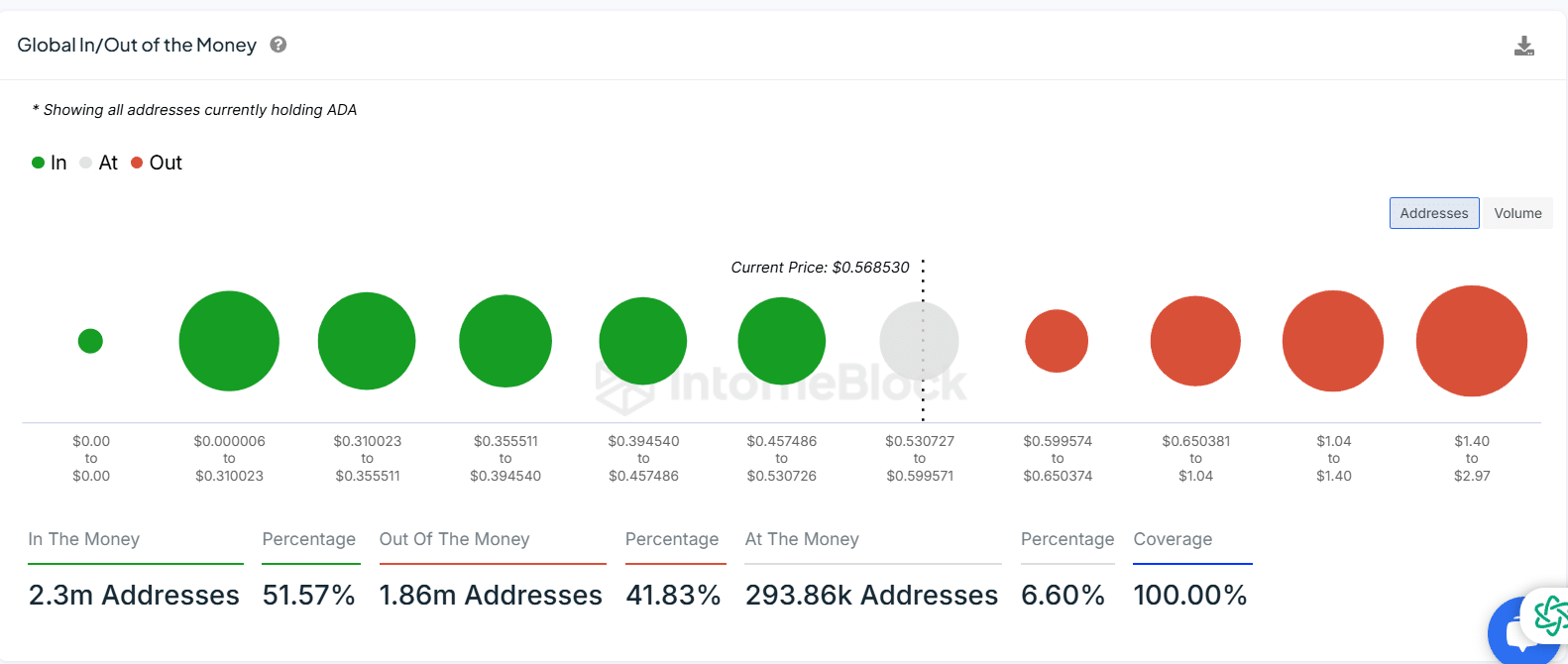

- Key ADA price levels were $0.2 and $1.99, according to In/Out of Money data.

