- Ethereum is expected to see a 20% price increase due to whale accumulation and exchange outflows.

- Whale activity suggests increased bullish sentiment and reduced supply on exchanges.

Ethereum (ETH) has surged 20% over the past week due to significant outflows on exchanges and increased whale accumulation, reflecting growing confidence in the asset.

Despite the bullish momentum, the recent minor correction has placed ETH at a critical juncture, testing key support and resistance levels. As the market awaits clarity, these levels will play a key role in determining the next direction for Ethereum’s price.

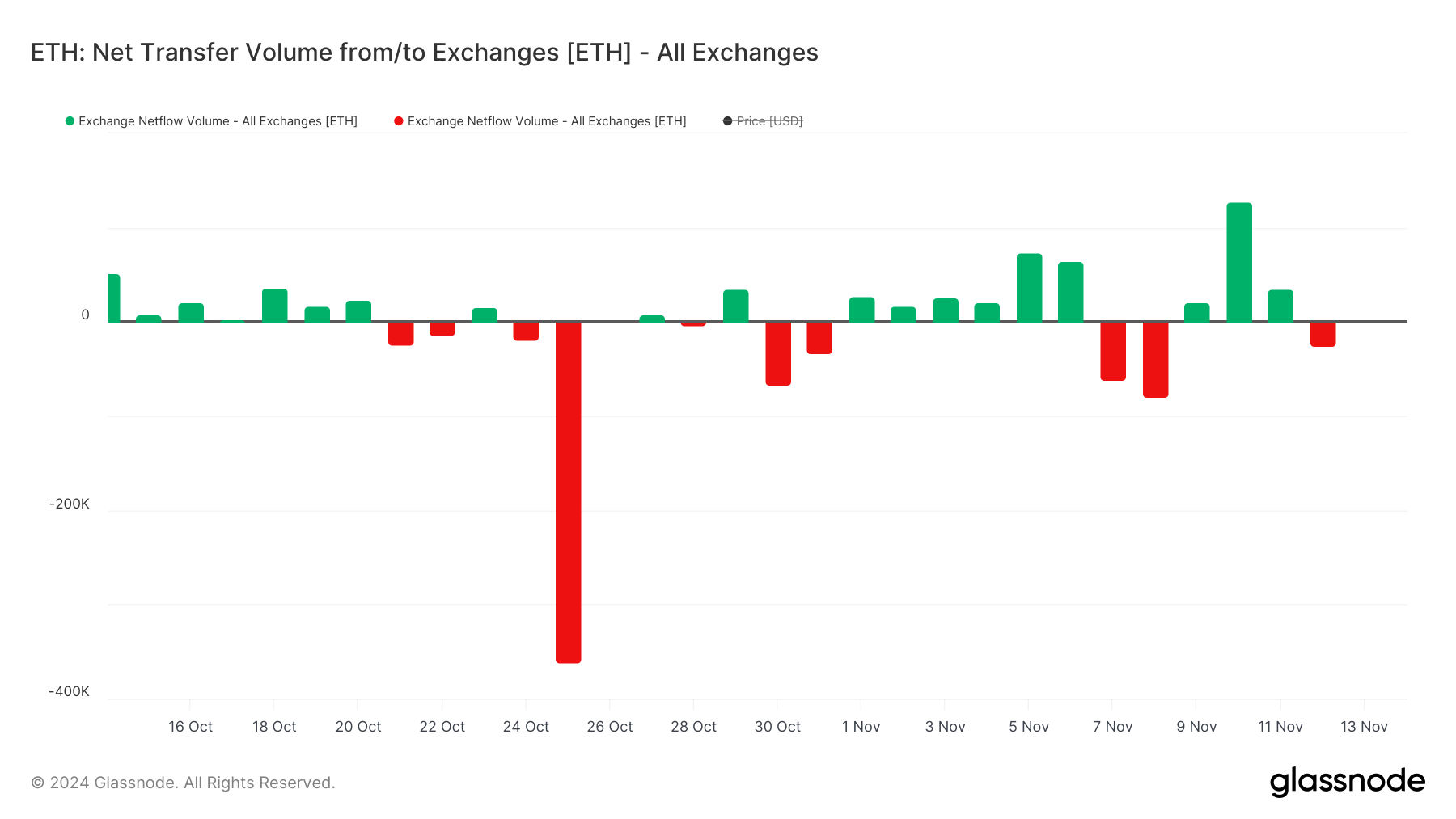

Ethereum exchange flow

Ethereum saw significant outflows around October 26, with massive withdrawals from exchanges increasing confidence among holders.

