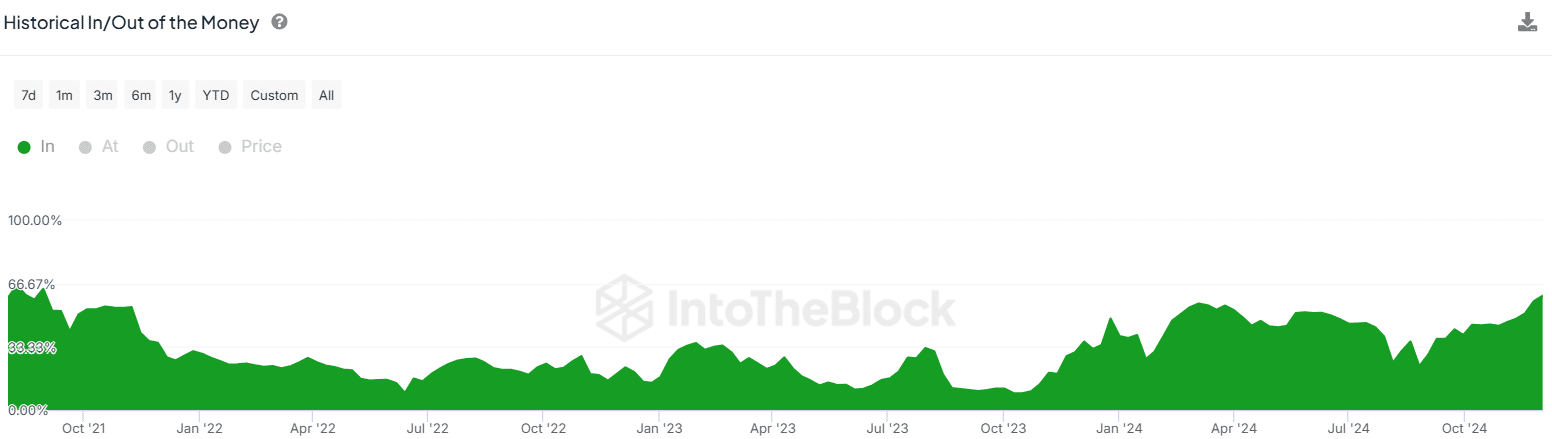

- 60% of Uniswap investors are making money after gaining 122% in 30 days.

- Wallet profitability is at the highest level since 2021, increasing the possibility of profit-taking activities.

Uniswap (UNI) It’s a strong rally after rising 124% in the last 30 days. At press time, UNI was trading at $15.55 on volume of more than $1 billion. CoinMarketCap.

UNI’s rally appears to have cooled off since then. Bitcoin (BTC) After surpassing $100,000, it attracted attention from altcoins. Nonetheless, altcoins remain in bullish territory amid surging wallet profitability.

Data from IntoTheBlock shows that more than 60% of UNI holders are now In the Money, marking the highest level of wallet profitability since mid-2021.

Source: IntoTheBlock

Whenever a rally shows signs of exhaustion and the number of wallets taking profits increases, traders tend to start selling to book profits. This could halt a rally or trigger a downtrend.

UNI exchange inflow increases

Amid a surge in inflows to spot exchanges, some trades are already recording profits on UNI. According to CryptoQuant, Uniswap exchange inflows reached a one-week high of 1.54 million UNI on December 4 with a value of over $24 million.

Source: CryptoQuant

The surge in foreign exchange inflows coincided with UNI rising to an eight-month high of $16.52, indicating that this level may have signaled a regional high.

However, considering that the net flow on the day was negative, this may mean that there is enough demand to prevent a trend reversal. Additionally, buyers can earn additional profits by remaining active.

