Bitcoin has been rising steadily since crossing $60,000 and is currently approaching the $70,000 level, a price it has not reached for several months. As market sentiment heats up, investors are wondering whether Bitcoin has the power to hit new all-time highs or whether it will struggle to break through key resistance levels.

healthy emotions

The Fear Greed Index is a useful tool for understanding market sentiment and how traders view Bitcoin’s trajectory. Currently, the index is at a “greed” level of around 70. While this has historically been seen as a positive sign, it is still quite far from the extreme greed levels that could indicate potential market highs. This index measures market sentiment, with low levels indicating fear and high levels indicating greed. Typically, when the index crosses the 90+ range, the market is overly bullish and raises concerns about overextension.

It is important to note that last year, when the Fear and Greed Index reached similar levels, Bitcoin was trading at around $34,000. From there it more than doubled to $73,000 over the next month.

main support

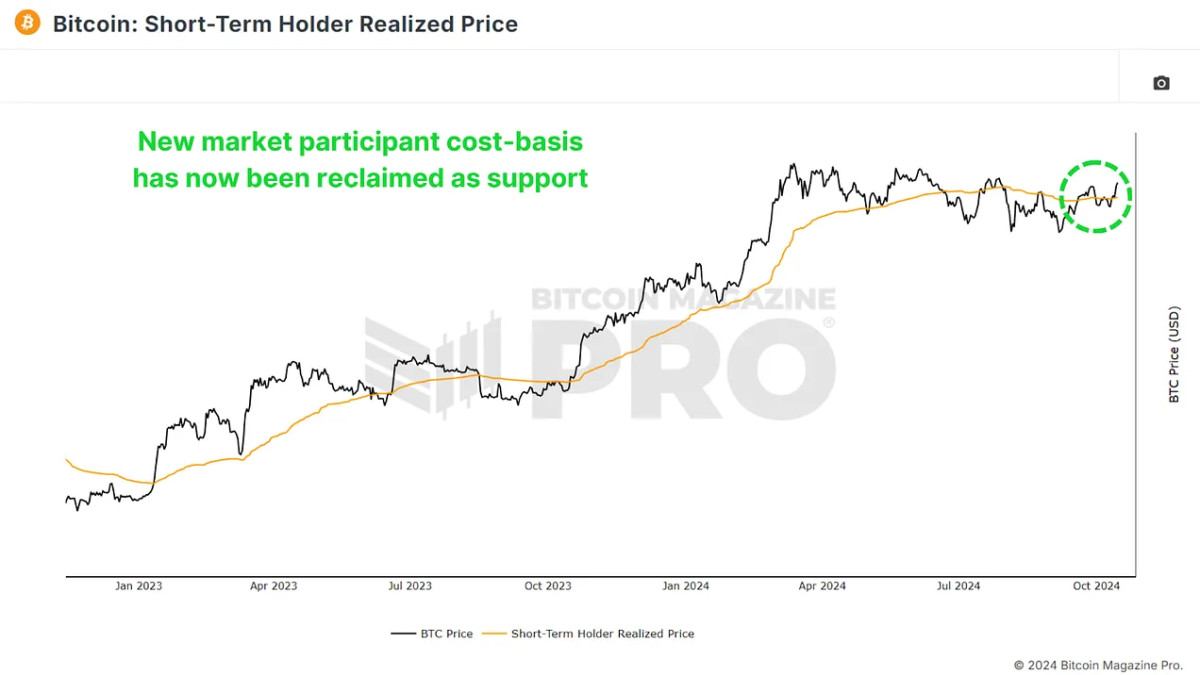

The short-term holder realized price measures the average price paid by new Bitcoin investors for Bitcoin. It is very important because it often acts as a strong support line in a bull market and a resistance line in a bear market. Currently, this price is around $62,000 and Bitcoin is holding above that. This is a promising sign as it shows that new market players are taking profits and Bitcoin is holding above a critical support zone. Maintaining this support is key to a sustained rally, as historically a break below this level has led to market weakness.

