- Chainlink appears to be closing in on the important $13.01 resistance within a symmetrical triangle.

- Rising technical indicators and open interest indicate a possible breakout if resistance is breached.

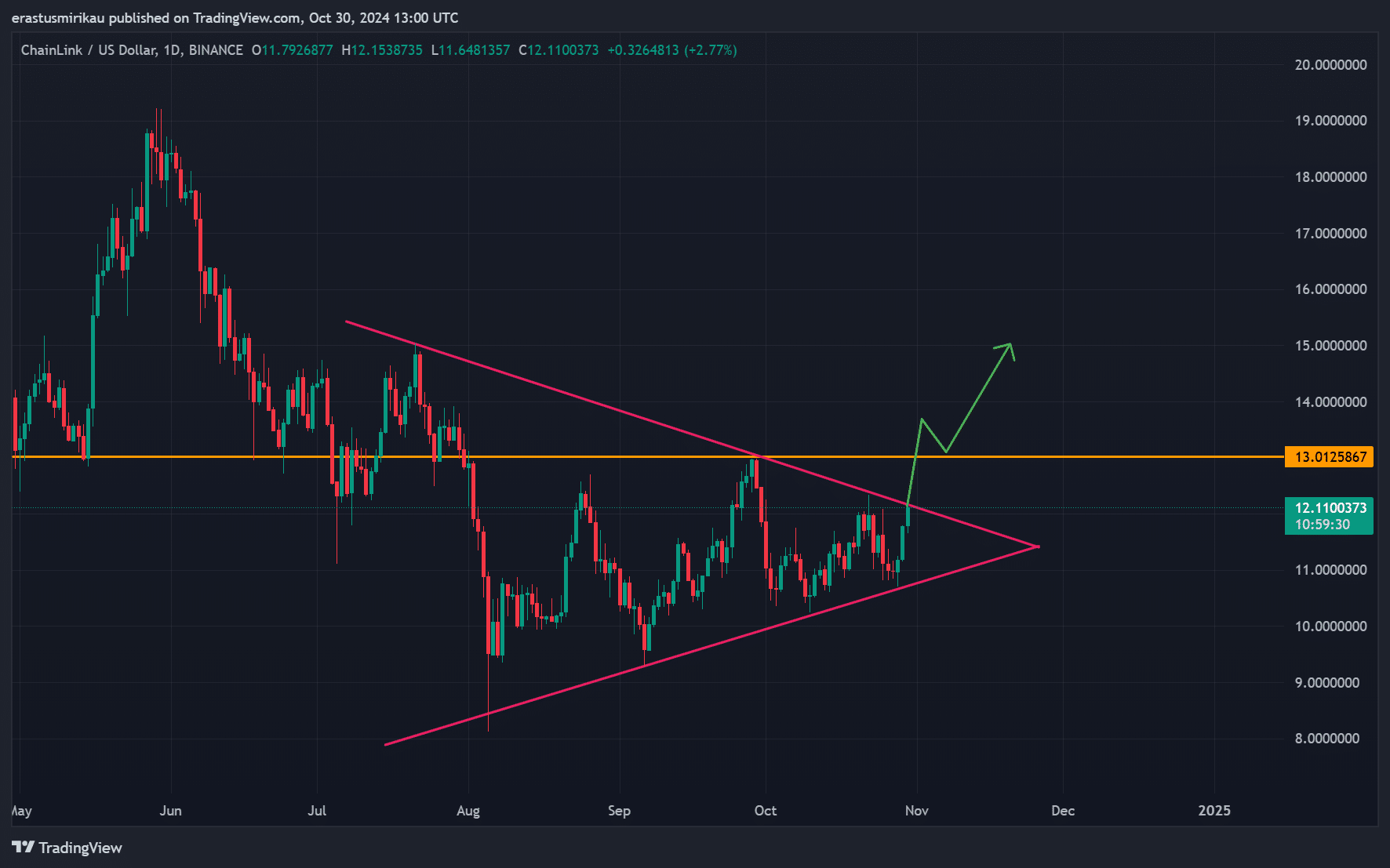

Chainlink (LINK) It caught the attention of the cryptocurrency community after it started consolidating within a large symmetrical triangle pattern on the daily charts. This formation, often a sign of upcoming volatility, brings LINK closer to triangle resistance around $13.01. Violation of this critical level could unlock bullish momentum, fueling LINK’s next rally.

