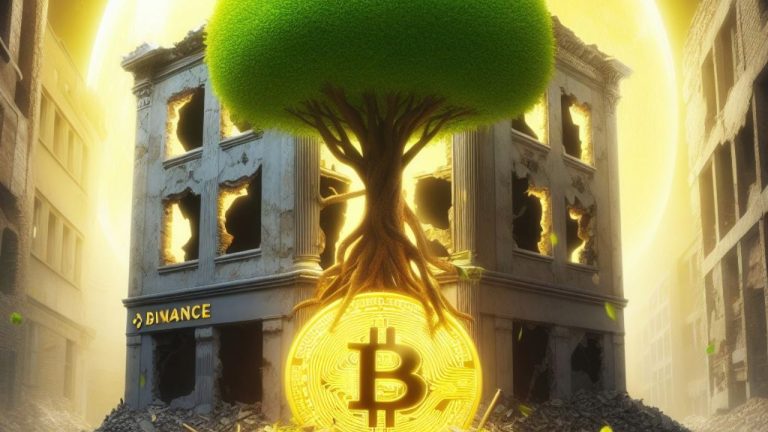

The recent settlement between Binance, its former CEO Changpeng Zhao, and the U.S. Department of Justice (DOJ) has shocked the entire cryptocurrency industry due to its money laundering and terrorism-related financial implications, but many analysts and executives believe it is: Ultimately, this is a good outcome considering it allows the cryptocurrency space to grow without the uncertainty associated with one of the largest players.

Analysts claim Binance’s agreement is a sign of industry growth

Groundbreaking dispute over money laundering and terrorist financing charges between Binance, one of the world’s largest cryptocurrency exchanges, and its former CEO, Changpeng “CZ” Zhao, and the U.S. Department of Justice (DOJ) Agreement could usher in a new era. Cryptocurrency industry according to analysts and cryptocurrency executives.

Coinbase CEO Brian Armstrong said the move could open a new path for the industry and emphasized that it must be built with a focus on compliance. armstrong decided:

Today’s news highlights that taking the hard way was the right decision. Now we have the opportunity to start a new chapter in this industry. We have a lot of arrows in the balance here in the United States due to lack of regulatory clarity, and we hope that today’s news will be the catalyst to finally get that done.

Coinbase is also facing legal action from the U.S. Securities and Exchange Commission (SEC), which claims the exchange has been operating as an unregistered securities broker while evading U.S. regulations for years.

more reactions

JPMorgan analysts, led by Managing Director Nikolaos Panigirtzoglou, believe the agreement is important for the cryptocurrency landscape and removes future uncertainty regarding the largest cryptocurrency actors. In a statement provided to The Block, JPMorgan analysts declared:

We believe the payment outlook is positive as uncertainty about Binance itself will subside and Binance’s trading and BNB smart chain business will benefit.

The $4.3 billion deal also helps eliminate potential “systemic risk” from a hypothetical collapse of Binance, according to JPMorgan.

Other analysts believe there is an opportunity for the cryptocurrency market to finally approve a spot Bitcoin ETF, with Binance coming under DOJ scrutiny and having to withdraw completely from the United States. Michael Rinko, research analyst at Delphi Digital, told CNBC:

How can we approve ETFs if we are actively investigating the companies and CEOs who advertise the prices of these assets to everyone? If this agreement is reached, it could be the final big step needed for this ETF.

What do you think about the state of the cryptocurrency industry after Binance’s plea deal? Let us know in the comments section below.

Source: Bitcoin.com