This article is also available in Spanish.

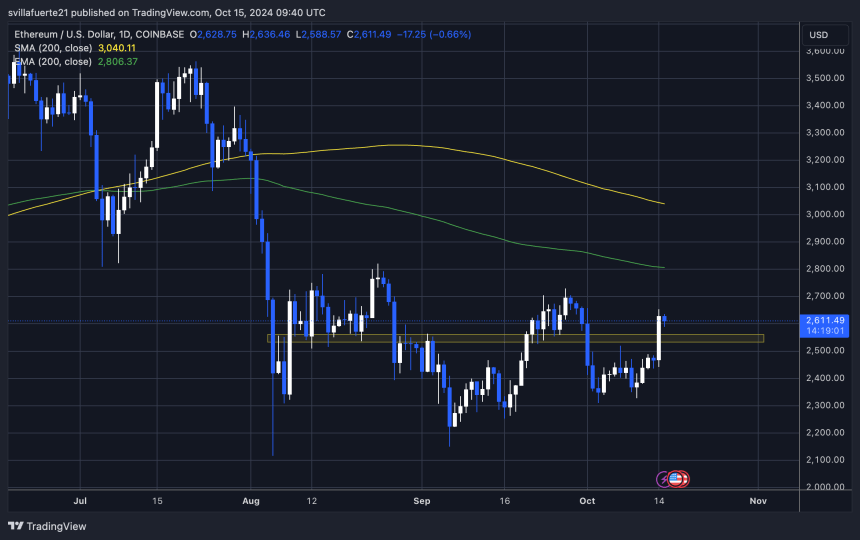

Ethereum (ETH) has surged above $2,500 and is now testing critical supply levels that could trigger a massive rally for both ETH and altcoins.

After several days of anxiety and uncertainty, yesterday’s market surge has reignited optimism across the cryptocurrency industry. Investors and traders are closely watching Ethereum’s price movements. Because a break above this critical area could signal the start of a significant upward trend and potentially set the stage for an Altseason.

Related Reading

Top analysts and investors are waiting for confirmation that ETH is ready for a rebound soon. Renowned analyst and investor Carl Runefelt shared his technical analysis on Ethereum, suggesting that the long-awaited rally may be just around the corner.

According to Runefelt, if ETH breaks out of its current supply zone, it could lead to a significant price surge, sparking bullish momentum for Ethereum and broader altcoins.

The next few days are critical for Ethereum’s price action as the market awaits signals that could define the direction of this potential rally. Investors remain optimistic, hoping that ETH can lead the market into the next major bullish phase.

Ethereum Test Conclusive Supply

Ethereum has been trading within a bullish triangle formation since early August, and the moment of truth for a potential breakout may be near.

ETH has underperformed BTC throughout the year, leading many investors and traders to question ETH’s strength during this cycle. This trend has led to a shift in confidence as Bitcoin continues to dominate, leaving Ethereum behind.

However, during yesterday’s market boom, Ethereum showed renewed strength, outperforming Bitcoin for the first time in a long time, signaling a possible change in market dynamics.

Renowned cryptocurrency analyst Carl Runefelt recently shared his technical analysis on X, highlighting that Ethereum will soon break out of its bullish triangle pattern.

According to Runefelt, Ethereum is approaching a critical moment and a break from this pattern could lead to a massive rally. He suggested that if ETH breaks out, the next supply zone to target would be around $3,400, which would represent a significant upside from current levels.

Related Reading

This optimistic outlook stems from renewed positive sentiment across the market and improved price action for Ethereum. Traders and investors are watching closely over the coming days as a successful breakout could signal the start of a long-awaited bullish trend for Ethereum and re-establish its strength over Bitcoin.

ETH technical levels to watch out for

Ethereum is trading at $2,611 after a notable 7% surge yesterday. This upward momentum allowed the price to break above $2,500, a key resistance level that has been pushing prices lower since early October.

Ethereum is now less than 8% off its 200-day exponential moving average (EMA), currently at $2,806.

ETH needs to reclaim this 200-day EMA and close above the $2,800 level for the bulls to gain control and establish a sustained upward trend. Doing so will continue the bullish momentum and set the stage for a potential rise in price levels.

On the other hand, if Ethereum fails to stay above the $2,500 support level, a deeper correction could be imminent. In this case, the price could return to $2,300, with the market stabilizing due to increased demand.

Related Reading

The next few days are critical for Ethereum as traders and investors are watching closely to see if the price can maintain its recent gains and break through key resistance levels.

Featured image by Dall-E, chart by TradingView