At press time, LINK was trading at $12.00 following a daily gain of 4.55%. Therefore, a decisive breakout here could validate the bullish outlook and create an interesting setup for traders waiting to see if LINK can break free and trigger a sustained upward trend.

Source: TradingView

Is the symmetrical triangle pointing to a bullish move?

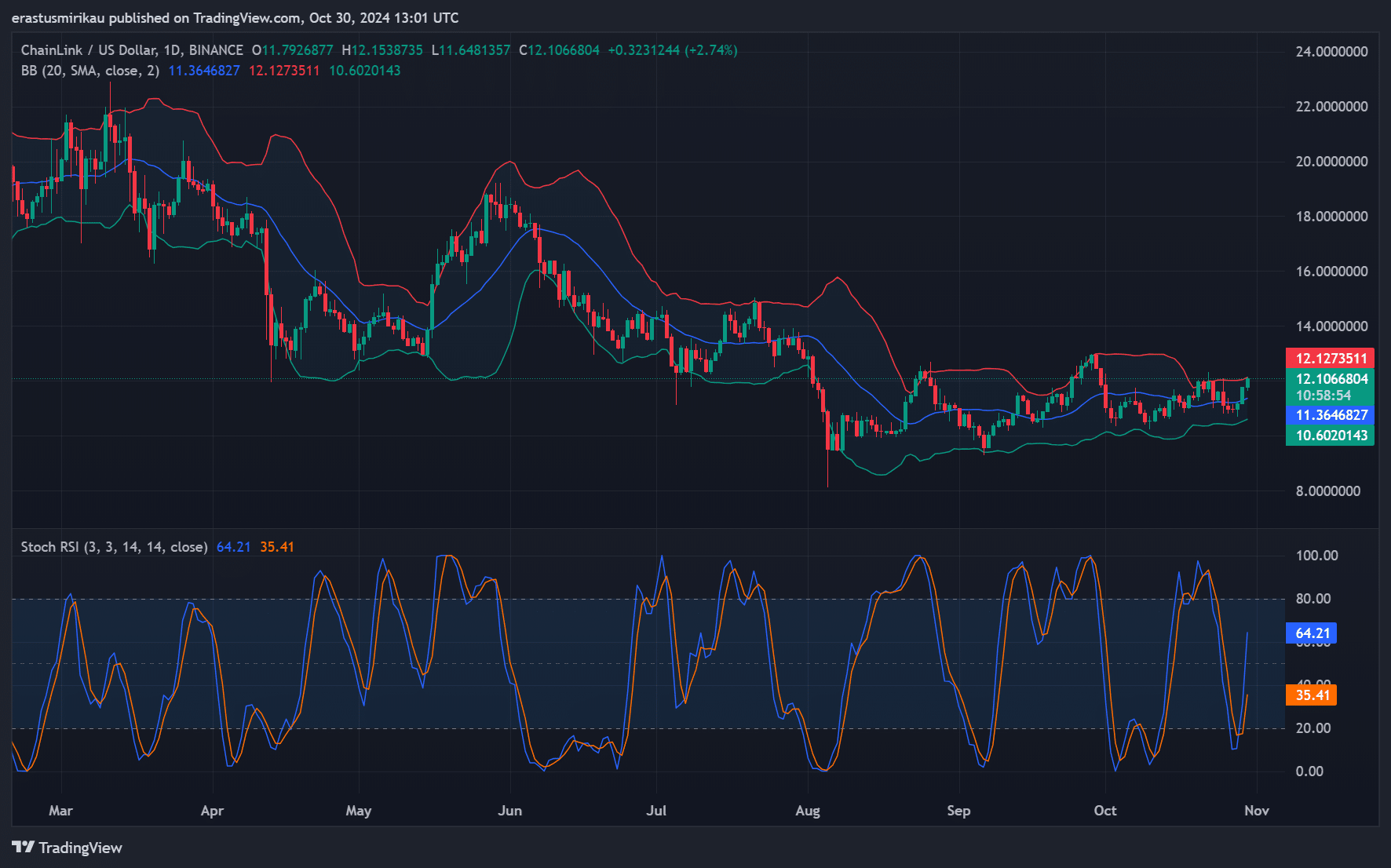

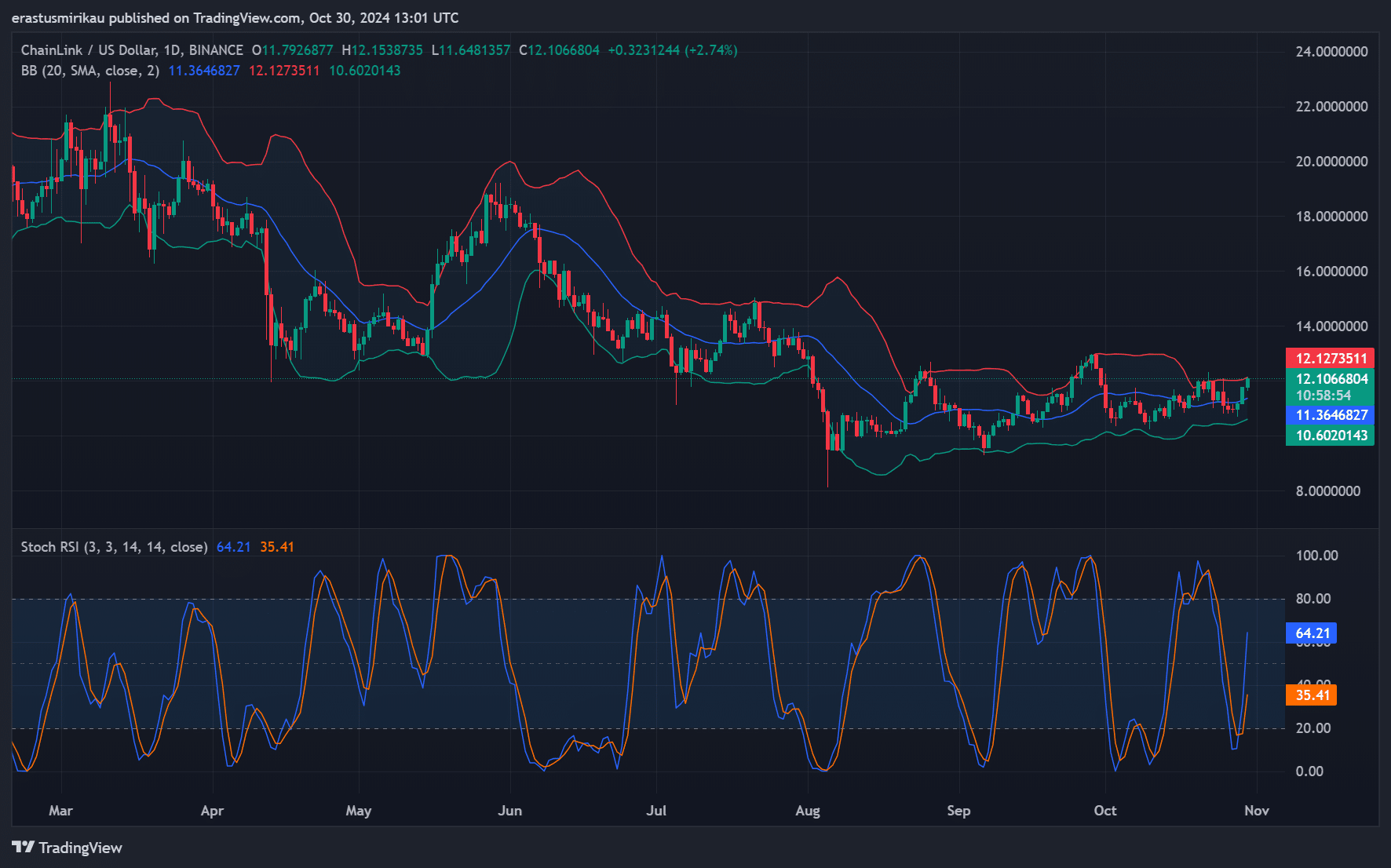

However, the possibility of this breakout is not based solely on chart patterns, as several technical indicators have strengthened the bullish potential. The Bollinger Bands (BB) on the daily time frame are narrowing, indicating that volatility may be imminent. As LINK’s price rises towards the upper band of $12.12, a significant break above this level could confirm a shift to bullish momentum.

Additionally, the Stochastic RSI, which hit 64.21, remained below overbought territory, highlighting increasing buying pressure.

As a result, this means that LINK has room to continue rising before it reaches serious resistance on the charts.

Source: TradingView

What does the LINK on-chain signal say?

