- XRP may be heading towards key resistance at $1.33 with strong bullish momentum and whale accumulation.

- On-chain indicators show an increase in activity and a decrease in exchange reserves.

Market capitalization exceeds $50 billion, XRP It has re-established itself as a dominant force in the cryptocurrency market. After surging more than 16% in just 24 hours to reach $0.9342, the token’s momentum has now attracted widespread attention.

But the pressing question now is whether XRP can sustain this rally and surpass $1 to reach the $2 milestone.

Is XRP ready for a major breakout?

XRP’s chart showed a potential breakout as the price neared the key resistance level of $1.33. A decisive move above this level could lead to a sharp rise towards the aforementioned target. Additionally, the overall bullish trend appears to be supported by technical indicators.

For example, the stochastic RSI read an extreme reading of 97.56, indicating that XRP is in overbought territory at press time.

While this may suggest a short-term correction, the MACD was bullish, highlighting the positive momentum in the market. Additionally, broader market sentiment also appeared to be favorable, providing the tailwind that XRP needed to sustain its rally.

Therefore, it may be possible to break above the $1 level in the near term. That would make $2 a realistic medium-term target if momentum is maintained.

Source: TradingView

XRP whale activity adds fuel to the fire

XRP whales contributed significantly to this rally, accumulating over 320 million tokens in just 72 hours.

This massive accumulation is a sign of growing confidence among large investors, many of whom are positioning themselves for further profits. As a result, this heavy buying could lead to a shortage of available supply, creating continued upward pressure on prices.

Since whale activity often precedes major price movements, this trend means that XRP’s rally has room to grow further.

On-chain activity reflects higher demand.