We have seen this dynamic in past cycles, especially the 2016-2017 bull market, where Bitcoin reverted to this level several times before continuing its rise. If this trend continues, Bitcoin’s recent breakout could provide a foundation for further gains.

market stabilization

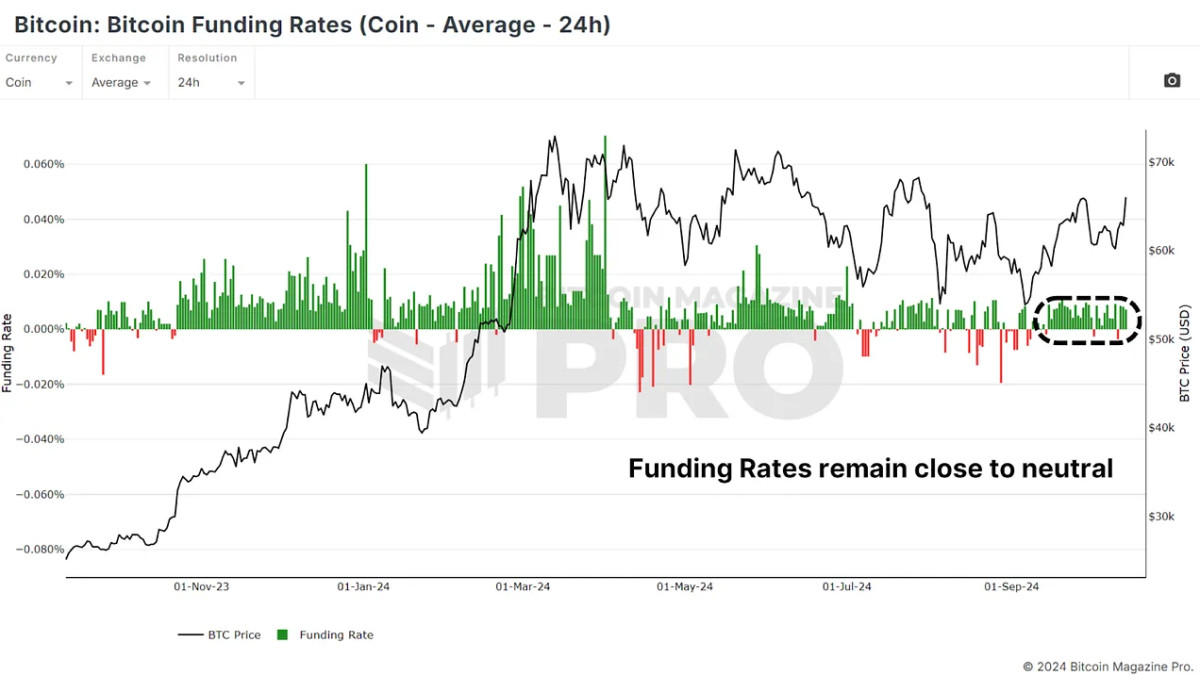

One area that traders often look at is Funding Rates. This represents the cost of holding a long or short position in Bitcoin futures. Over the past few months, funding rates have been volatile, swinging between overly optimistic buy positions and overly bearish sell positions. Fortunately, the market has now stabilized and funding rates remain at neutral levels. This is a healthy sign that suggests traders are not overleveraged in either direction.

In the neutral zone, there is less risk of liquidation cascades, which often occur when overleveraged positions are wiped out, resulting in sharp market declines. As long as funding rates remain stable, Bitcoin may have the breathing room it needs to continue rising without much volatility.

The tough road to $70,000 and above

Market sentiment and technicals suggest that Bitcoin is in a healthy position, but there is still a significant level of resistance. First, the current resistance trend line is the trend line that Bitcoin is struggling to break. This downtrend line has been tested several times, but each time Bitcoin has reached it and then retraced.

Apart from this, Bitcoin faces several additional barriers such as $70,000. This level has acted as resistance in the past and represents a psychological level that traders will be watching closely. And above that, it hit an all-time high between $73,000 and $74,000. Breaking this could be a major bullish signal, but it may take several attempts for Bitcoin to clear this level.

