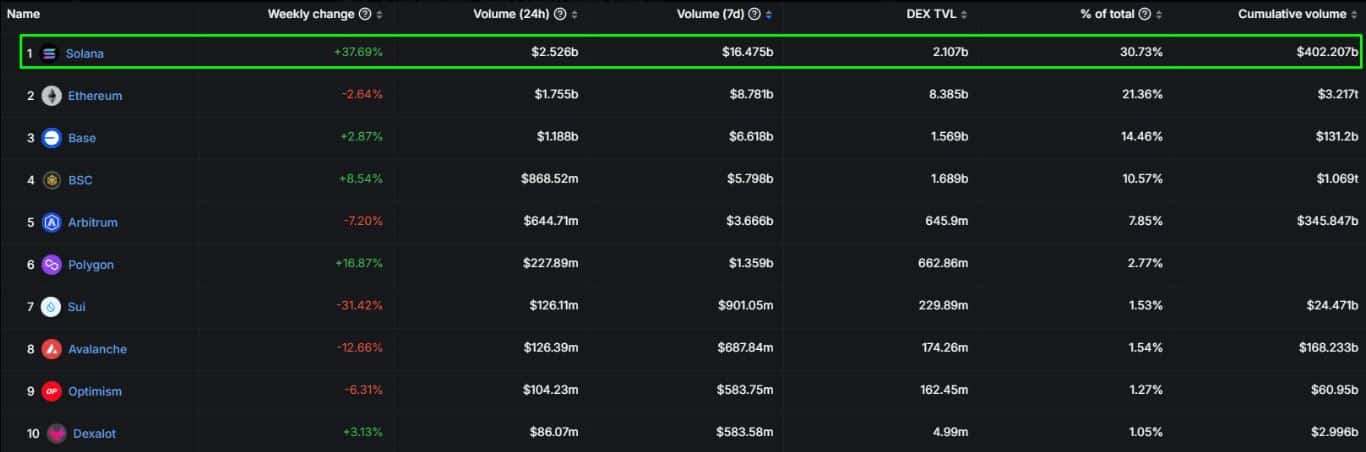

- Base ranks third on the list of most traded blockchains, behind Solana and Ethereum.

- Driven by strong address growth, daily transactions hit a record high of $6.52 million.

Basechain has been one of the fastest growing networks in 2024 and has clearly set its sights on the top spot. But how close are we to achieving that goal?

Recent research shows that it is already on par with the best blockchains that face fierce competition.

According to the latest GeckoTerminal rankings, Base had the third highest weekly volume. Solana (SOL) took first place, and Ethereum (ETH) took second place.

Base achieved weekly volume of $6.61 billion, with the top two coming in at $16.47 billion and $8.78 billion respectively.

Source: GeckoTerminal

According to the rankings, Base has been one of the most preferred blockchains during the recent surge in DeFi activity. DEX TVL is $1.56 billion, meaning the DeFi ecosystem is enjoying a flurry of activity.