Source: Glassnode

These outflows have dominated the trend, especially over the past week, coinciding with a rise in the price of ETH as whales have been accumulating and reducing supply on exchanges.

There will be some inflows around November 7th and 10th, so some profit taking is expected, but the overall sentiment remains optimistic. However, a continued shift towards inflows could challenge ETH’s support levels, resulting in potential volatility.

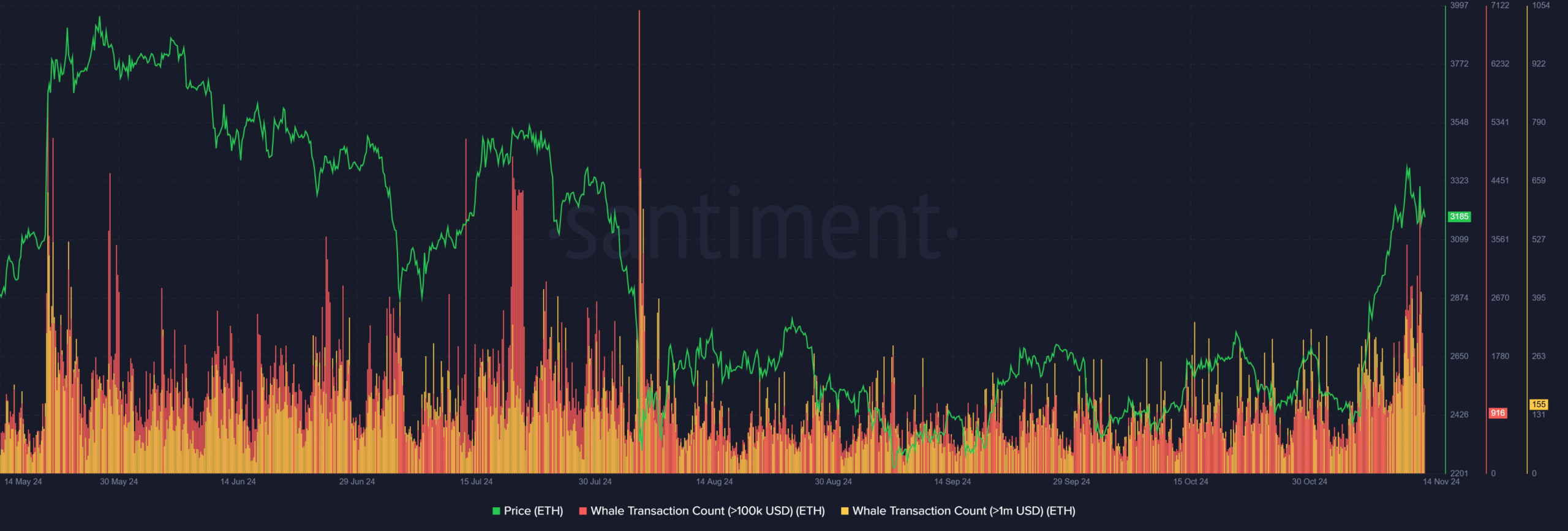

Whale activity driving ETH’s bullish momentum

Whale trading surged in late October and early November, which was linked to a 20% price rise in ETH, suggesting that large holders played a pivotal role in the price rise.

Source: Santiment

Historically, surges in whale activity often precede major price movements, reinforcing the idea that whales are both indicators and catalysts for ETH price action.

However, as ETH reaches severe resistance levels, whale trading may decrease, signaling profit taking or caution against higher prices.

Continued whale participation is critical to maintaining upward momentum. A continued decline in whale activity could indicate a potential correction or increase in volatility.

