|

Top news of the week

Solana ETF regulatory filings abound as Gensler sets departure date.

Cboe BZX Exchange filed four 19b-4 filings on November 21 for asset managers to list the Solana cash exchange-traded fund (ETF). On the same day, U.S. Securities and Exchange Commission Chairman Gary Gensler announced that he would resign in January.

If approved, the spot Solana ETF issued by Bitwise, VanEck, 21Shares and Canary Capital will be listed on the Cboe BZX Exchange.

19b-4s notifies the SEC of rule changes proposed by self-regulatory organizations, such as financial regulators or stock exchanges.

This differs from the Form S-1 registration statements that VanEck and 21Shares filed for the Solana ETF as early as late June and that Canary Capital filed four months later, on October 30.

FTX provides creditor and customer refund payment schedules.

FTX Bankruptcy Trust has updated its creditor and former customer refund schedule, which should be finalized in January 2025, with first payments expected in March 2025.

According to a November 21 announcement from the collapsed cryptocurrency exchange, FTX plans to prepare refund payments in early December with a distribution agent to handle the payment process and manage the customer payment portal. John J. Ray III, interim CEO overseeing the FTX bankruptcy, said:

“We are committed to reaching an agreement with our distribution agents and returning proceeds to our creditors and customers as quickly as possible, while continuing to take steps to maximize our recovery.”

SEC Chairman Gary Gensler resigns

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler, known for his hard-line stance on cryptocurrency regulation, will leave the SEC on January 20, 2025, the securities regulator said in an announcement on November 21.

According to the announcement, Gensler will leave the agency the day cryptocurrency-friendly President-elect Donald Trump begins his second term as president.

“It has been the honor of a lifetime to serve on behalf of and alongside the American people and ensure that our capital markets remain among the best in the world,” Gensler said in a statement.

In July, Trump pledged to fire Gensler in a bid to lure cryptocurrency enthusiasts ahead of the US presidential election on November 5.

The president has the power to select a chairman to lead the SEC, but he cannot force the commissioner to leave the SEC entirely, as Gensler planned in January.

MicroStrategy completes a $3 billion fundraising to buy more Bitcoin as MSTR falls 25%.

MicroStrategy has completed a $3 billion public offering of 0% convertible senior notes due December 2029 and plans to use some or all of the proceeds to purchase more Bitcoin.

The business intelligence company announced the completion on Nov. 21, with its stock price falling more than 25%, according to Google Finance data.

The convertible senior notes were offered at a 55% premium, with an implied exercise price of approximately $672. This is a predetermined price at which option holders can buy or sell shares of MicroStrategy’s Class A common stock.

A 0% senior convertible bond means no regular interest payments are made to bondholders. These convertible bonds are sold at a discount and will mature at par if not converted before the maturity date.

Coinbase CEO to meet with Trump to discuss appointments — WSJ

Brian Armstrong, CEO of U.S.-based cryptocurrency exchange Coinbase, calls out Donald Trump as President-elect Donald Trump continues to release staff recommendations for heads of his administration and government departments. It is reported that he will meet with Trump.

According to a report by the Wall Street Journal (WSJ) on the 18th, President Trump was scheduled to meet privately with Armstrong to discuss personnel matters. Coinbase’s CEO said the cryptocurrency exchange would be ready to work with the Trump administration ahead of the U.S. election, although he does not appear to have donated directly to the Republican’s 2024 campaign or the political action committees (PACs) that directly support him.

