- Ethereum continued to trade in the $3,000 price range.

- However, the ETH/BTC pair broke support for the first time since 2016.

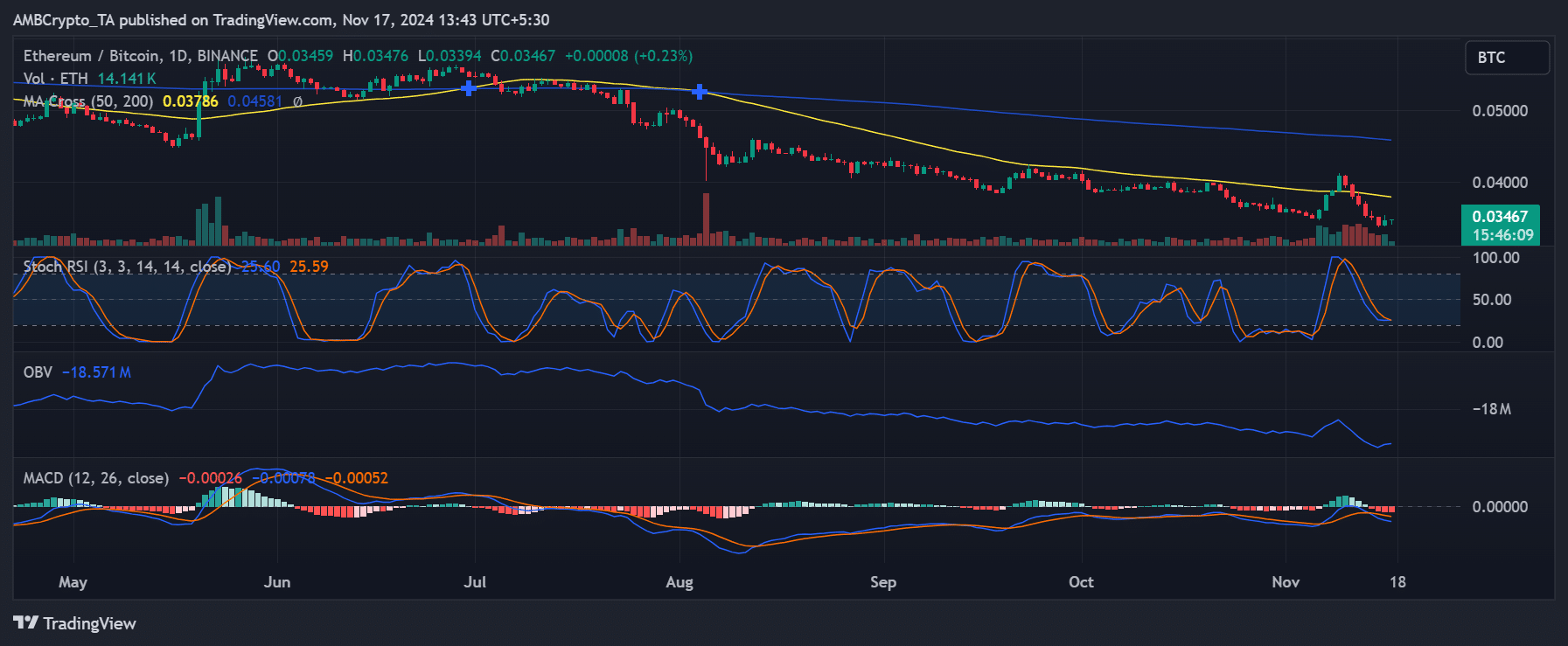

Ethereum (ETH)’s ongoing struggle against Bitcoin (BTC) continues to dominate market discussions as the ETH/BTC pair remains in a precarious position.

Recent data shows that Ethereum’s native token, ETH, is hovering around a critical support level for Bitcoin, while staking trends have shown continued inflows.

Charts provide insight into Ethereum’s trajectory and market health.

Ethereum test key resistance

Ethereum’s ETH/BTC pair has experienced a slight recovery from its recent downtrend, trading at 0.03469 BTC at the time of writing.

This follows a significant decline in ETH earlier this year, breaking above the 50-day moving average and 200-day moving average, solidifying a bearish crossover.

However, recent gains have pushed it back above 0.034, but at press time the 200-day MA was seen as a formidable resistance level at 0.0459 BTC.

