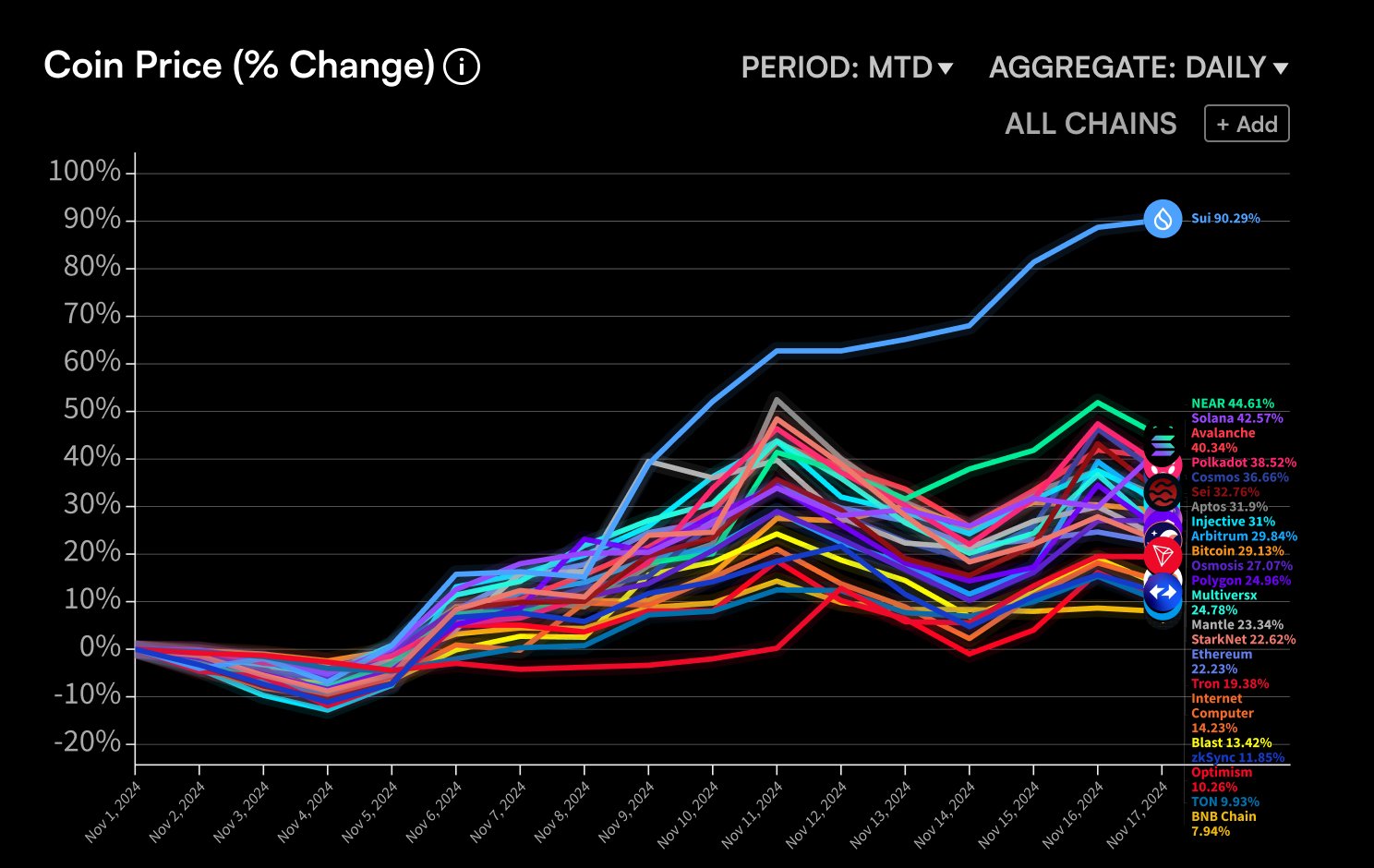

- SUI stood out in the cryptocurrency market in November with a 90% surge.

- Increasing activity and word of mouth can drive explosive growth.

November was a winning month for Sui (SUI) as it established itself as one of the most explosive performers in the cryptocurrency market.

Riding a wave of rising investor confidence, ecosystem development, and favorable market conditions, SUI’s price has surged more than 90% so far in November.

But what is driving this upward momentum other than price movements?

What factors are driving the surge in SUI?

Source: X

SUI’s massive price rise this month has captivated both retail and institutional investors.

This surge may be the result of a combination of ecosystem developments, heightened market sentiment, and potential institutional accumulation.

Recent partnerships and dApp integrations have amplified the usefulness of SUI, increasing interest in expanding the ecosystem.

