- Toncoin’s recent increase was influenced by BTC’s ETF inflows, with resistance at $6.8 being a key level to watch.

- If TON fails to break above $6.8, it may retreat to the $6.1 support level before trying again.

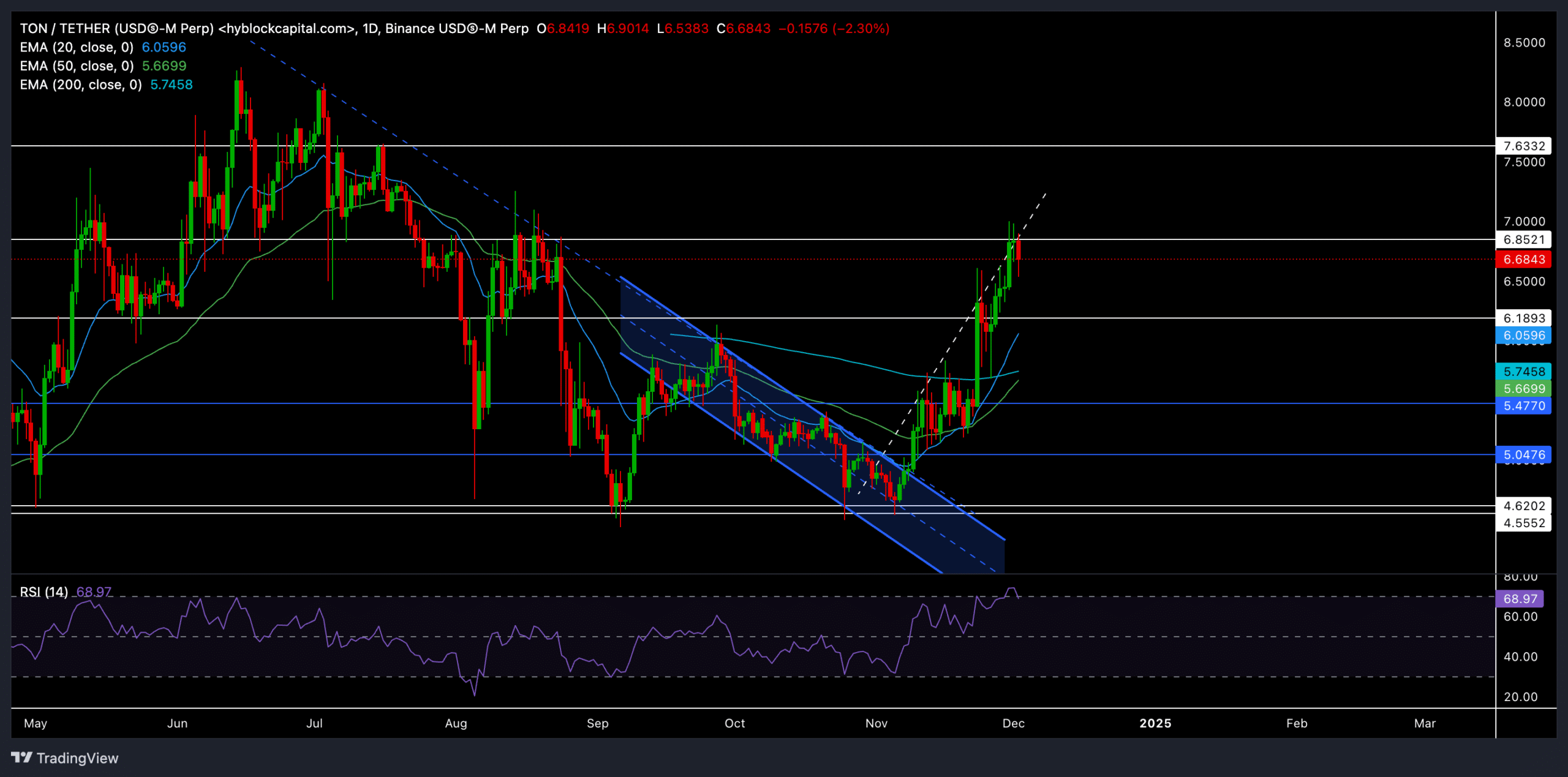

Toncoin (TON) has posted a strong bounce from long-term support levels near $4.6, benefiting from a broad market rally and renewed buying interest across altcoin markets.

With a series of green candles and a clear break above key resistance levels, TON has captured the attention of traders. At the time of writing, TON was trading at $6.7 and had tested a three-month high.

Will Toncoin continue its upward trend?

Source: TradingView, TON/USDT

The altcoin’s recent rally saw prices break out of a downward channel they had been trapped in since September.

During the recent rally, a golden cross appeared where the 20-day EMA crossed the 200-day EMA. This historically indicates the potential for a long-term upward trend. Additionally, the altcoin found comfortable points above the 20-day, 50-day, and 200-day EMAs after noting healthy bullish sentiment.

The next milestone for the bulls is for the 50-day EMA to cross the 200-day EMA. A successful crossover could set the stage for a sustained bullish rally, with the first major resistance being $6.8 and then $7.6.

However, if TON struggles to maintain its dominant momentum, a short-term correction could push the price to test the support zone around $6.1. This support level also appears to be consistent with the liquidity zone and provides a decent safety net for the bulls. A successful bounce from this support could reignite buying pressure.

The Relative Strength Index (RSI) is at nearly 69 at press time, indicating that Toncoin is approaching overbought territory. Traders should monitor RSI closely. A move below 70 could lead to a period of sideways movement or a slight decline before the next step higher.

What’s revealed in Toncoin’s derivatives analysis

Source: Coinglass

Volume increased 69.39% to $444.65 million, indicating strong trader activity amid the recent rally. However, open interest has decreased by 8.15%, suggesting that some traders may be closing positions to lock in profits after the recent rally.

The long/short ratio for TON across exchanges is 0.8591, suggesting a slight preference for short positions overall. However, Binance’s long/short ratio was more favorable to the bulls at 3.8473, indicating optimism among traders on this exchange.

Additionally, the top trader long/short ratio for TON on Binance was 4.5 for accounts and 2.38 for positions.

Additionally, Bitcoin’s broader movements should be monitored as they may affect TON’s trajectory in the short term.