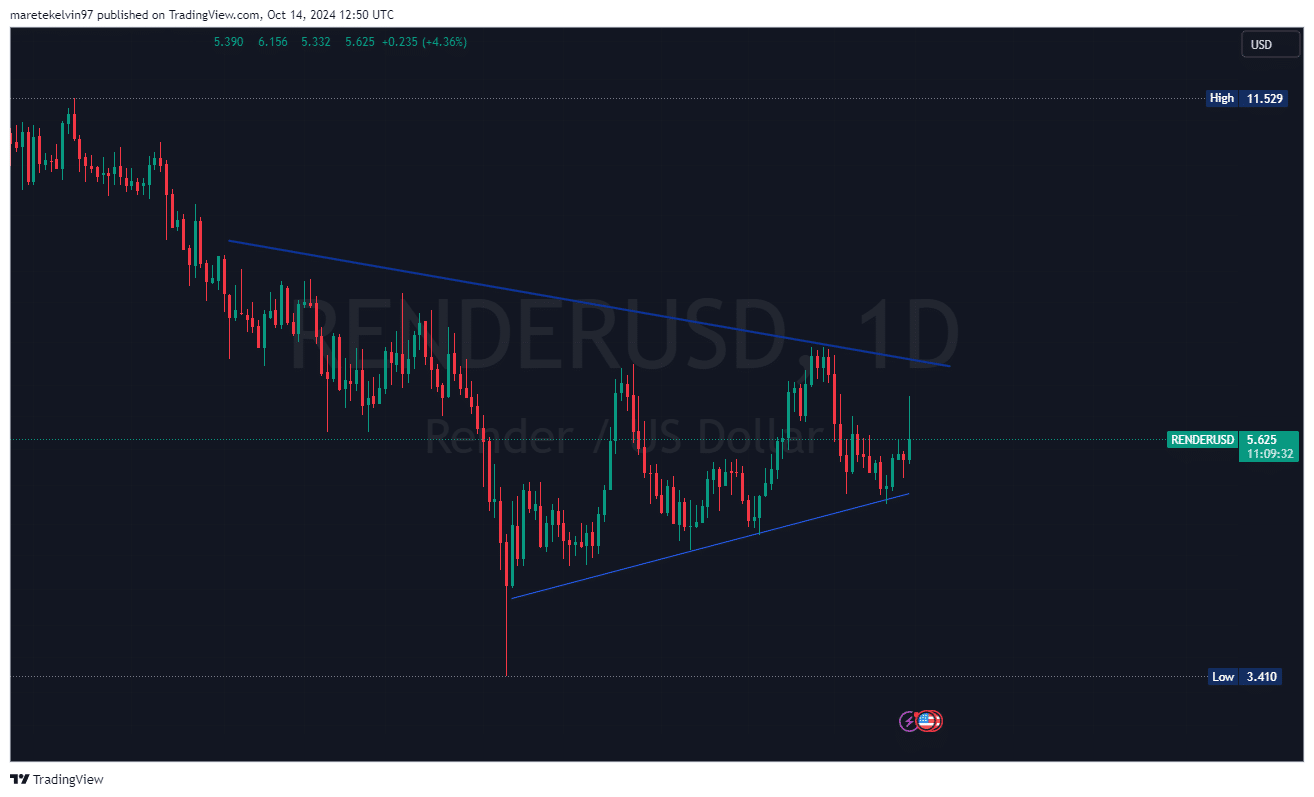

Considering the altcoin’s recent price action and support from several major on-chain indicators, the biggest question is whether the token is ready to break the triangle consolidation and further advance its bullish rally.

Rising prices signal render optimism

Render has been trending steadily upward over the past few days, raising hopes of a breakout beyond the extended consolidation pattern.

Significant on-chain action coupled with upward price action demonstrated very positive market sentiment.

Market participants are eagerly awaiting a potential breakout, but can price action occur?

