- POL is consolidating within a bearish channel as bullish sentiment builds despite recent price stagnation.

- On-chain indicators such as active addresses and stable futures funding ratio support the possibility of a breakout.

POL (formerly MATIC) Both crowd and smart money indicators are experiencing notable shifts in market sentiment that signal growing optimism.

Herd sentiment is at 0.95 and smart money is at an impressive 3.00. This bullish sentiment, combined with increasing network activity, could lead to significant moves.

However, POL’s price action has not yet broken out of the consolidation phase. At press time, Polygon is trading at $0.3636, down 2.49%, leaving investors questioning whether this positive sentiment will lead to a sustained rally.

POL Technical Analysis: Is a Breakout Imminent?

Polygon’s price action continues to move within a downward channel and is struggling to break out of a consolidation phase between $0.4477 and $0.5761. Moreover, recent candlestick patterns indicate that POL is approaching a critical point.

So the next move could determine whether it bounces back or continues to consolidate. A break above the $0.4477 level is crucial for upward momentum.

Source: TradingView

The Stochastic RSI, currently at 32.65, suggests that POL is near oversold territory, suggesting potential buying pressure in the near future.

MACD also shows a neutral signal with minimal difference between MACD and the signal line, further indicating that POL may consolidate before making a decisive move.

Source: TradingView

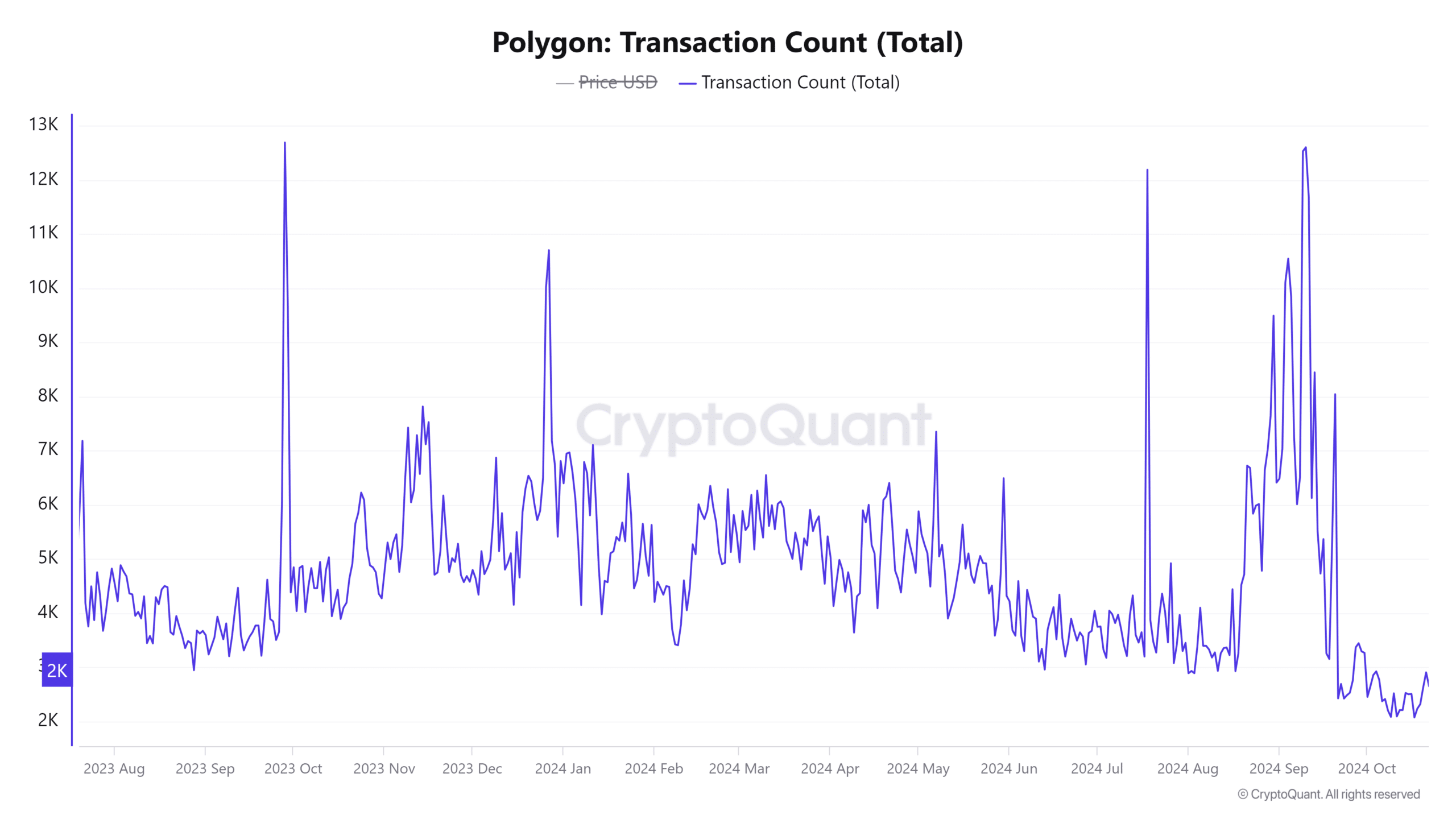

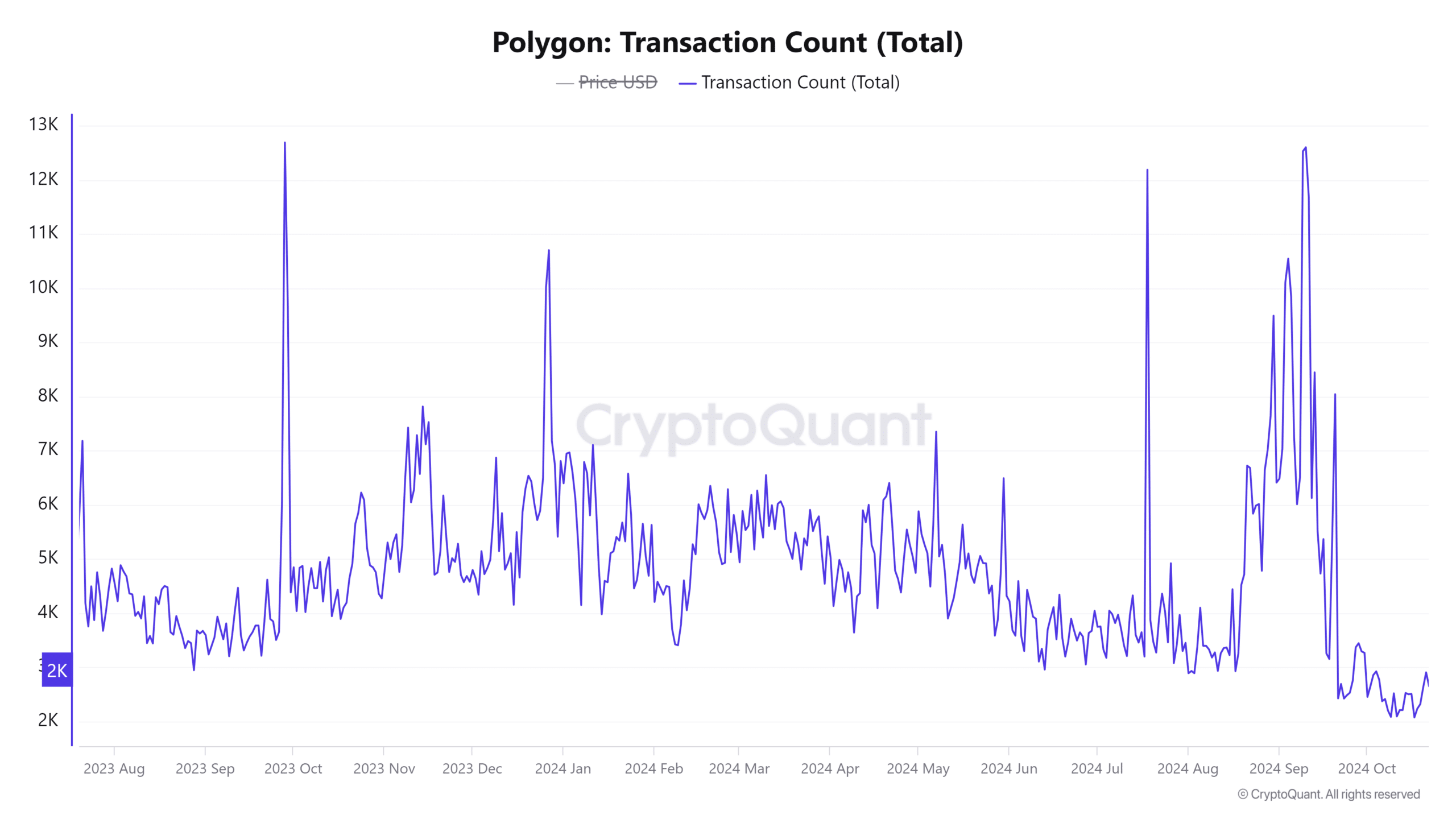

On-chain metrics: increase in active addresses and transactions

Interestingly, Polygon’s underlying on-chain data continues to attract interest. According to CryproQuant, in the last 24 hours, active addresses increased by 0.96% and number of transactions increased by 0.86% to 2.49K.