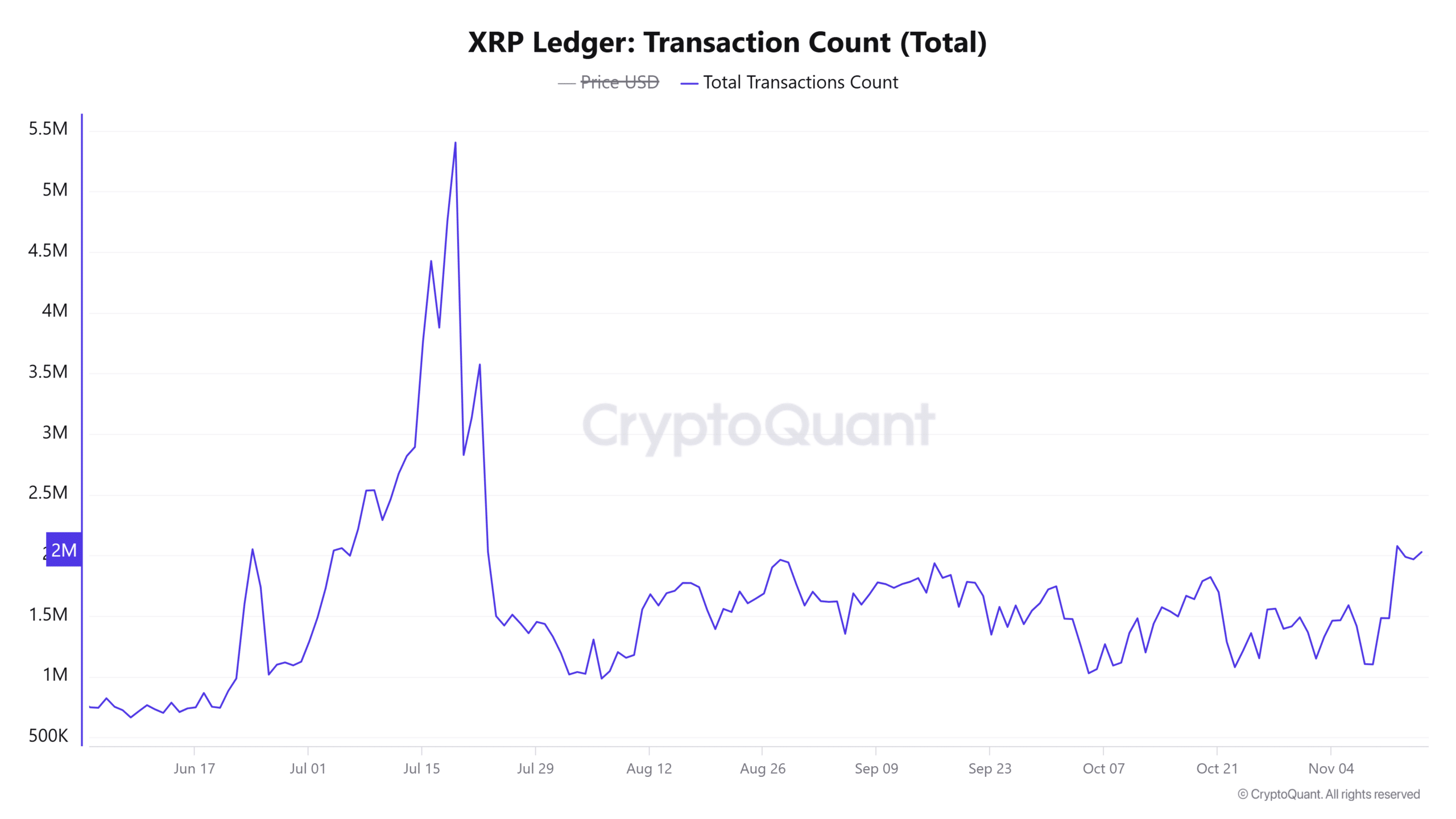

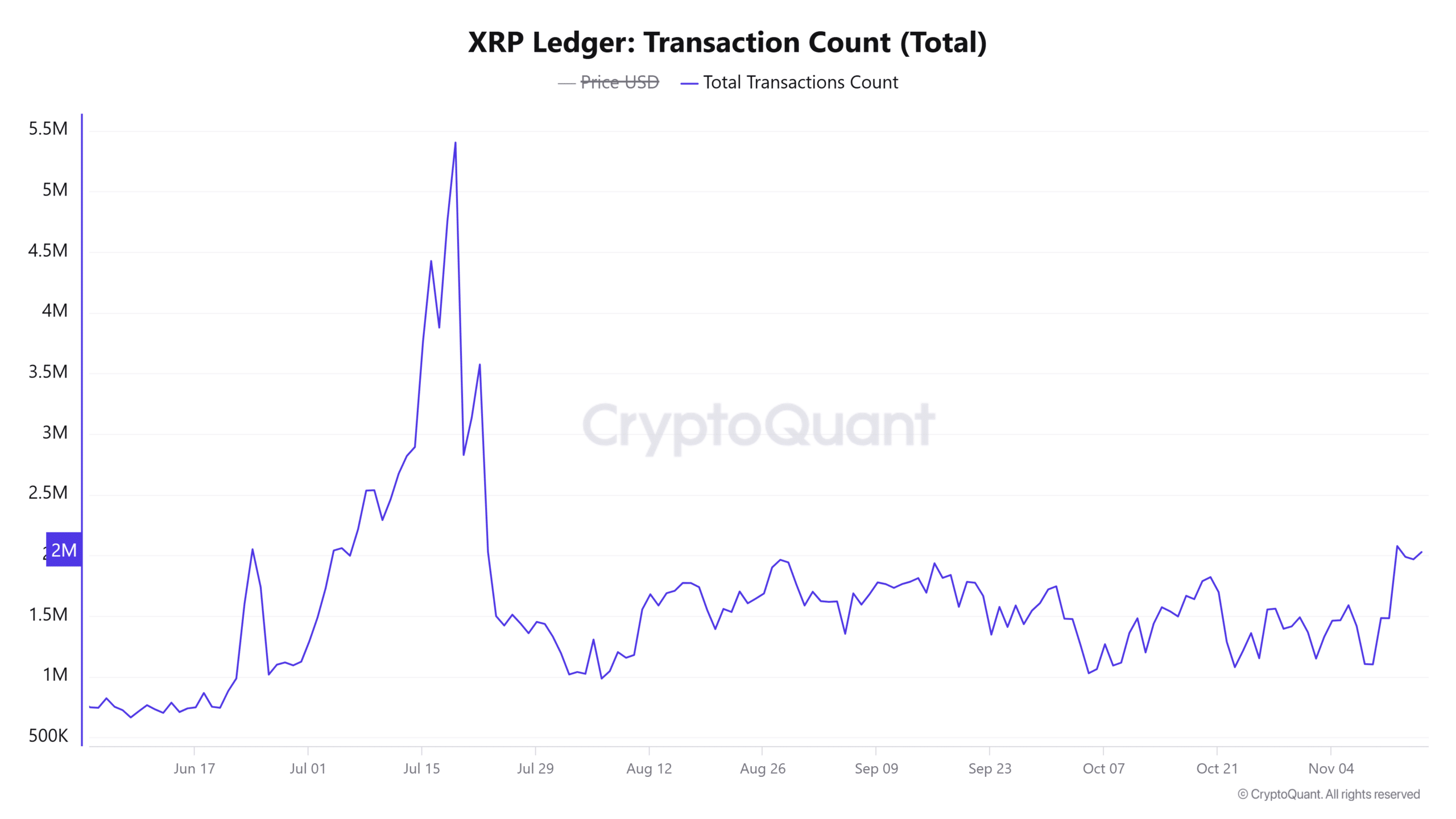

On-chain indicators further supported XRP’s bullish outlook. Active addresses increased 1.17% to 27,421.