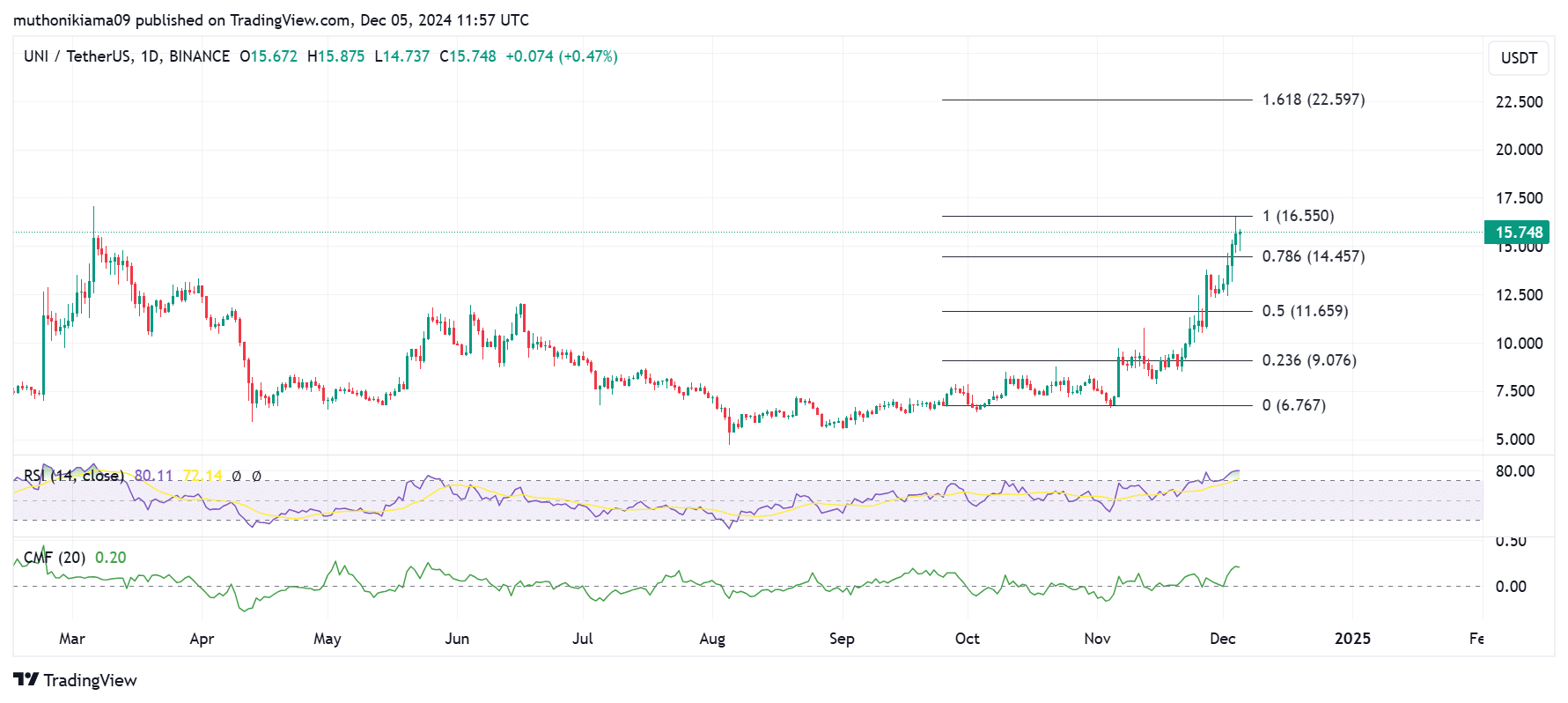

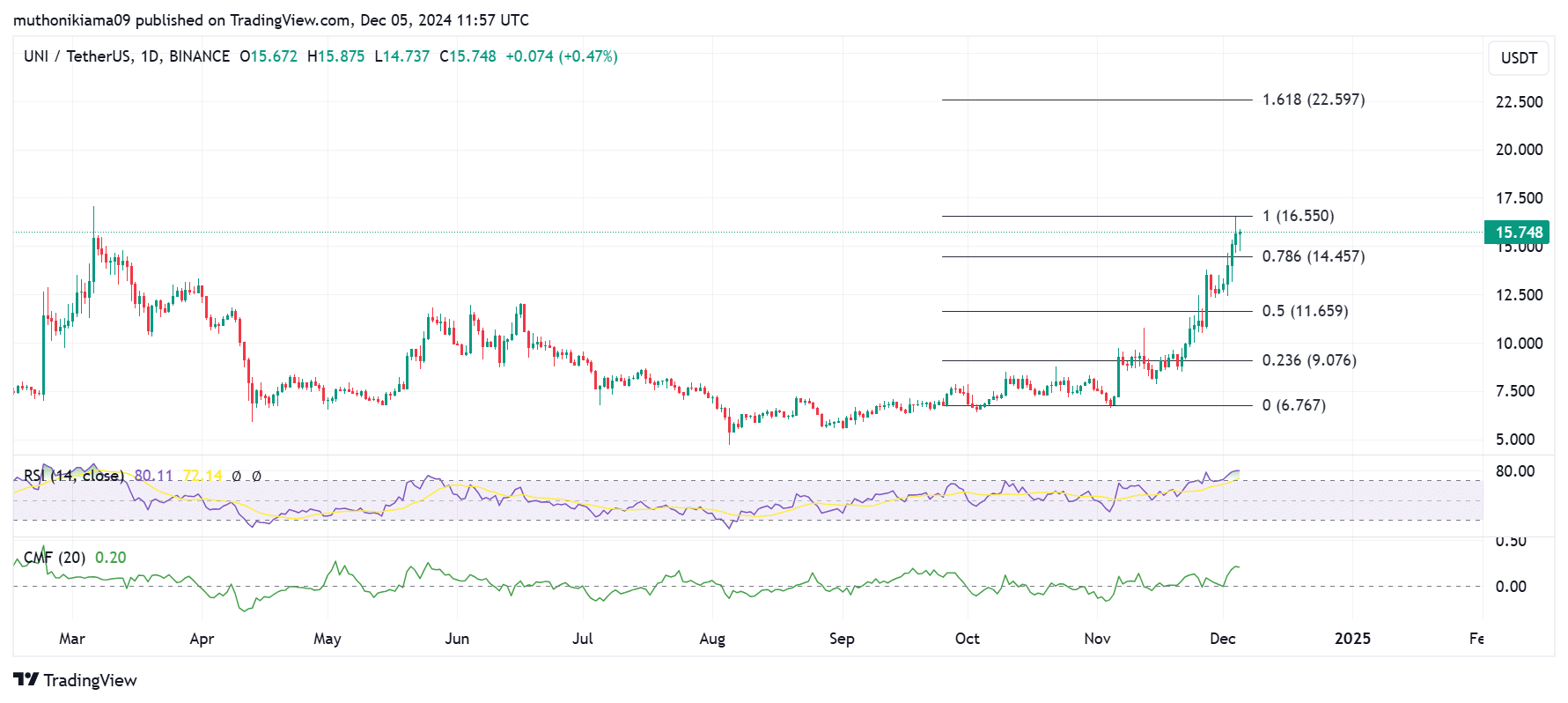

Uniswap’s RSI is at overbought levels.

Uniswap’s daily chart shows that the altcoin is at overbought levels after the Relative Strength Index (RSI) reached 78. This may be preceded by a short-term adjustment, as has been the case in the past.

Meanwhile, UNI’s Chaikin Money Flow (CMF) reached 0.20, suggesting purchasing activity has reached its highest level in months.

(Source: Trading View)

If buyers continue to maintain momentum, UNI could surge to the 1.618 Fibonacci level ($22.59), reaching its highest level since early 2022. Conversely, a drop below $14.45 could trigger another downtrend.