Source: TradingView

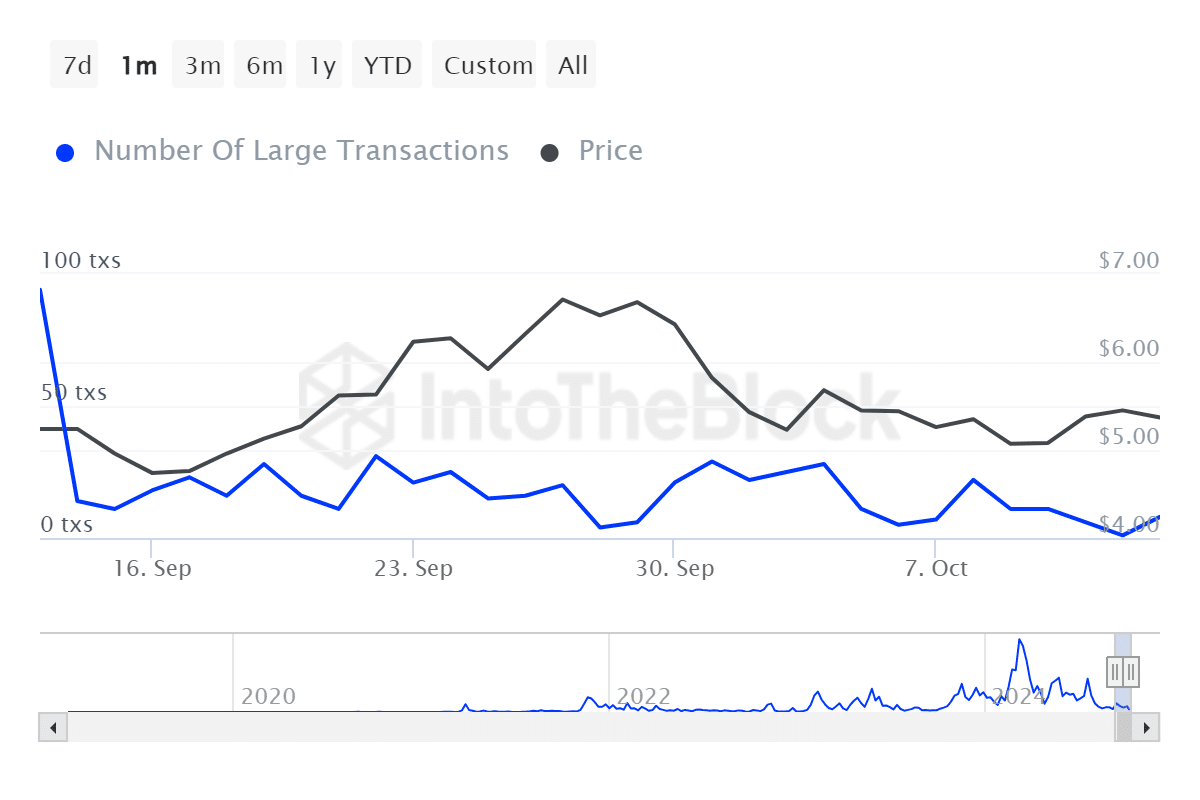

Whale activity surges

According to IntoTheBlock data, large transactions on Render have surged a whopping 527% in the past 24 hours, signaling increased interest from large holders.

This could mean that there is a period of accumulation as institutional investors or high-net-worth individuals make big moves.

In most cases, interest in whales suggests strong price direction, and the recent surge fuels speculation that RNDR is ready for a breakout.