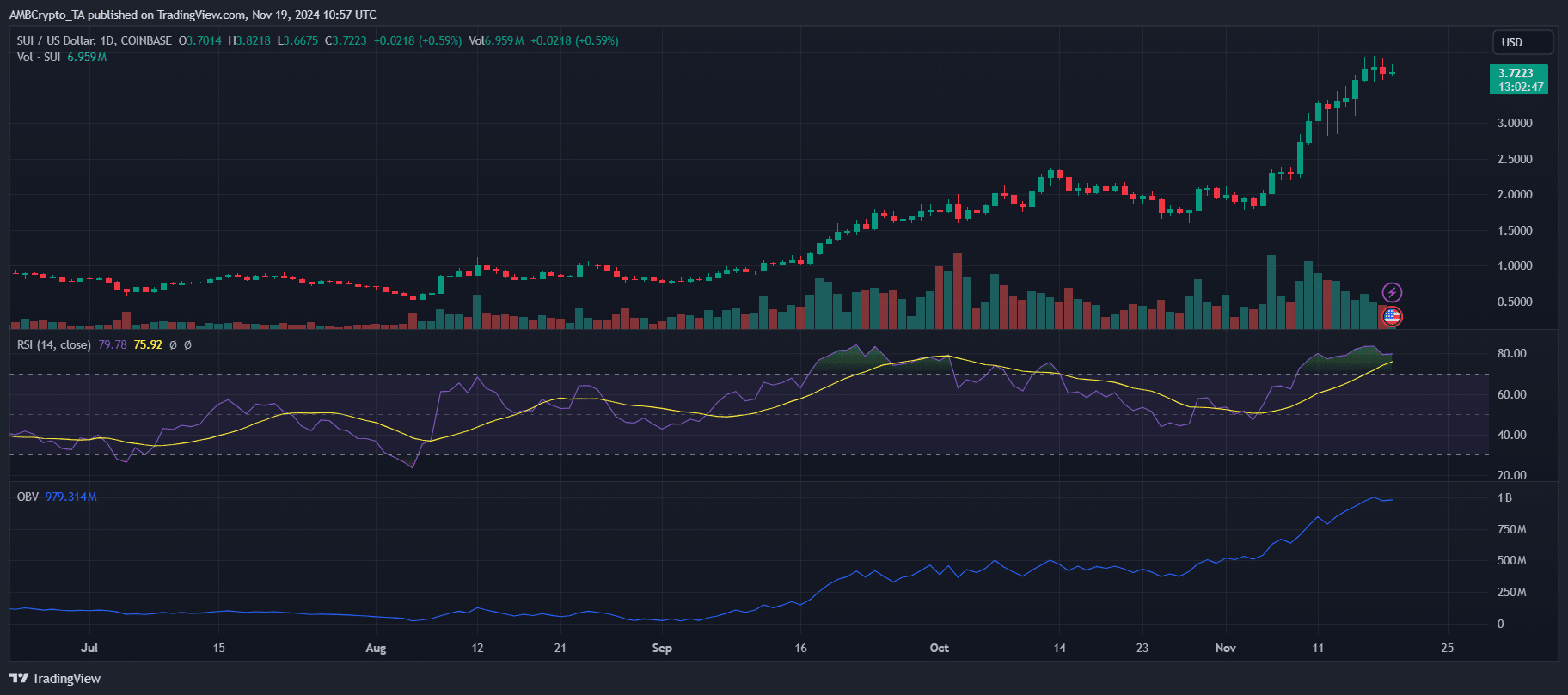

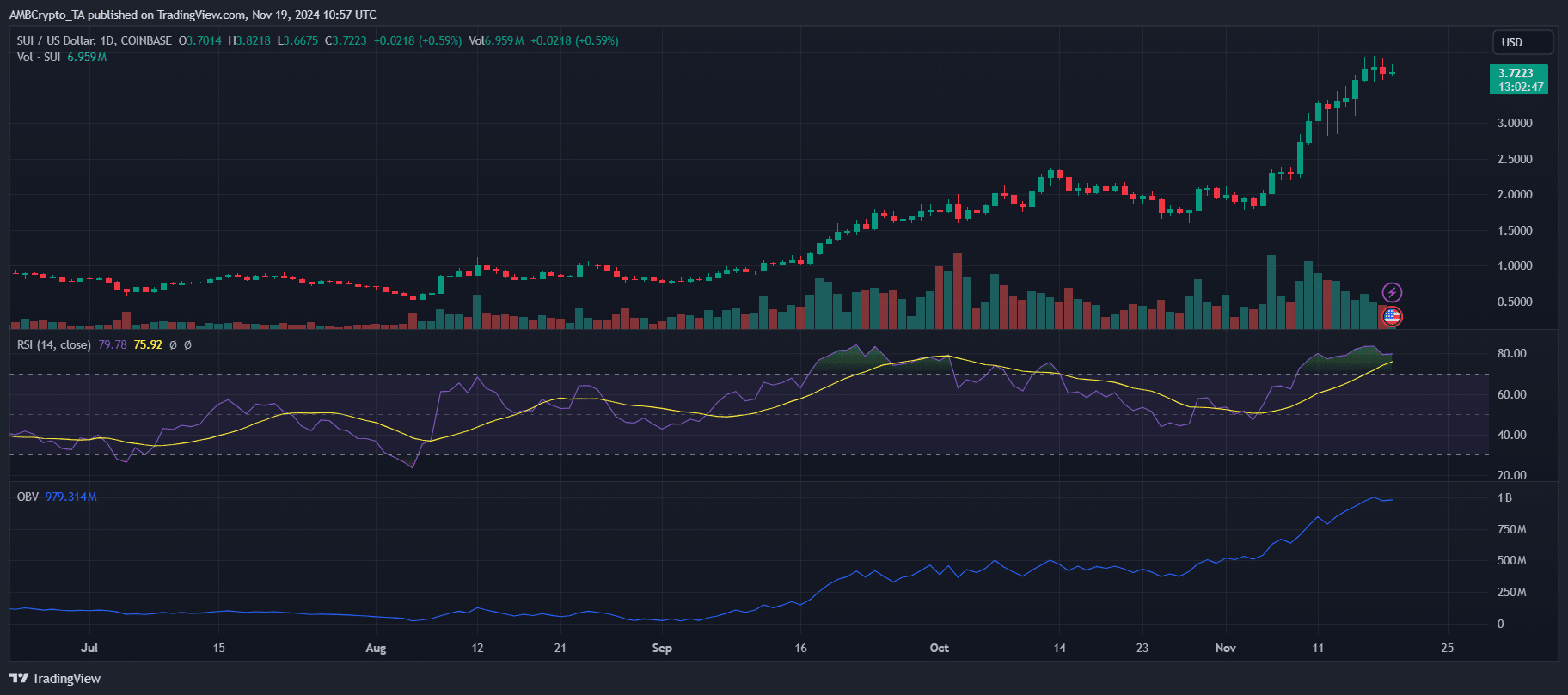

Source: TradingView

High trading volume means significant whale activity, which indicates long-term confidence. Meanwhile, retail investors are creating buzz on social media, further fueling demand.

However, this rally comes with risks as technical indicators such as the Relative Strength Index (RSI) have suggested overbought conditions.

Market watchers are keeping an eye on key resistance levels and potential profit taking. Despite the risks, SUI’s notable rise positions it as a token to watch in the coming months.

Source: SUUIVision

Meanwhile, the token’s daily active addresses increased rapidly in mid-November, peaking at over 900K on November 13 before settling near 650K on November 18.

This surge highlighted the explosive price rise of the token and, at the same time, increased user engagement.

With a total token supply of 10 billion and a circulating supply of 2.85 billion, SUI’s current supply dynamics have created a scarcity effect that can drive price momentum.

The relatively low circulating supply compared to the total highlights the potential for controlled token distribution in the future.