Read Uniswap (UNI) price prediction for 2024-2025

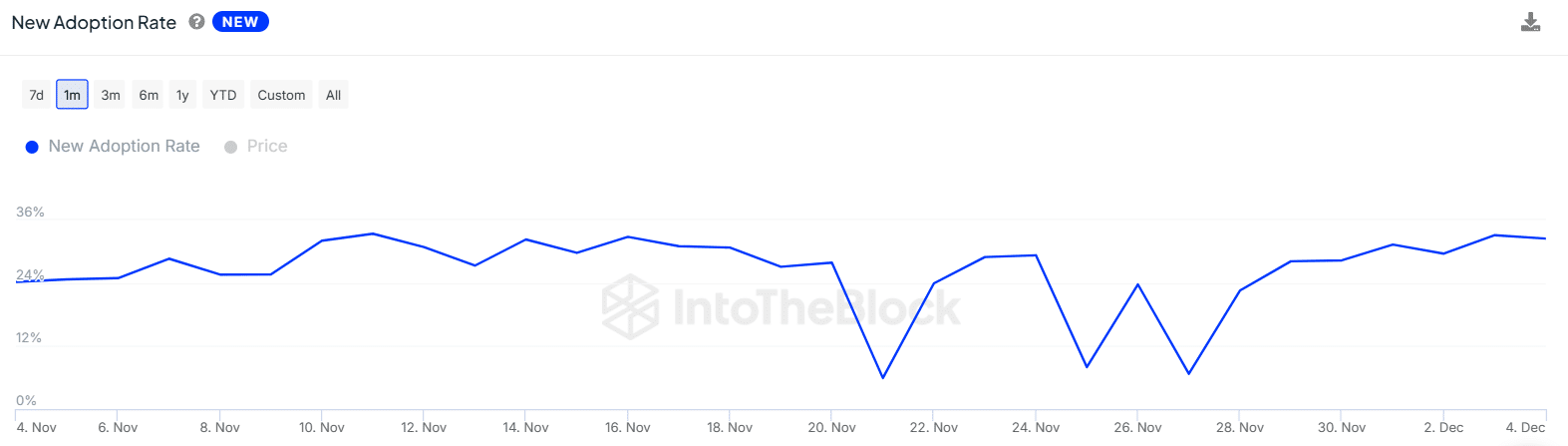

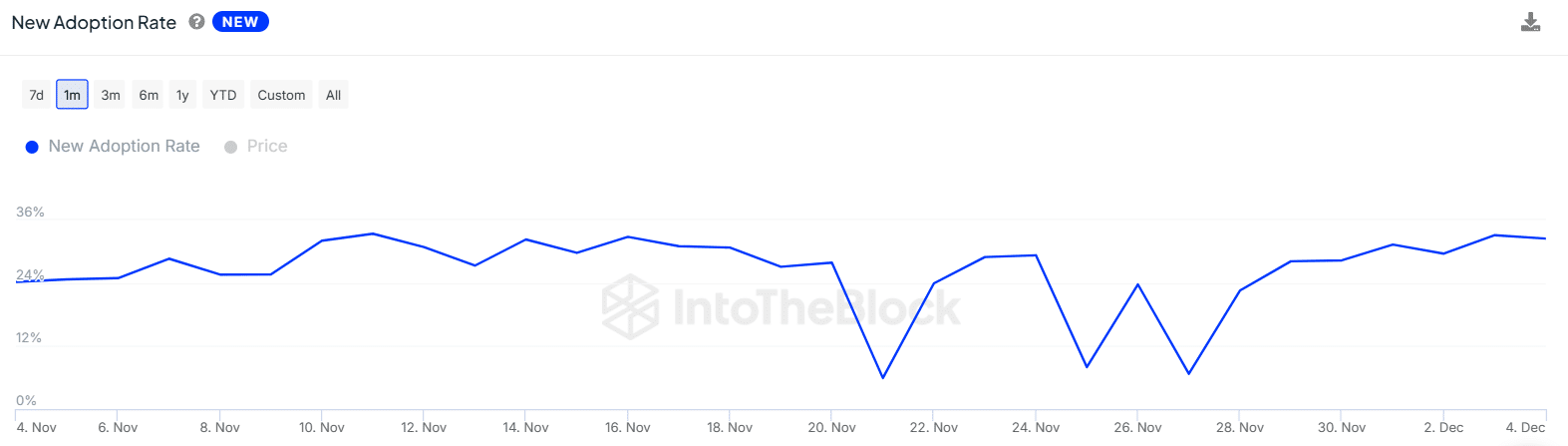

The new adoption rate is increasing…

Per IntoTheBlock, the new adoption rate has gradually increased to 32.44% over the past week. This means there are a lot of new buyers accumulating Uniswap.

Source: IntoTheBlock

The increase in new Uniswap addresses signals retail FOMO, which could accelerate UNI’s upward trend and help it generate more profits.