Source: TradingView

Indicators such as MACD showed a bearish trend with its signal line still below zero, while Stochastic RSI pointed to oversold conditions, hinting at a potential relief rally.

On-Balance Volume (OBV) suggested muted momentum, further reinforcing the notion that ETH faces a serious challenge in regaining dominance over Bitcoin.

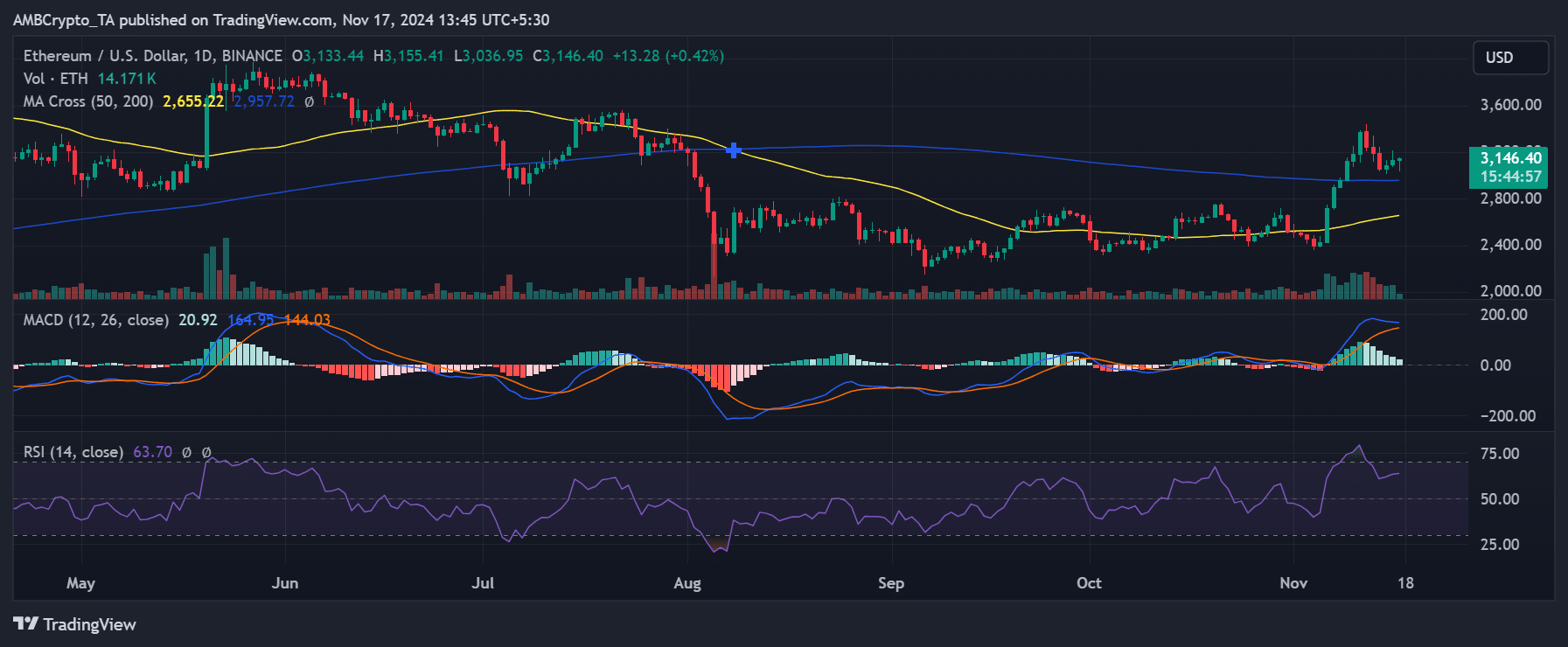

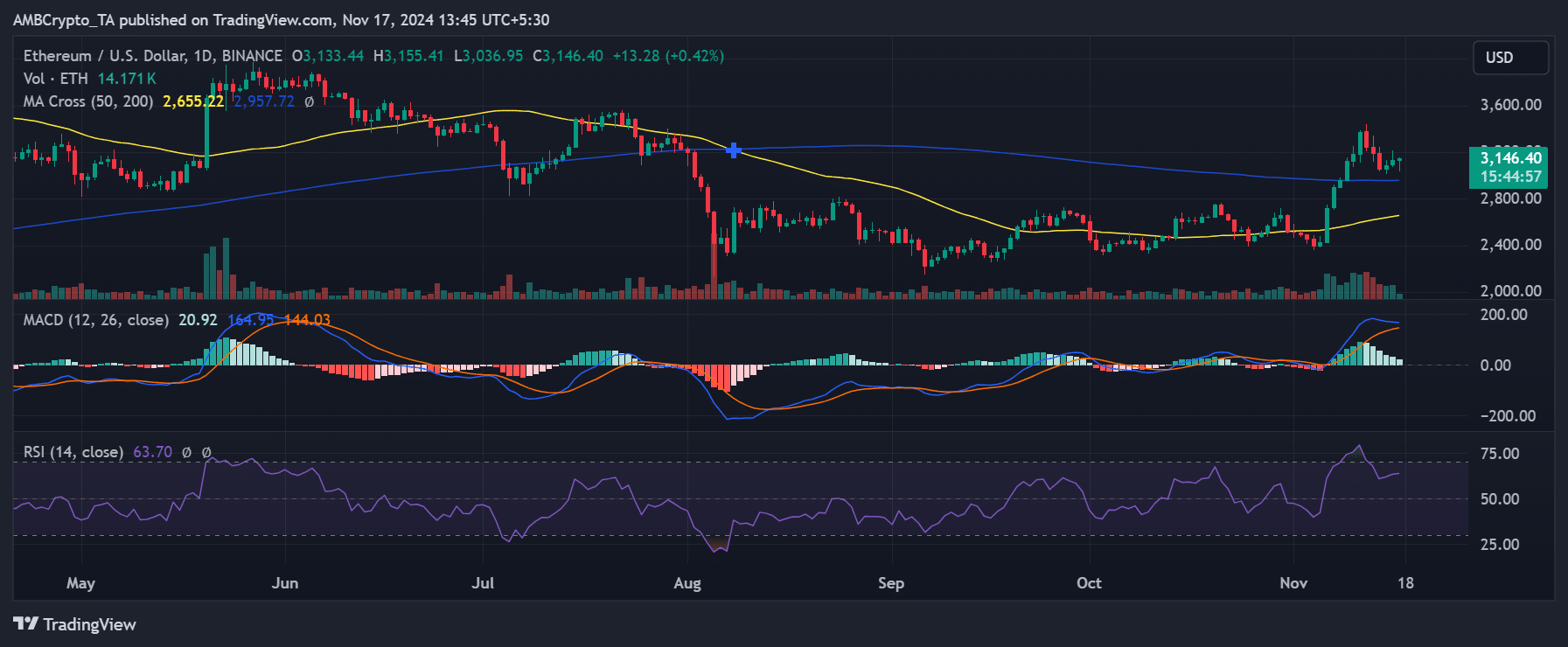

ETH/USD Trend: Bullish Momentum

In contrast to the struggles against Bitcoin, ETH/USD painted a more optimistic picture. Ethereum was trading at $3,147 at press time, having recovered from its 200-day moving average of $2,955.

The recent bullish crossover between the 50-day moving average and the 200-day moving average signaled a potential change in momentum, with a key resistance level around $3,200 being closely watched.

RSI remained near 71, indicating mild overbought, while MACD remained in a bullish zone, suggesting further upside.

Ethereum’s ability to hold above $3,000 will be critical to maintaining its upward trajectory in the coming weeks.