One positive technical factor is the recent recovery of the 200-day moving average. This is a key level that investors should pay attention to, as it has acted as resistance for BTC over the past few months.

Macro: Institutional and ETF inflows

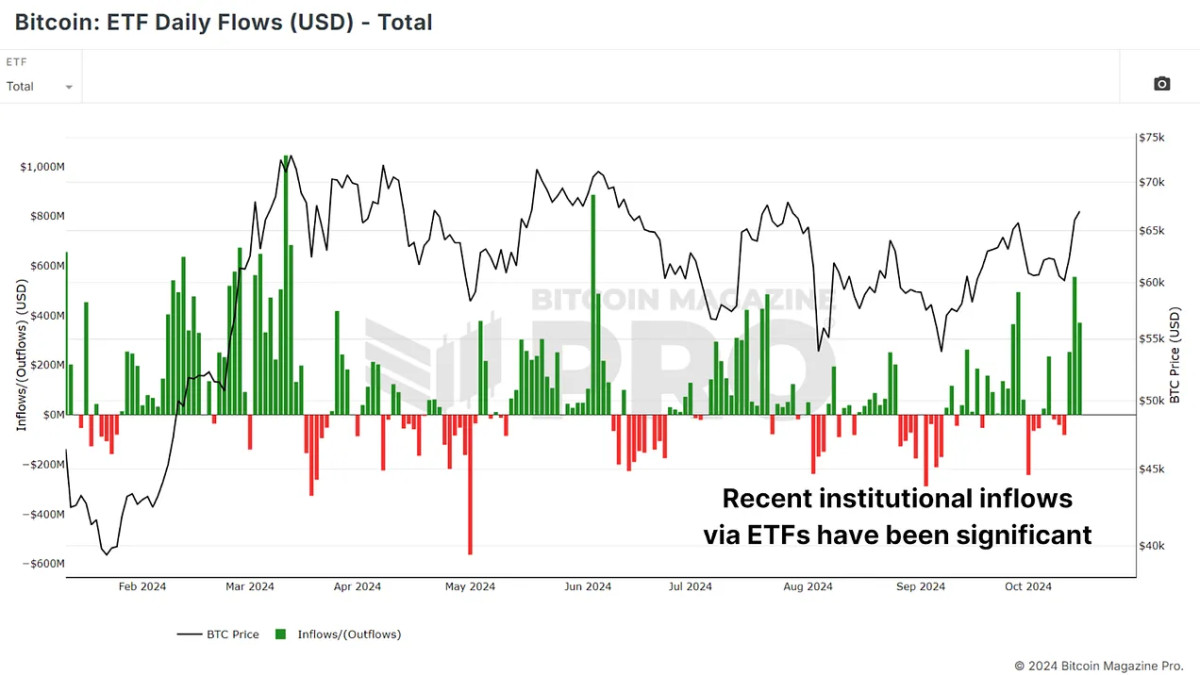

Beyond technical indicators, the macro environment is becoming increasingly favorable for Bitcoin. Institutional money continues to flow into Bitcoin exchange-traded funds (ETFs). Over the past few days, more than $1 billion has flowed into Bitcoin ETFs, reflecting growing confidence in the asset. Over the past few weeks, we have seen hundreds of millions of dollars in ETF inflows, indicating that the smart money, especially institutional investors, are optimistic about the future of Bitcoin.

This is important because institutional funds tend to take a long-term view, providing a more stable base of support than retail speculation. Moreover, with stocks and even gold rallying in recent months, Bitcoin appears to be lagging a bit. This could set the stage for Bitcoin to catch up, especially if investors switch from traditional assets to the riskier realm of Bitcoin.

conclusion

Bitcoin’s price action, funding rates, and sentiment all suggest that the market is in a healthier state than it was a few months ago. As institutions begin to pour funds into ETFs and macro conditions improve, more optimistic tailwinds are blowing. However, significant resistance lies ahead, and any rally is likely to be challenged before Bitcoin truly breaks out to new highs.

To learn more about this topic, check out our recent YouTube video here.

Can Bitcoin now create a new ATH?