It is unclear whether Armstrong or Coinbase employees could potentially have a role in the next U.S. presidential administration.

winners and losers

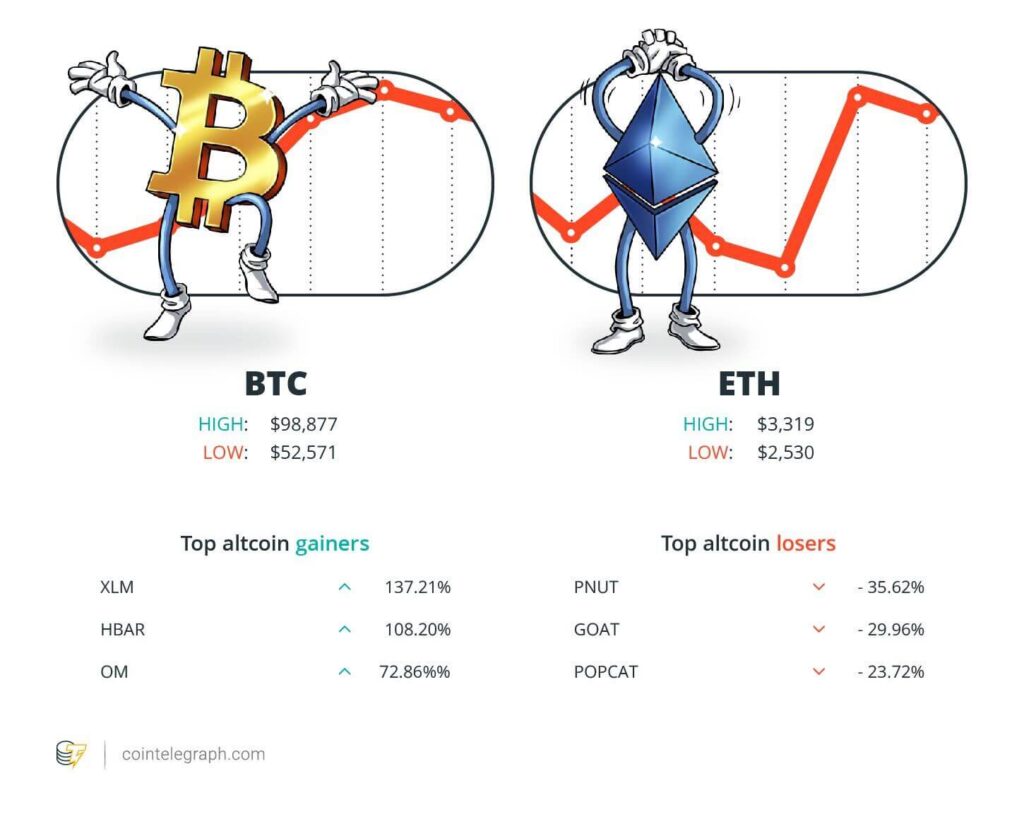

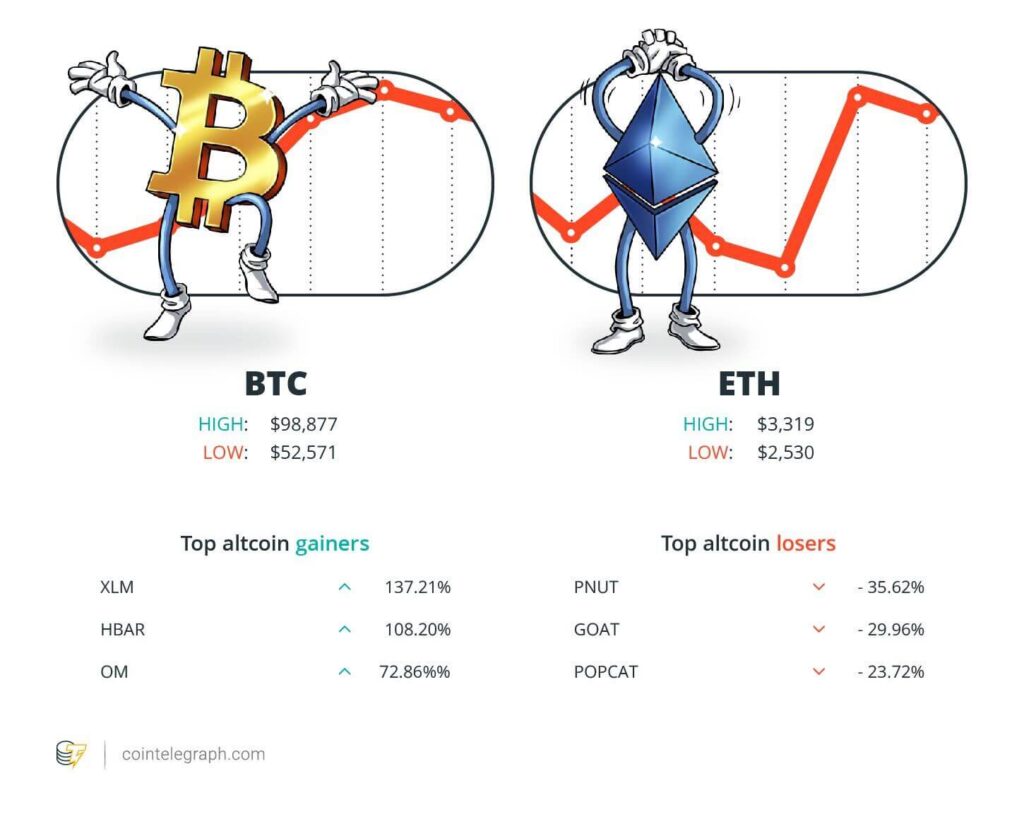

Bitcoin this weekend (BTC) It’s in $98,877; ether (ETH) to $3,319 and XRP to $1.47. The total market capitalization is $3.31 $1 trillion, according to CoinMarketCap.

Among the top 100 cryptocurrencies, the top three altcoin gainers this week are Stellar. (XLM) 137.21%, Hedera (HBAR) 108.20% and Mantra (for) 72.86%.

The top three altcoin losers of the week are Squirrel Peanuts. (PNUT) 35.62%, Capricornus maximus (chlorine) 29.96%, Popcat (SOL) (Pop Cat) 23.72%. For more information on cryptocurrency prices, read Cointelegraph’s market analysis.

most memorable quotes

“The good thing about memecoin is that it gets people who are in (crypto) primarily for speculative reasons and who think very short-term. It attracts those people.”

jeffrey jillinSky Mavis Co-Founder

“In this rapidly changing cryptocurrency environment, we cannot overemphasize how important federal judges and willing partners are to resolution.”

Adam MoskowitzManaging Partner, Moskowitz Law Firm

“These options are almost certainly part of the move toward new Bitcoin all-time highs today.”

James SeiffartETF analyst at Bloomberg Intelligence

“I chose the easy way, the cowardly way, rather than doing the right thing. I will spend the rest of my life trying to make amends.”

