- According to analysts, Ethereum’s price surge and transaction speed signal the start of altcoin season.

- Chainlink is showing strong growth with increasing active addresses and public interest, indicating bullish sentiment.

Ethereum (ETH) has recently made notable gains, demonstrating its strength as the second-largest cryptocurrency by market capitalization. Over the past 24 hours, ETH has surged nearly 10%, reaching a trading price of $3,374 at the time of writing.

While still about 30% below the all-time high of $4,878 recorded in 2021, the recent rally portends potential bullish activity in the broader altcoin market.

Amid these achievements, CryptoQuant analyst Mac.D. highlighted A post on the QuickTake platform announces the start of altcoin season. Analysts pointed to Ethereum’s circulation speed and increased transactions as indicators of this rally.

Altcoin season begins

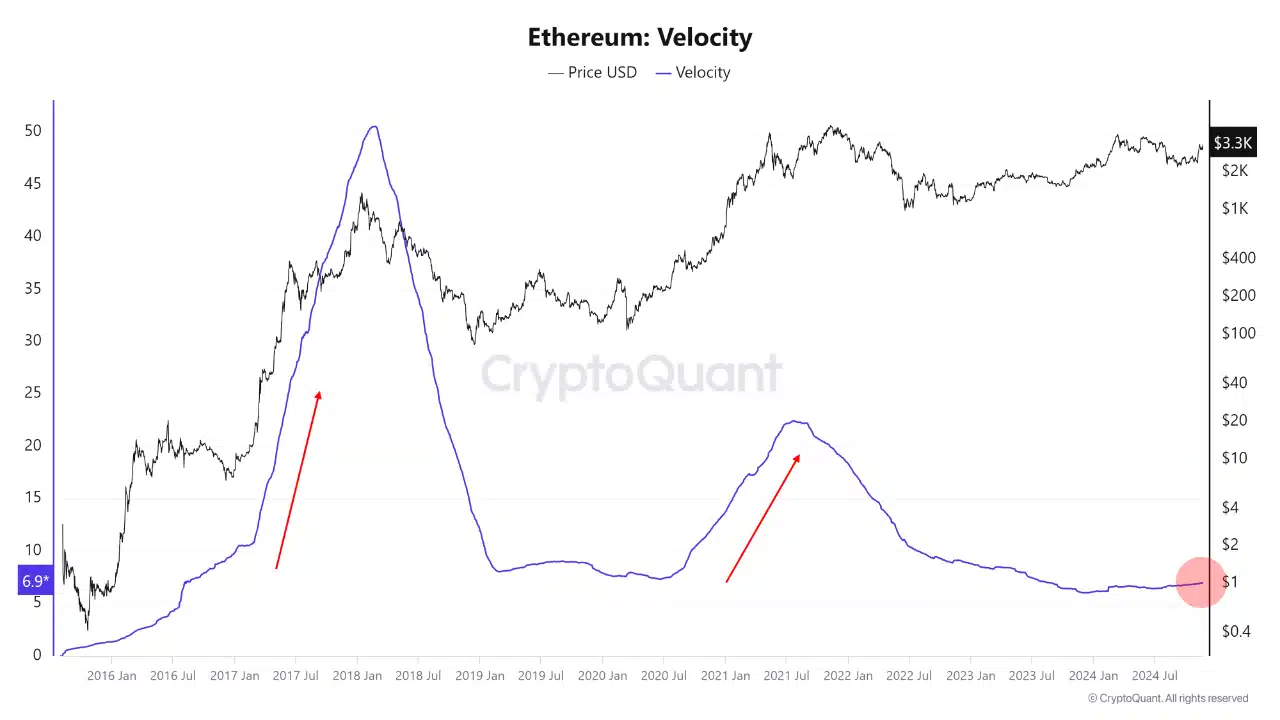

Velocity, which measures how quickly coins circulate in the market by dividing the annual volume of coin movement by the total supply, has historically risen during altcoin market rallies.

Source: CryptoQuant

Ethereum’s role as a major collateral asset remains strong despite its low velocity, currently at around 7 times the total supply. institutional investor It is expected to play a pivotal role.

The analyst highlighted that the rise in ETH price could stimulate DeFi liquidity and confirm the start of altcoin season.

Ethereum’s recent gains occur in the context of a broader story. Bitcoin has surpassed Ethereum in its recent rally, but Ethereum’s role as the backbone of DeFi and top choice for institutional collateral could lead to significant leverage.

However, challenges such as competition from faster and cheaper blockchain networks such as Solana, Tron, and Aptos highlight the obstacles that Ethereum must overcome. However, as Ethereum’s transaction growth and speed improves, it is expected to benefit the altcoin ecosystem by boosting liquidity creation.

