- Solana’s Open Interest rose to hit a new ATH.

- SOL price has risen 44.46% over the past month.

Over the past 11 days, Solana (SOL) has recorded significant gains on the charts. In fact, after hitting a local low of $155 earlier this month, the altcoin surged 45.15% to a high of $225 in just a few weeks.

On the daily chart, SOL is up 4.67%. Likewise, the altcoin also rose 9.85% and 44.46% on the weekly and monthly charts, respectively.

Needless to say, recent market conditions have raised some questions about the factors driving the aforementioned hikes. According to AMBCrypto’s analysis, one factor sustaining the upward trend is the growing demand and interest in SOL.

Solana Open Interest Launches New ATH

The growing demand and interest in altcoins can be evidenced by the fact that investors are constantly opening new positions.

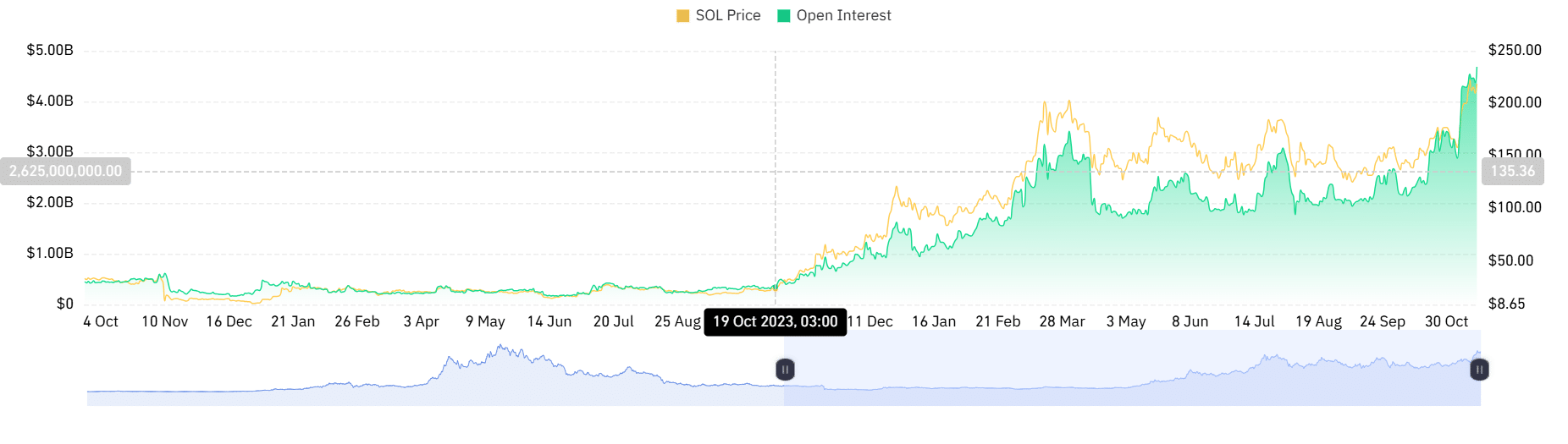

According to data from Coinglass, Solana’s Futures Open Interest has surged over the past 24 hours, hitting a new ATH on the charts.

Source: Coinglass

Looking at this, the altcoin’s open interest reached an all-time high of $4.68 billion. This increase in open interest highlighted the high demand for altcoins, with new investors opening new positions while existing investors remained trading.

Typically, higher open interest means the asset is more desirable to investors. Especially since they expect further rise in the charts.

With the overall cryptocurrency market rising and the overall market cap reaching $3 trillion, Solana holders see potential in this bull market. This motivates them to maintain their positions while attracting new employees.

What does SOL’s chart say?

