Yorg Healer

October 17, 2024 02:36

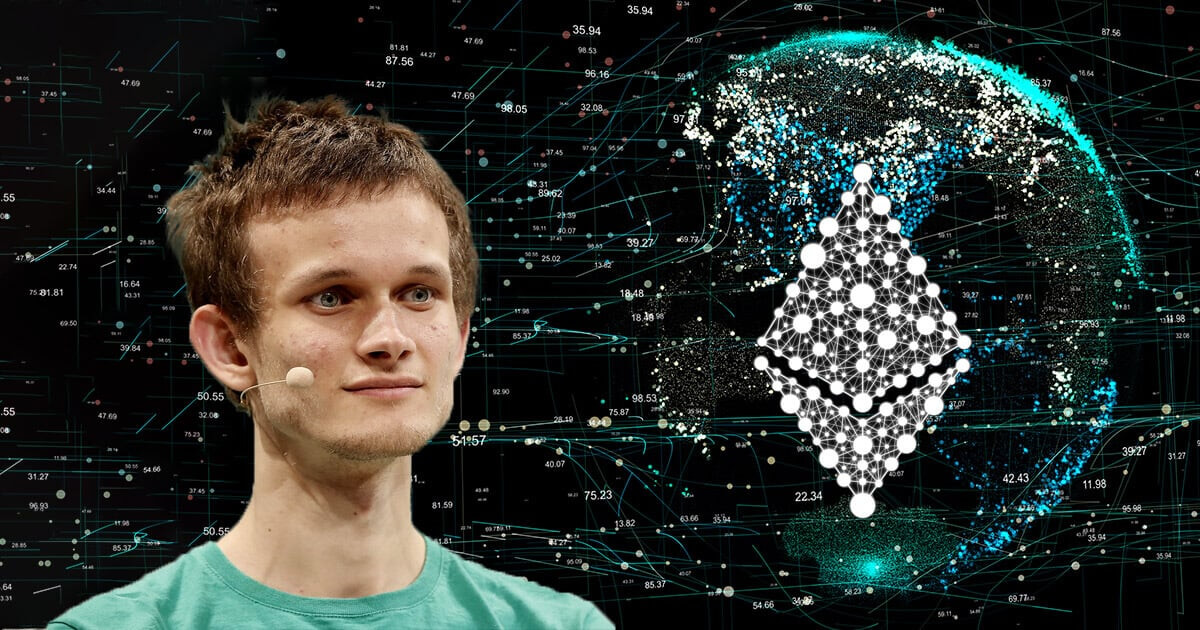

Vitalik Buterin discusses the potential future of Ethereum in ‘The Surge’, focusing on scalability and decentralization through sharding and rollups, and targeting 100,000+ TPS.

Ethereum’s future scalability strategy, known as ‘The Surge’, is gaining attention as the blockchain community anticipates significant improvements in transaction throughput and decentralization. According to Vitalik.eth.limo, this initiative is consistent with Ethereum’s long-term roadmap to address scalability issues by enhancing both layer 1 (L1) and layer 2 (L2) protocols.

Sharding and Rollup: The Basics

Initially, Ethereum’s roadmap included two main scaling strategies: sharding and layer 2 protocols. Sharding reduces the load on individual nodes by allowing only a portion of the entire blockchain data to be stored and verified. This approach is similar to how P2P networks like BitTorrent work. On the other hand, layer 2 solutions such as state channels and rollups aim to process off-chain transactions while leveraging the security of Ethereum.

Rollups have evolved to be more powerful than previous solutions such as state channels and plasma, but they require significant on-chain data bandwidth. Advances in sharding research led to a rollup-centric roadmap, which remains Ethereum’s primary expansion strategy today.

Surge: Primary Objective

Surge achieves several goals, including processing over 100,000 transactions per second (TPS) on both L1 and L2, maintaining the decentralization of L1, and ensuring that L2 fully inherits Ethereum’s core properties of trustlessness and censorship resistance. We aim to do so. Additionally, maximum interoperability between L2s is important to avoid fragmentation of the ecosystem into isolated blockchains.

Solving the scalability trilemma

Introduced in 2017, the scalability trilemma highlights the tension between decentralization, scalability, and security. Ethereum’s approach includes using data availability sampling and SNARKs to ensure data availability and computation accuracy without downloading large amounts of data. This combination promises to solve the trilemma by maintaining security and decentralization while scaling.

Progress in data availability sampling

The Ethereum Dencun upgrade allows the blockchain to handle approximately 375 kB of data availability bandwidth per slot, which equates to approximately 173.6 TPS for rollups. Future enhancements such as PeerDAS aim to significantly increase this capacity, targeting up to 58,000 TPS through improved data compression.

Data Compression and Generalized Plasma

Data compression techniques are being researched to reduce the on-chain data footprint of rollup transactions and further increase scalability. Plasma architectures that offload data to users in an incentive-compatible manner are also being revisited, and their viability is improving, especially with the mainstreaming of SNARKs.

Improved interoperability between L2s

Improving interoperability between L2s is essential to create a seamless user experience across the Ethereum ecosystem. Initiatives such as chain-specific address and payment requests, cross-chain swaps, and gas payments are being developed to facilitate these goals.

the way forward

As Ethereum continues to evolve, the community faces the challenge of balancing L1 and L2 scaling strategies. The ultimate vision is to determine which features belong to L1 and L2, allowing Ethereum to accommodate high transaction volumes while remaining strong and decentralized.

Image source: Shutterstock