Gary WangFTX Co-Founder

“As long as there is mistrust from retail traders, whales can continue pumping out cryptocurrencies with little resistance.”

st tlyOn-chain analytics company

“Although the SEC plausibly asserted a theory of securities violations against Kraken, only discovery can establish whether Kraken’s sales, trading and exchanges actually met all Howey factors.”

William OrrickSenior U.S. District Judge for the Northern District of California

Predictions of the Week

Will Bitcoin go back to $90,000 next? Traders have mixed opinions regarding the probability of BTC price falling.

Bitcoin faced a serious challenge of breaking the $100,000 mark on November 22, with $300 million of selling liquidity blocked.

BTC prices continued to decline at the opening bell on Wall Street, according to data from Cointelegraph Markets Pro and TradingView.

Also read

characteristic

Tokenizing music royalties into NFTs could help the next Taylor Swift.

characteristic

Should we ban ransomware payments? It’s an attractive but dangerous idea.

Earlier, the journey towards the key six-figure mark ended in defeat as sellers lined up to prevent the BTC price from going higher. This is a general characteristic of Bitcoin at a key psychological level.

“FireCharts shows a massive Bitcoin selling wall compressed between the $99.3,000 – $100,000 range.” Trading resource Material Indicators confirms this in its latest post about X.

