- Solana whales recently purchased 100K SOL worth $23.86M.

- Solana recorded stablecoin inflows of $311 million in the last 24 hours, its largest ever.

Solana (SOL) held the $230 support level, up 2.01% over the last 24 hours. This follows increased volatility as Bitcoin hit an all-time high of $99,000.

Meanwhile, Solana’s 24-hour trading volume surged 9.41%, reaching $7.31 billion. Analysts are expecting further strength in ‘Pumpcember’, but questions remain: can do Solana Is the $400 price achievable?

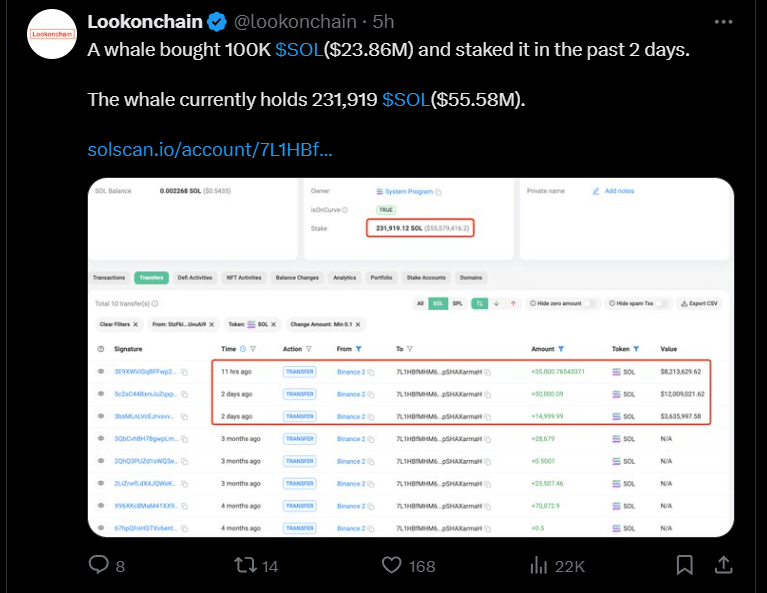

Solana Whale Staking Continues

According to blockchain analytics platform Lookonchain, Whale recently purchased 100K SOL worth $23.86 million and staked it within two days.

This whale’s trade shows it strategically accumulating and staking Solana tokens to maximize rewards.

Whale’s current holdings total 231,919 SOL (worth $55.58 million), demonstrating significant confidence in Solana’s long-term potential.

Source: X

The data shows that transactions primarily originated from Binance accounts and were transferred to the whale’s staking address.

Notably, the most recent transfer of 50,000 SOL worth $11.8 million was completed a few hours ago as of this writing.

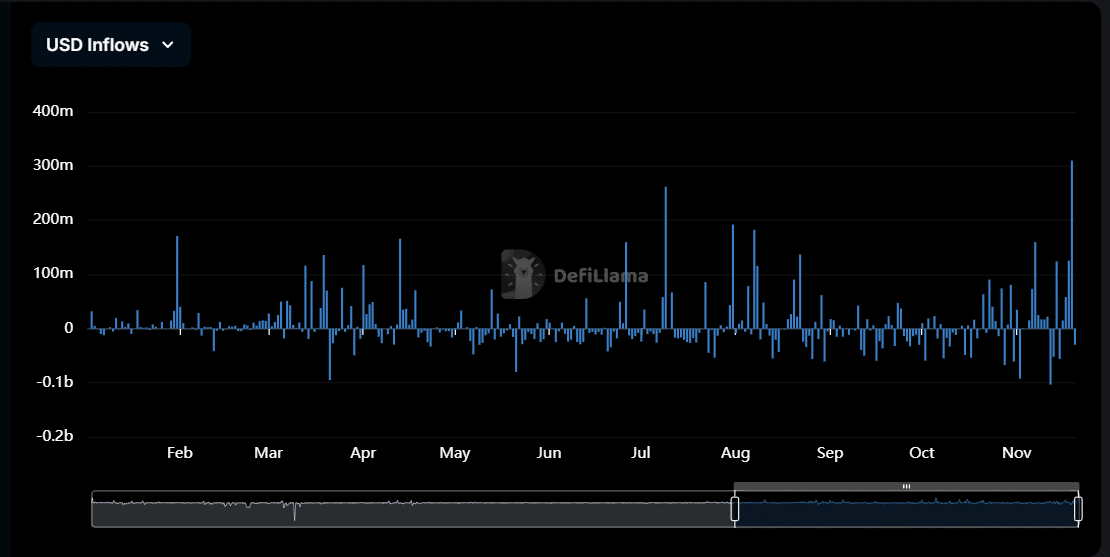

Solana records record stablecoin inflows worth $310 million

Solana has experienced unprecedented stablecoin inflows, with $310 million flowing into its ecosystem over the past 24 hours. This marked the largest daily inflow in history.

