- A breakout of HBAR’s descending channel signals a potential trend reversal and golden cross.

- Increasing social dominance and public interest imply market trust.

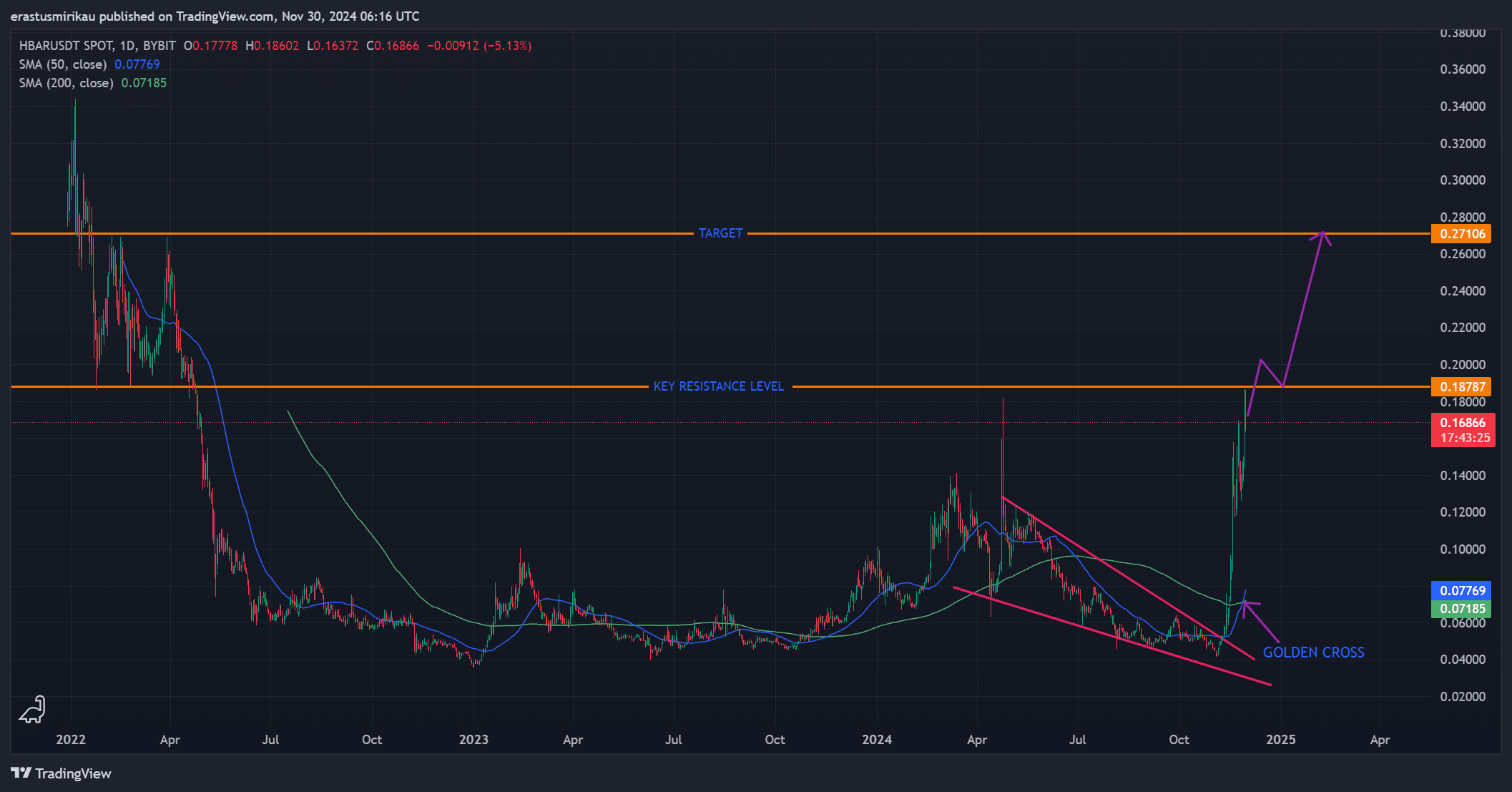

At the time of writing Hedera (HBAR) It was trading at $0.1703, up 14.60% in the last 24 hours, with trading volume up 234% to $1.63 billion. This surge followed a significant breakout from the downward channel and the formation of a golden cross. Both are bullish indicators.