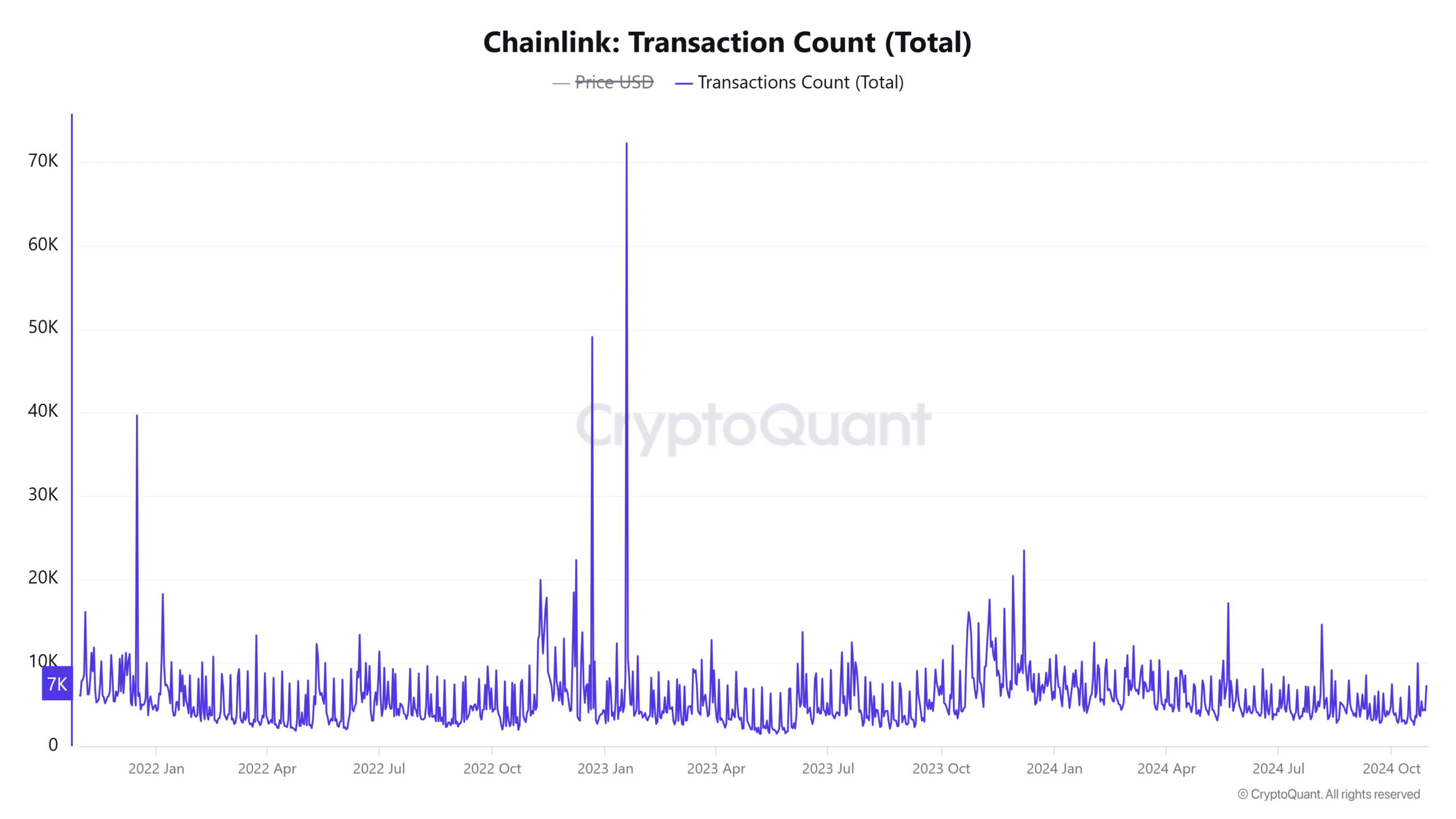

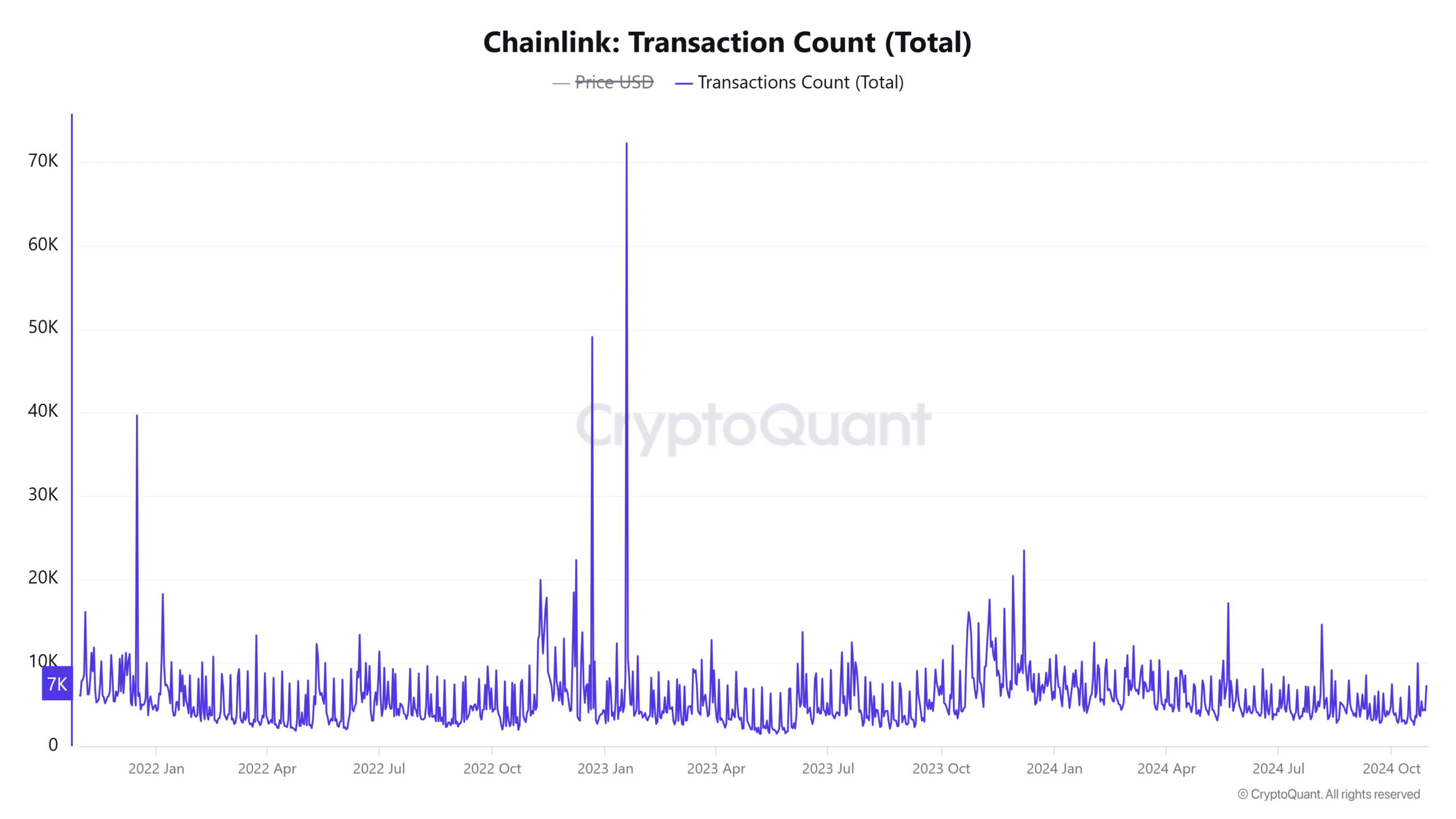

Additionally, on-chain indicators provided supporting data showing a steady increase in network activity consistent with potential upward momentum. Active addresses increased by 1.03% in the last 24 hours. This increase in user engagement is often tied to price strength. This is because increased activity often reflects growing interest in LINK.

Additionally, the number of transactions increased by 0.63%, indicating consistent network usage. This is a sign that interest in LINK remains robust. These indicators highlighted a healthy network backdrop as LINK approached breakout levels.