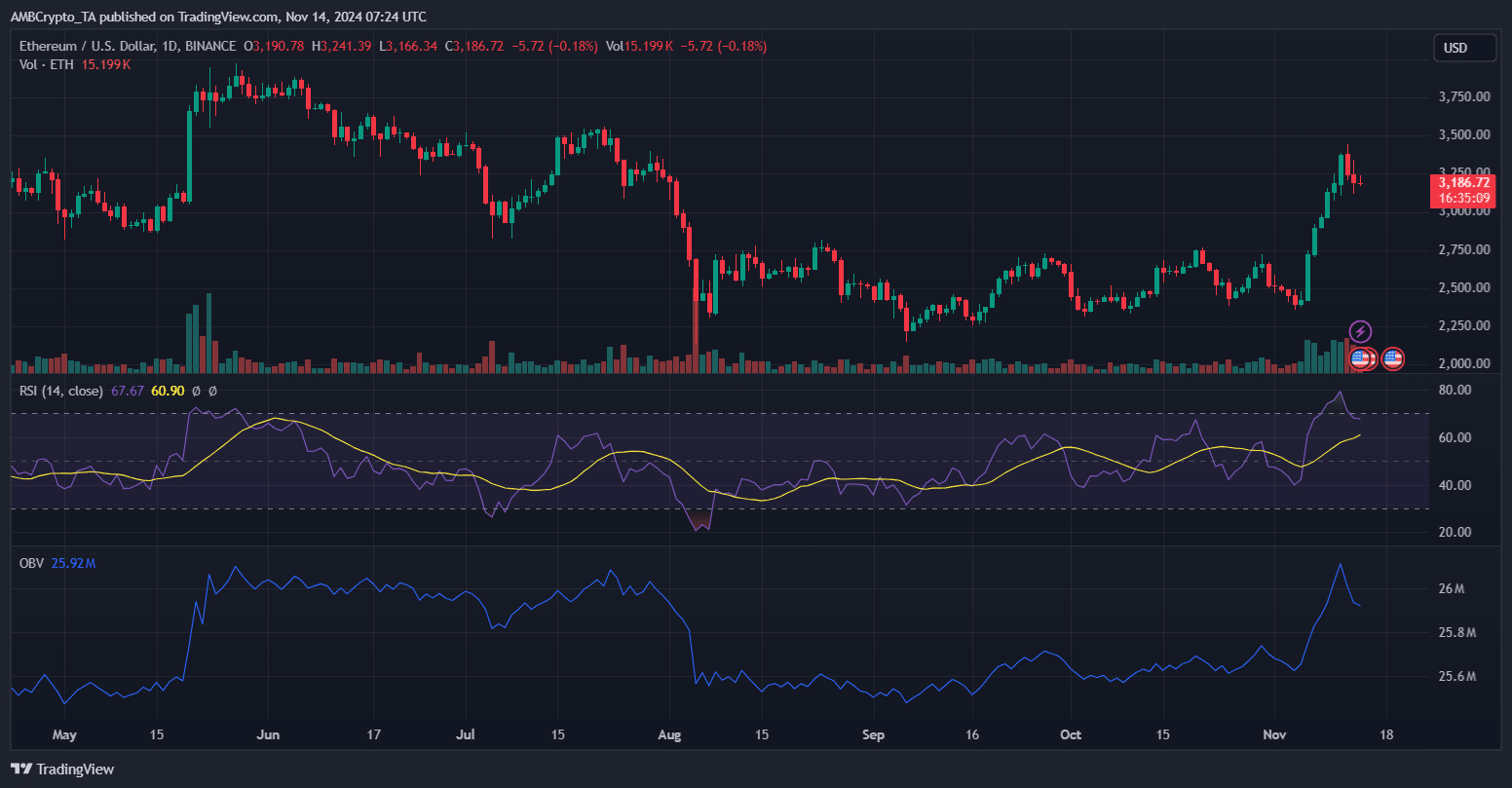

Ethereum’s path to ATH

Source: Santiment

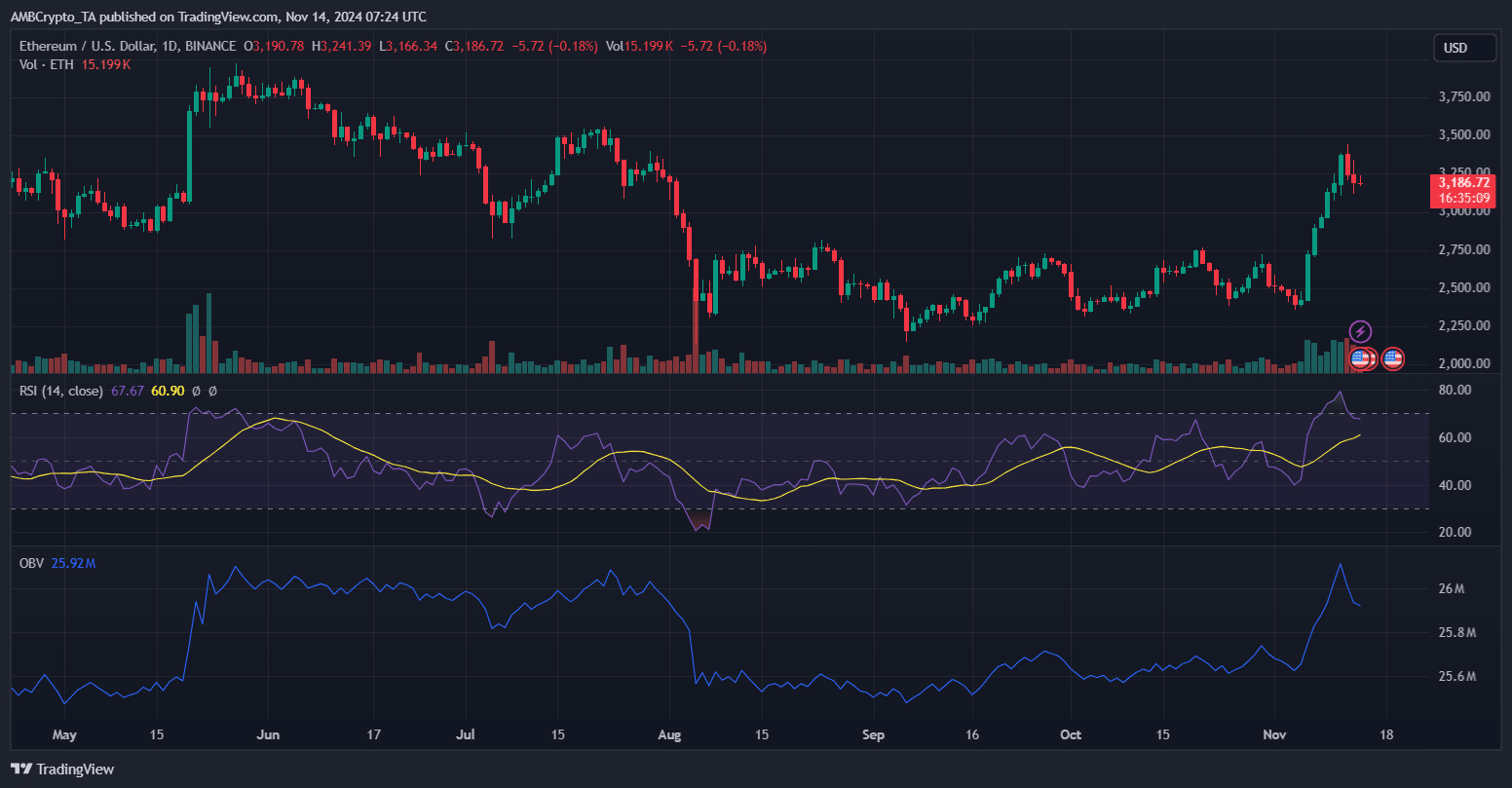

Ethereum’s recent rally and strong whale accumulation increases the chances of it re-examining or surpassing ATH. An RSI of 67 indicates bullish momentum without being overbought and suggests there is room for further growth.

Meanwhile, OBV is seeing strong buying, indicating continued demand.

Read Ethereum (ETH) price prediction for 2024-2025

ETH remains above the key EMA line with immediate resistance at $3,500. A breakout of this could move to $3,700 with the next target being $4,000.

The minor correction reflects profit-taking, but ETH’s resilience and whale activity suggest a potential push for a new ATH if support holds above $3,000.