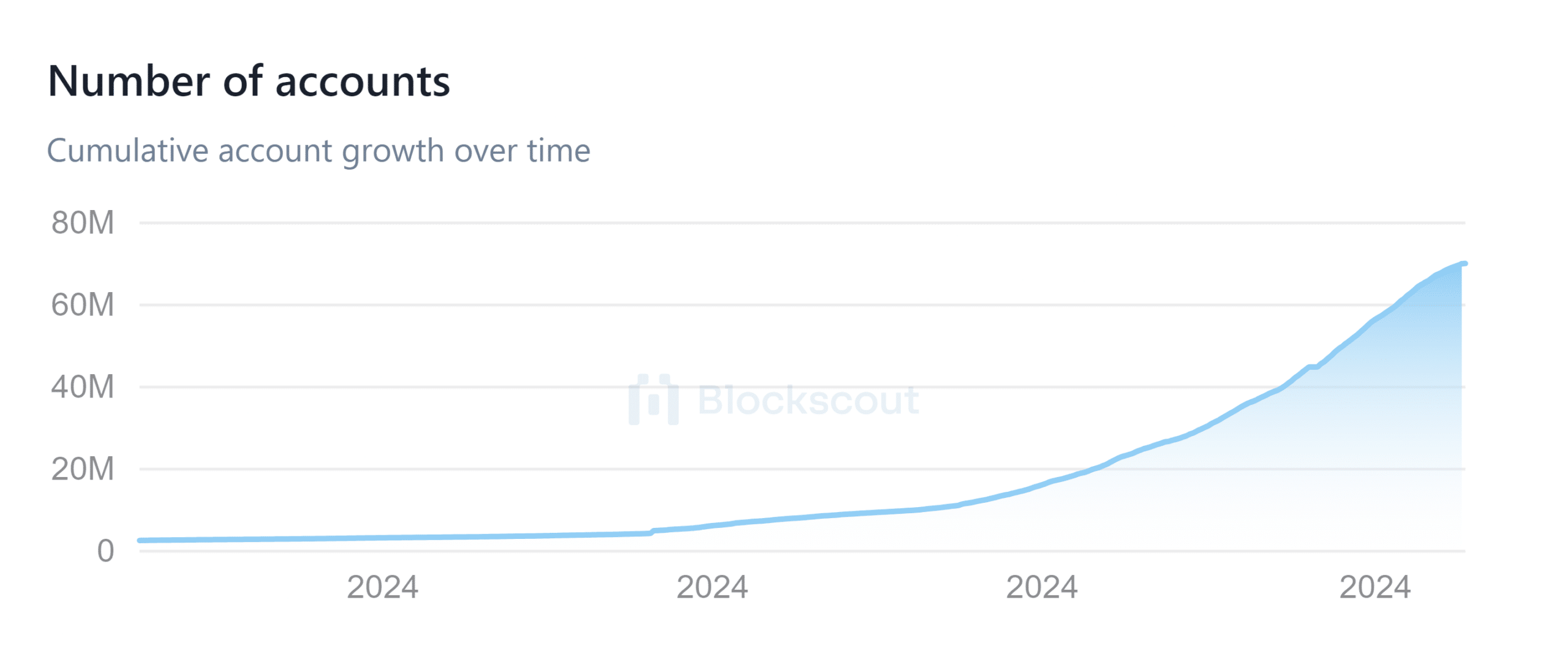

AMBCrypto looked at the number of active addresses to establish the level of activity in the network. The number of addresses or accounts on Base has grown exponentially over the past 12 months.

For perspective, at the beginning of January this year, the network had fewer than 2 million accounts. This figure has since grown to over 69.7 million addresses as of October 25.

source; Block Scout

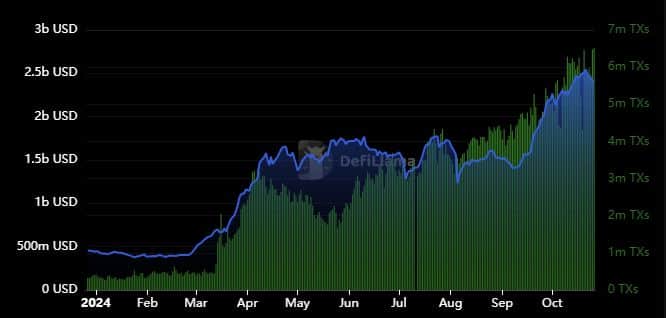

This impressive level of growth was bound to result in a surge in on-chain activity. Nothing demonstrates this better than the level of network transactions.

Primary daily trading volume reached an all-time high.

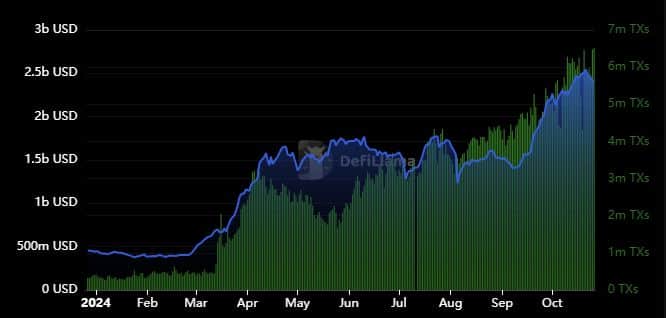

According to DeFiLlama, primary daily transactions have reached an all-time high of 6.52 million in the last 24 hours as of this writing.

This is the same network with less than 500,000 average daily transactions in Q1 2024.

Source: DeFiLlama

TVL, which hit a historic high of $2.54 billion earlier this week, has retreated to $2.41 billion at the time of writing. This small retracement is likely related to the recent slowdown in bullish activity.

The same observation explains the latest basic fee statistics. The network collected about $141,000 in fees on Oct. 25. Last week’s performance showed average daily fees were less than $150,000.

Base fees previously hit a daily high of over $3.78 million per day in March. The main reason for this difference is that the price of ETH was much higher in March and therefore gas fees were also higher.

The price and gas fees of ETH have been decreasing over the past few months.