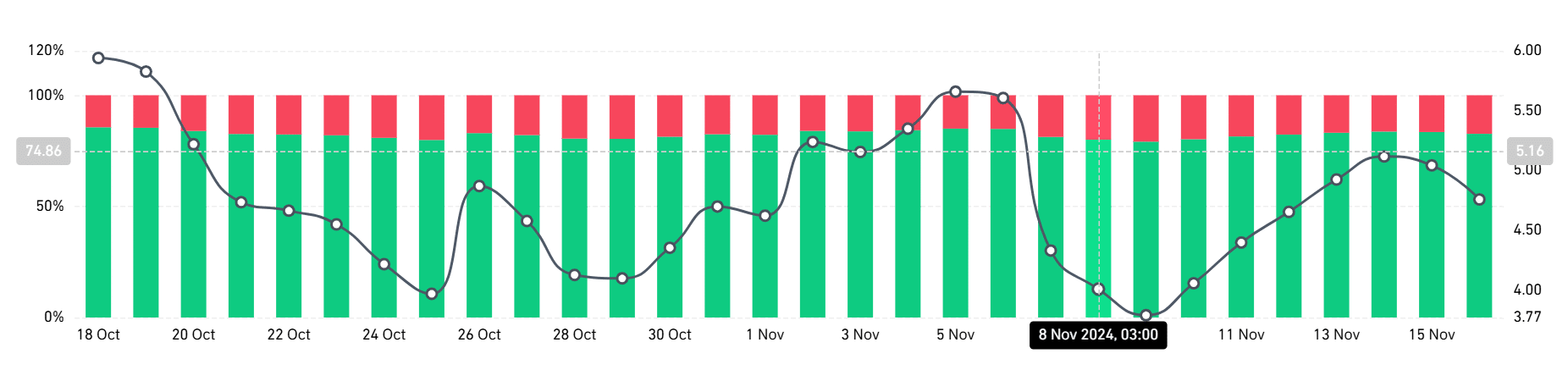

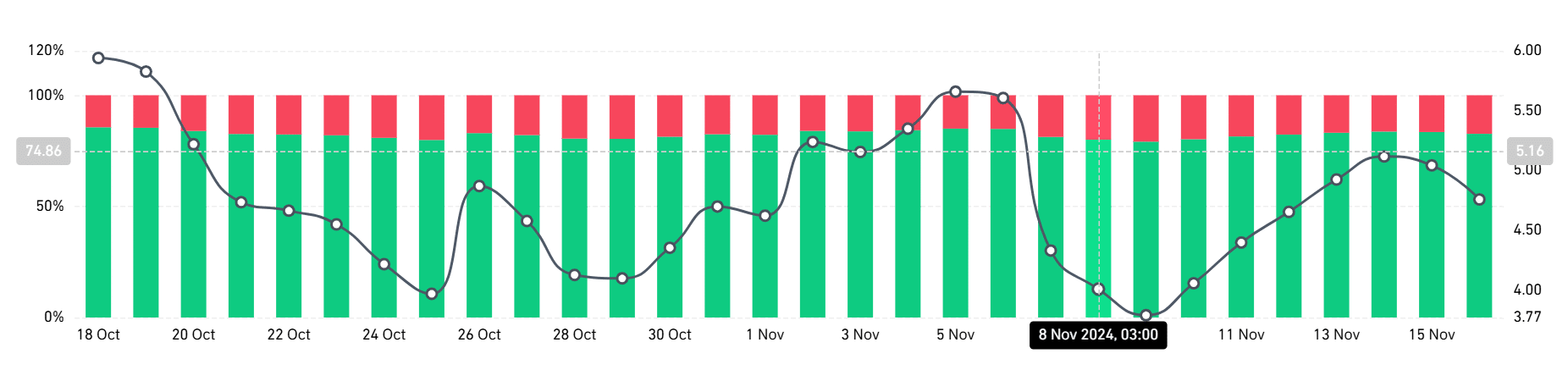

Solana has been seeing increased demand recently, especially for long positions. This demand for futures can be evidenced by the fact that long position holders have dominated the market.

Source: Coinglass

On the daily chart, Solana’s perpetual (long/short) has 82.56% long positions and 17.44% short positions.

This means that the majority of investors are betting on cryptocurrency prices rising.