Source: IntoTheBlock

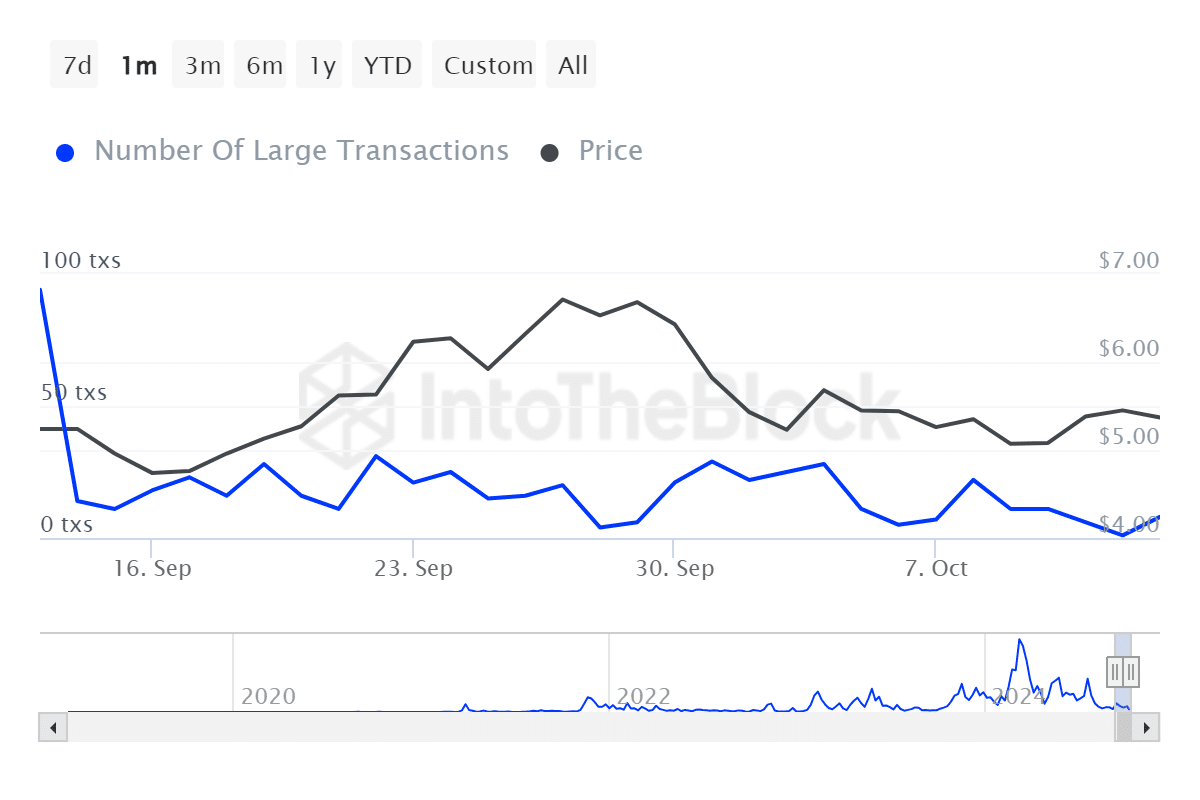

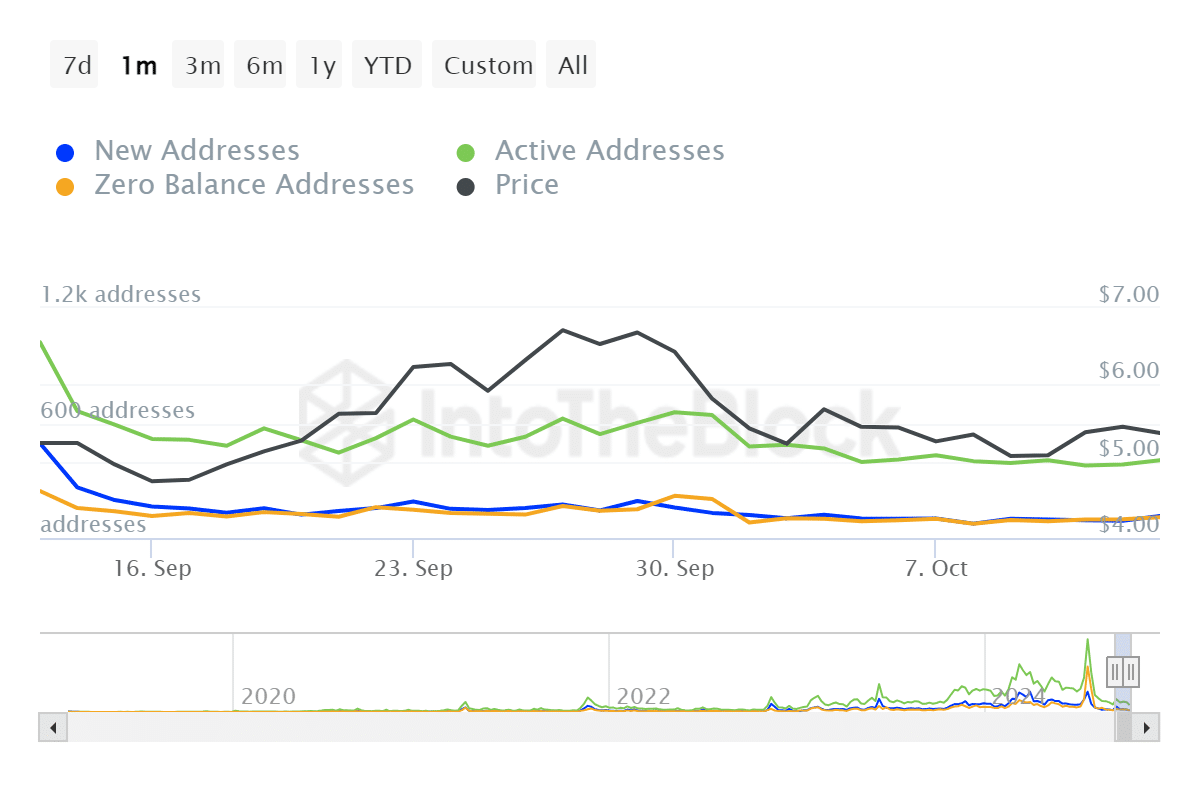

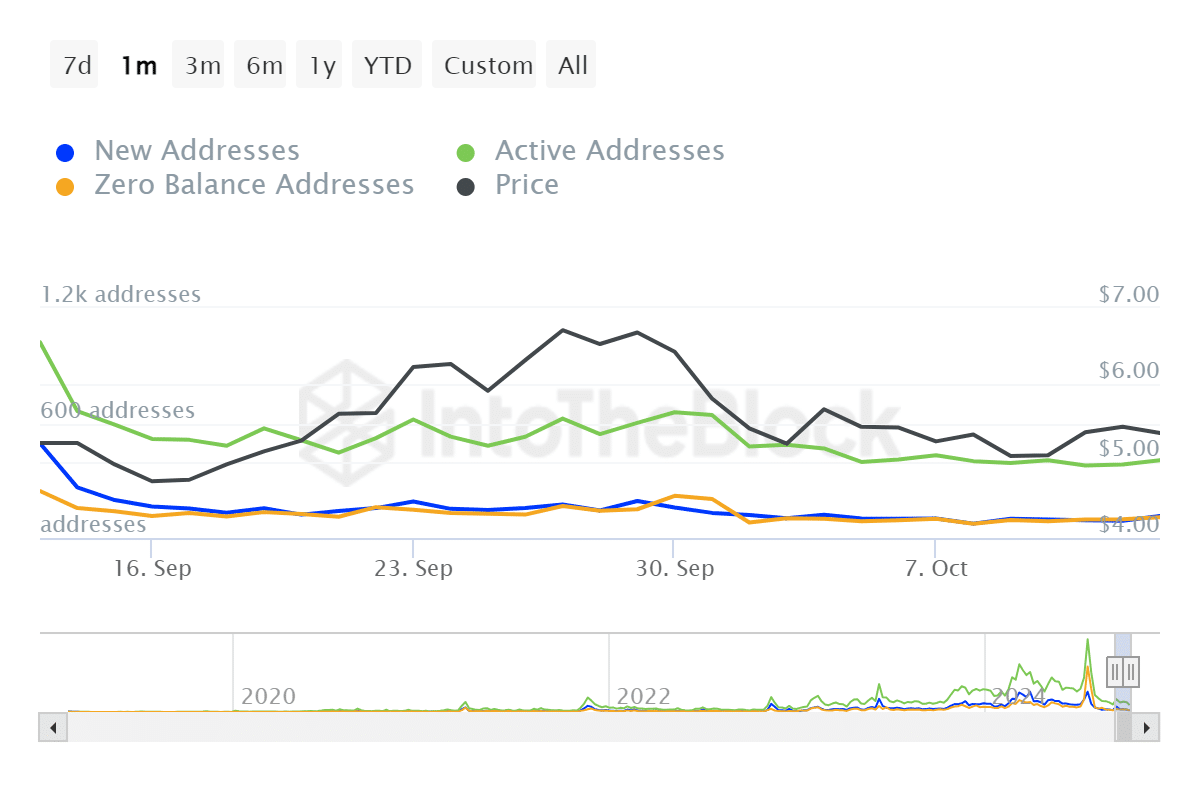

More render traders are joining

During the surge in large transactions, the number of renders from active addresses also increased by 6%, indicating increased retail engagement.

Source: IntoTheBlock

However, only 46% of current render holders are making money at existing prices.

Relatively low profitability ratios may indicate some caution among retail traders as the rally may not yet have reached a level that is sustainable for all investors.

Source: IntoTheBlock

Will RNDR’s bullish surge continue?

The recent surge in whale activity and slight increase in active addresses suggests a bullish bias.

Is your portfolio green? Check out our render profit calculator

But with less than half of the holders making profits, the direction of the market remains uncertain.

If Render maintains its current bullish momentum, it could break out of the triangle consolidation and potentially lead to a sustained upward trend.