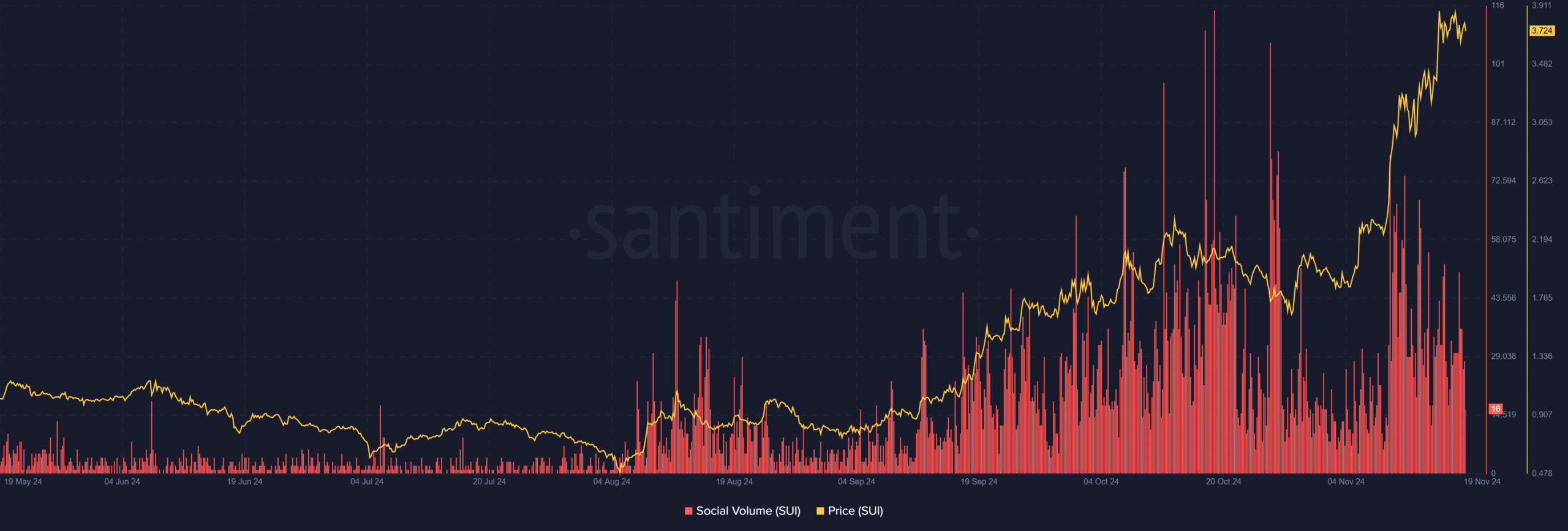

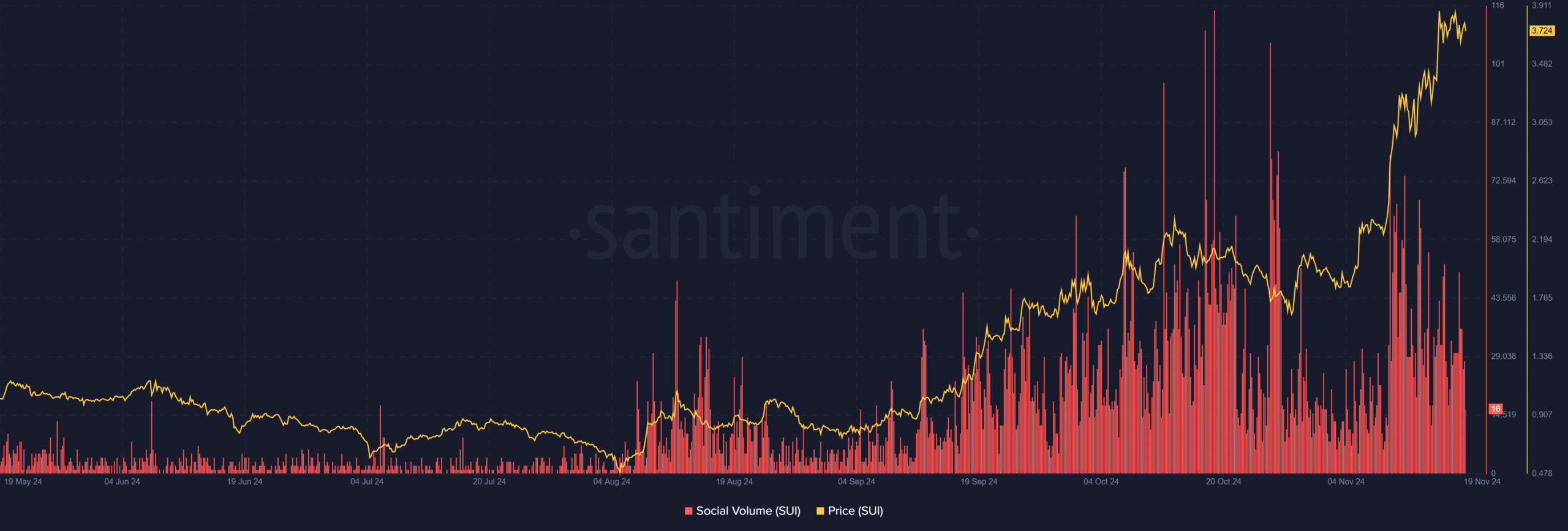

Source: Santiment

SUI’s social sentiment has soared along with its price, which is reflected in the dramatic surge in social volume.

This surge indicates increased buzz and engagement across social platforms due to investor excitement and speculation.

The correlation between heightened social activity and price movements suggested retail sentiment was the main catalyst behind the token’s November rise.

But continued growth will depend on whether this enthusiasm translates into long-term adoption and usefulness.

The beginning of long-term growth?

SUI’s explosive performance in November undoubtedly put it in a position to stand out. However, it remains unclear whether this momentum is sustainable.

Indicators indicate strong near-term enthusiasm, but sustaining these levels will depend on continued ecosystem growth and adoption.

With only 28.5% of total supply in circulation, SUI has room to strategically manage its supply dynamics to potentially support long-term value.

Read Sui (SUI) price forecast for 2024-2025

For tokens to outperform speculative rallies, the ecosystem must provide consistent utility and innovation that can attract the attention of retailers and institutions alike.

Current trends show promise, but the true test will be whether SUI can maintain its trajectory amid potential market corrections and broader sentiment shifts.