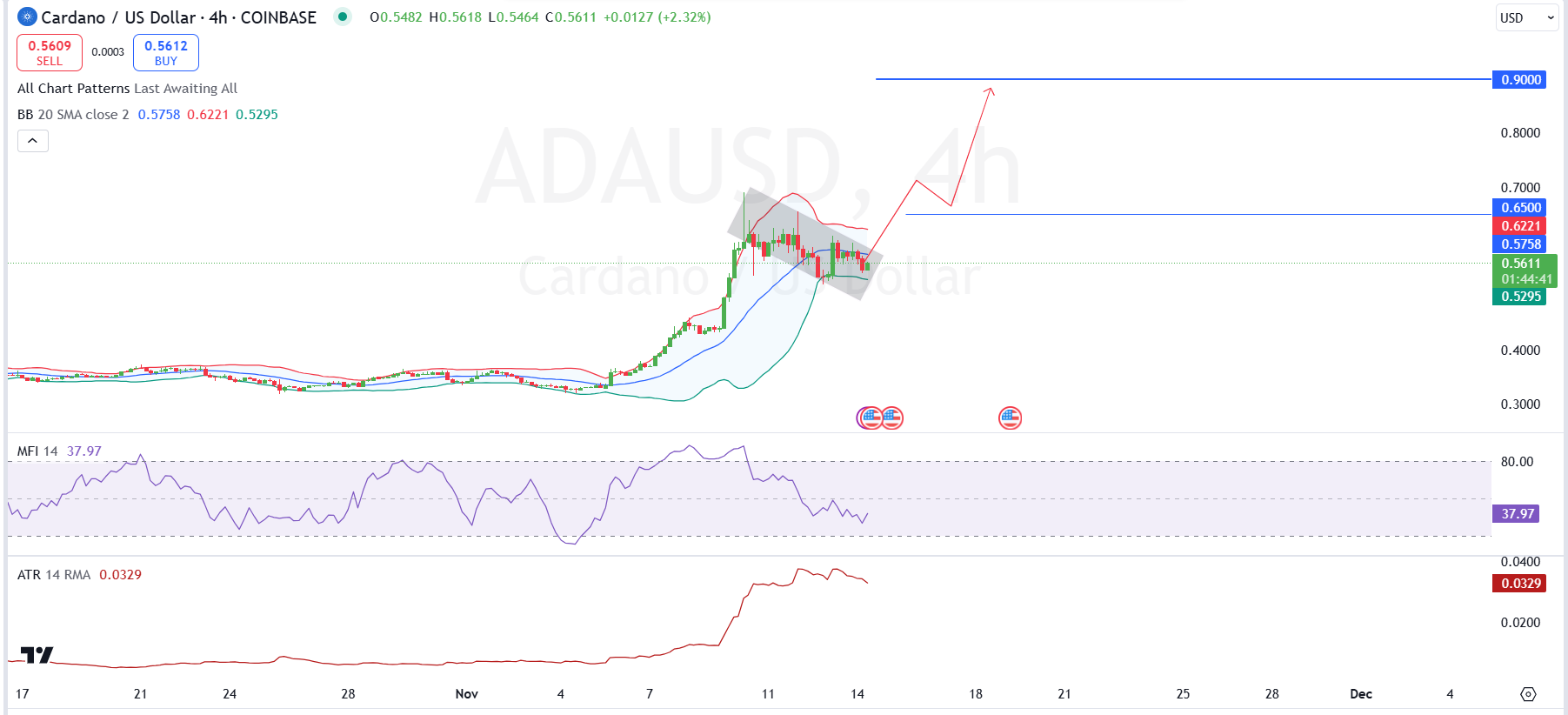

- Strengthening the Bollinger Bands shows that ADA is preparing for a breakout.

Cardano (ADA) has been on a rising streak in recent weeks, with its value rising 42% over the past seven days, reaching $0.50 last recorded in April.

As of November 14th, ADA It was trading at $0.55, down slightly 4.07% over the last 24 hours. Cardano recently reclaimed its place in the top 10 cryptocurrencies, surpassing Tron in market capitalization.

Is Cardano integration building for a breakthrough?

Cardano It was trading in a consolidation phase after a strong rally, and was trading within a tight range with some strength at press time.

The Bollinger Bands on this 4-hour chart are showing tight compression, suggesting that ADA is preparing for a breakout. The upper boundary of the channel near $0.65 serves as the next resistance level, with the long-term target seen near $0.90.

Supportive indicators add to optimism. The Money Flow Index is at 37.97, indicating that the stock is not approaching overbought conditions and still has room for upside.

Meanwhile, the Average True Range shows decreasing volatility, which could be a sign that a sharp move is coming.

Source: TradingView

If ADA breaks the $0.65 resistance level, a new uptrend could begin, with traders eyeing $0.90 as the next important target.

On-chain data shows $0.2 and $1.99 as key levels.

An analysis conducted by AmbCrypto has revealed two important price levels for Cardano that could have a significant impact on market activity.

At the $0.2 level, approximately 540,000 addresses holding ADA would become “outside funds,” meaning they would face losses. If the price of ADA falls to this threshold, many holders may decide to sell, which could increase liquidation pressure and push the price even lower.

Source: IntoTheBlock

Conversely, at the $1.99 level, approximately 726,000 addresses move to profitability, moving from “Out of the Money” to “In the Money.”

If the price of ADA reaches $1.99, we could see a wave of profit-taking from these holders, which could create resistance and slow further price rises as many choose to cash out.

Two levels are critical to ADA’s market outlook: $0.2, a possible support with high selling risk, and $1.99, a strong resistance with profit-taking pressure.