This gradual increase in network activity could indicate new user interest, supporting the current optimistic outlook.

However, absent a stronger upward price movement, this uptick may not be enough to maintain bullish momentum over the long term.

Source: CryptoQuant

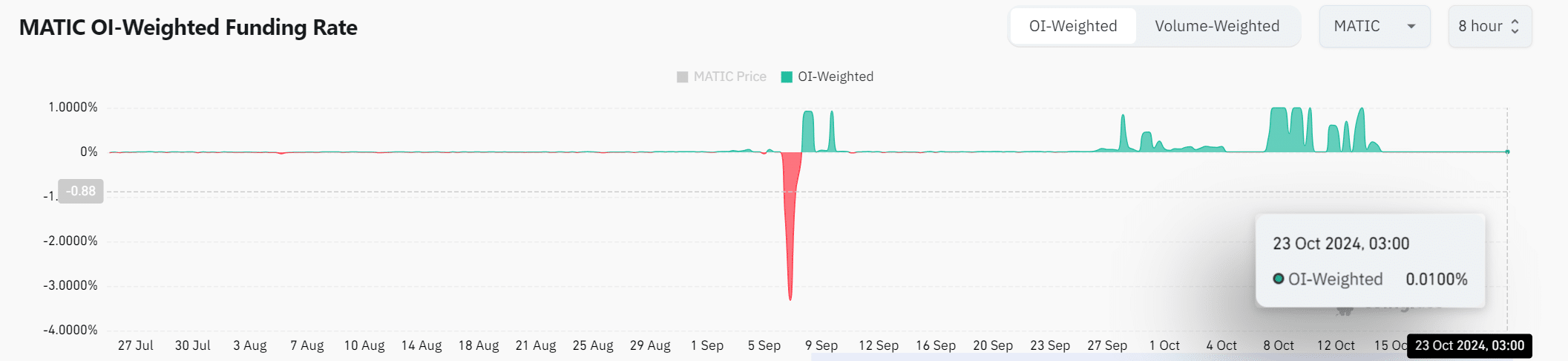

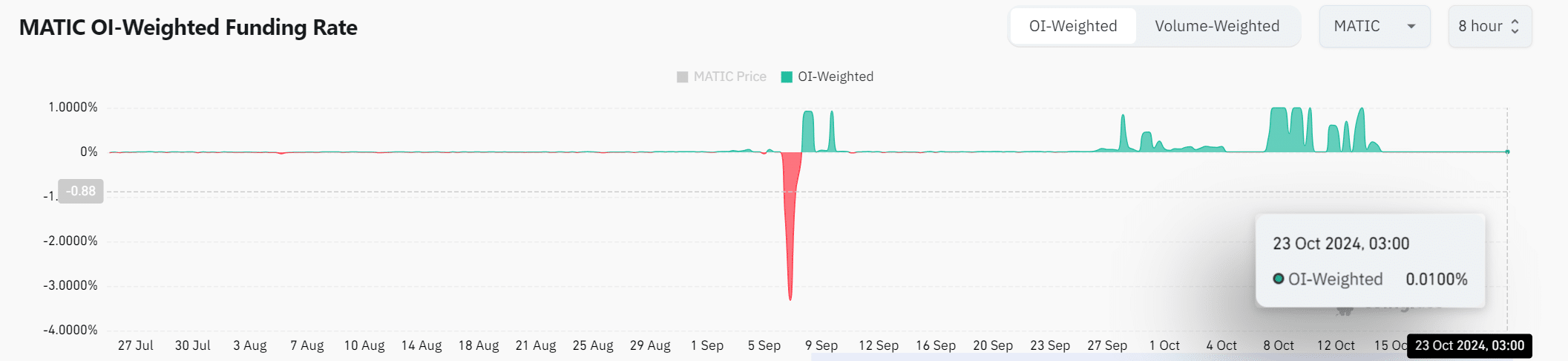

POL OI Weighted Funding Rate: Neutral but likely

Looking at the futures market, the POL OI weighted funding ratio is steadily maintained at 0.0100%. As a result, this neutral rate suggests that neither bulls nor bears are currently exerting significant pressure.

However, changes in this funding rate can signal a change in momentum, especially if they coincide with increasingly bullish smart money sentiment.

Source: Coinglass

Is your portfolio green? Check out our POL Profit Calculator

Polygon’s bullish sentiment is clear, especially from a smart money perspective. However, the question is whether the price can break the resistance level of $0.4477.

If POL can break out, we see significant upside potential. But until then, caution is needed as prices are locked in the consolidation phase.