LINK as a case study

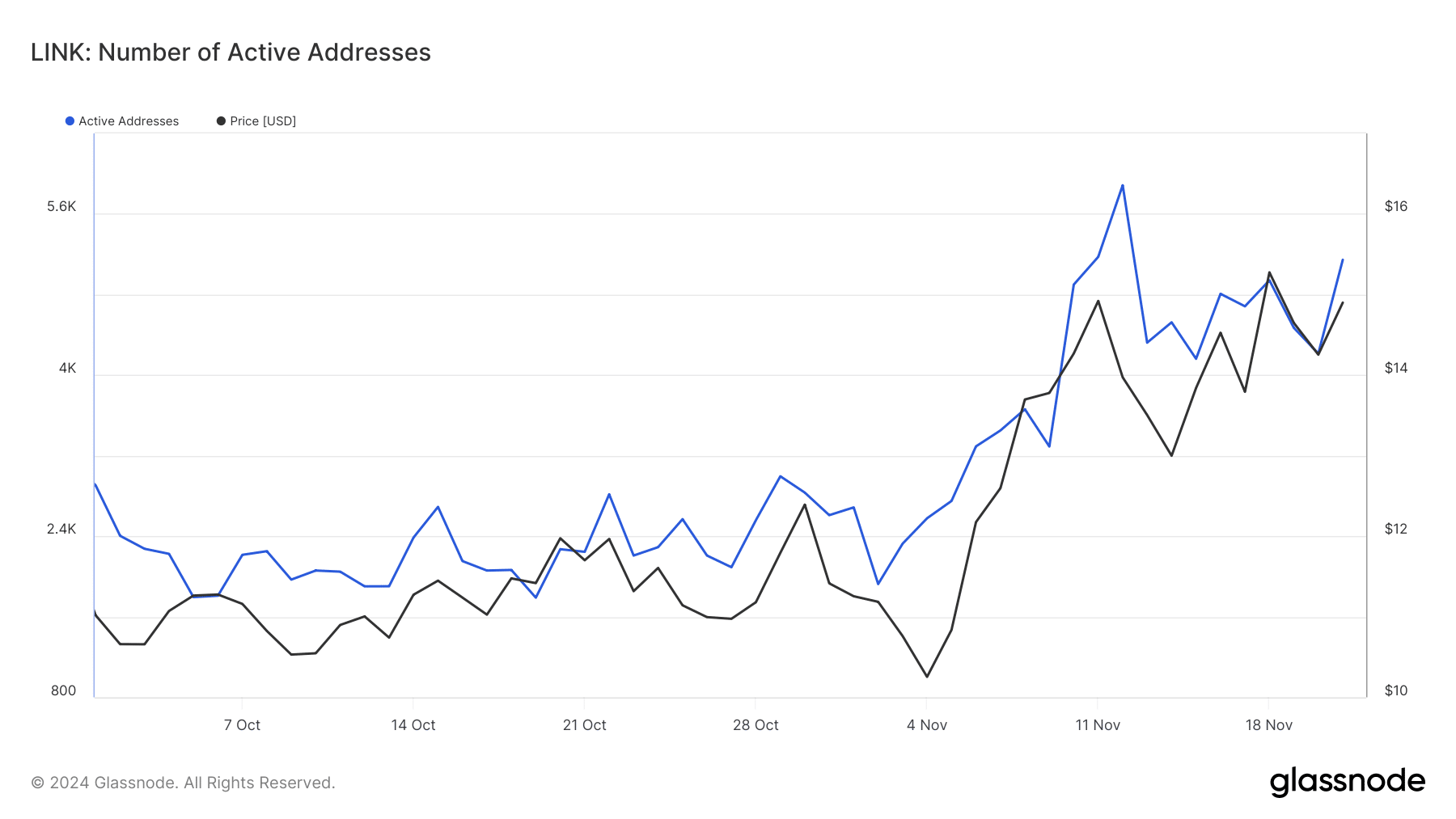

A closer look at one of the popular altcoins, Chainlink, supports the altcoin season thesis. LINK rose 16.6% last week, reaching a trading price of $15.26.

This growth coincides with increased activity on Ethereum and suggests broader altcoin momentum. Key indicators support this case. LINK’s active addresses, a measure of retail interest, are rapidly increaseAccording to Glassnode, it increased from less than 2,000 in October to more than 5,000 by November 21.