Price movement towards any one level can have a significant impact on liquidity and volatility, making it a key point to pay attention to.

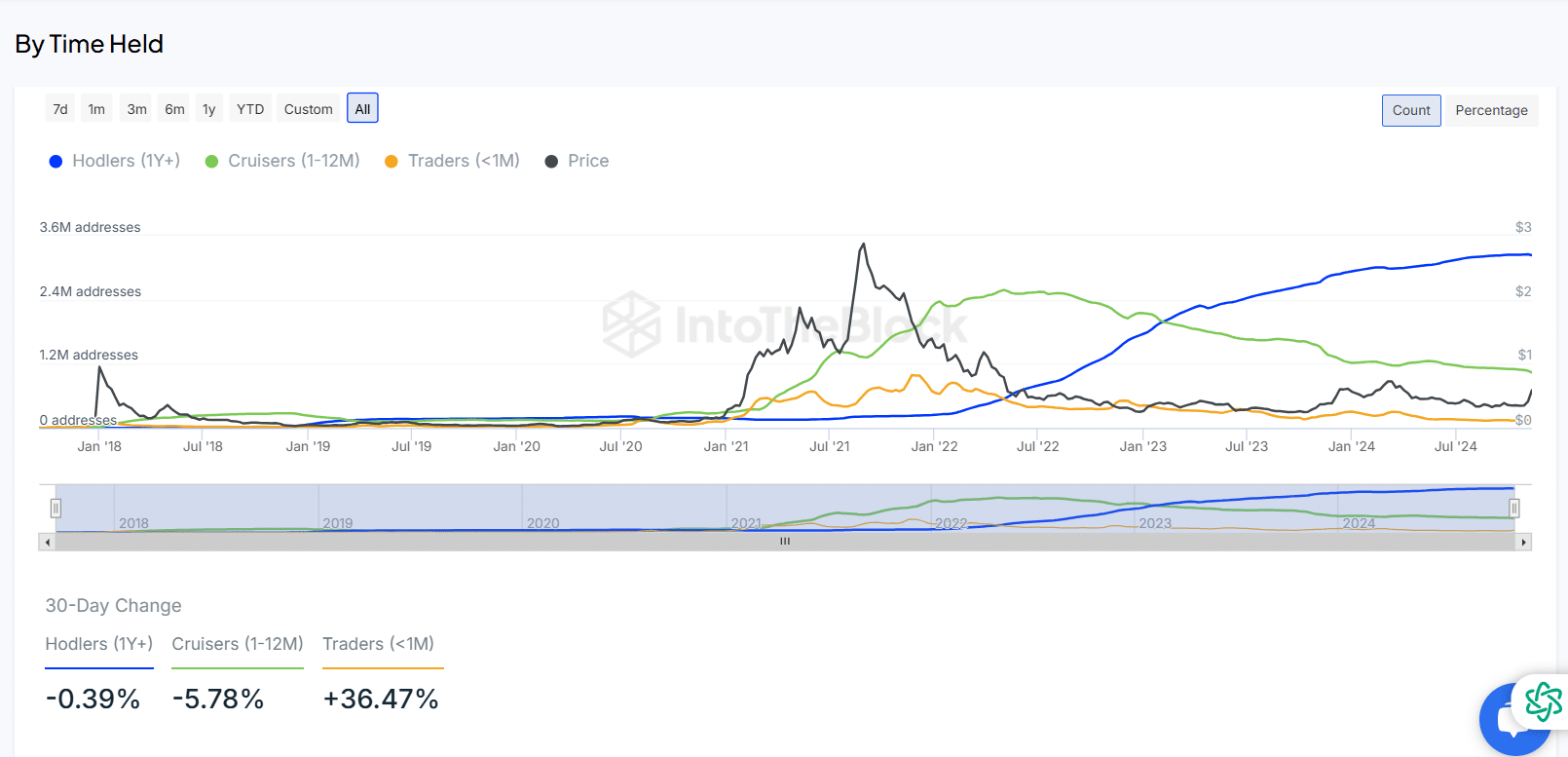

ADA holder trends: Cruisers down 5.78%, Merchants up 36.47%

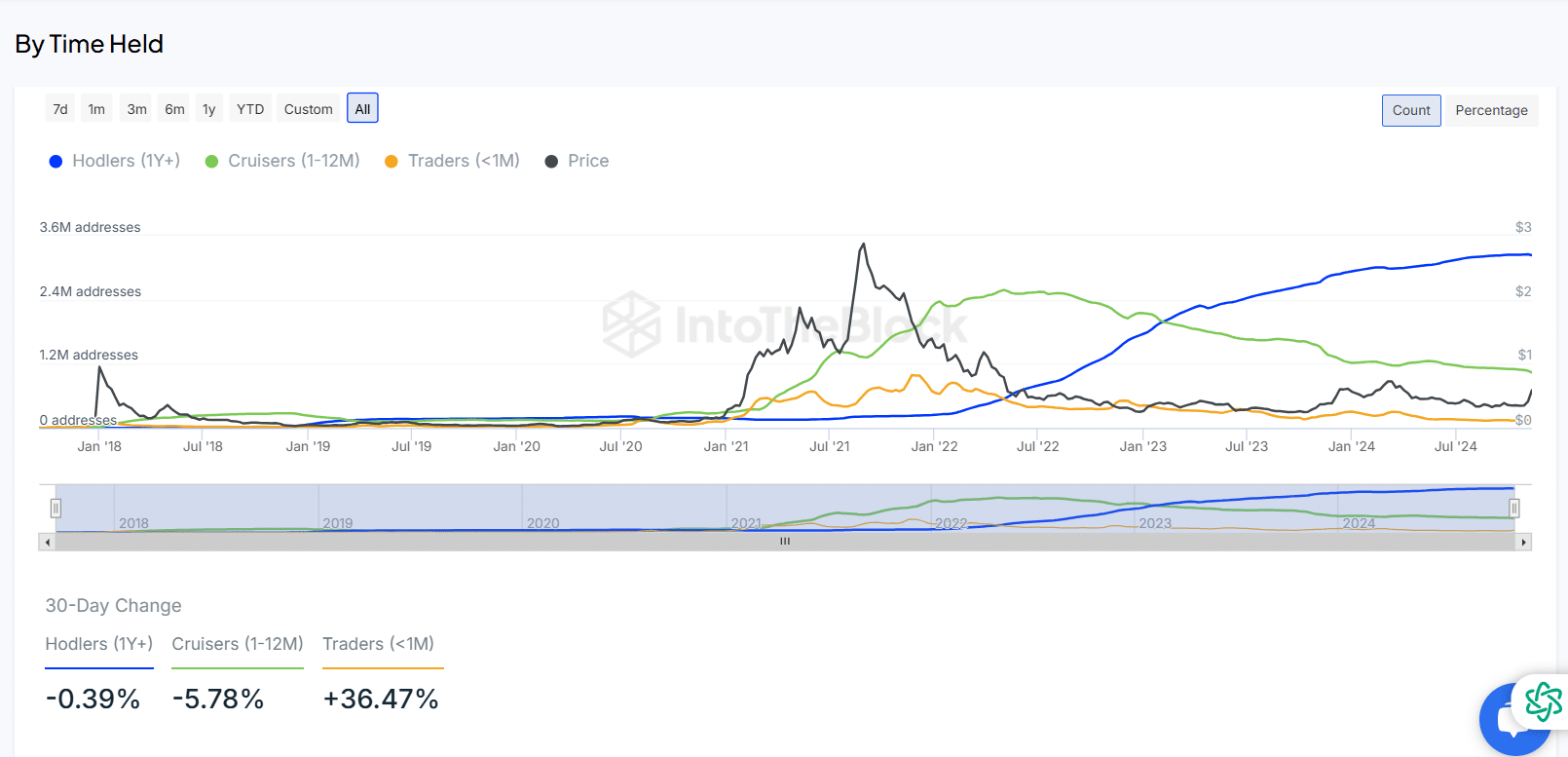

IntoTheBlock data analysis provides analysis of Cardano addresses by holding time, highlighting key trends in holder composition.

Overall, the number of long-term holders (1 year or more), represented by the blue line, has been steadily increasing, suggesting the confidence and commitment of ADA investors is growing.

The group has continued to hold ADA over a number of years, reflecting its strong belief in the future potential of the asset.

Meanwhile, cruisers (1-12 months), represented by the green line, have seen a decline of 5.78% over the past 30 days. This suggests that medium-term holders can cash out or move to a shorter holding period to profit from market changes or re-evaluate their positions.

Source: IntoTheBlock

Traders (less than 1 month), represented by the orange line, have surged 36.47% in the last 30 days.

Realistic or not, the market cap of ADA in BTC is:

This increase reflects increased trading activity and short-term interest in ADA due to recent price movements or speculative trends.

The general trend shows a slight shift in Cardano’s holder base. Long-term holders remain stable and short-term traders increase, adding a layer of short-term activity to ADA’s market dynamics.