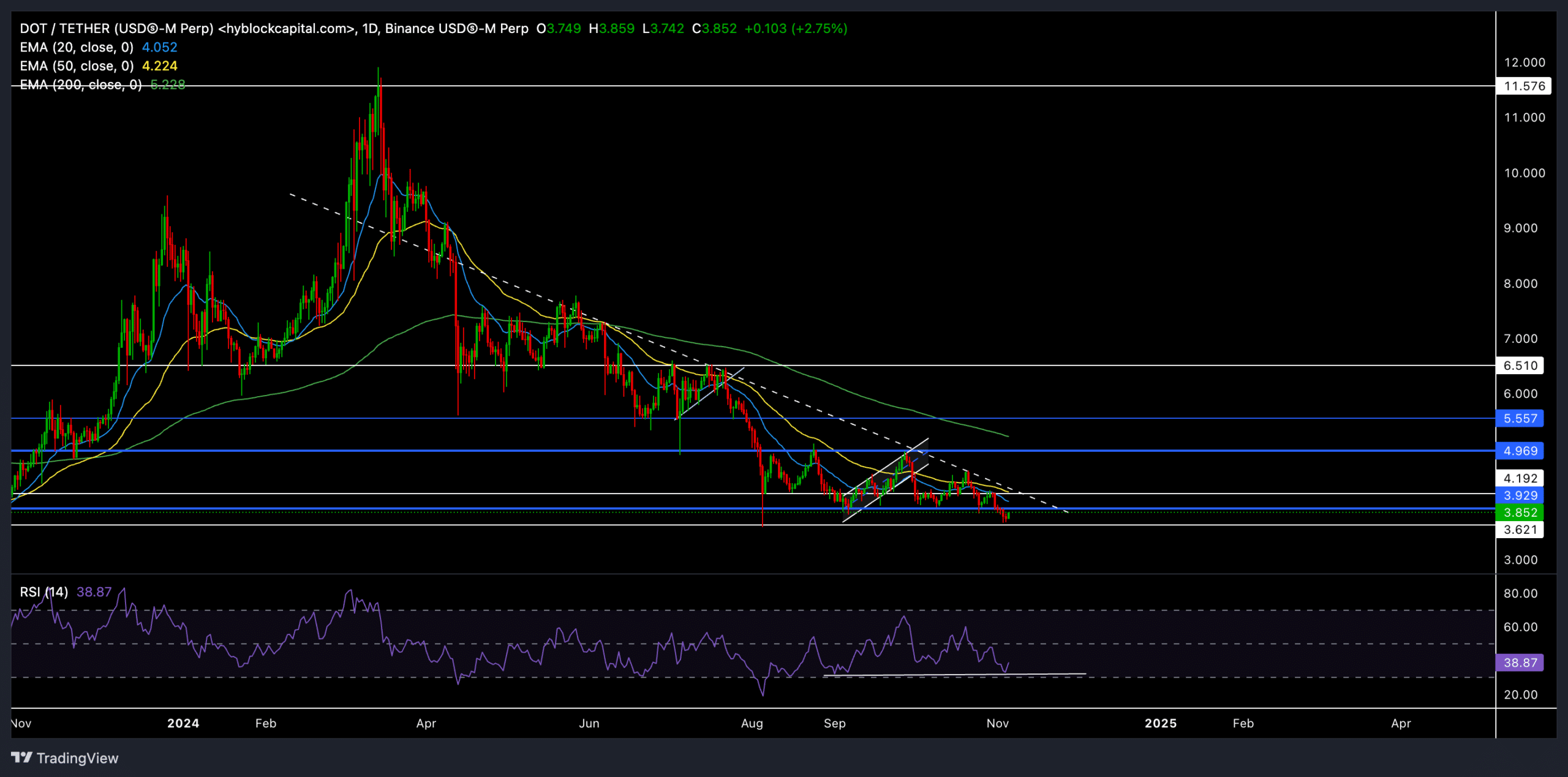

- Polkadot continued its long-term decline and hovered around multi-year lows.

- For DOT to restore its bullish outlook, it will need to find a decisive close above the 20-day and 50-day EMAs.

The recent price action of Polkadot (DOT) has revealed a steep bearish trend. The altcoin approached long-term support levels and returned to 2020 levels.

DOT is trading around $3.85 at press time, up nearly 2% in the last 24 hours. However, the overall trend remained weak. With continued selling pressure, will buyers be able to find the momentum to regain critical resistance levels?

DOT fights close to key support levels

Source: TradingView, DOT/USDT

DOT has declined steeply over the past few months, consistently failing to break above the $4.9 resistance level. At the time of writing, the altcoin was trading well below the 20-day EMA ($4.05), 50-day EMA ($4.22), and 200-day EMA ($5.23).

Repeated rejection of these moving averages and the inability to break the 6-month trendline resistance (white, dotted line) have intensified selling pressure. Recently, DOT has fallen below the support level of $3.9 (currently resistance), putting it closer to multi-year lows of around $3.6. This is an important level to monitor.

DOT’s price movements suggested high volatility in the near future. If the altcoin can gather enough bullish momentum to break above the $3.9 resistance level again, it could test the 20/50-day EMA. Recovering these EMAs is critical for buyers to take advantage in the near term and could potentially open the path to a test of higher resistance at $4.9.

However, the bearish outlook remained strong due to the overall downtrend. A break below the crucial $3.6 support could accelerate the decline and force DOT to explore new lows.

Also, at the time of writing, RSI is at 40. It is worth noting here that recent higher lows in RSI suggest a bullish divergence from lower lows in price action.

Key levels to note

apply: The immediate support level was confirmed to be $3.6. This is a multi-year low that is psychologically very important. A drop below this could lead to further declines.

resistance: The first resistance level was $3.9, followed by the 20-day EMA at $4.05 and the 50-day EMA at $4.22. A decisive move above these levels could provide DOT buyers with an opportunity to regain control of the market.

What is disclosed in derivatives data

Source: Coinglass

Derivatives data revealed mixed feelings among DOT traders. The 24-hour long/short ratio was 0.9029, showing a slight preference for short positions and traders showing some caution. However, the long/short ratios of Binance and OKX were quite optimistic. Binance recorded 4.7013 and OKX recorded 3.58. This is a sign that traders on these platforms are hopeful about a recovery.

Traders should closely monitor broader market trends, especially Bitcoin’s movements.