- UNI is struggling to break out of its downward trend despite Uniswap reaching $2 trillion.

- Technical indicators suggest a potential bounce, signaling market interest as open interest increases.

Uniswap (UNI) Recently, the cumulative transaction volume of the Ethereum layer 1 blockchain reached a whopping $2 trillion, further highlighting its importance in the decentralized finance ecosystem.

However, the protocol’s governance token, UNI, is still declining, raising concerns among investors. Trading at $7.18, down 4.61% at press time, Uniswap faces a tough road to recovery.

The key question now is whether this milestone can spark enough momentum to reverse Uniswap’s bearish trajectory.

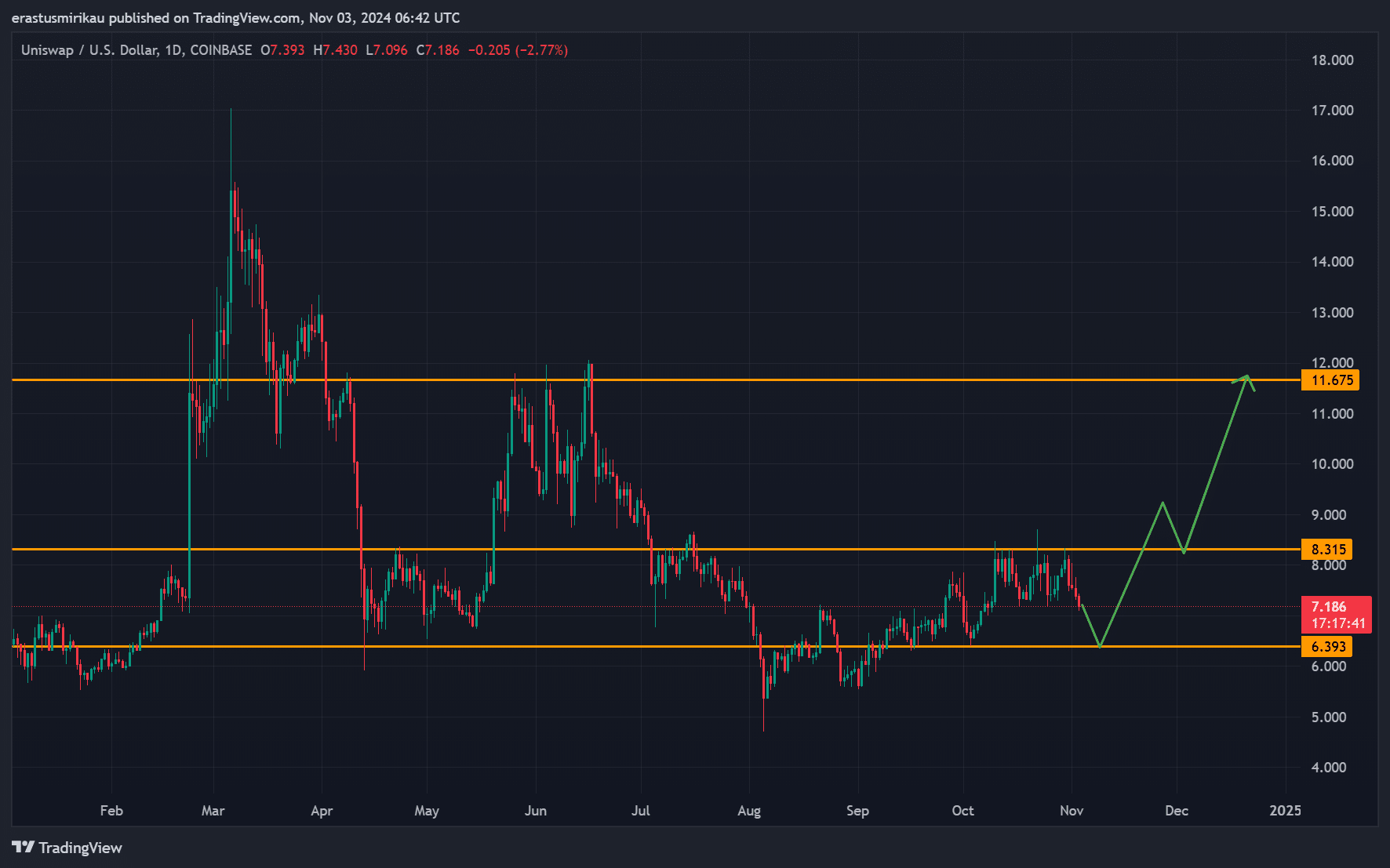

UNI’s key support and resistance levels

UNI’s price chart shows important support and resistance levels that could shape its immediate future. The underlying support level is around $6.39, a vital area to prevent further declines if sellers maintain pressure.

However, if UNI maintains above this level, it can attract buyers and stabilize.

Additionally, Uniswap faces significant resistance at $8.31, a level it must break to confirm a recovery. A more ambitious target is at $11.67, which, if reached, could signal strong market confidence.

These levels are therefore essential for investors looking for signs of a trend reversal.