Others have considered where a potential deeper price retracement could end up, with popular household name trader Crypto Chase eyeing $90,000 as what he calls the “optimal scenario.” Crypto Chase explained that this “washout” will be “healthy price action” that will continue beyond $100,000.

Fellow pseudonym trader CJ had a higher target, focusing on the mid-$90,000 range.

FUD of the week

Korea Delio declares bankruptcy with $1.75 billion in asset losses

According to multiple domestic media reports, Delio, a domestic virtual asset deposit platform, was declared bankrupt by a Seoul court on November 22. Delio, which owes customers 245 billion won, stopped withdrawals last year.

Delio enters liquidation procedures. Customers can make claims until February 21, 2025, and the first meeting of creditors is scheduled to take place on March 19, 2025. According to the report, a court official said:

“The debtor leased and entrusted the management of customer-deposited virtual assets to a management company, and a significant portion of them were deposited and managed in the FTX account.”

Coinbase scammer claims to be making $50,000 a week by targeting cryptocurrency CEOs.

Crypto phishing scammers appear to be making five-figure weekly income by posing as Coinbase support and using leaked data to target senior cryptocurrency executives and software engineers.

Nick Neuman, CEO and co-founder of Bitcoin self-storage solutions provider Casa, recently received a call from a “Coinbase-backed” scammer, and “after I decided to turn the tables on him and ask him if he existed, I found out more than I bargained for.” He said. “A fraudster.”

“We make at least five figures a week. Two days ago it hit $35,000. “We do it for a reason: to make money.” When asked how much he earned, the conman replied:

Also read

characteristic

Why are cryptocurrency fans obsessed with micronation and seasteading?

characteristic

NFT collapse and monster egos emerge at new Murakami exhibition

Neuman posted this conversation to

The United States has indicted five people in an $11 million cryptocurrency hacking scheme linked to the ‘Scattered Spider’.

U.S. prosecutors have charged five people with being part of a group that hacked dozens of companies and individuals, stealing $11 million in cryptocurrency and sensitive information.

The U.S. Attorney’s Office for the Central District of California said on November 20 that the defendants sent SMS phishing links or SIM-swapped individuals and employees of certain companies to steal login credentials for work or cryptocurrency exchange accounts.

Court documents seen by Cointelegraph detail at least 29 victims of private cryptocurrency theft. Prosecutors allege one victim was robbed of $6.3 million worth of cryptocurrency after having her email and wallet hacked.

Featured Magazine Articles of the Week

Cryptocurrency will grow this much in 4 years. ‘No one can stop it’: Kain Warwick, Infinex

Kain Warwick said Infinex and other cryptocurrency platforms should adopt the Uber model and become too big and useful to be shut down.

Bitcoin’s $100,000 push wakes up tax collectors and Vitalik visits the real Moo Deng: Asia Express

As Bitcoin reaches $100,000, governments are eyeing cryptocurrency taxes, a Chinese judge says BTC is a commodity, and a cryptocurrency scandal erupts in the Indian election.

110 Million Doodles Coffee Cups Appear in McDonald’s Across America: NFT Collector

In the largest NFT partnership to date, 110 million Doodles coffee cups have been released at McDonald’s across the United States.

subscribe

The most interesting read on blockchain. Delivered once a week.

editorial staff

Cointelegraph Magazine writers and reporters contributed to this article.

Also read

Hodler’s Digest

Bitcoin Massacre, Eth2 Milestone, Libra Launch, PayPal Mistake: Hodler’s Digest, November 21-27.

9 minutes

November 28, 2020

Best (and worst) estimates, adoption and regulation highlights, major coins, predictions, and more – all in one link on Cointelegraph for the week!

read more

heat

Crypto City: The Ultimate Guide to Miami

14 minutes

July 13, 2022

Miami-Dade County, with its tropical climate, low taxes, and diverse population, is one of the wealthiest and blockchain-friendly cities in the United States.

read more