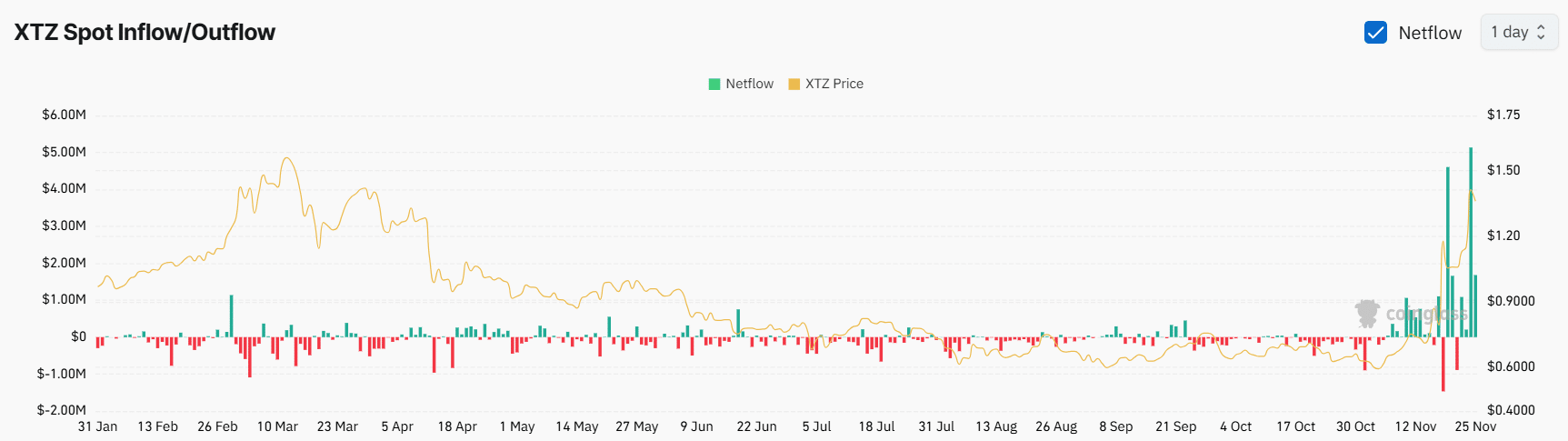

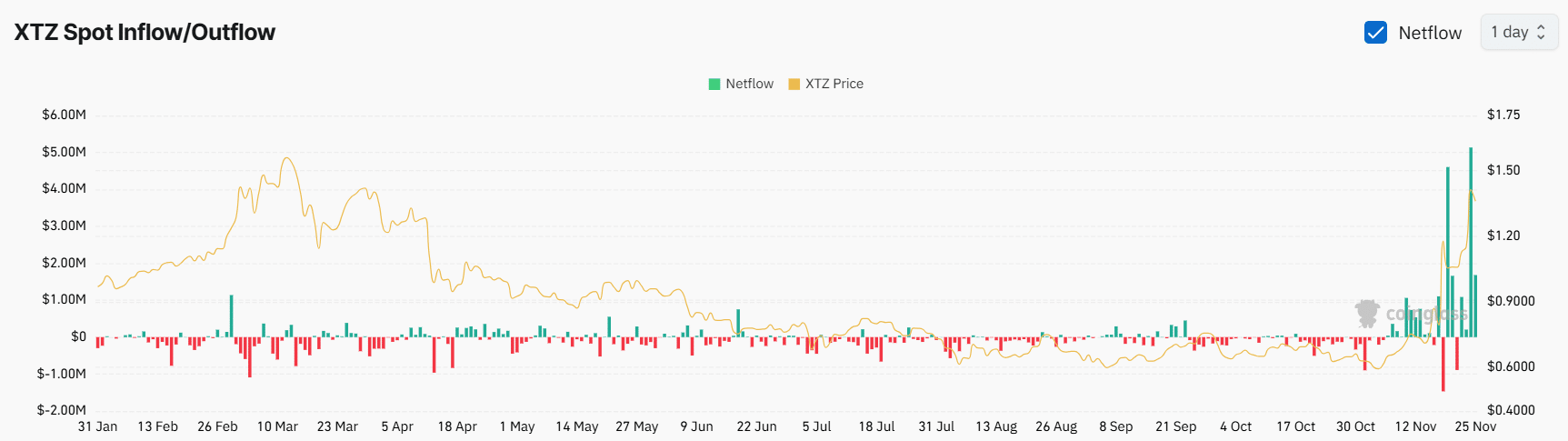

- Net exchange flows for the XTZ cryptocurrency continued to remain positive.

- XTZ’s relative strength index (RSI) was 74.5, indicating a possible price correction.

Tezos (XTZ) has seen huge gains over the past few days following the announcement of Everstake, a staking platform supporting the token.

As a result, XTZ rose 24% on November 24th while other altcoins struggled.

Will the price of XTZ cryptocurrency fall?

Following a notable rally, altcoins have reached levels where they have historically experienced selling pressure and price declines.

However, the current sentiment has changed as the overall market remains strong, with blockchain receiving support from Everstake and increasing participation from traders and investors.

At press time, XTZ was trading near $1.37 after falling 4.5% in price over the past 24 hours. During the same period, trading volume increased by 31%, increasing participation from traders and investors.

AMBCrypto’s technical analysis showed that XTZ was at a strong resistance level of $1.50 and was struggling.

During the recent price surge, the altcoin broke through three resistance levels. Each time the resistance line was broken, there was some price consolidation before breaking again.

Source: TradingView

When the XTZ rally initially began, it faced resistance at $0.75. The price consolidated for 4 days before violating this level. It consolidated for two days when it reached the next resistance at $0.90.

Finally, when the price reached the resistance level of $1.13, it consolidated for almost 5 days.

Now that the price has reached $1.50, today is the first day at this level and we expect to see some price correction before a major rally occurs.

Based on historical price momentum, if the altcoin breaks resistance and closes the daily candle above $1.50, it is likely to surge 40% and reach the $2.10 level in the coming days.

However, this speculation may take some time to play out, as XTZ’s Relative Strength Index (RSI) is at 74.5 at press time, indicating that the asset is in overbought territory.

This RSI value suggested a possible price correction or decline in the future.

Bearish On-Chain Indicators

On-chain indicators also indicate a bearish outlook for the asset. According to on-chain analytics firm Coinglass, XTZ’s exchange net flows have remained consistently positive since November 22nd.

Source: Coinglass

Read Tezos (XTZ) Price Forecast for 2024-2025

This suggests that whales and investors have been continuously transferring tokens from wallets to exchanges, signaling potential selling pressure and reinforcing the bearish outlook.

Meanwhile, XTZ’s open interest (OI) has been flat over the past 24 hours, suggesting that traders may be hesitant to open new positions or may be waiting for the price to trigger stop-loss orders.