Source: CryptoQuant

Will a surge in open interest spur a breakout?

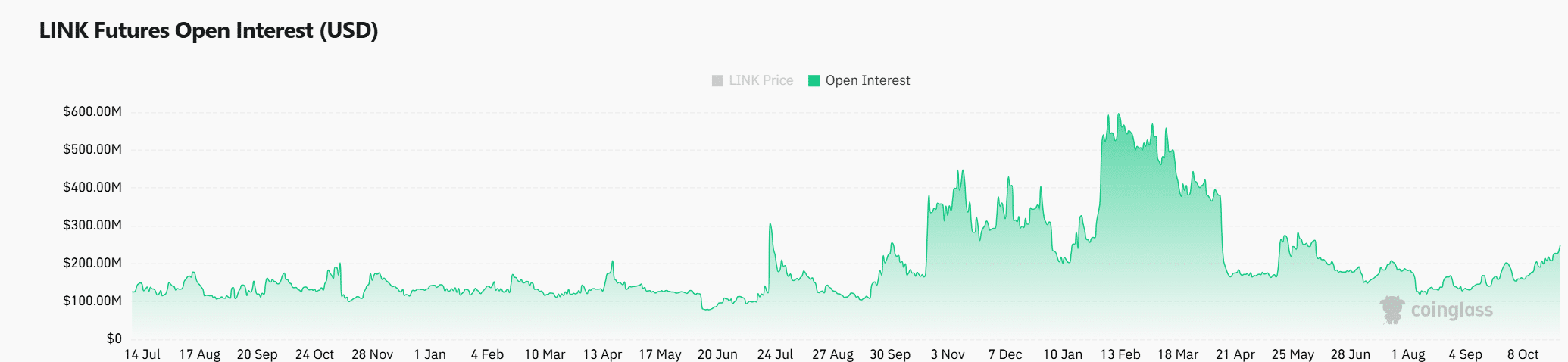

Lastly, open interest in LINK futures surged 13.14% to $274.29 million. The same price increase highlights that more traders are taking positions in the LINK market in anticipation of a decisive move.

Such uptrends are often seen as a sign of confidence, with market participants expecting meaningful price movements in the near term. Therefore, LINK appears to be well positioned for a potential breakout if it can break the $13.01 level, with both technical and on-chain signals consistent.

Source: Coinglass

Read Chainlink’s (link) price prediction for 2024-2025

Will LINK Breakout and Spark a Rally?

Chainlink’s charts, indicators, and on-chain indicators were all hovering near the $13.01 resistance level, hinting at a key moment. Supported by bullish momentum due to technical patterns and increasing network participation, Chainlink is poised for an upward move.

However, only a clear break above this resistance level will confirm Chainlink’s bullish direction. Can LINK finally break through and ignite the rally its supporters have been hoping for? The answer will come over the next few days.