Source: TradingView

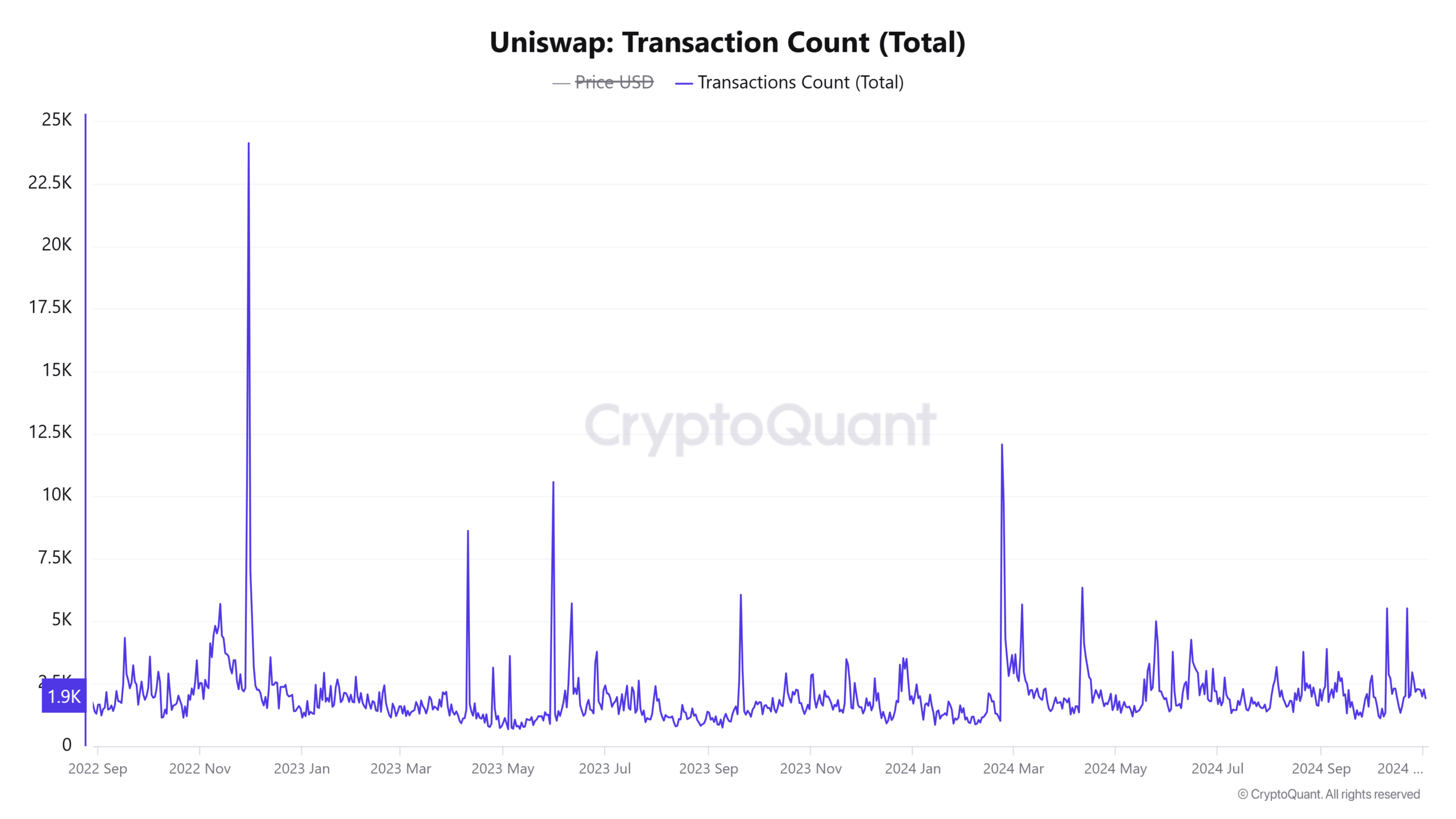

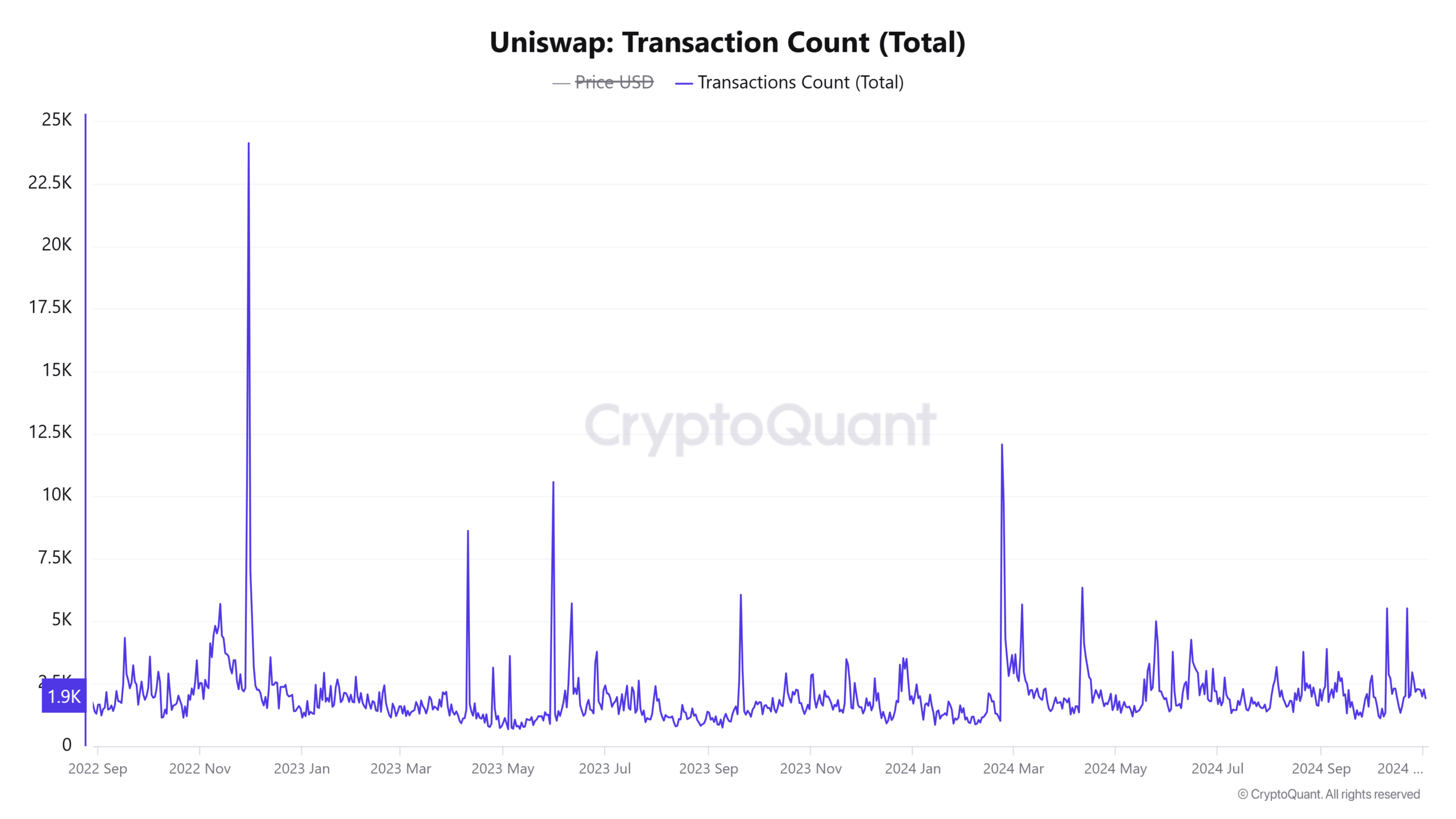

Deal Count Analysis: Does Activity Mean Growth?

The number of transactions on Uniswap reached 1.838K, up 0.8% in the last 24 hours. Although slight, this uptick suggests continued trading activity that could help support UNI’s price.

High trading volume is often associated with increased liquidity, which can stabilize prices. As a result, it will be important to observe whether trading growth continues to assess whether Uniswap can regain strength in the near term.