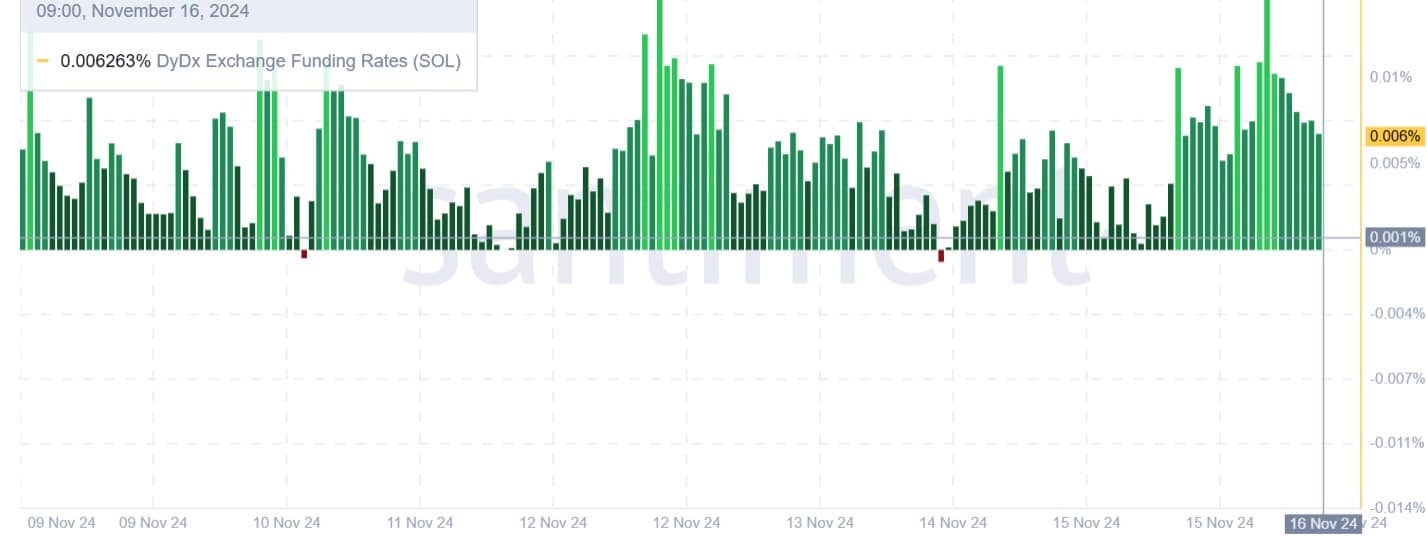

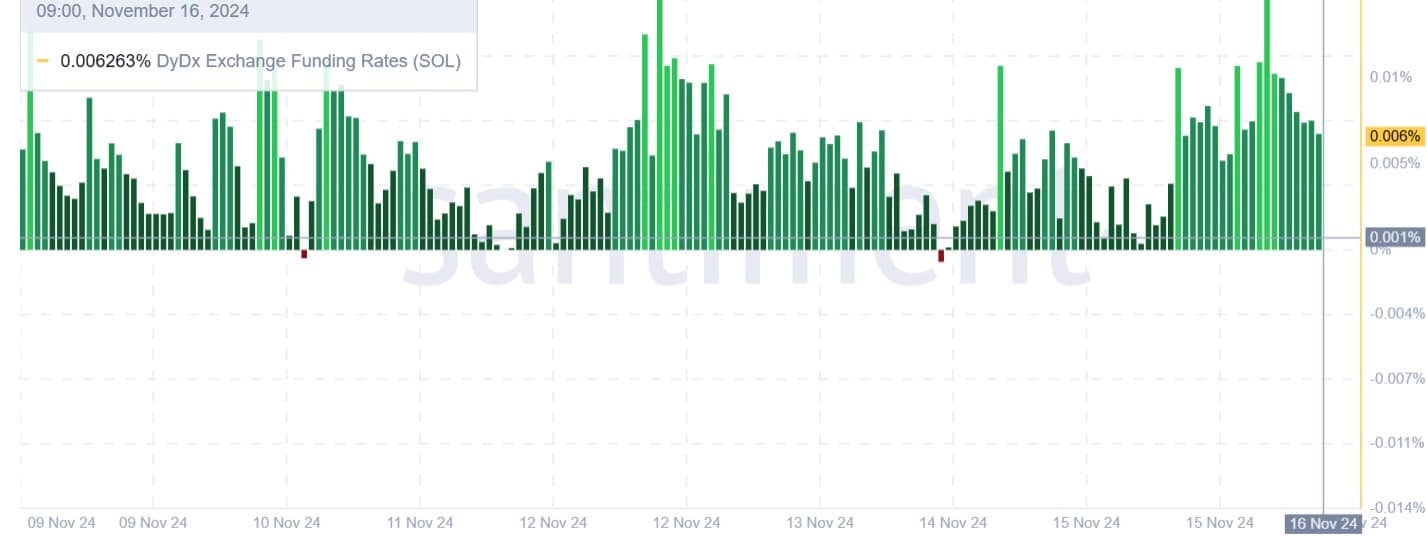

Source: Santiment

Demand for these long positions is further supported by the positive DyDx exchange funding ratio.

The same numbers have remained largely positive over the past week, suggesting investors are paying fees to hold positions during market downturns. These market trends are a sign of market confidence among investors.

What’s next for altcoins?

Solana’s open interest has hit a new high, suggesting that the market is currently overly bullish. Therefore, most investors are optimistic and expect prices to rise. Especially since these positions were largely long positions.

Considering these favorable conditions, SOL may record more profits on the price chart. If so, SOL will regain the $222 resistance level. A breakout here could see the altcoin find the next resistance at around $242.