These consistent increases highlighted growing network activity and engagement. Additionally, the total number of transactions increased by 0.92% to exceed 1.88 million. Taken together, this suggests that XRP adoption is expanding. Developments like these often translate into stronger price performance.

Source: CryptoQuant

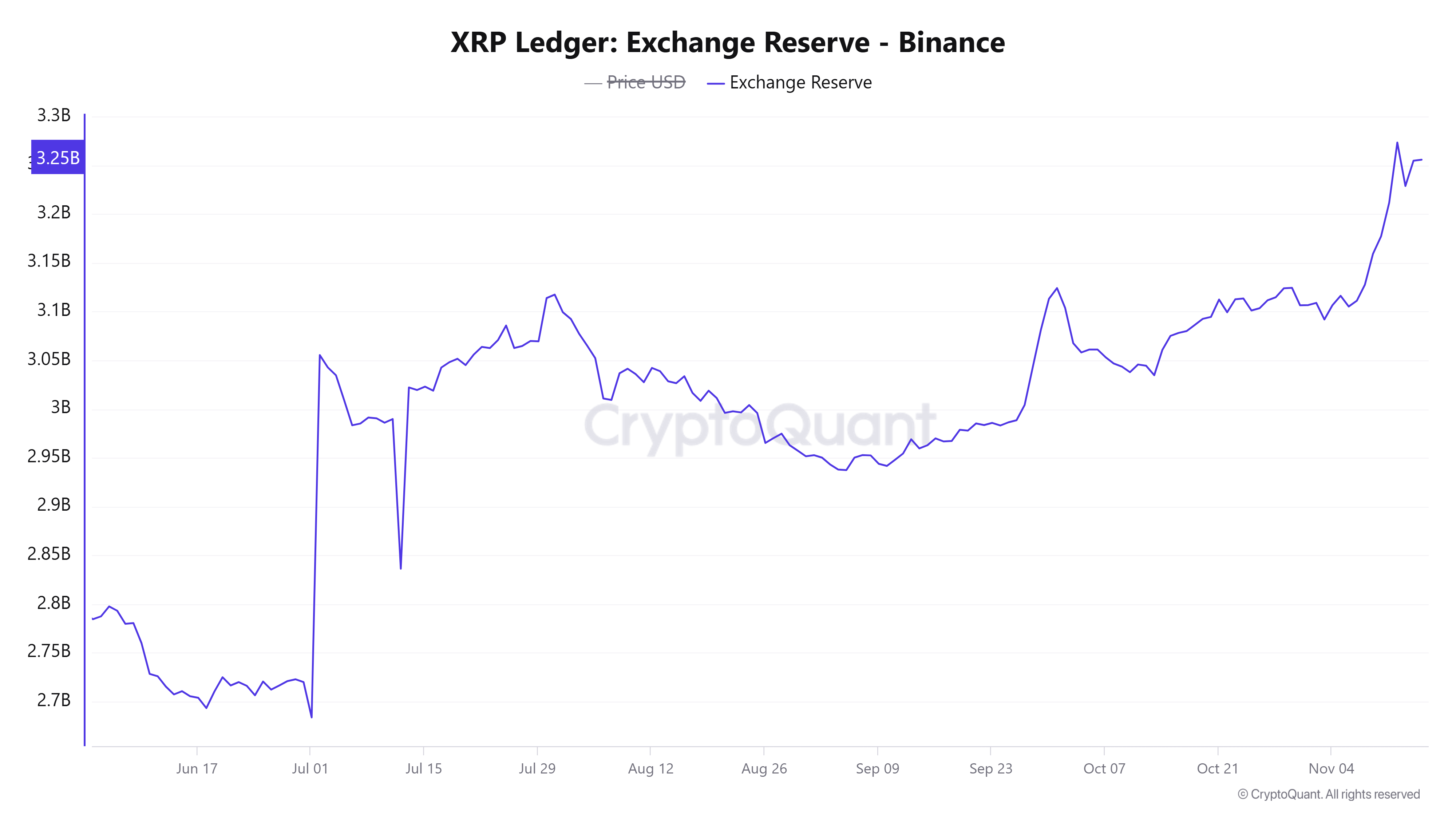

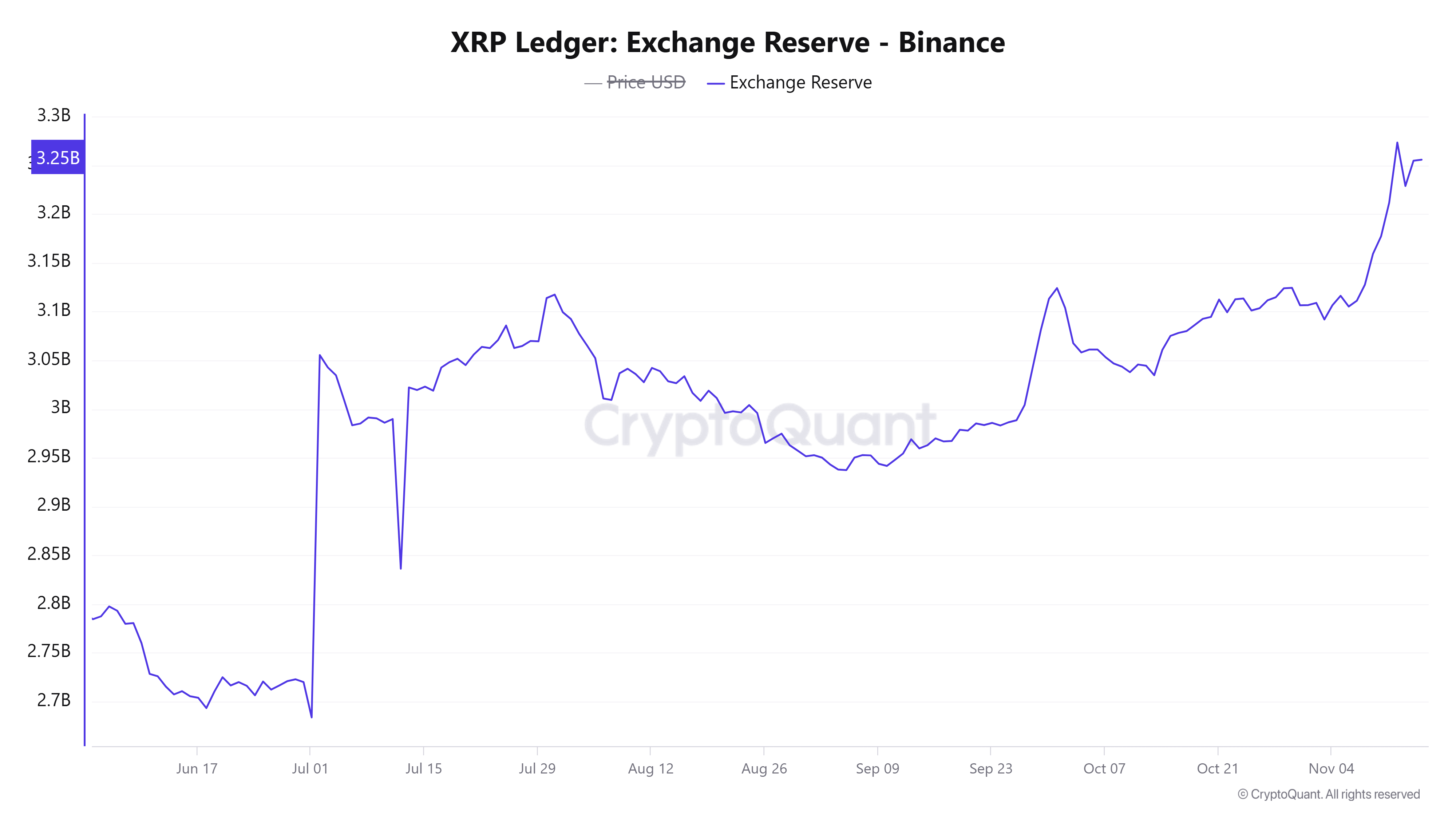

A decrease in exchange reserves signals a decrease in selling pressure.

Exchange holdings of

This decline indicates that investors are moving tokens off exchanges for long-term holding. As a result, lower selling pressure creates a favorable environment for further price increases. When combined with increased demand and whale accumulation, this indicator could strengthen the bullish case for XRP.

Source: CryptoQuant

Read Ripple (XRP) Price Prediction for 2024-25

XRP’s surge past the $50 billion market cap and strong technical and on-chain indicators suggested that a $1 breakout could be imminent. The next few days will be crucial to confirm this upward trajectory on the charts.