Source: CryptoQuant

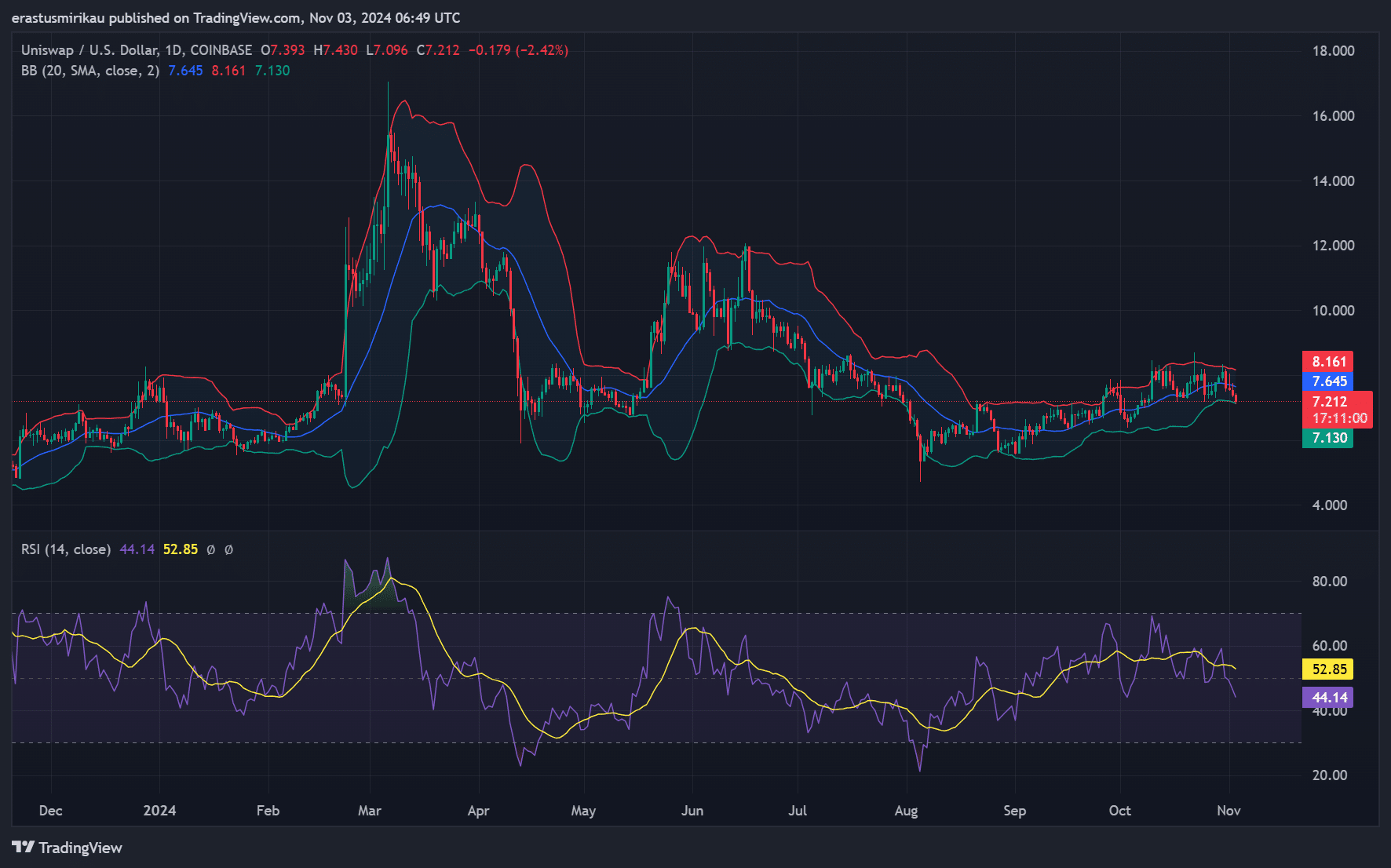

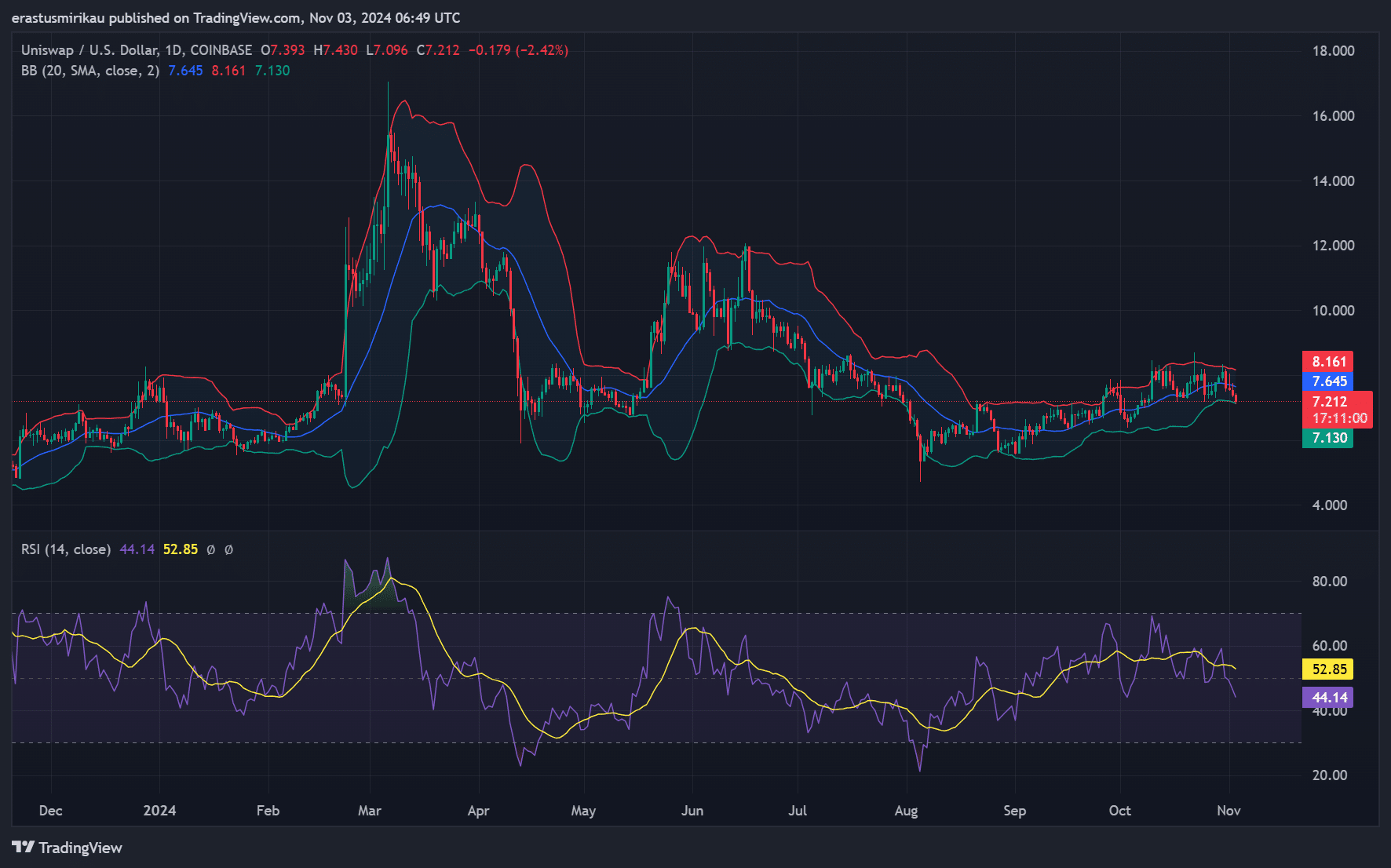

Technical Indicators: Are Bollinger Bands and RSI Sending a Reversal Signal?

Analyzing UNI’s technical indicators, especially Bollinger Bands and RSI, can provide insight into potential price movements.

UNI is currently trading near the lower Bollinger Bands, indicating potential oversold territory. This can lead to a bounce if you are buying interest income.

