Ethereum is experiencing its longest inflationary period since the Dencun upgrade in March, with 350,000 ETH (worth about $1.1 billion) added to its supply, according to Ultrasound.money data. Ethereum’s current inflation rate is 0.35%.

The increase brought total supply to 120.4 million ETH, leaving just under 95,000 ETH remaining, consistent with levels seen in the September 2022 Ethereum Merge.

Nearly two years of ETH supply decline were wiped out in just seven months following EIP-4844, also known as Dencun or Proto-Danksharding.

How Dencun Changed Ethereum’s Supply Dynamics

The Dencun update introduces important changes that reduce Ethereum’s default fee burn rate.

Competition for mainnet block space is reduced by allocating specific block space to the layer 2 network to process bundled transactions, known as blobs. Additionally, the proto-danksharding mechanism makes data availability more efficient, significantly lowering base fees.

These events have had a significant impact on blockchain network transaction fees, causing Ethereum to mint more ETH than it consumes in most blocks.

For context, Ethereum has minted 78,676 ETH while burning 45,022 ETH over the past 30 days. This increased net supply by over 30,000 ETH, highlighting the inflationary impact of a reduced base fee environment.

Staking Impact

The increase in inflationary pressure on Ethereum is also linked to an increase in the ETH staking rate. Coinbase analyst David Han noted that while the Dencun upgrade had a major impact on the Ethereum ecosystem, the change in inflation rates appears to be linked to broader factors, including rising ETH staking rates, which are accelerating the issuance of all tokens.

Ethereum’s transition to proof-of-stake (PoS) has strengthened network security and increased participation, but it has also resulted in more ETH being issued. Validators who lock up ETH to secure the network are rewarded with newly minted tokens.

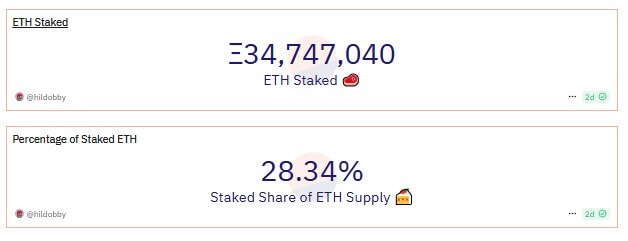

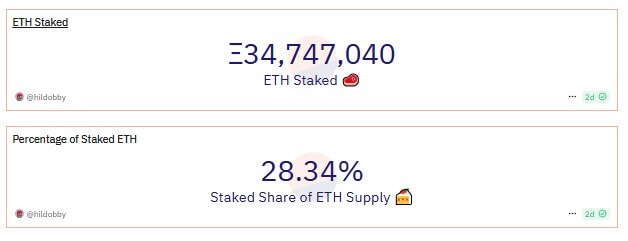

According to Dune Analytics data, approximately 34.7 million ETH is currently staked, representing approximately 28% of total supply. This staked ETH secures the network and generates rewards, further increasing the supply of Ethereum.

This effect is also amplified by the growing trend of re-staking, especially using protocols such as EigenLayer. Users who reinvest their staking rewards generate more ETH, compounding the impact of inflation.