This surge brings Solana’s overall stablecoin market cap to $4.481 billion, a whopping 15.67% increase over the past seven days.

Solana’s stablecoin landscape continues to be dominated by USDC, which accounts for 72.07% of the market.

Source: DefiLlama

This significant inflow highlights growing confidence in the Solana ecosystem, driven by growing adoption and the network’s robust infrastructure.

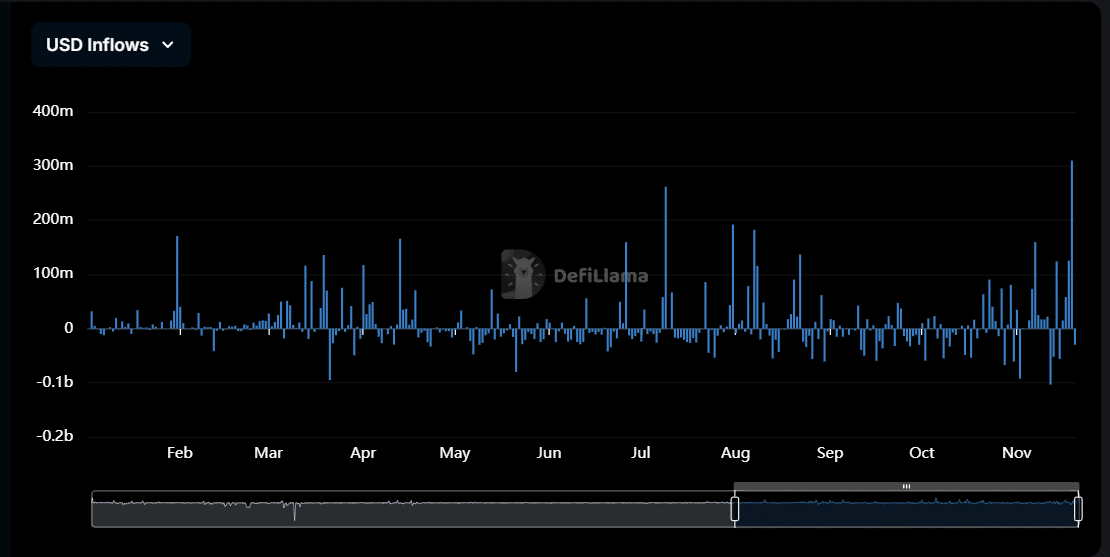

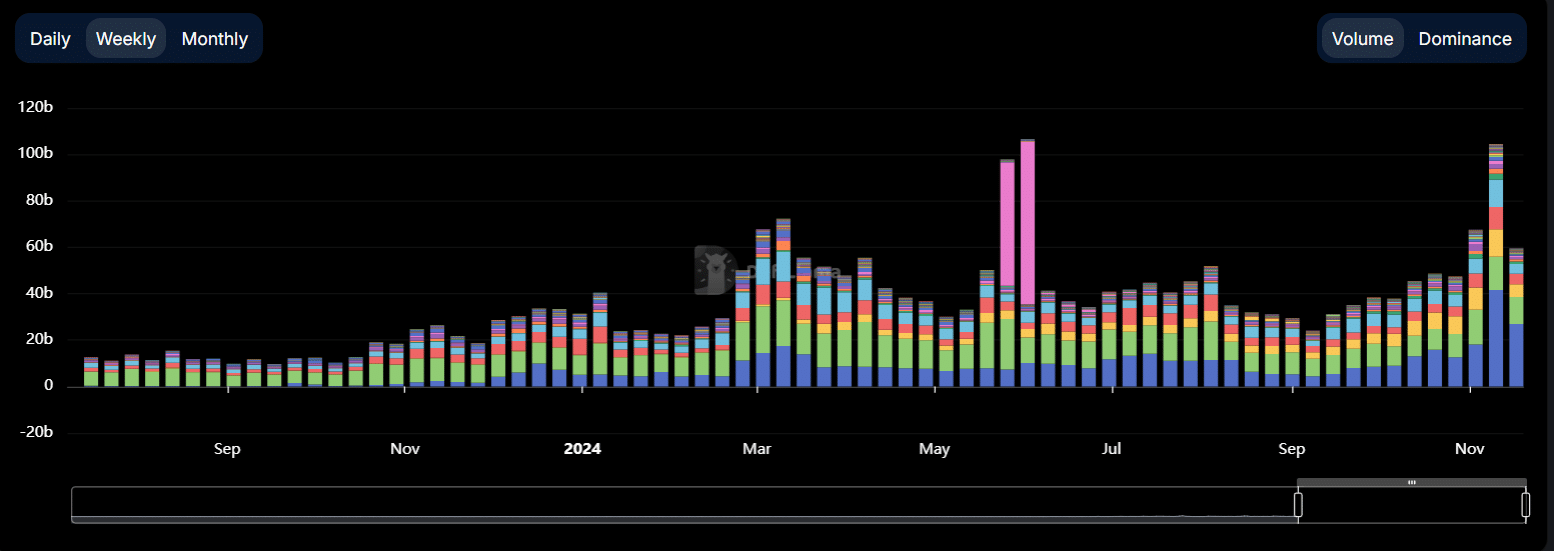

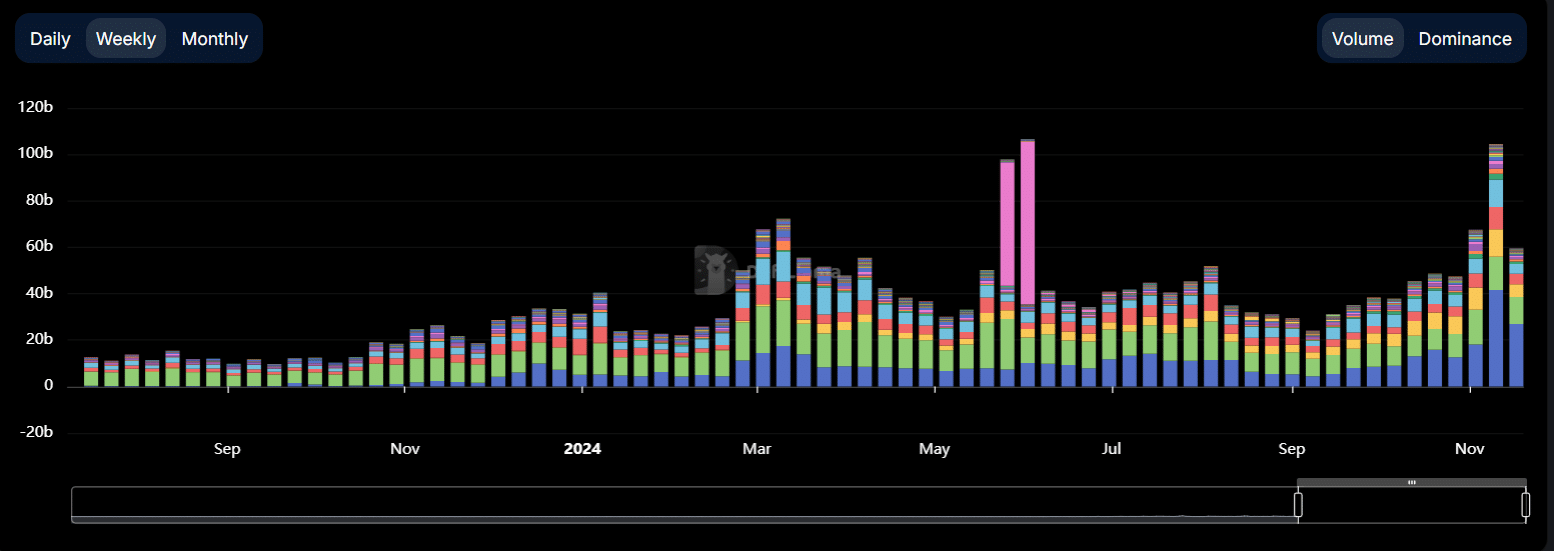

SOL has +300% DEX volume compared to ETH.