Source: Glassnode

Read Ethereum (ETH) price prediction for 2024-2025

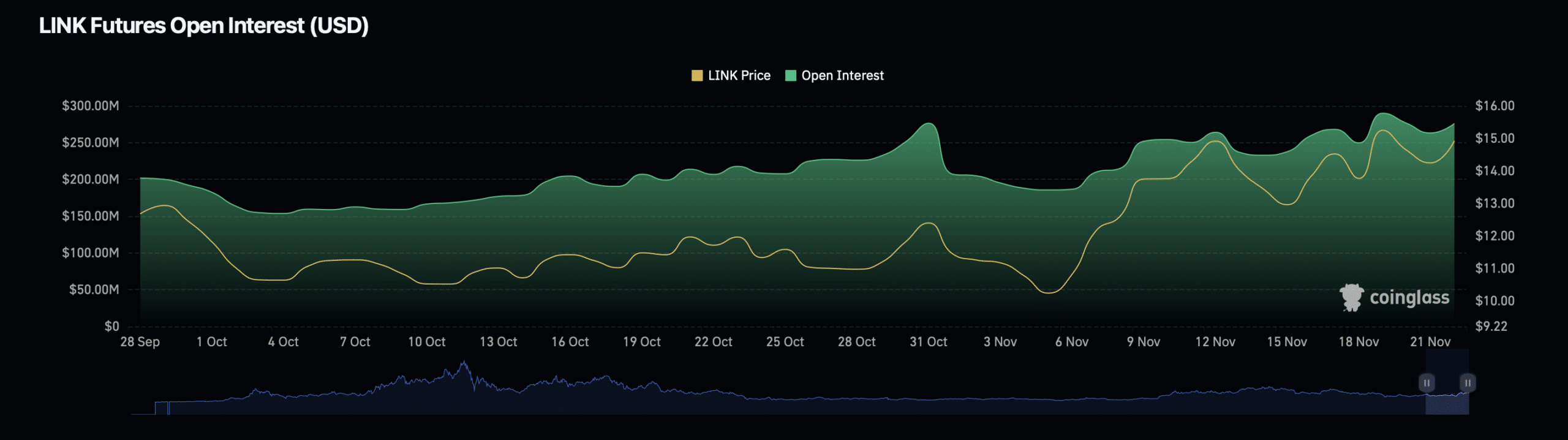

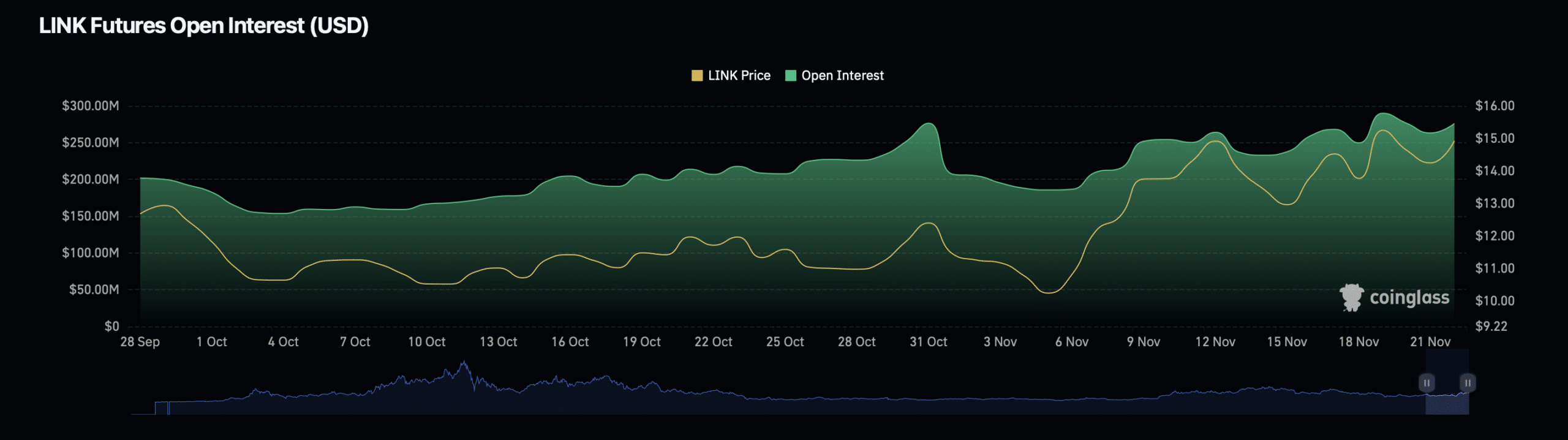

Chainlink’s derivatives further strengthen the case for altcoin season data It also shows bullish signs. According to data from Coinglass, LINK’s open interest has increased by 7.76% and is currently valued at $294.88 million.

Source: Coinglass

Additionally, LINK’s open interest increased by 0.86% to $726.97 million. These indicators suggest increased investor activity and confidence in LINK’s near-term performance.