Source: TradingView

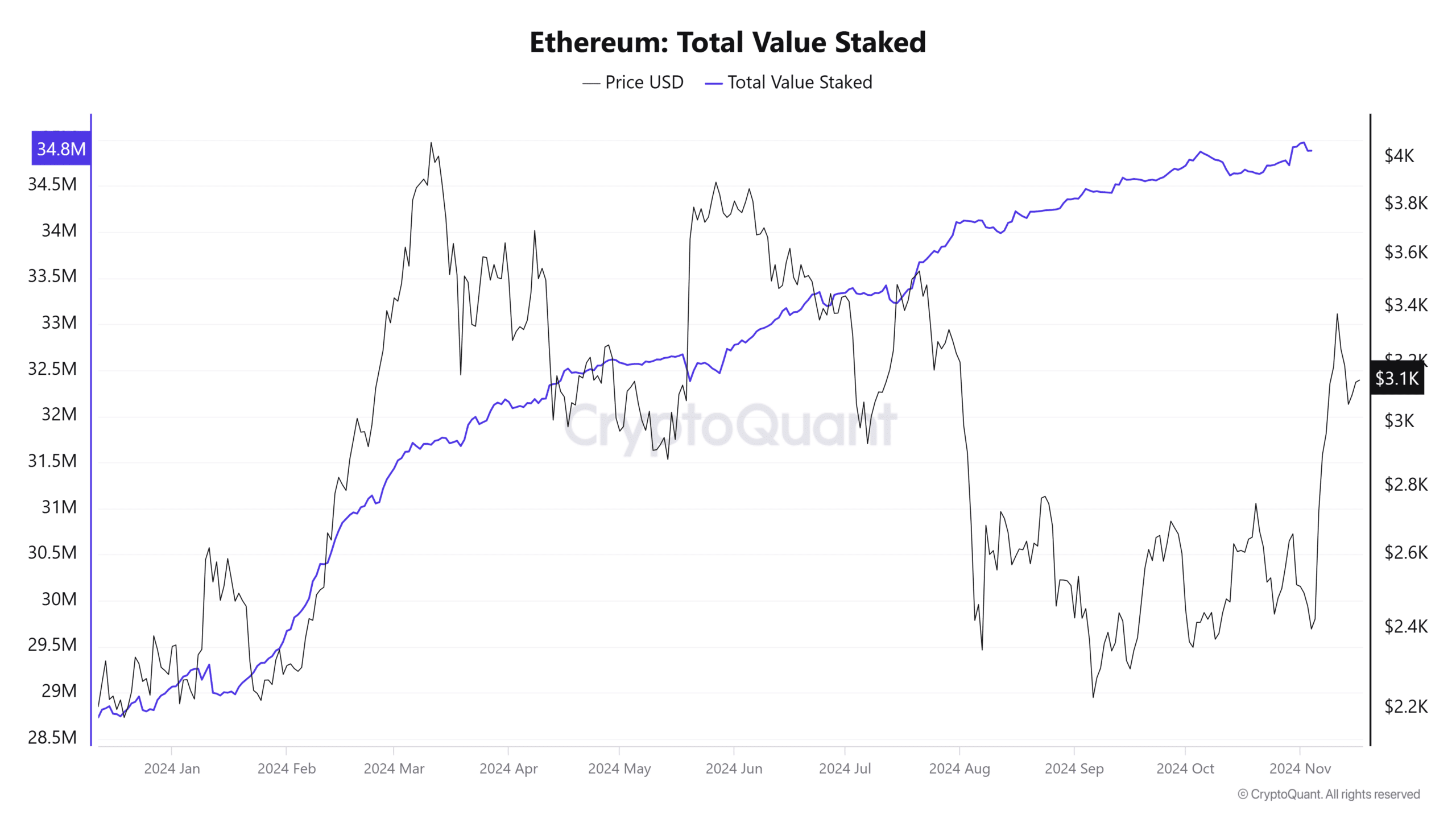

Ethereum’s TVL Still Bright

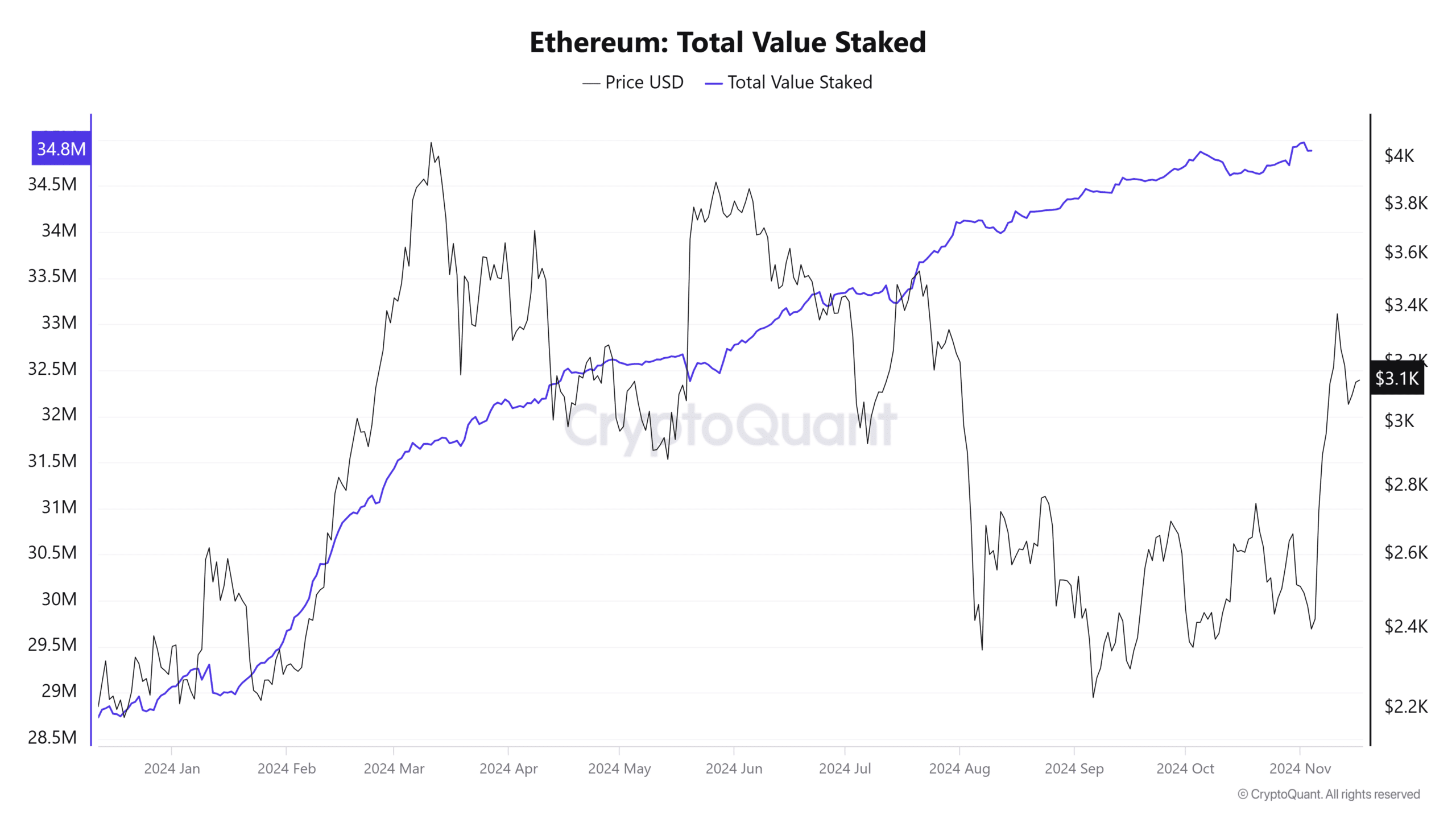

In terms of staking, Ethereum’s fundamentals remained solid. The total value staked on the Ethereum network reached an all-time high of 34.8 million ETH, garnering strong confidence among holders.

This indicator, combined with Ethereum’s press time price of $3,100, highlighted a steady increase in staking participation despite the lackluster performance against Bitcoin.

Source: CryptoQuant

A chart from CryptoQuant shows that staked ETH has continued to increase over the past year, even as Ethereum’s price has endured volatility.

This resilience could indicate long-term bullish sentiment towards the network, even if the ETH/BTC pair falters in the short term.

What’s next for Ethereum?

Broad market sentiment surrounding Ethereum is mixed. While the increase in total value staked shows investor confidence, the inability of the ETH/BTC pair to hold key levels raises concerns.

ETH’s progress will largely depend on its ability to regain strength against Bitcoin, especially as Bitcoin’s dominance continues to rise.

A break above the 0.045 BTC resistance is essential for Ethereum to regain its footing. Meanwhile, it remains important to watch the 0.033 BTC support in case of further declines.

Read Ethereum (ETH) price prediction for 2024-25

Ethereum’s immediate outlook remains clouded by its struggles against Bitcoin, but staking metrics and broader network fundamentals remain solid.

With the market eyeing a potential reversal in the ETH/BTC pair, Ethereum’s strong staking participation and USD’s strong performance could act as a lifeline, ensuring long-term viability amid near-term volatility.