Traders are asking as HBAR approaches the key resistance level at $0.188. Can we break this level and trigger a rebound towards $0.27?

Breaking the Bearish Trend – Is HBAR Ready for More?

HBAR’s chart showed a clear breakout of a long downtrend channel, signaling a potential shift in market sentiment. After several months of a downtrend, this move indicates that HBAR may be reversing its downtrend.

The breakout is particularly important because it coincides with the formation of a golden cross, a well-known bullish pattern. Therefore, the next major challenge is resistance at $0.188. A breakout here could confirm a trend reversal and pave the way for further upside towards 0.27.

Source: TradingView

Are technical indicators confirming a bullish trend?

HBAR’s technical indicators highlighted further confidence in the bullish move. For example, the Relative Strength Index (RSI) was at 72.47 at press time, indicating that HBAR is in overbought territory. While this implied strong buying pressure, it also meant that the market could face some downside. However, as long as RSI stays above 70, HBAR can maintain its upward momentum.

Additionally, MACD (Moving Average Convergence Divergence) showed a positive figure of 0.00327. This indicates continued bullish sentiment.

Simply put, technical indicators suggest that HBAR’s momentum can continue as long as these conditions hold.

Source: TradingView

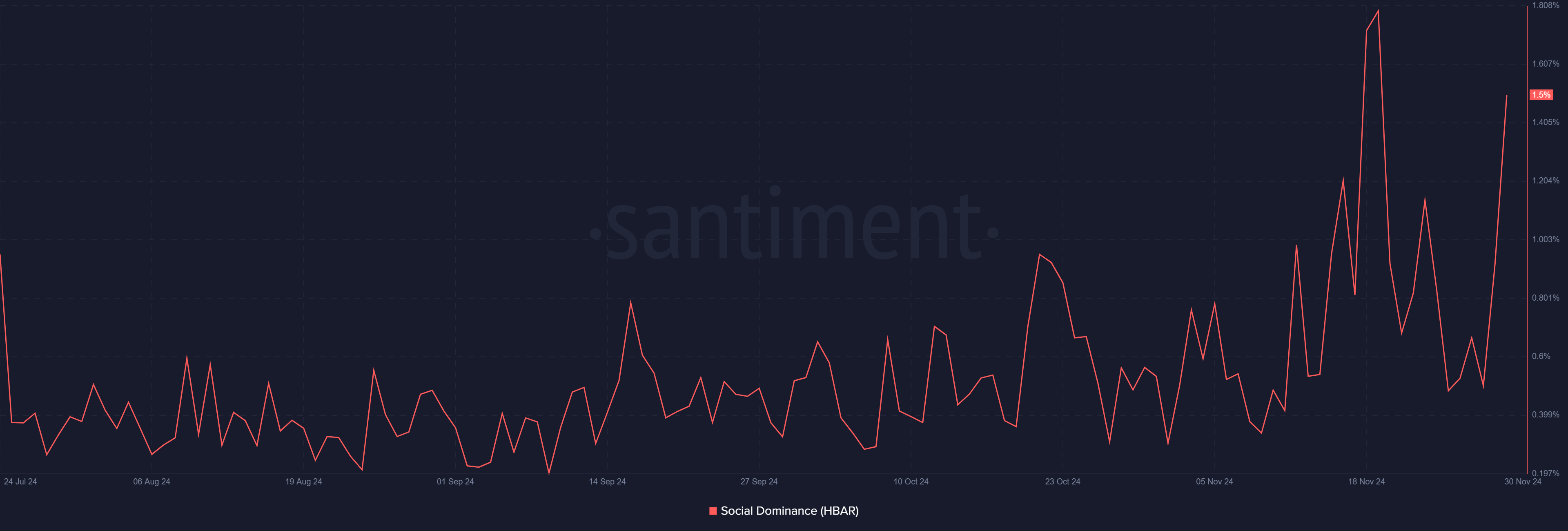

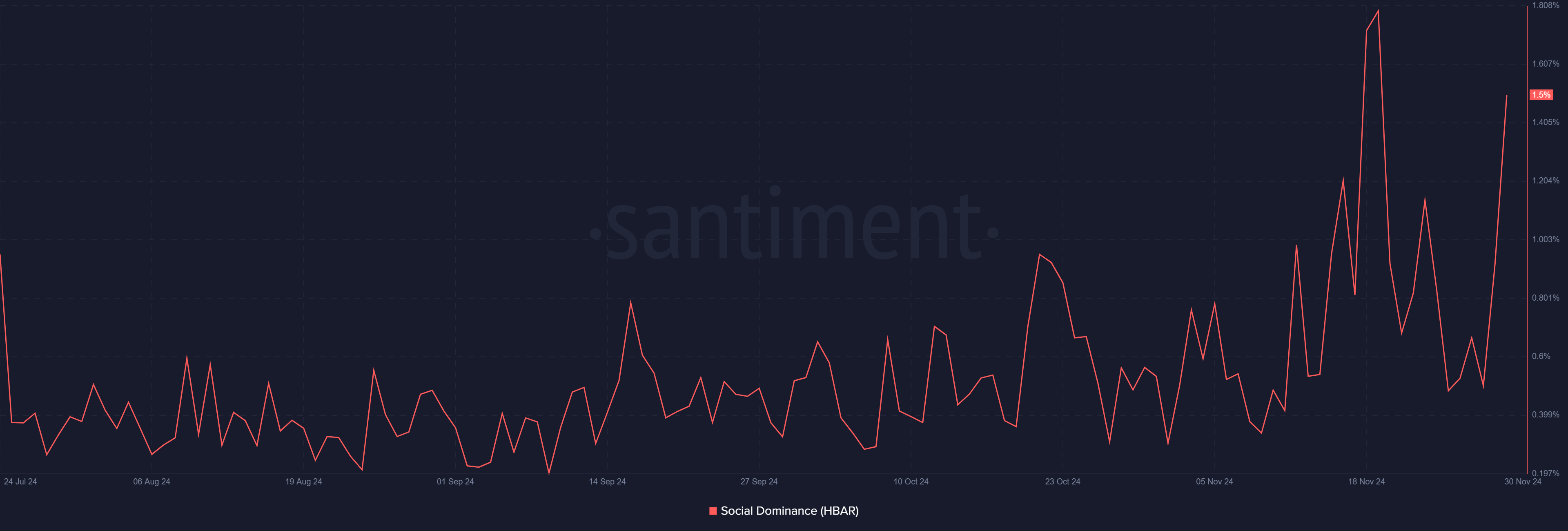

Social Dominance – Is HBAR Gaining Traction?

With increasing interest in social media platforms, social dominance has increased dramatically from 1% to 1.5%. This increase in mentions is a positive sign. This is because higher social dominance is often associated with higher trading volume and price fluctuations.

The increased community engagement suggests Hedera is gaining traction among both retail investors and traders. This could further fuel price volatility in the short term.

Source: Santiment

Market sentiment – surge in open interest?

Market sentiment is also becoming increasingly positive toward HBAR, with open interest increasing 29.30% to $189.52 million.

This indicates that more traders are now positioning themselves for further price increases. A rise in open interest is generally a bullish signal. This is a sign of confidence in Hedera’s future price action. As a result, this surge suggested that traders expect HBAR to break above the critical resistance level of $0.188.

Source: Coinglass

Read Hedera (HBAR) Price Prediction for 2023-24

Can Hedera break through $0.188?

HBAR’s breakout of the downward channel, strong technical indicators, and increasing social dominance all signaled a bullish outlook. However, major resistance at $0.188 needs to be overcome to maintain some momentum.

If HBAR can clear this level, it is likely to move towards $0.27. With positive market sentiment and technical support, Hedera has the potential to continue its upward trajectory. This is especially true if it holds above support and breaks resistance at press time.