Solana Decentralized exchange (DEX) trading volume has almost set a record, surpassing Ethereum Layer-1 for three consecutive days. 300% more volume.

Source: DefiLlama

The chart shows a significant surge in activity for Solana, with stacked bars showing consistently higher DEX volume than other networks.

This consistent dominance demonstrates strong adoption of the Solana ecosystem based on its high speeds, low fees, and increasing liquidity.

The dramatic increase in DEX trading volume highlights Solana’s growing role as a leader in the DeFi space and further strengthens its competitive advantage over Ethereum layer-1.

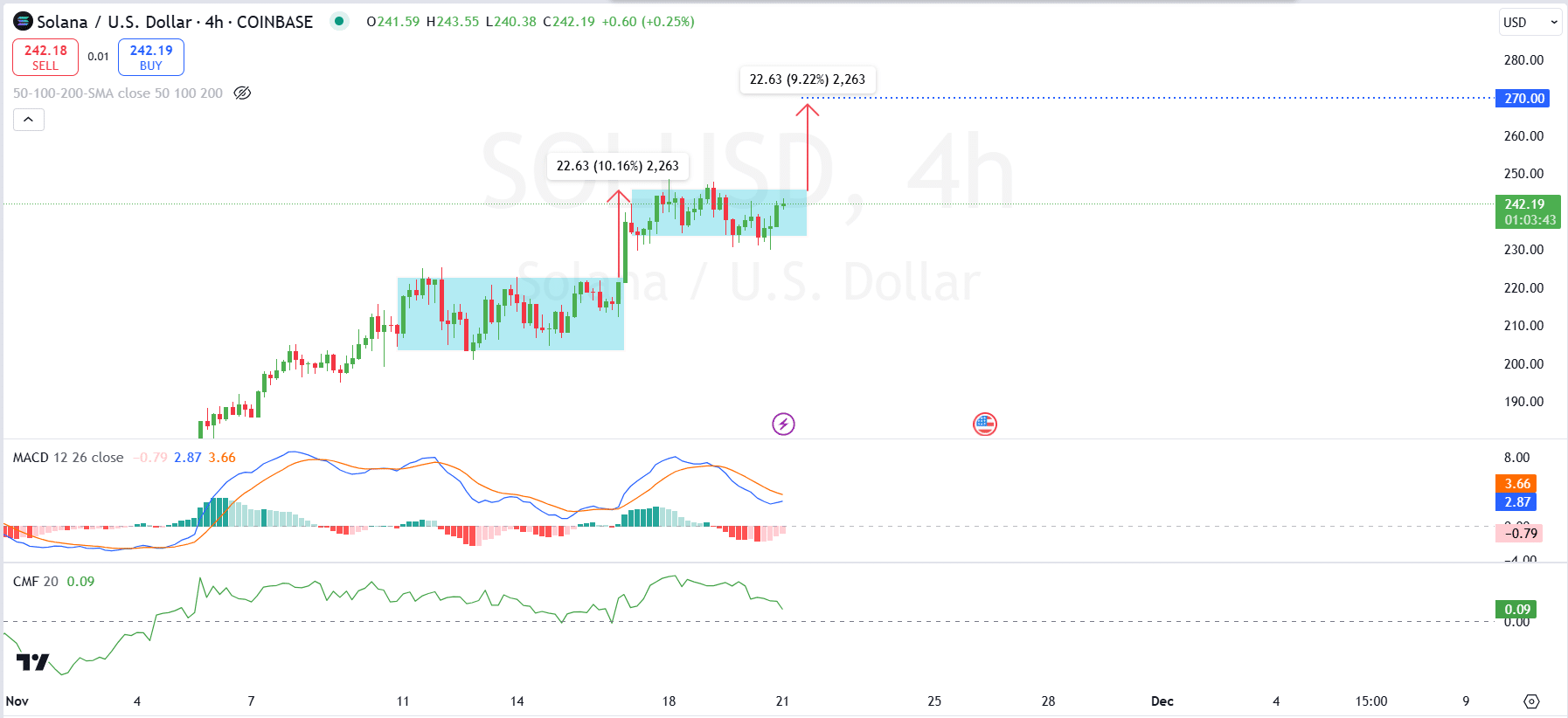

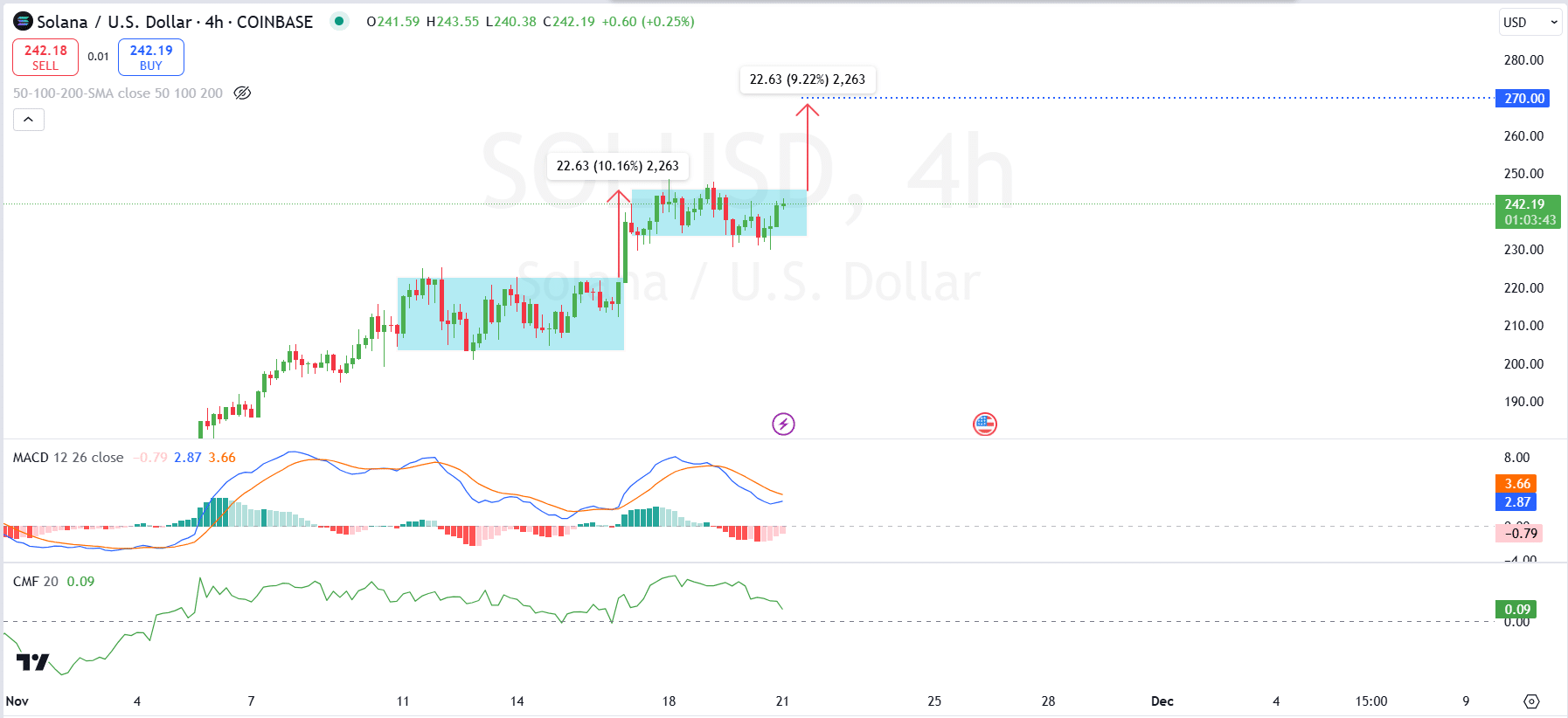

Next $270 for SOL’s 4-hour breakout.

Solana is trading at $242.79 at press time, maintaining a steady upward trajectory with major support at $234 and major resistance at $250.

Prices recently surged more than 10% before stabilizing out of a consolidation phase. A successful break above $250 could push the price towards the next resistance level at $270, extending the previous breakout.

Source: TradingView

The MACD indicator shows a bearish crossover with the MACD line falling below its signal line, indicating a slowdown in momentum or a possible short-term retracement.

Read Solana (SOL) price prediction for 2024-2025

However, the narrowing histogram suggested that bearish pressure was waning and there was room for a bullish reversal.

Meanwhile, Chaikin Money Flow (CMF) remained positive at 0.10, reflecting steady net capital inflows and continued buying interest.