Meanwhile, the relative strength index (RSI) is 44.14, suggesting downward pressure, although it is not oversold. So, if UNI fails to break $8.31, any bounce may lack the momentum for a sustained recovery.

Source: TradingView

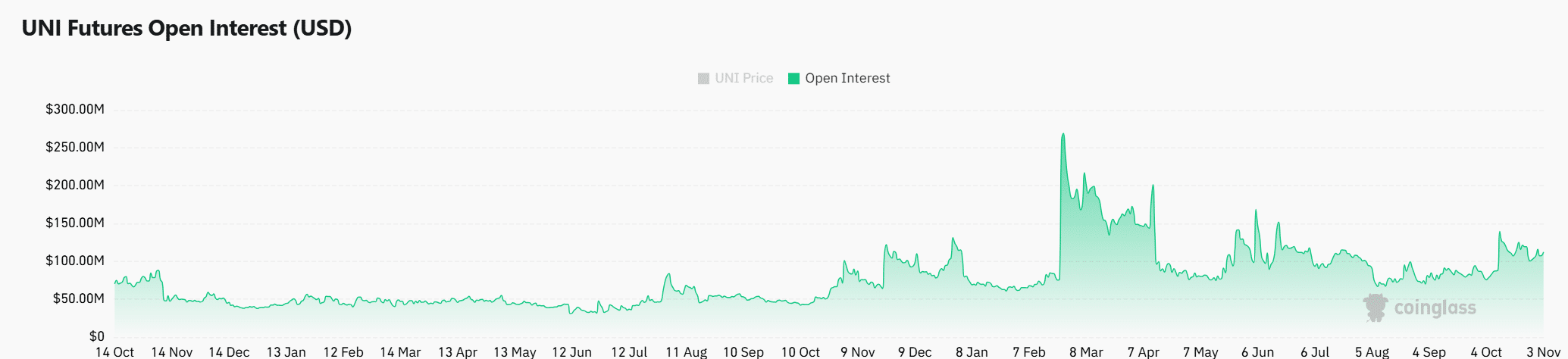

UNI Market Sentiment: What Does Increased Open Interest Mean?

Market sentiment indicates increasing trader participation, with open interest increasing 6.79% to $114.83 million. This rise suggests expectations of a potential price move.

If UNI maintains this sentiment along with increased volumes, the chances of a recovery could increase.

Source: Coinglass

Is your portfolio green? Check out the UNI Profit Calculator

While Uniswap’s $2 trillion milestone highlights its strength, UNI’s recovery will depend on breaking resistance and attracting more buyer interest.

Trading growth and market sentiment will be important to watch over the coming weeks.